EUR, SEK, JPY flows: EUR and SEK unmoved by data, JPY firms on BoJ comments

EUR and SEK little changed after weaker than expected January and Q4 data, helped by positive back revisions. JPY suported by BoJ comments, but still limited by strong global risk sentiment

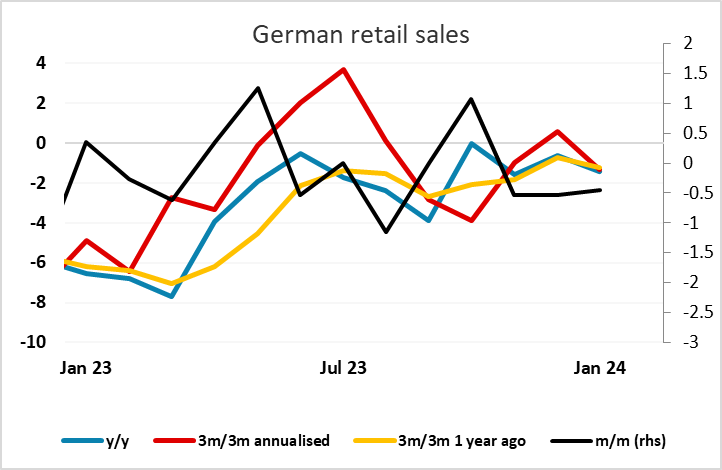

Slightly disappointing numbers from Germany and Sweden this morning, with Germany seeing the third consecutive m/m decline in retail sales and Sweden the third consecutive quarterly decline in GDP. However, there has been little market reaction, partly because of revisions. In Sweden, the 0.1% decline in Q4, although disappointing relative to the consensus for a 0.1% rise, was mitigated by the upward revision to Q3 from -0.3% to -0.1%. The German retail sales decline of 0.4% was weaker than the 0.5% rise anticipated, but included a big upward revision to the November data, so the underlying trend, while still weak, remained quite steady. EUR/USD and EUR/SEK looks likely to hold steady for now, with the EUR focus very much on the various Eurozone country CPI data due later. France, Spain and Germany are all on the calendar.

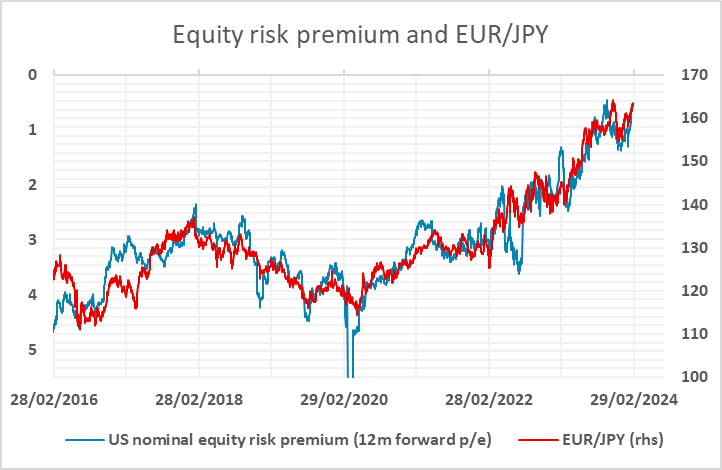

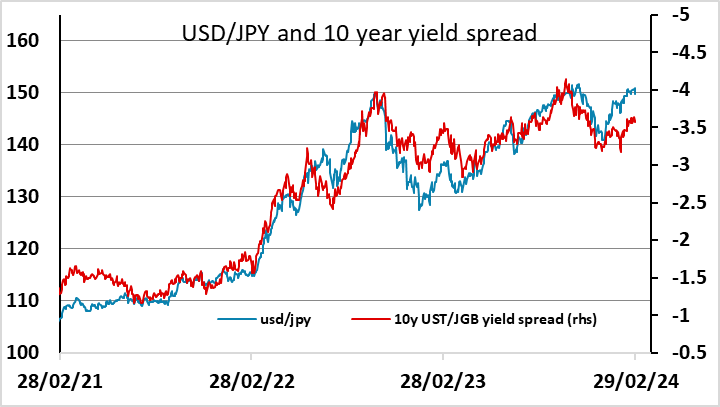

The main move overnight was the rise in the JPY, encouraged by some more hawkish comments from the BoJ’s Takata, who indicated significant wage increases were likely in the spring wage round, above the 2023 increases, and hinted at potential tightening measures including the end of YCC and negative rates. USD/JPY fell nearly a big figure in response. However, while USD/JPY still looks high relative to the yield spread correlation seen in recent years, EUR/JPY and other JPY crosses continue to benefit from the negative correlation with equity risk premia. These rose slightly yesterday, but remain at levels that make a major JPY recovery unlikely without more significant declines in US bond yields and/or equities.