Turkiye’s Inflation Reaccelerated Fast in December to 64.8%

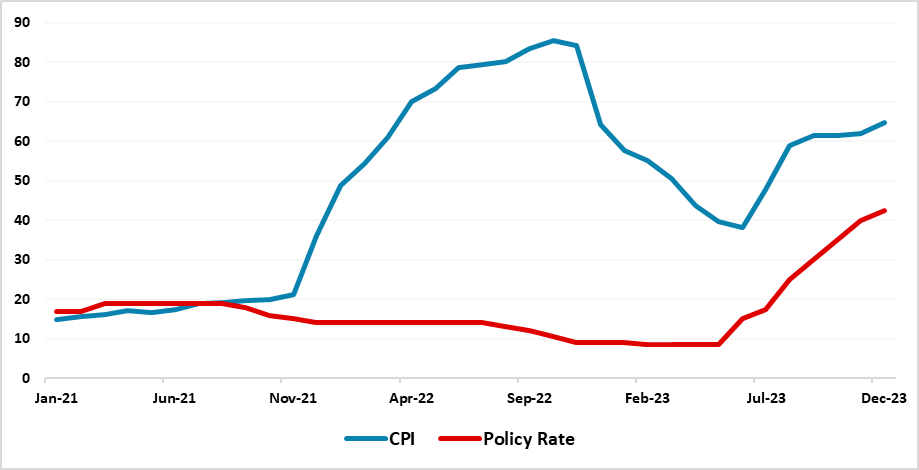

Bottom Line: Turkish Statistical Institute (TUIK) announced on January 3 that Turkish CPI surged to 64.8% annually and 2.9% monthly in December due to continued adverse impacts of deterioration in pricing behaviour, high consumption, depreciating Turkish Lira (TRY) and strong inflation expectations. We see that the acceleration pace fastened after November in line with Central Bank of Republic of Turkiye’s (CBRT) predictions, and we think %49 hike in monthly minimum wage on December 28, and expected hike in wages of civil servants this week (likely more than 50%) will push prices further up and won’t help inflation. We feel upside risks such as weakening currency, elevated upward pressures in services, and expected hike in public spending before the 2024 local elections in March remain strong, which would likely drive the inflation in 1H of 2024, as the impacts of the strong monetary tightening are still feeding through.

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2021 – December 2023

Source: TUIK, Datastream, Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in December, we see that housing with 40.4% was the main group with the lowest annual increase while hotels, cafes and restaurants with 93.2% was the main group where the highest annual increase was realized. It is worth mentioning that education (82.1%), health (79.6%), and transportation (77.1%) also recorded remarkable YoY increases.

Core inflation (CPI-C) recorded a 2.31% MoM increase, scaling up to 70.64% on an annual basis as it improved in December. After domestic producer price index (PPI) hit 157.69% hike on annual basis in October 2022, domestic PPI stood at 1.14% MoM translating into 44.2% YoY in the last month of the year. D-PPI in four main sectors of industry increased by 65.6% for mining and stone quarrying, increased by 53.7% for manufacturing, decreased by 29.7% for electricity, gas, steam and air conditioning, increased by 67.0% for water supply, annually. Despite PPI continued to surge slightly in the two months of the year, relative fall in PPI in 2023 demonstrates improvement in cost pressures.

In addition to TUIK’s official figures, Istanbul Chamber of Commerce (ITO) recently revealed its price indices report for December 2023 and announced that the annual inflation rate in Istanbul as 74.9% for retail prices while overall annual wholesale price inflation in the province was 62.8%. According to the ITO Bulletin, retail prices rose by 3.52% in December, and wholesale prices rose by 2.31%.

We are of the view that there are signs that inflation will continue to stay high in the first half of 2024, in line with CBRT’s inflation projections. We think %49 hike in monthly minimum wage on December 28, and expected hikes in wages of civil servants (likely more than 50%) to be finalized this week will push prices further up in Q1 and Q2. (Note: The increase in the minimum wage was around 34% in 2023, as the government increased it to 11,400 TRY ($387) in June from 8,506 TRY ($220). The minimum wage has been lifted to 17,002 TRY ($578) valid as of January 1, 2024). We think increase in workers' wages, the surge in the tax burden of companies, and the increase in raw material prices would likely continue to ignite production costs and lead to a hike in the general level of prices.

Despite strong monetary tightening in force and lagged impacts of the tightening cycle are still feeding through, the official borrowing costs remain deeply negative when adjusted for current inflation. (Note: The CBRT raised the policy rate from 42.5% on December 21 MPC meeting to establish the disinflation course as soon as possible, and it strongly signalled that the cycle will be completed in a short period of time if inflation would allow). We know that CBRT remains concerned about the course of inflation, the strong course of domestic demand, the stickiness of services inflation, and the deterioration in inflation expectations, but the recent hikes in wages and taxes won’t help. Upside risks like weakening currency, deteriorated pricing behaviour and expected hike in public spending before the 2024 local elections in March remain strong, which would likely drive the inflation in Q1 and Q2.