USD, EUR, JPY, AUD, NOK flows: Mild risk recovery, but...

Equity markets recovering modestly but still value in JPY

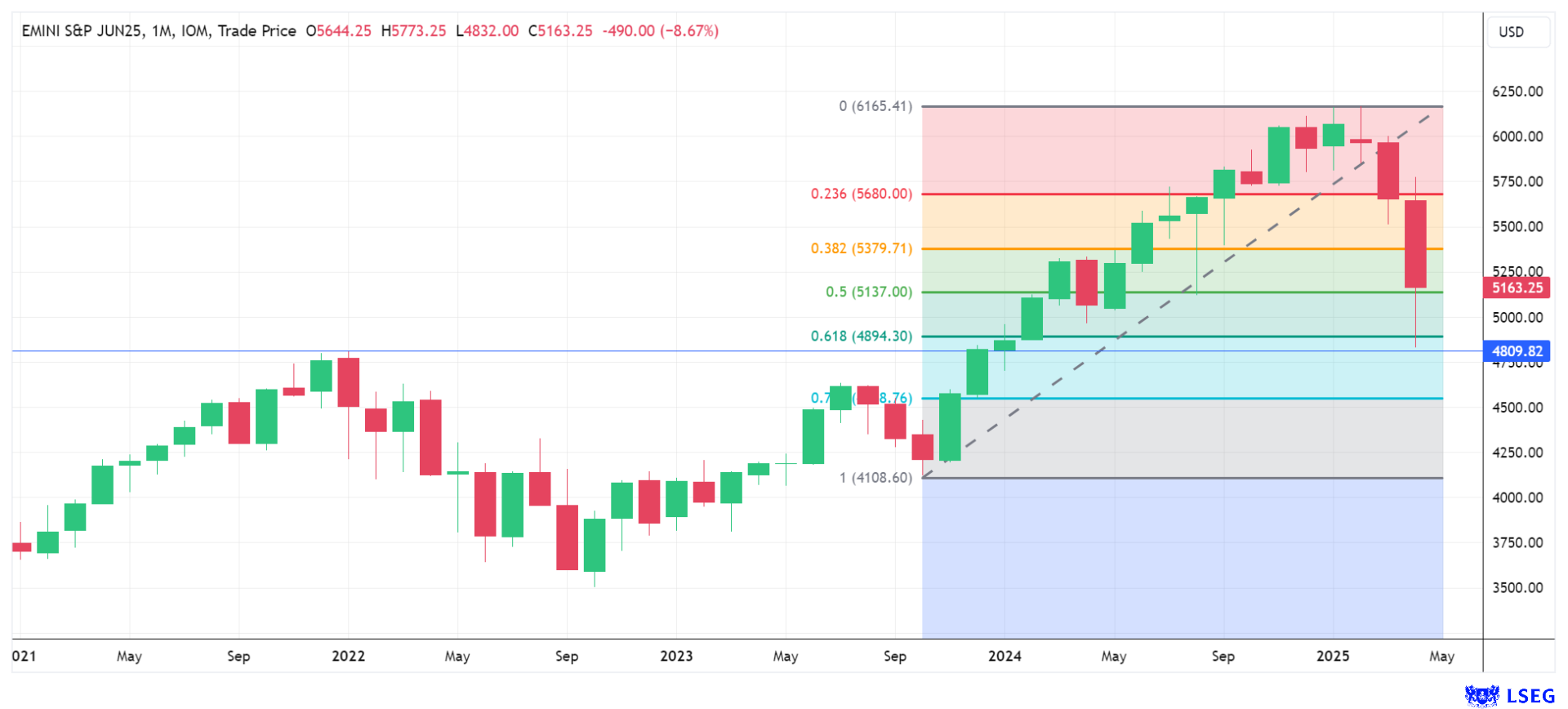

S&P hitting support area

The equity markets have managed a modest recovery overnight, with some hopes that Trump will announce a delay to the “reciprocal” tariffs at tomorrow’s announcement. Latest comments from the White House suggest this may be a false hope, with the reports of comments from White House adviser Hassett yesterday denied, but the recovery is also partly technical. A quieter day looks likely given the tariff announcement on Wednesday.

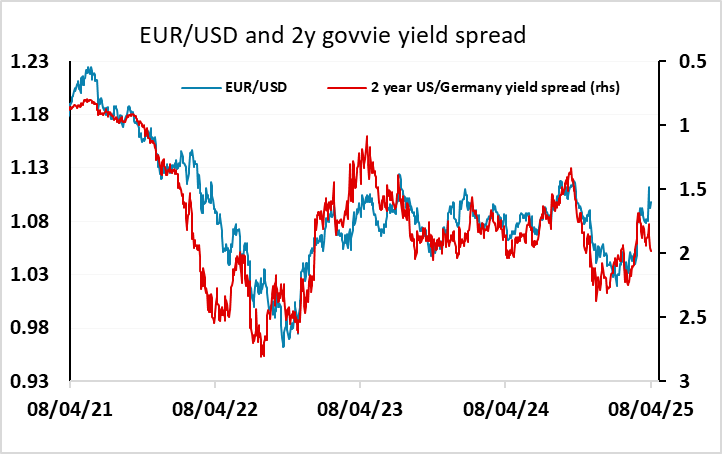

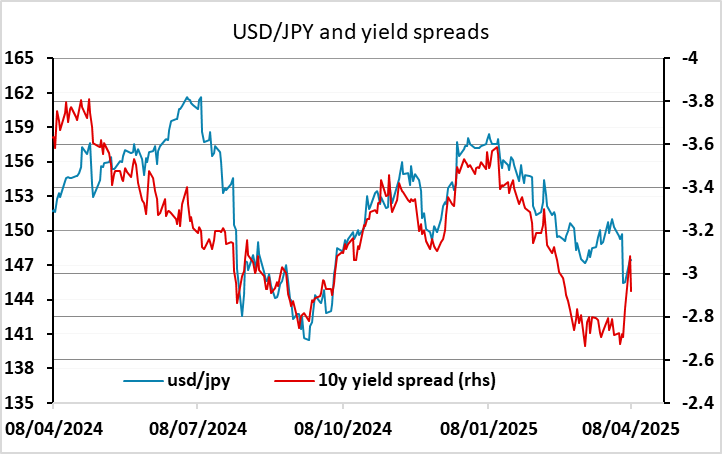

From an FX perspective, the rise in US yields since yesterday has justified some USD recovery, with the 10 year yield spread now more closely in line with the current level of USD/JPY. However, front end yield spreads suggest downside risks for EUR/USD.

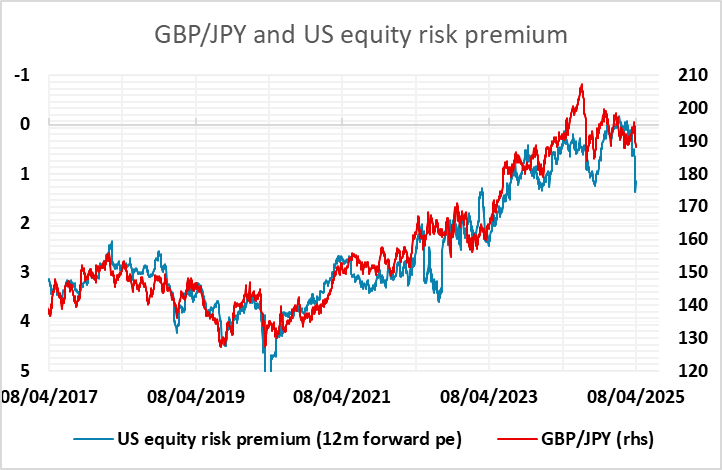

The equity recovery has helped the riskier currencies a little overnight, but has not been substantial enough to bring the US equity risk premium back to anywhere near the levels seen before last week’s tariff announcement. This metric has been a key guide to the performance of EUR/JPY and other JPY crosses in recent years, and at current levels suggests substantial downside risks for EUR/JPY and GBP/JPY, consistent with the yield spread pointing lower for EUR/USD.

There is more of a case for a recovery in the AUD and NOK, both of which have been closing in on their pandemic lows against the USD and EUR respectively. Both currencies still look good value relative to yield spreads, and while they tend to suffer in risk downturns, their economies have been relatively strong performers in recent years.