U.S. February Retail Sales - Q1 looking subdued, but reasons unclear

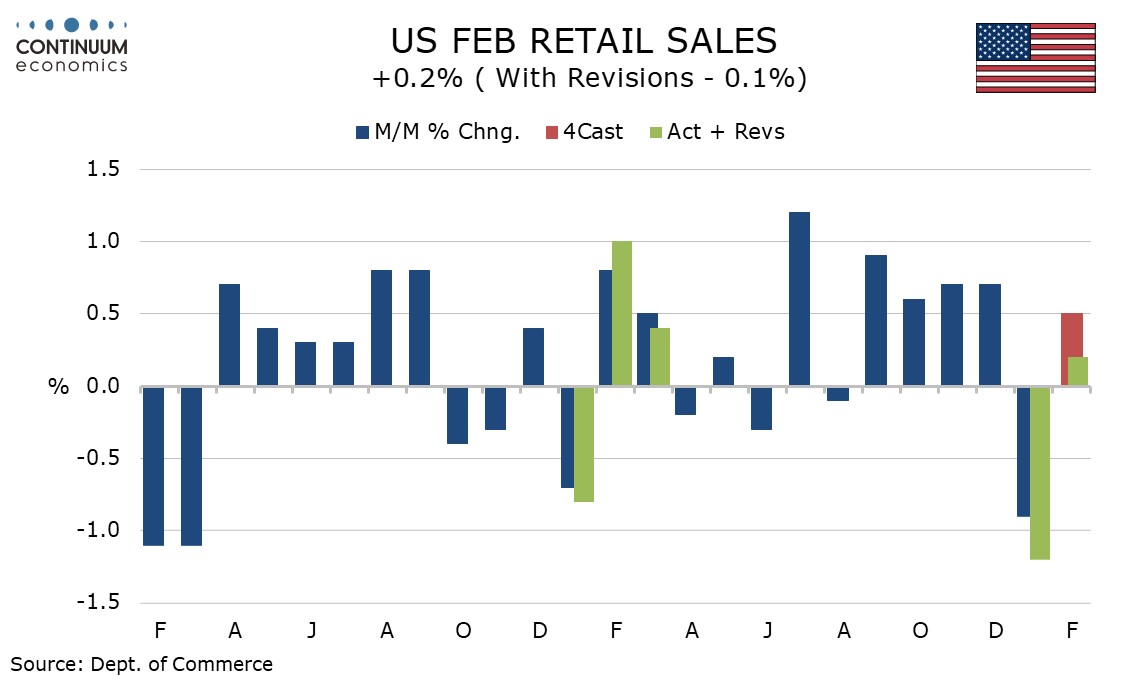

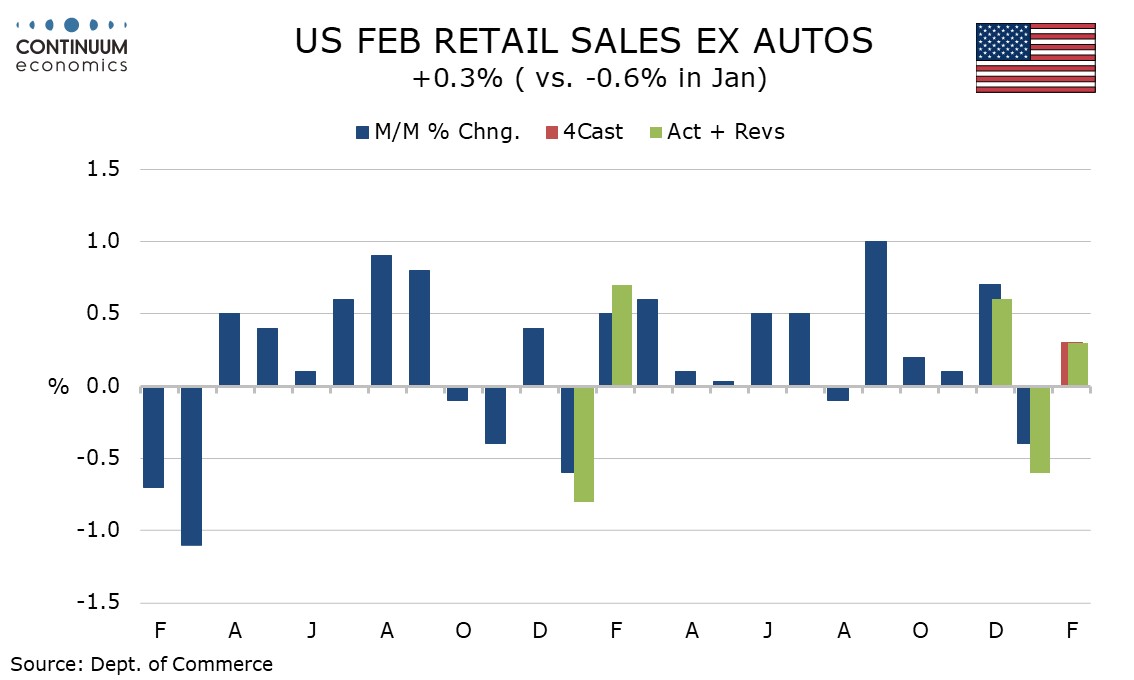

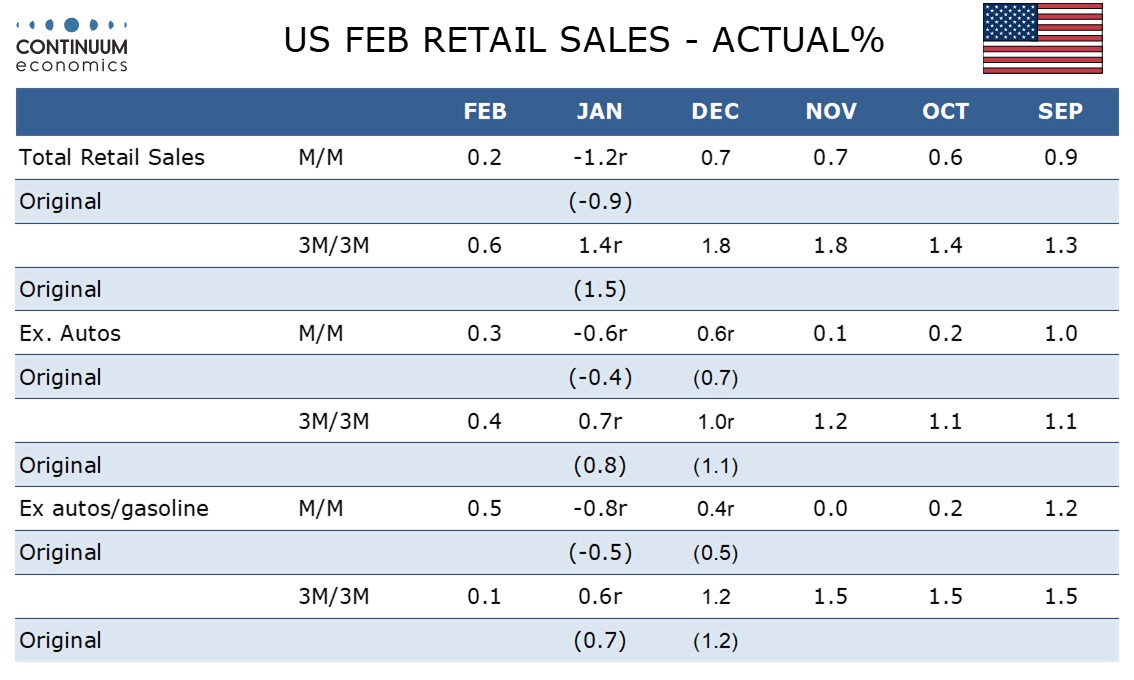

February retail sales with a gain of 0.2% overall is unimpressive, particularly with January revised down to -1.2% from -0.9% while gains of 0.3% ex auto and 0.5% ex auto and gas fail to reverse respective January decline of 0.6% and 0.8%. However the control group, which contributes to GDP, with a 1.0% rise has reversed a 1.0% January decline.

January’s weakness was seen as largely due to bad weather and weather remained a concern in February. March weather has been mostly milder, but the south has seen several storms.

Q1 looks set to be a subdued quarter, but it unclear yet whether falling consumer confidence is having an impact. Personal income saw a solid rise in January.

Most components of February retail sales were subdued outside a 1.7% surge in health and personal care, which followed a 1.1% decline in January. Food services and drinking as particularly weak at -1.5% and has not risen for three months. Weather may be a factor, but weakening tourist arrivals, particularly from Canada due to strained political relations, may be having an impact.

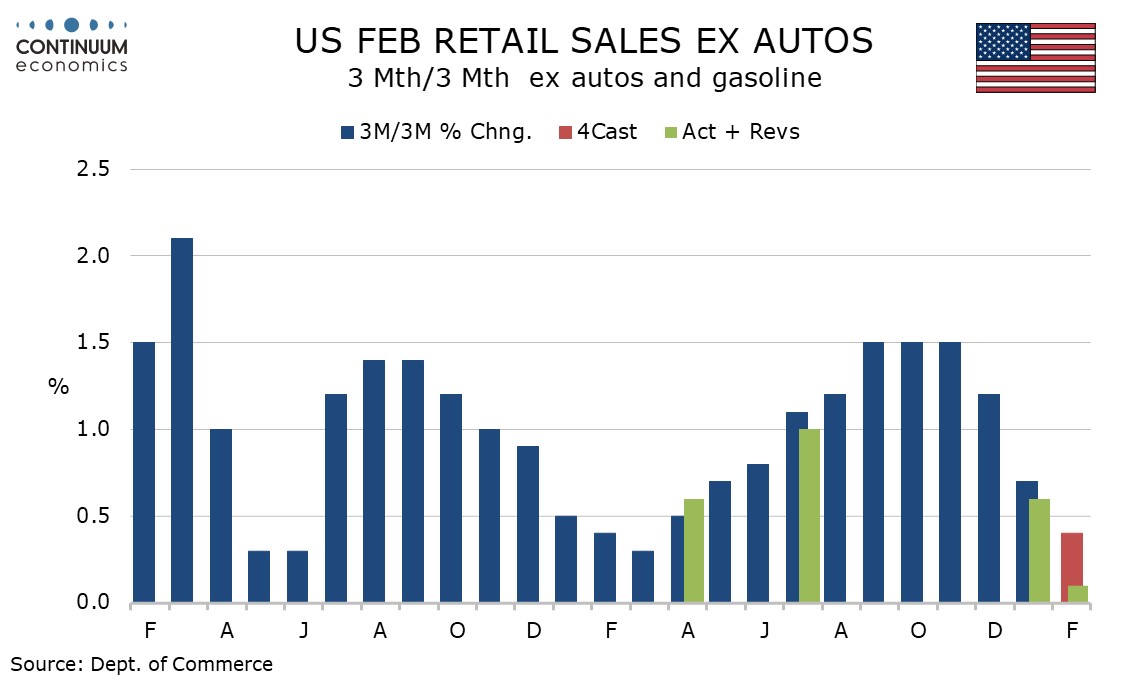

3 month/3 month changes are looking subdued with overall at 0.6% (not annualized) the slowest since March 2024, as is 0.4% rise ex autos. Ex auto and gasoline sales are up only 0.1% and this is the weakest since June 2021 at the height of the pandemic. A strong December is due to drop out in March, which will restrain 3 month/3 month rates further unless March is strong.

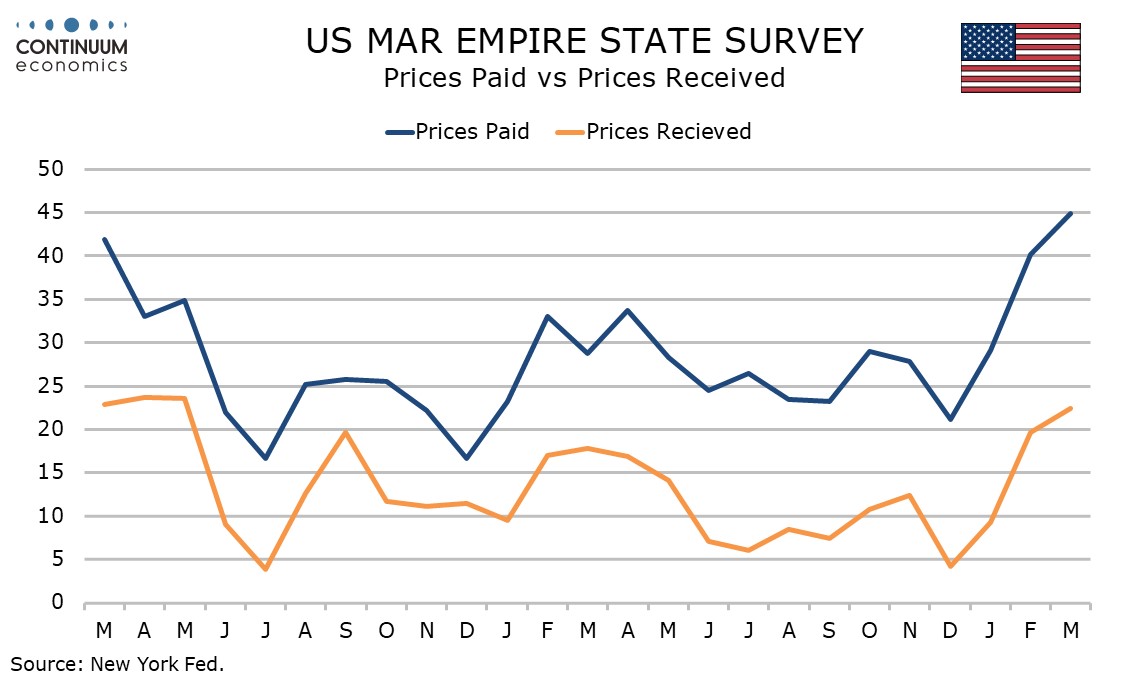

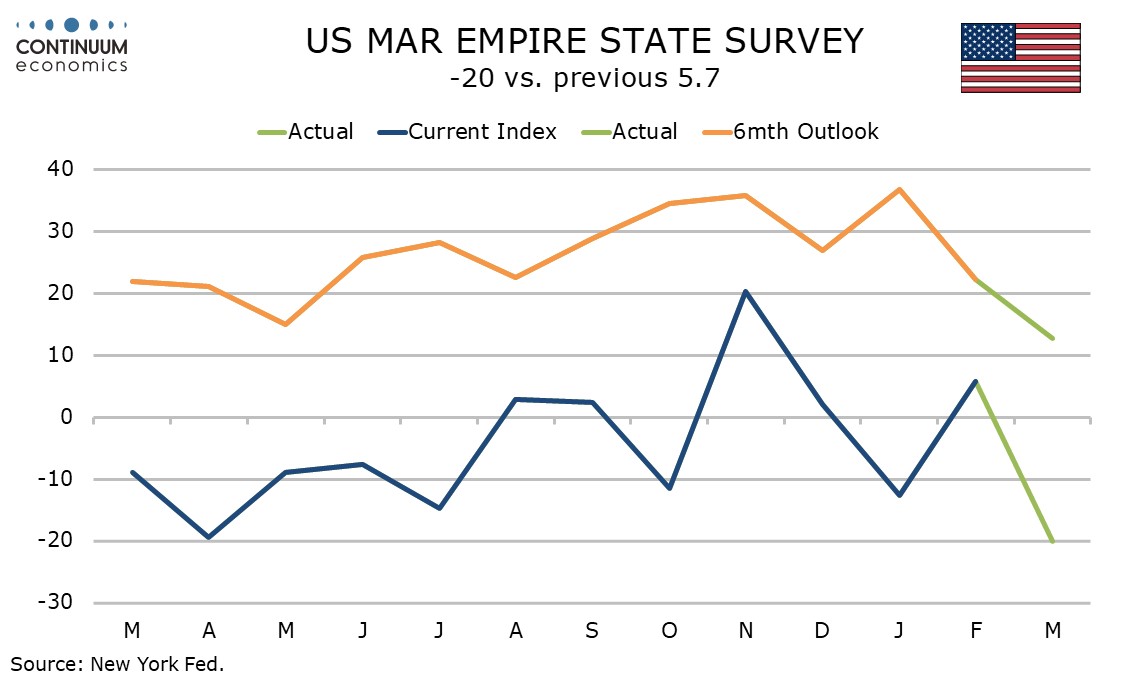

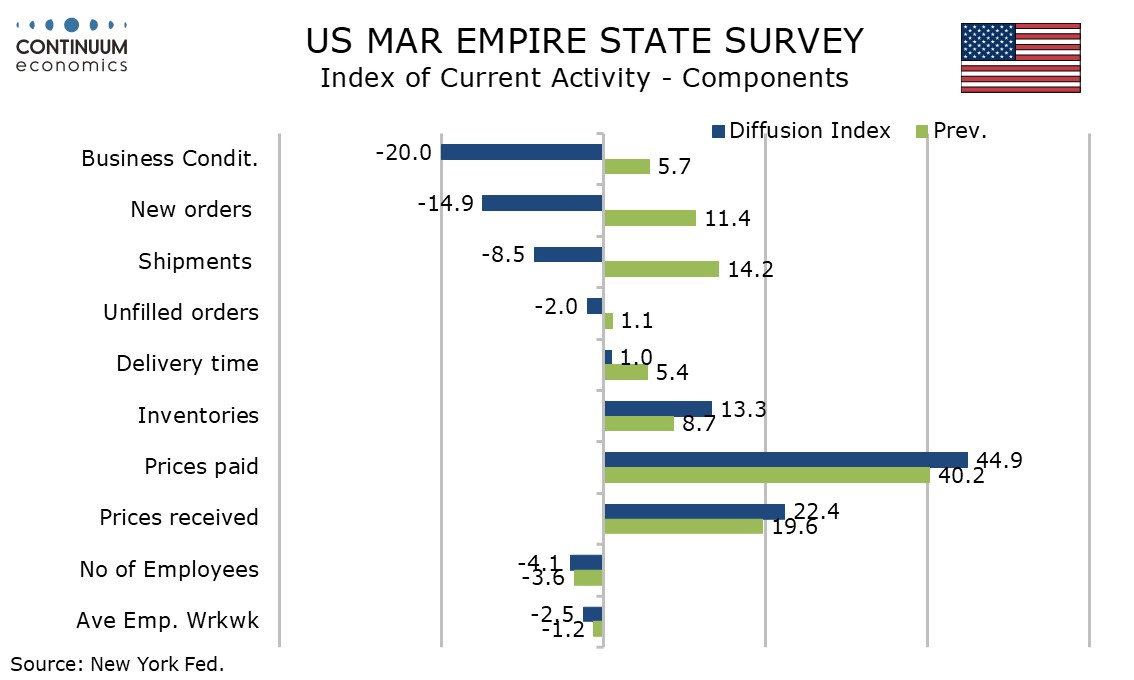

March’s Empire Sate manufacturing index of -20.0 from a positive 5.7 in January is the weakest since January 2024, and a warning sign that the net impact of the trade wars is negative, though the volatile nature of the survey means that conclusions should be cautious.

The details are not constructive, with new orders weak at -14.9 and six month expectations at 12.7 from 22.2 the weakest since December 2023.

Despite the slowing in activity, price indices have extended what were significant bounces in January. Prices paid at 44.9 are the highest since February 2023 and prices received at 22.4 the highest since May 2023.