U.S. February Core PCE Prices firm, Income outpaces Spending again

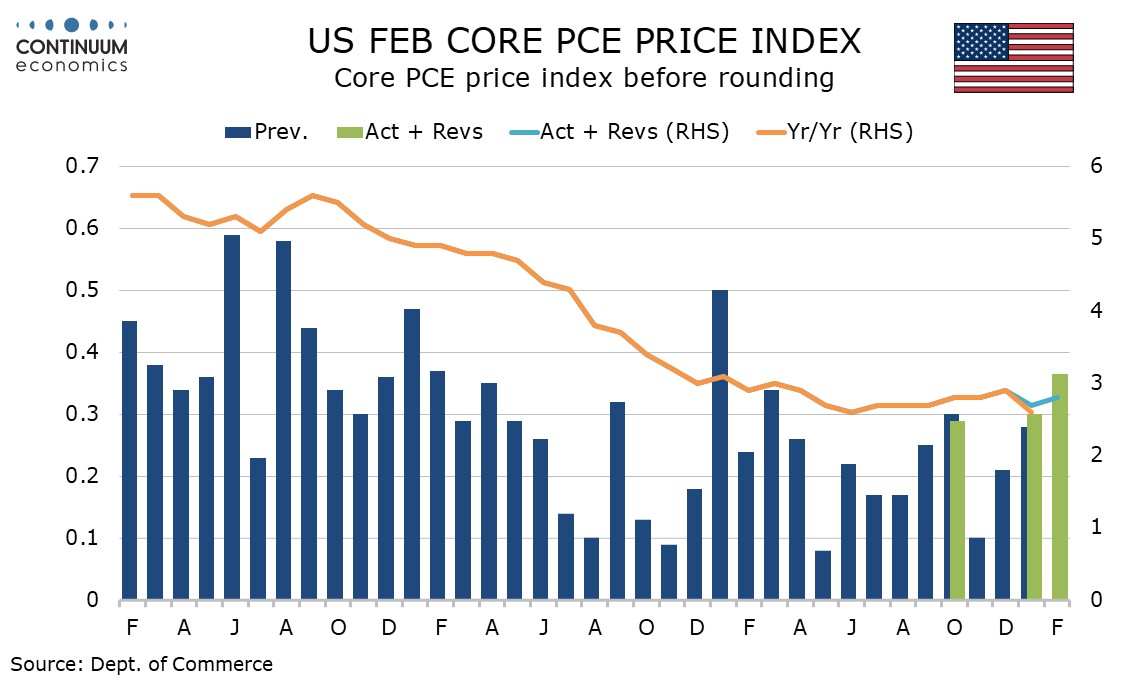

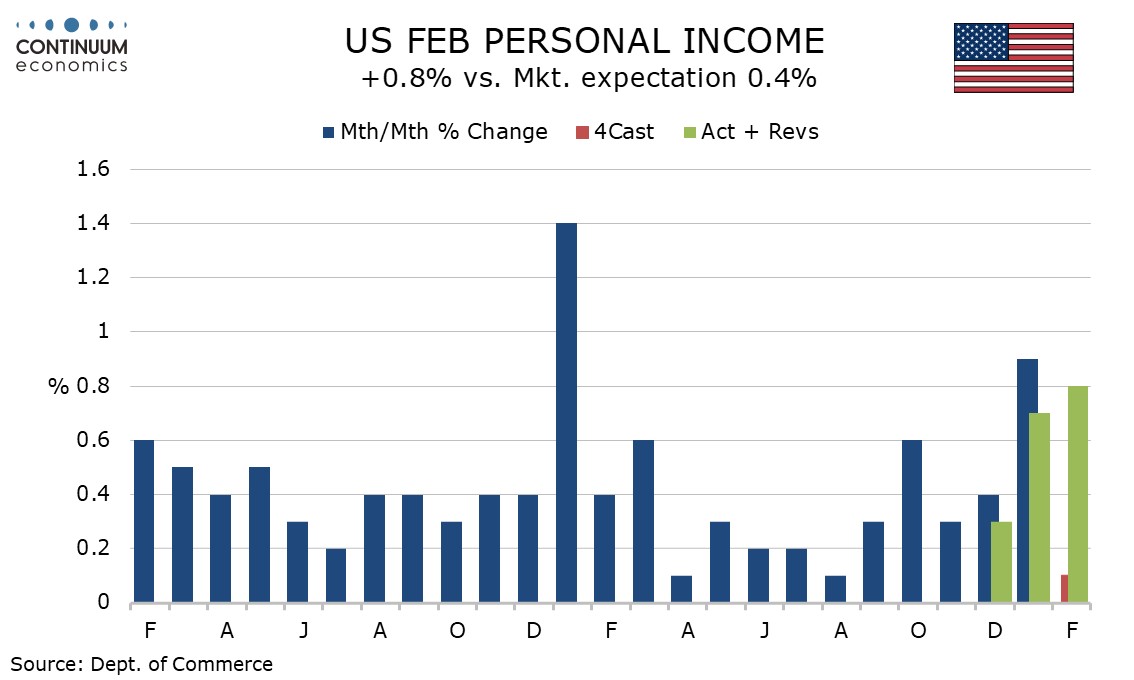

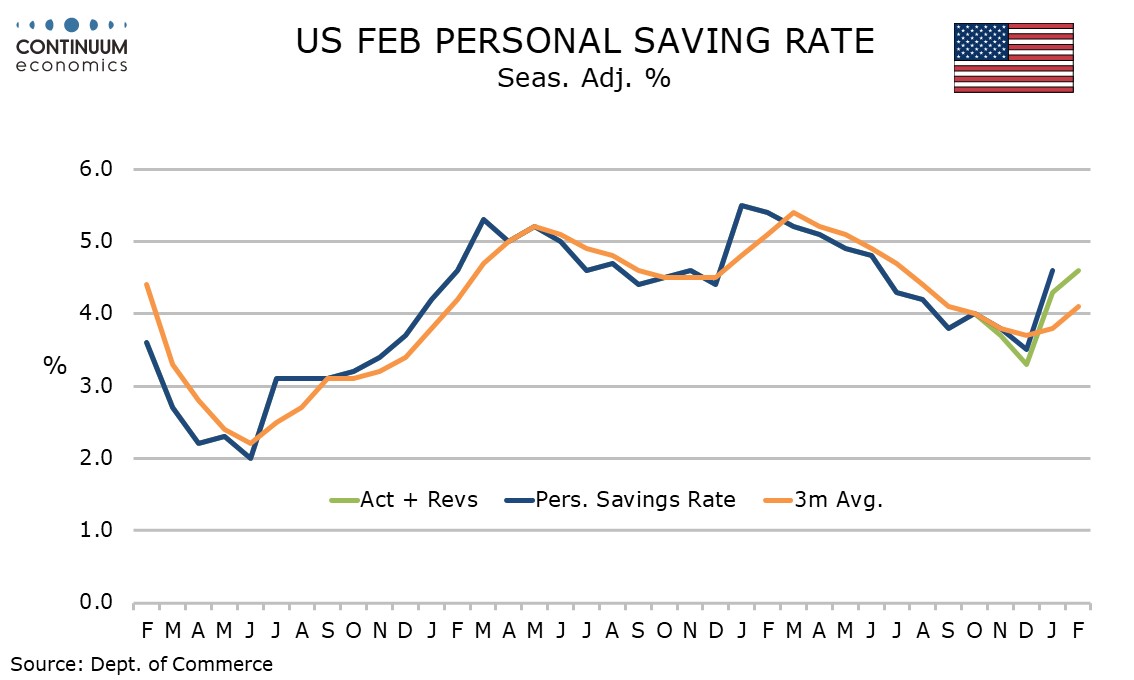

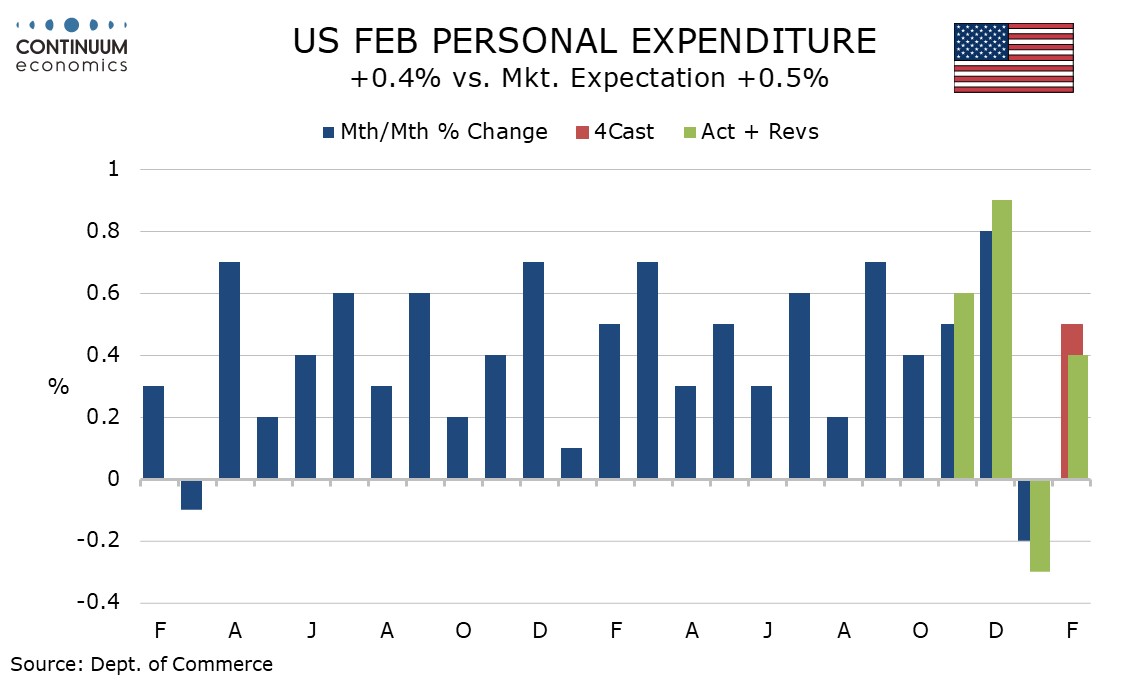

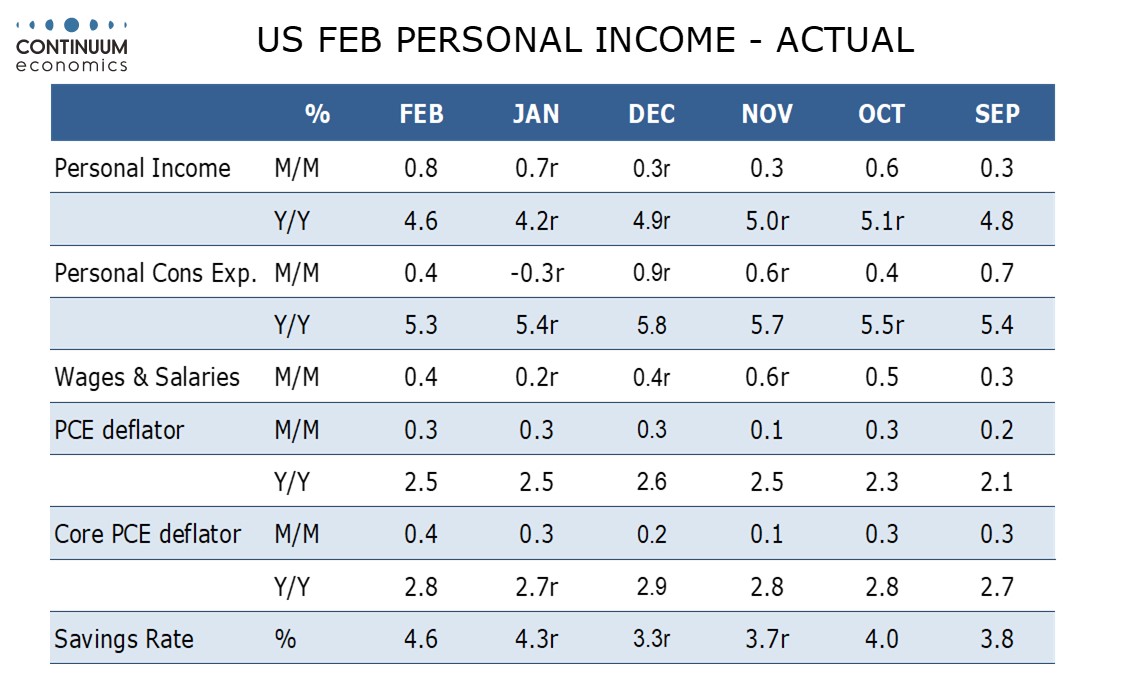

February’s core PCE price data at 0.4%, 0.365% before rounding) has come in considerably stronger than the 0.2% core CPI though the 2.8% yr/yr pace, with January revised up to 2.7% from 2.6%, is in line with a forecast from Fed’s Powell. Personal income was surprisingly strong with a 0.8% increase, exceeding spending, which rose by a moderate 0.4%, for a second straight month.

The difference between overall PCE prices, which rose by 0.3%, and core PCE prices was marginal, with the overall pace up by 0.328% before rounding, with yr/yr growth stable at 2.5%, again as Powell had predicted. Core PCE prices outperformed core CPI in February after significantly underperforming in January.

Personal income, up by 0.8% in February after a 0.7% rise in January has had a strong start to 2025, significantly exceeding spending which rose by 0.4% in February after a 0.3% decline in January. The spending weakness is probably more due to weather than signs of weakening confidence, though the latter is a risk going forward.

The savings rate of 4.6% is up from 4.3% in January and 3.3% in December, and the highest since June 2024.

Wages and salaries rise by a moderate 0.4% after a 0.2% rise in January. January’s personal income rise was led by social security when annual cost of living adjustments were done. February was led by premium tax credits for health insurance and business payments to persons reflecting settlements in two legal cases. Both of these look like one-time boosts to income.

The personal spending detail showed gains in durables, up by 1.4% in a correction from a 4.3% January decline, and non-durables, up by 0.6% after a 0.2% January decline. However services were weak with a rise of only 0.2%, meaning a decline in real terms. That many Canadians refused to take their usual winter breaks in the USA may be a factor.

.