USD, JPY, EUR, NOK flows: NOK and JPY remain attractive

The dip in the NOK after this morning's GDP data looks like a buying opportunity. JPY strength has further to go.

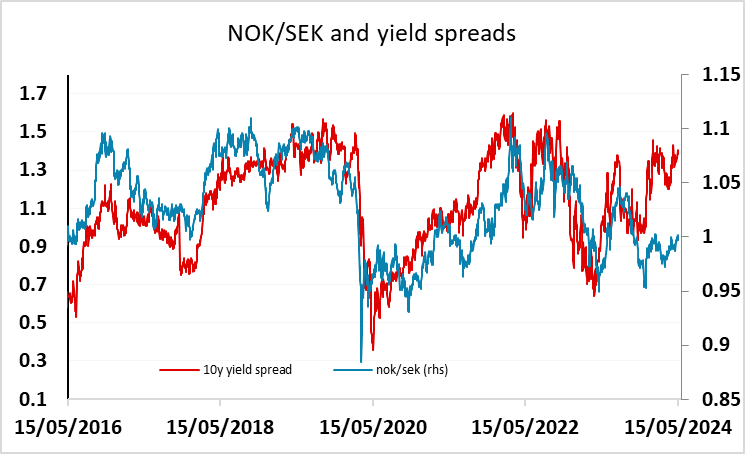

There’s not a great deal on the calendar to move markets on Thursday, but there is scope for FX moves nevertheless. This morning’s Norwegian GDP data was unremarkable, showing a 0,2% q/q rise in line with expectations, and although EUR/NOK has moved a little higher in response, we still favour the NOK due to its low level and the relative hawkishness of Norges Bank. NOK/SEK in particular looks attractive having dipped back below parity, with yield spreads suggesting potential for gains to 1.05.

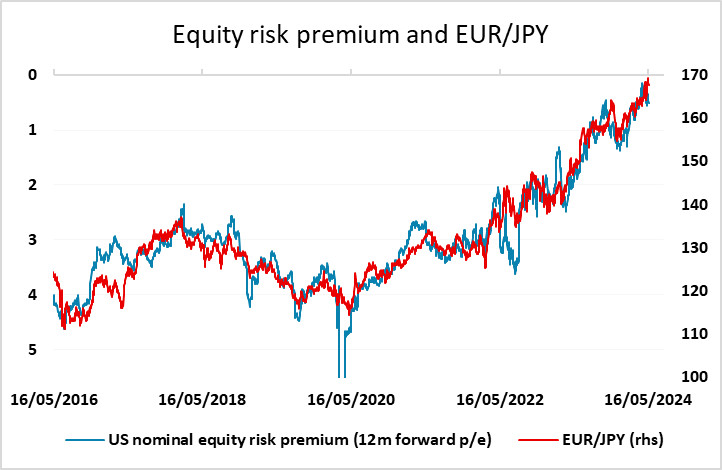

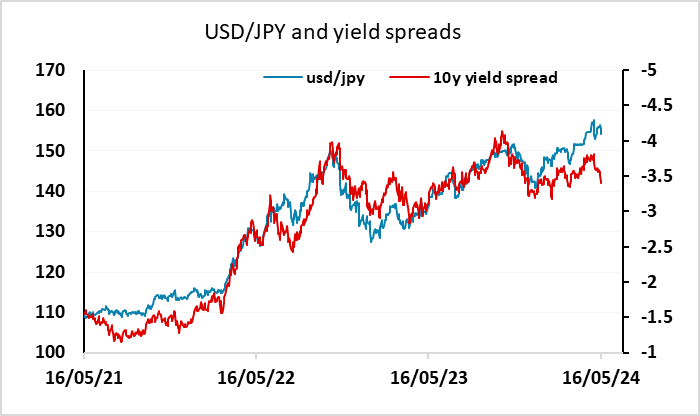

Otherwise, the softer USD tone seen yesterday after the marginally weaker than expected US CPI and retail sales data has extended overnight, with the JPY seeing the most pronounced gains. We still look for more dramatic JPY strength, as yield spreads point clearly to a USD/JPY move back below 150 while rising equity risk premia suggest EUR/JPY can fall to sub-165.