India GDP Review: Rural Strength vs Manufacturing Weakness - Q2 Story

India’s Q2 GDP slowed to 5.4%, driven by weaker manufacturing and global headwinds, but rural demand and agriculture showed resilience. Public investment and festive consumption are expected to support recovery in H2, though challenges like export contraction and fiscal constraints remain.

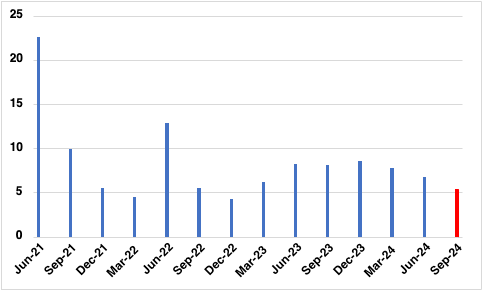

India’s economic momentum slowed to its weakest pace in nearly two years in Q2 FY25, with GDP growth decelerating to 5.4% yr/yr, down sharply from 8.1% yr/yr in the same period last year. The slowdown, attributed to lacklustre manufacturing activity and sluggish private consumption, casts a shadow over the Reserve Bank of India’s (RBI) full-year growth target of 7.2%.

Despite this moderation, India remains one of the fastest-growing major economies globally, bolstered by government spending and rural resilience. However, achieving the RBI’s target appears over-ambitious and would require GDP growth to average an improbable 8.3% in the second half of the fiscal year.

Figure 1: India Real GDP Growth (% yr/yr)

Source: Continuum Economics

Factors Behind the Slowdown

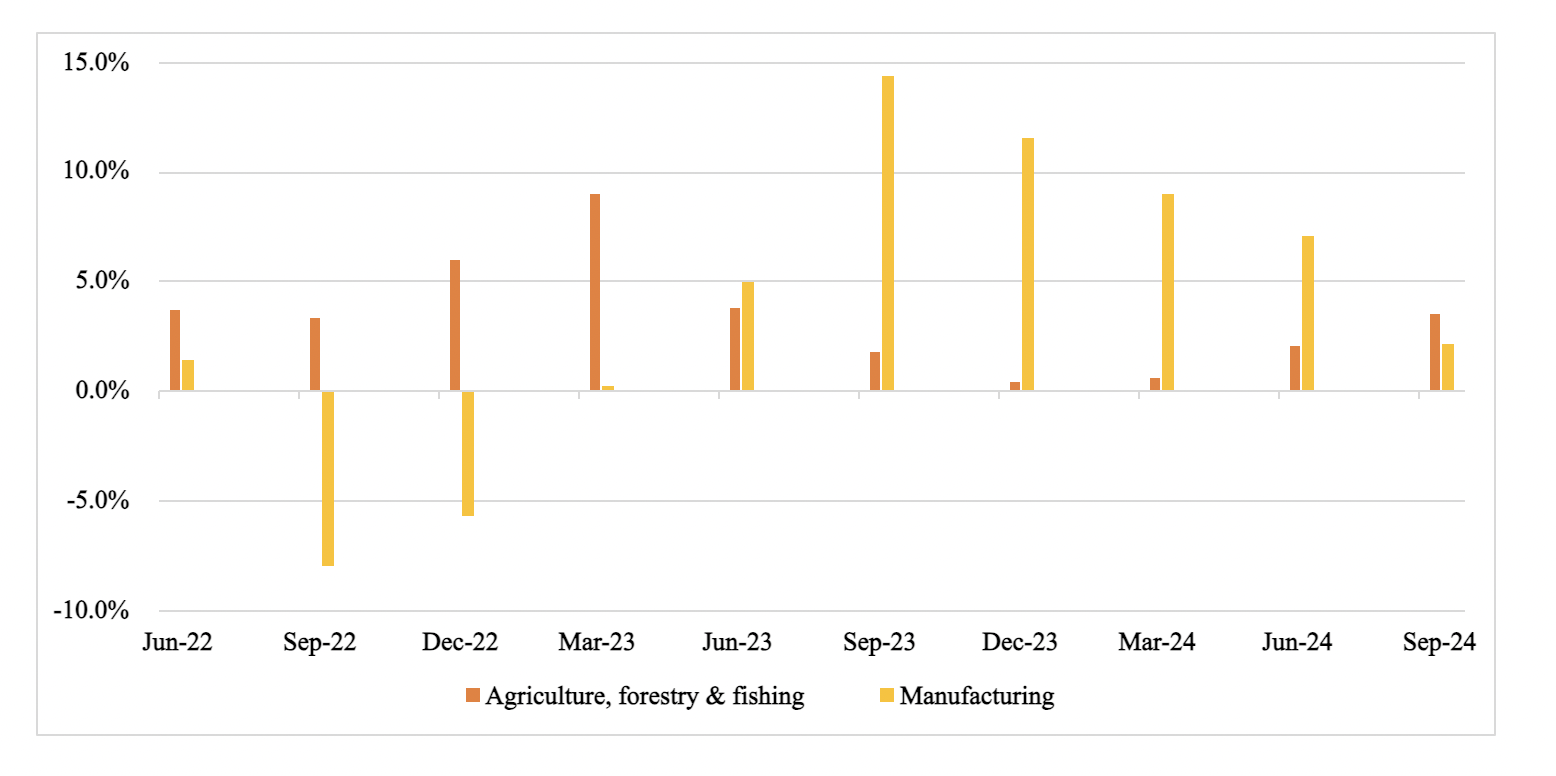

The manufacturing sector, a linchpin of economic activity, grew by a tepid 2.2% yr/yr in Q2, a stark decline from the robust 14.3% yr/yr growth recorded a year earlier. Sectoral imbalances further exacerbated the downturn, with private consumption growth moderating to 6%, a drop from the first quarter’s 7.4%. Weak corporate earnings and global headwinds also weighed on growth. Instances of import dumping and excess global manufacturing capacity impeded domestic production, while geopolitical uncertainties—amplified by the US election cycle and volatile commodity prices—posed additional challenges. Rainfall anomalies and election-related expenditure constraints disrupted economic activities in Q2.

Signs of Resilience

Amid these challenges, agriculture and rural demand provided much-needed buoyancy. Agricultural output grew by 3.5% yr/yr in Q2, significantly outperforming the 1.7% yr/yr expansion in the same period last year. Indicators such as rising rural wages and robust sales of two-wheelers signal a revival in rural consumption, which is expected to sustain GDP momentum in the coming months.

Figure 2: Agriculture and Manufacturing Growth (% yr/yr)

Source: Continuum Economics

Government spending also offered support. Gross fixed capital formation, a proxy for investment, grew by 5.4% yr/yr, albeit slower than the 11.6% growth in Q2 FY24. Public sector capital expenditure is anticipated to accelerate in the second half, bolstered by pre-election fiscal spending in some states and infrastructure projects. It is worth noting that capital expenditure is down 14% yr/yr so far in the Apr-Oct FY25 period, underscoring the subdued momentum in infrastructure projects.

Outlook for H2 FY25

We remain cautiously optimistic about a modest recovery in H2. Festive-season demand, coupled with a wedding season-induced consumption surge, is expected to invigorate urban and rural markets. Sectors like hospitality, transport, and broadcasting services, which grew by 6% yr/yr in Q2, are poised for further expansion. Nevertheless, challenges persist. Exports of goods contracted by 2.6% yr/yr, reflecting weakening global demand. Net tax growth also slowed, constraining fiscal headroom. We anticipate GDP growth of 6.6% yr/yr in FY25. Meanwhile, the RBI is unlikely to lower its benchmark interest rate despite the slowdown, given persistently high inflation and geopolitical risks. Policymakers are expected to focus on catalyzing investment while addressing structural bottlenecks, including inefficiencies in manufacturing and regulatory rigidities. India’s economic trajectory in the second half will hinge on its ability to leverage domestic consumption and public spending to offset external pressures. While the glass appears half empty following two quarters of subdued growth, signs of resilience in rural demand and infrastructure investment suggest it might yet be half full.