USD flows: USD up strongly on higher than expected CPI

Stronger than expected US CPI pushed the USD higher across the board.

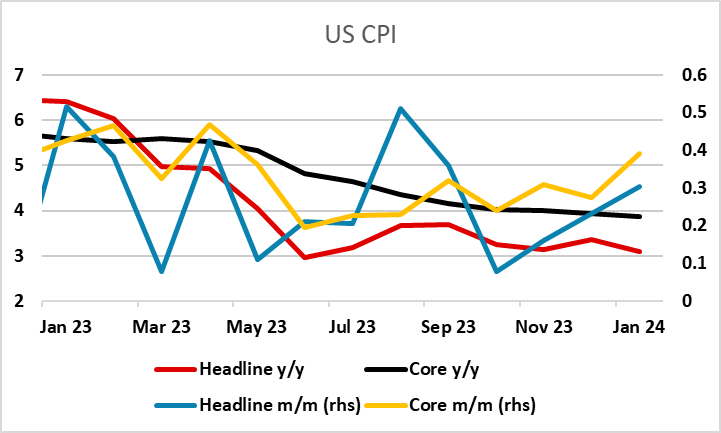

A clearly stronger than expected US CPI number for January has pushed the USD up across the board, with the AUD and JPY suffering the biggest declines. Headline and core CPI were both 0.1% above expectations on a m/m basis, at 0.3% and 0.4% respectively, but 0.2% above on a y/y basis, at 3.1% and 3.9%. US yields are up almost 15bps at the short end and 10bps at the long end, while equities have lost around 1%.

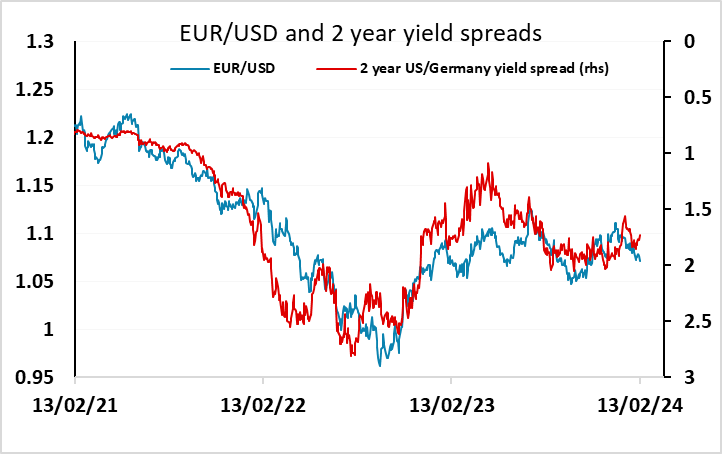

As usual, yields elsewhere are being dragged up by the rise in US yields, even at the short end, and after this morning’s relatively strong labour market data, GBP may be the best protected of the riskier currencies, although initially the EUR has outperformed. Even so, expect 1.07 in EUR/USD to come under pressure.

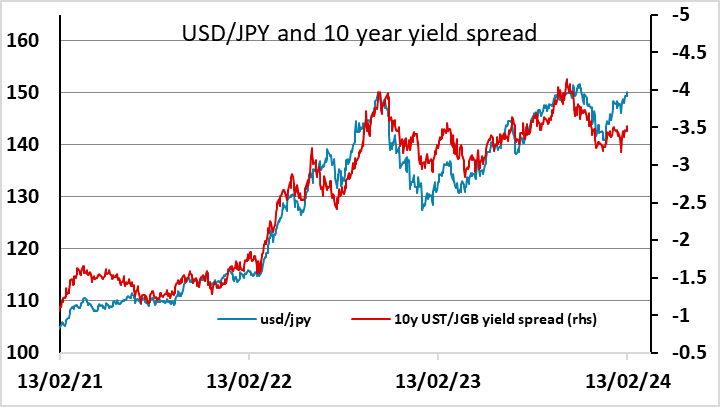

We would expect concerns around a tighter Fed will undermine risk sentiment, and US equities are starting from a vulnerable position ,so the more equity sensitive currencies are likely to suffer, with the AUD probably most vulnerable. Also, the JPY is starting from a level that is already low relative to the historic correlation with yield spreads. So we would expect initial JPY losses on the crosses to be reversed.