U.S. November Core PCE Prices significantly softer than Core CPI

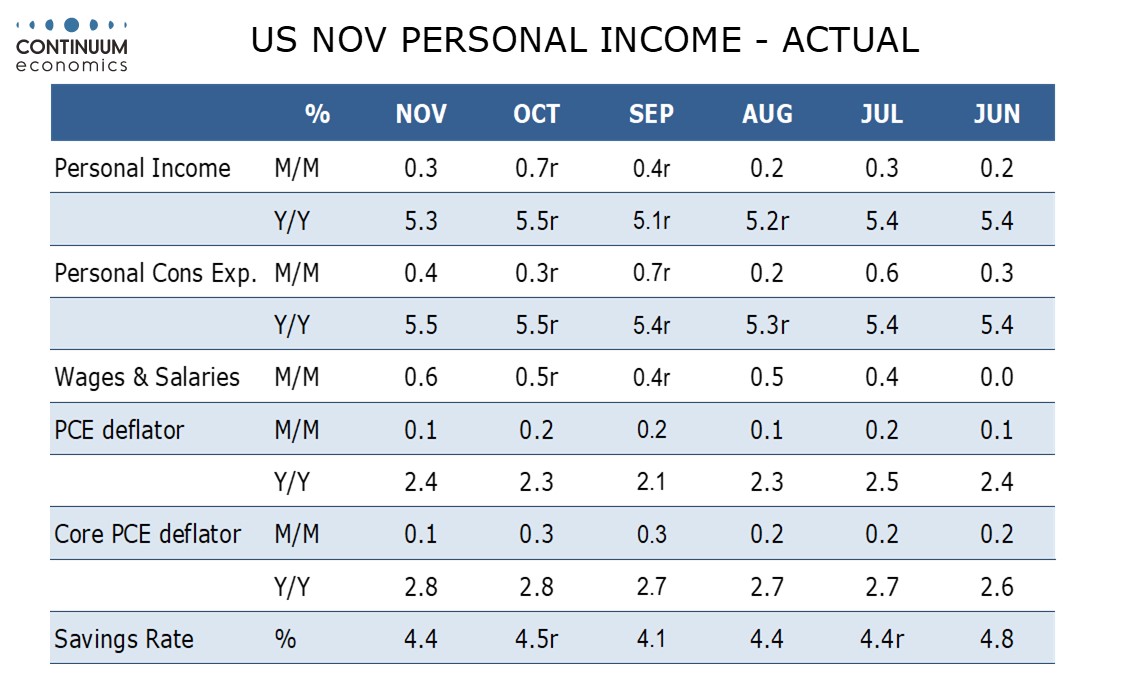

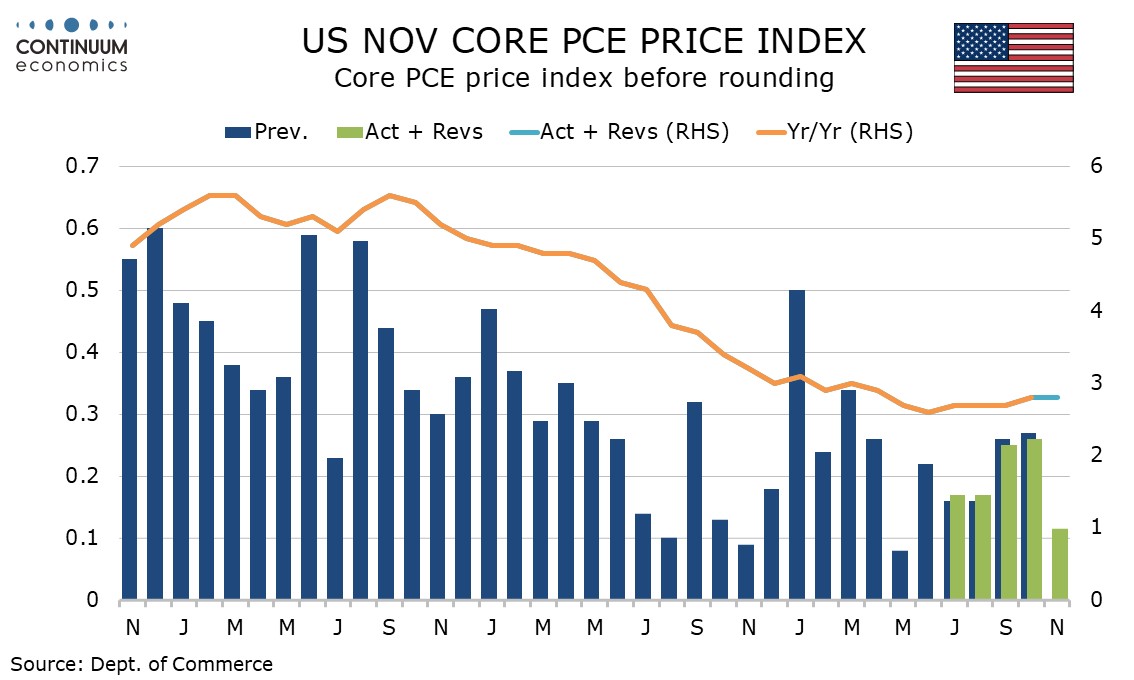

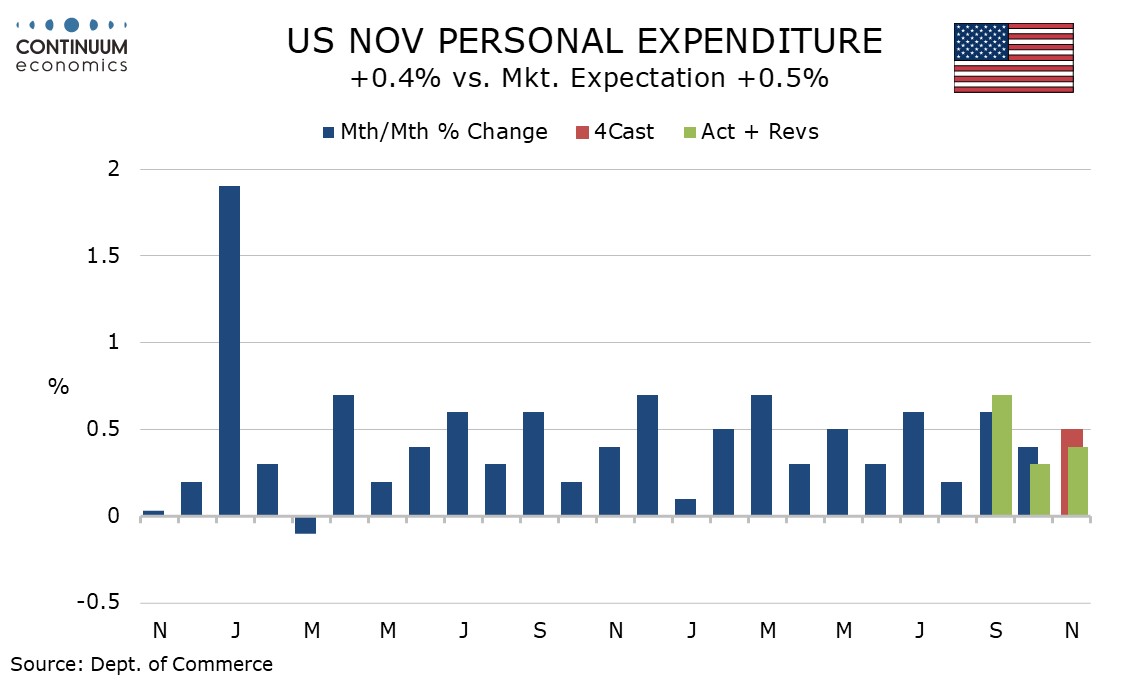

November PCE prices at 0.1% overall and core has sharply underperformed gains of 0.3% in both overall and core CPI, easing some of the inflationary concerns generated by two straight gains of 0.3% in September and October core PCE prices. Gains of 0.3% in personal income and 0.4% in spending are also on the low side of consensus, though still respectable in real terms.

Before rounding core PCE prices rose by 0.115% while the overall pace rose by 0.128%, so while rounded down were quite comfortably below 0.15%. Fed’s Powell had signaled that the numbers could come in on the low side of 0.2% but these are surprisingly soft. Yr/yr core PCE prices were unchanged at 2.8% while the overall pace edged up to 2.4% from 2.3%.

Personal income rose by 0.3% but wages and salaries were strong at 0.6% as the November non-farm payroll details had implied. The other components of personal income showed weakness in a correction from strength in October, the main negatives being a correction lower in dividend income and a drop in transfer receipts, Social Security and the “other” category both falling.

Personal spending rose by 0.4% with durables strong at 1.8% and nondurables subdued at 0.2% as the retail sales report had shown. Services at 0.2% were also subdued. The savings rate slipped to 4.4% from 4.5% but remains above recent low of 4.1% seen in September.