Argentina: December CPI Data and IMF

Argentina's CPI surged in December due to a sharp exchange rate devaluation. The new government's bold fiscal measures aim to curb inflation, but potential contractionary effects and public reactions pose challenges. A $4 billion IMF disbursement supports their plan, diverging from past gradualism. The success of this shock strategy will determine the future of Milei's administration, balancing economic stability against potential political consequences.

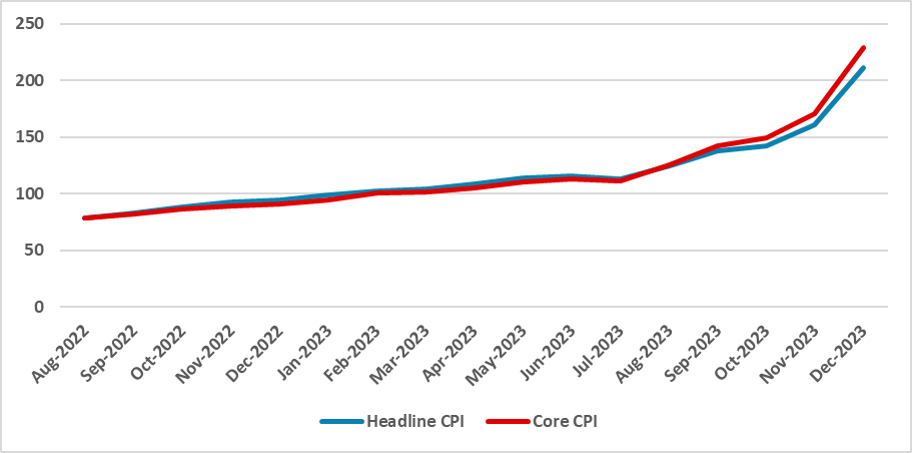

Figure 1: Argentina’s CPI (%, y/y) Source: INDECThe National Institute of Statistics and Censuses of Argentina (INDEC) has released the Consumer Price Index (CPI) data for December. The data indicates a significant rise in the CPI numbers, attributed to the strong devaluation of the exchange rate. The exchange rate, previously stable until the election, experienced a substantial increase under the new government. Additionally, other public service prices were readjusted, contributing to the overall CPI surge.In December alone, the CPI increased by 25.5%. On an annual basis, the CPI accumulated a 211% increase during 2023. Core CPI figures rose by 28.8% (month-on-month) in December, slightly above the headline. Additionally, the figures were higher for goods than for services.The main drivers of the high level of inflation in 2023 could be attributed to a sharp drop in reserves, the fiscal deficit, and exchange rate depreciation. Furthermore, the decision to depreciate the official exchange rate to a level close to the black market contributed to the accumulation of most of the inflation in only one month, differing from the gradual approach adopted by the past administration. In the short term, we believe month-on-month CPI will continue to rise above the 10% level as a result of inertia. For the longer term, the new administration bets that a tight monetary policy, fiscal adjustment, and the deregulation of the economy will help to slow down inflation. We believe this strategy will be partially successful, especially in the second half, but it will come with a cost in terms of growth.

Source: INDECThe National Institute of Statistics and Censuses of Argentina (INDEC) has released the Consumer Price Index (CPI) data for December. The data indicates a significant rise in the CPI numbers, attributed to the strong devaluation of the exchange rate. The exchange rate, previously stable until the election, experienced a substantial increase under the new government. Additionally, other public service prices were readjusted, contributing to the overall CPI surge.In December alone, the CPI increased by 25.5%. On an annual basis, the CPI accumulated a 211% increase during 2023. Core CPI figures rose by 28.8% (month-on-month) in December, slightly above the headline. Additionally, the figures were higher for goods than for services.The main drivers of the high level of inflation in 2023 could be attributed to a sharp drop in reserves, the fiscal deficit, and exchange rate depreciation. Furthermore, the decision to depreciate the official exchange rate to a level close to the black market contributed to the accumulation of most of the inflation in only one month, differing from the gradual approach adopted by the past administration. In the short term, we believe month-on-month CPI will continue to rise above the 10% level as a result of inertia. For the longer term, the new administration bets that a tight monetary policy, fiscal adjustment, and the deregulation of the economy will help to slow down inflation. We believe this strategy will be partially successful, especially in the second half, but it will come with a cost in terms of growth.

Shifting the focus, the IMF has approved a $4 billion disbursement, as previewed by the deal. However, the new government has completely changed the past approach of the deal. Instead of continuing the gradualism approach, the new government introduced a shock plan to their deal. Their target for the primary surplus for 2024 was set at 2% of the GDP, indicating a 6-percentage point consolidation from the 4.0% GDP deficit in 2023. With this level of fiscal surplus, the government would have no need to finance the deficit through monetary emissions, likely helping in the battle against inflation.Additionally, the target for net reserves accumulation was set at $10 billion USD. Unlike 2023, the harvest in 2024 is expected to be better, which will help the Central Bank accumulate reserves. The key will be to keep the official exchange rate at an attractive level for exporters.The fiscal target is ambitious and is likely to cause contractionary effects if achieved. The key question for 2024 will be whether the Congress and the Judicial powers will help or hinder Milei’s plan. Additionally, when the contractionary effects are felt, how will the people react? We believe in Argentina there will be plenty of desire for the population to embark on this adjustment road, but the level of pain needed to be supported is unclear. In case Milei’s popularity decreases sharply due to his economic measures, it is possible that Congress may impeach him. The future of Milei’s administration relies on the success of his shock plan in his first year.