India's Budget FY25: Assessing the Promises and Pitfalls

India’s FY25 budget presented by the Finance Minister continues the trend of incremental reforms, with a focus on predictable continuities. Anchored in themes of poor, women, youth and farmer, the budget aims to balance fiscal prudence with targeted growth initiatives. However, the budget's cautious approach, while commendable for its fiscal discipline, raises questions about its adequacy in addressing India's broader economic challenges that come with a growing population.

FY25 Budget Projections

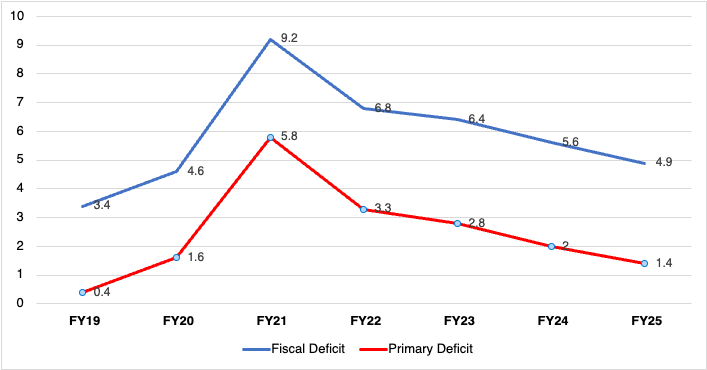

The budget projects a nominal GDP growth of 10.5%, a figure that appears optimistic given the current global economic uncertainties and domestic structural issues. The fiscal deficit is set at 4.9% of GDP, a reduction from the interim budget's 5.1%, reflecting a commitment to fiscal consolidation. While this targets stability, it may constrain the government's ability to stimulate growth in the face of potential external shocks. The optimistic target is also made achievable by the large surplus of INR 2.1tn provided by the Reserve Bank of India earlier this year in May. A large part of the surplus transfer is geared towards reducing fiscal deficit.

Figure 1: Fiscal and Primary Deficit (% of GDP)

Source: Ministry of Finance

Despite the surplus though, market borrowings through dated securities estimated at INR 14.01tn, the budget indicates a significant reliance on debt. The net borrowing requirement of INR 11.63tn underscores the government's heavy dependence on debt markets. This strategy, though necessary for funding critical expenditures, risks crowding out private investment, particularly in the current high interest rate environment. In terms of specifics of the latest budget, the government has projected an 11.7% growth in gross revenue, bringing it to INR 38.4tn. This revenue target is underpinned by a 16.1% increase in income tax, a 10.5% rise in corporation tax, and an 8.7% growth in customs duty. The tax buoyancy for FY25 is estimated at 1.1 based on gross tax revenue. The goods and service tax collection target is set to rise by 11% to INR 10.6tn compared to the FY24 revised estimates. Major subsidies (food and fertiliser) are expected to decrease by 7.8% to INR 3.8 lakh crore. These tax buoyancy figures appear reasonable and, being lower than historical trends, are likely to be achievable. The modest disinvestment target of INR 500bn for FY25 suggests a cautious approach towards privatisation, which could slow down the pace of public sector reforms.

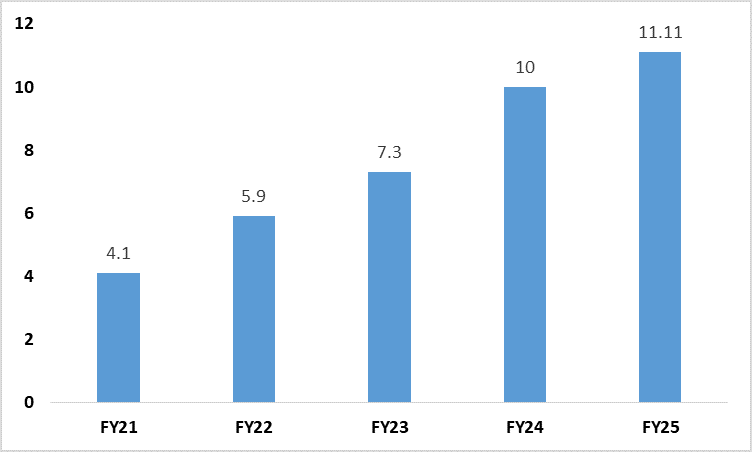

Meanwhile, on the spending front, expenditure is estimated to increase by 10.8% from actual provisional of FY24 to INR 48.2tn in FY25. This includes central government's expenditure and transfers. Capital expenditure accounts for about 23% of the total expenditure. Rising by 17% from the actual provisional figure of FY24, capex is pegged at INR 11.1tn. This indicates that the fiscal push for infrastructure continues, as no amendment has been made to the capex from the interim budget.

Figure 2: Government Capex Outlay (INR tn)

Source: Ministry of Finance

Key Budget Announcements

Infrastructure and Urban Development

The budget's allocation of 3.4% of GDP for capital expenditure signifies a robust commitment to infrastructure development. Initiatives like the PM Awas Yojana Urban 2.0, with an investment of INR 10tn, and urban transit-oriented development plans for 14 large cities reflect an ambitious agenda. Yet, the real challenge lies in execution, as bureaucratic hurdles and project delays have historically hampered infrastructure projects in India. As many as 448 infrastructure projects reported cost overruns and 792 projects were delayed as of April 2024. However, the government has remained committed towards building connectivity and roads - a key NDA government policy. Phase IV of Pradhan Mantri Gram Sadak Yojana, aims to provide all-weather connectivity to 25,000 rural habitations.

Employment and Skilling

The government’s emphasis on job creation and skill development is evident through the introduction of the Prime Minister’s Five Schemes for Employment and Skilling, targeting 41mn youth over five years. This initiative includes a new centrally sponsored scheme for skilling 2mn youth and upgrading 1,000 Industrial Training Institutes. While these measures are laudable, their success hinges on effective implementation and the alignment of training programs with market needs. The focus on employment has been high in the budget as this was a pain point for the government in the latest elections. A large part of loss of seats in the national elections is attributable to the joblessness. As a consequence, the government also increased the allocation towards the employment guarantee scheme (MGNREGA) by 43.3% from FY24 to INR 860bn

Climate Transition and Adaptation

The budget acknowledges the urgency of climate action with several measures aimed at facilitating a green transition. The proposal for an ‘Energy Transition Pathways’ policy document is a positive step towards balancing employment, growth, and environmental sustainability. Financial assistance for micro and small industries to shift to cleaner energy sources and initiatives to promote natural farming practices are commendable. However, these measures, while directionally correct, may fall short in addressing the scale of India's climate challenges. The transition to a green economy requires substantial investments and robust regulatory frameworks, which are still in nascent stages.

Taxation Reforms

The budget introduces significant changes in taxation aimed at boosting consumption and rationalising capital gains. Enhancements in the simplified tax regime, including higher standard deductions and increased employer contributions towards the national pension scheme, are designed to increase disposable income and stimulate economic activity. Income tax relief was increased from the initial standard was INR 25,000. However, the impact of these measures on private consumption remains uncertain, particularly in the face of persistent inflationary pressures.

The reformation of capital gains tax, with new tax rates and definitions for holding periods, aims to encourage long-term investments. Yet, the increased tax rates on short-term gains may deter retail investors and affect market liquidity. The reduction in corporate tax rates for foreign companies from 40% to 35% is a strategic move to attract foreign investment, but its success will depend on broader economic conditions and investor confidence. A higher tax on financial assets (given increased short term capital gain tax), while simultaneously reducing long term capital gain on property, also underscore the government’s aim in boosting real estate.

Support for MSMEs

The budget also introduced eight new measures to support MSMEs, including enhanced Mudra loan limits and the establishment of E-Commerce Export Hubs under PPP mode. These initiatives are intended to facilitate MSME exports and provide the necessary financial support for growth. The increase in the Mudra loan limit under the ‘Tarun’ category from 1mn to 2mn is a notable move. It encourages responsible borrowing and supports the scaling up of small businesses. However, ensuring that these loans translate into productive investments requires close monitoring and support mechanisms.

Sector-Specific Allocations

Key Ministerial Outlays

| Key Ministry | Allocation (INR tn) |

| Defence | 4.5 |

| Rural Development | 2.6 |

| Agriculture and allied activities | 1.5 |

| Home Affairs | 1.5 |

| Education | 1.2 |

| IT and Telecom | 1.1 |

| Health | 0.892 |

| Energy | 0.687 |

| Commerce and Industry | 0.475 |

Agriculture

The allocation of INR 1.52tn to agriculture and allied sectors focuses on integrating 60mn farmers and their lands into a centralised registry and promoting natural farming practices. These measures aim to enhance agricultural productivity and ensure food security. But also boost support for the NDA at the rural level.

Banking and Financial Sector

While the budget's direct announcements affecting banking are modest, its emphasis on consumption revival, infrastructure development, and the digital economy holds significant implications. Initiatives like the digitalisation of land records and BhuAadhaar aim to enhance transparency and efficiency, benefiting the banking sector by reducing risks associated with land transactions. The guidance on greening the balance sheets of banks is a positive step towards sustainable finance.

The government is aiming to boost consumption through increased employment schemes, manufacturing outlays, and income tax relief. This strategy is anticipated given the government's recent loss of vote share in the elections, prompting a focus on welfare schemes and populist measures to appeal to the public. However, given strong opposition, changes to some aspects of the budget, particularly the change in tax on capital gains is expected to be amended before passing of the Finance bill. The bill is expected to be passed before the close of the Monsoon session of the parliament i.e August 9, 2024.

The FY25, while commendable for its fiscal discipline and targeted initiatives, raises questions about its adequacy in addressing India's broader economic challenges. The focus on employment, infrastructure, MSME support, and climate action sets the stage for sustainable growth. However, the budget's cautious approach, reliance on market borrowings, and incremental reforms may fall short in driving the transformative changes needed for robust economic growth.