Brazil CPI Review: 0.4% Growth in September

In September, Brazil's CPI rose by 0.44%, aligning with market expectations and increasing the year-over-year rate to 4.4%. The surge was mainly driven by rising electricity prices, influenced by droughts impacting hydroelectric generation. While other categories behaved predictably, cost-push inflation signals suggest temporary shocks rather than sustained demand pressures. With the BRL depreciation's impact largely absorbed, the main challenge remains achieving the 3.0% inflation target. Market expectations indicate a possible 50bps rate hike, though fundamentals suggest a more modest 25bps increase.

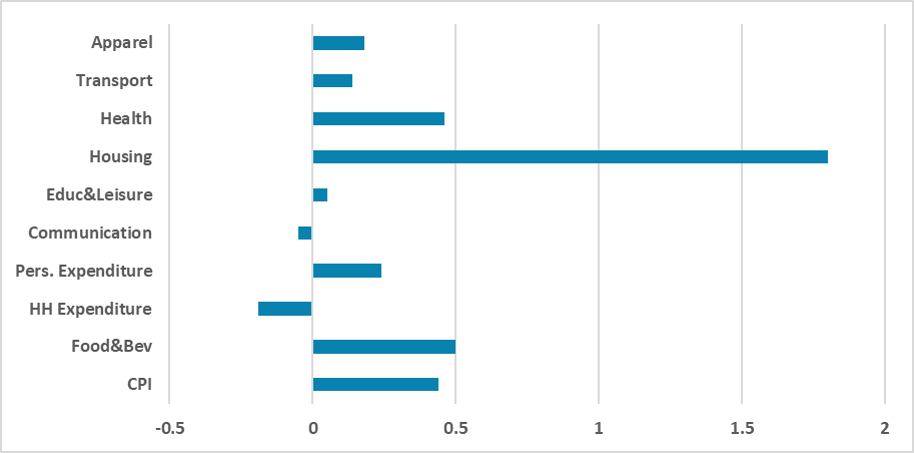

Figure 1: Brazil’s September CPI (%, m/m)

Source: IBGE

Brazil's National Statistics Institute has released the CPI data for September. The figures show that the CPI grew by 0.44% in September, in line with market expectations according to a Bloomberg survey. As a result, the year-over-year (Y/Y) CPI has increased to 4.4% from 4.2% in August. What primarily drove the CPI figures up during September was the rise in electricity prices, which contributed to the 1.8% increase in the Housing group. Brazilian hydroelectric plants, the main sources of electricity generation, are facing severe droughts that are affecting their electricity generation capacity. In response, thermoelectric plants, which are more expensive, are being used to generate electricity, leading to adjustments in electricity tariffs.

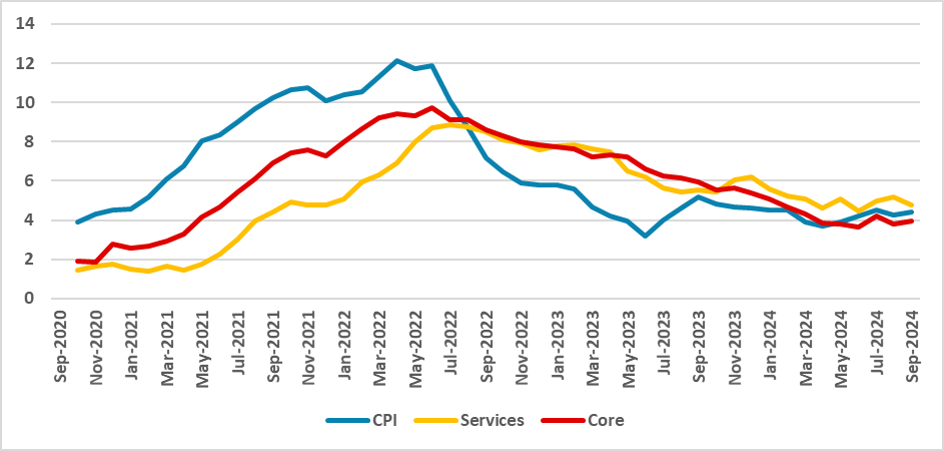

Figure 2: Brazil’s CPI (%, Y/Y)

Source: IBGE and BCB

The other groups behaved largely as expected. The Food and Beverages group grew by 0.5% in the month, driven by the rise in fruit prices. Household expenditures dropped by 0.2% during the month. Services inflation, a variable the Brazilian Central Bank closely monitors, rose by 0.15%, while its Y/Y CPI dropped to 4.8% from 5.2%. Looking at the numbers, what we observed in September points more to cost-push inflation, which tends to be a temporary shock, rather than demand pressures. Additionally, the tight labor market seems yet to cause significant price increases.

With almost five months of the exchange rate being above the 5.3 level, it is fair to say that most of the impact of the exchange rate depreciation should have already passed through to prices, meaning the effect of a more depreciated BRL will have a limited impact on CPI going forward.

Still, the major challenge has been ensuring inflation converges toward the 3.0% target. In recent months, the CPI is showing it will hover around the 4.0% mark, and market expectations still doubt that the Brazilian Central Bank (BCB) will be able to bring inflation down to the 3.0% target in the long term. The unanchored expectations and potential future price pressures stemming from a heated labor market are what justify the BCB resuming rate hikes. Most market participants now believe we will see a 50bps hike at the BCB’s next meeting, but we still believe that fundamentals only justify a 25bps increase.