U.S. September Retail Sales continue to show resilience, Initial Claims correct lower

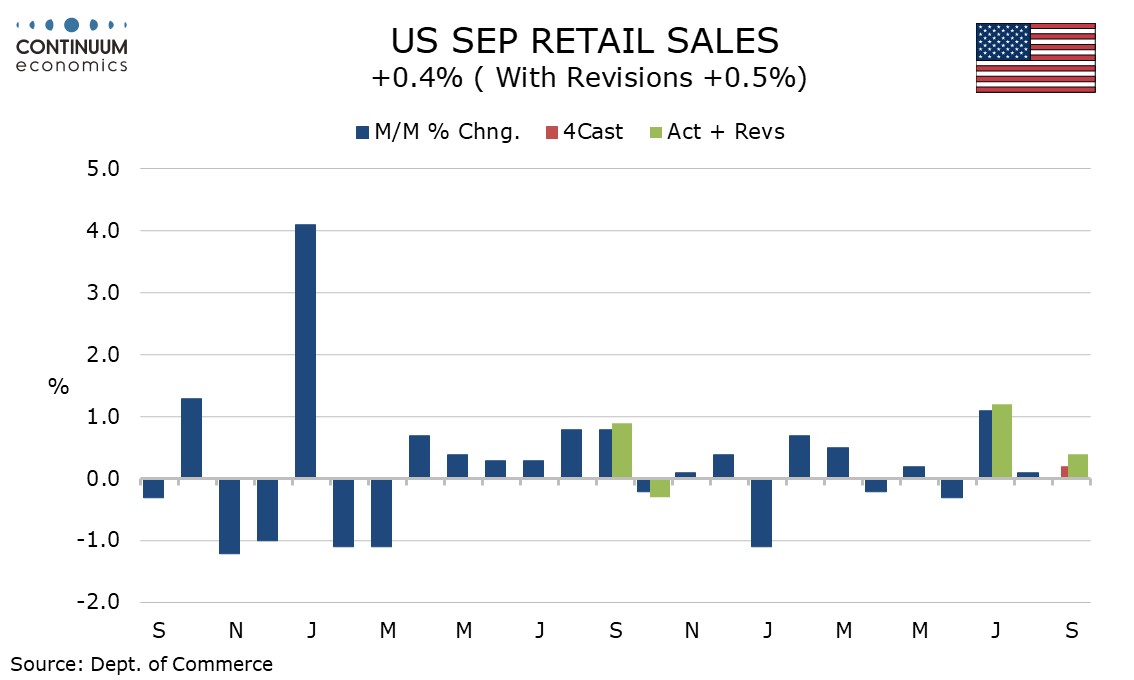

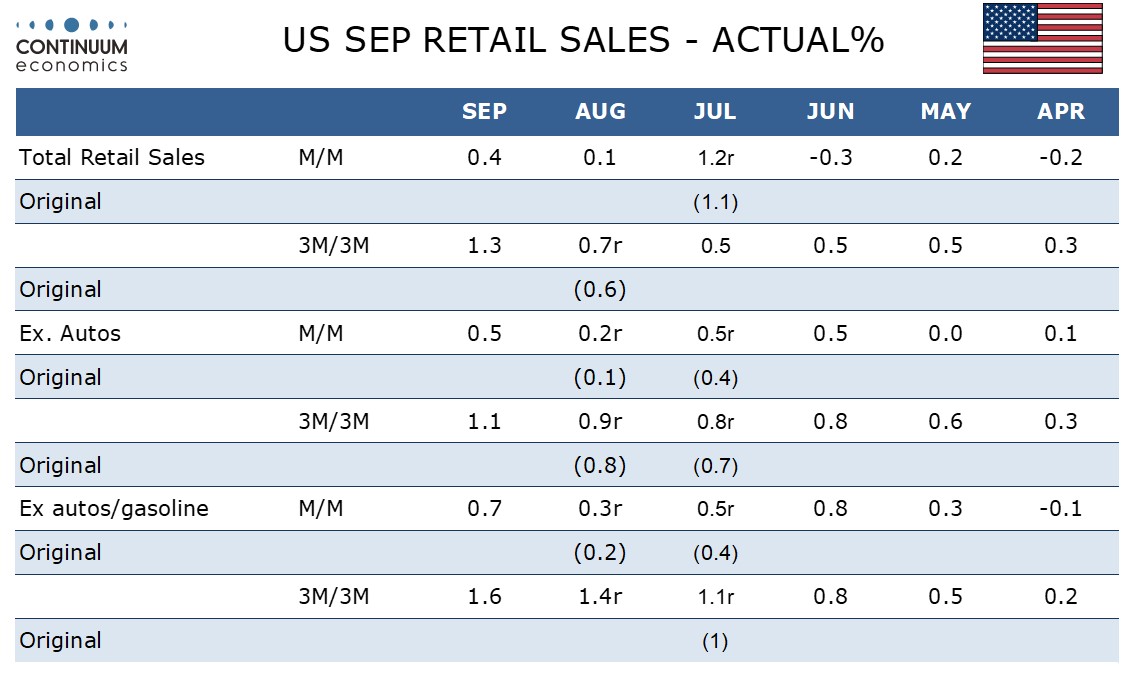

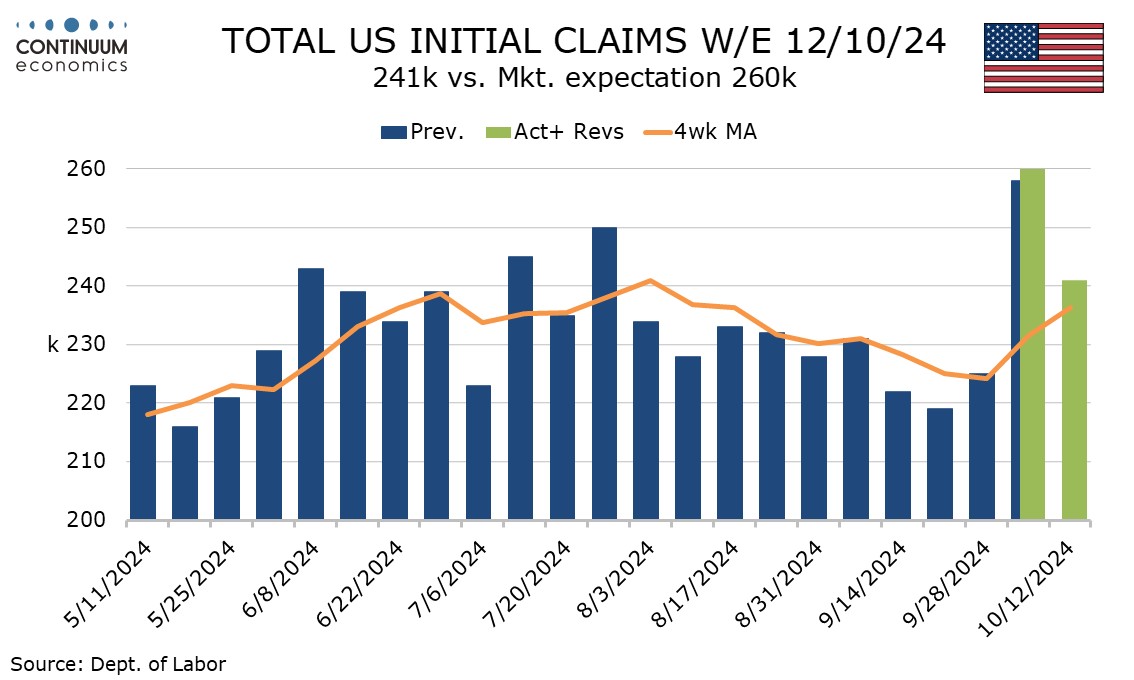

September retail sales show the consumer sustaining solid momentum through Q3 with a stronger than expected rise of 0.4% overall, 0.5% ex autos and impressive gains of 0.7% both ex autos and gasoline and in the control group that contributes to GDP. Initial claims in the survey week for October’s non-farm payroll slipped to 241k from 260k, which may reflect a lesser impact from Hurricane Milton than feared, though the impact of the Hurricane may not be fully reflected yet.

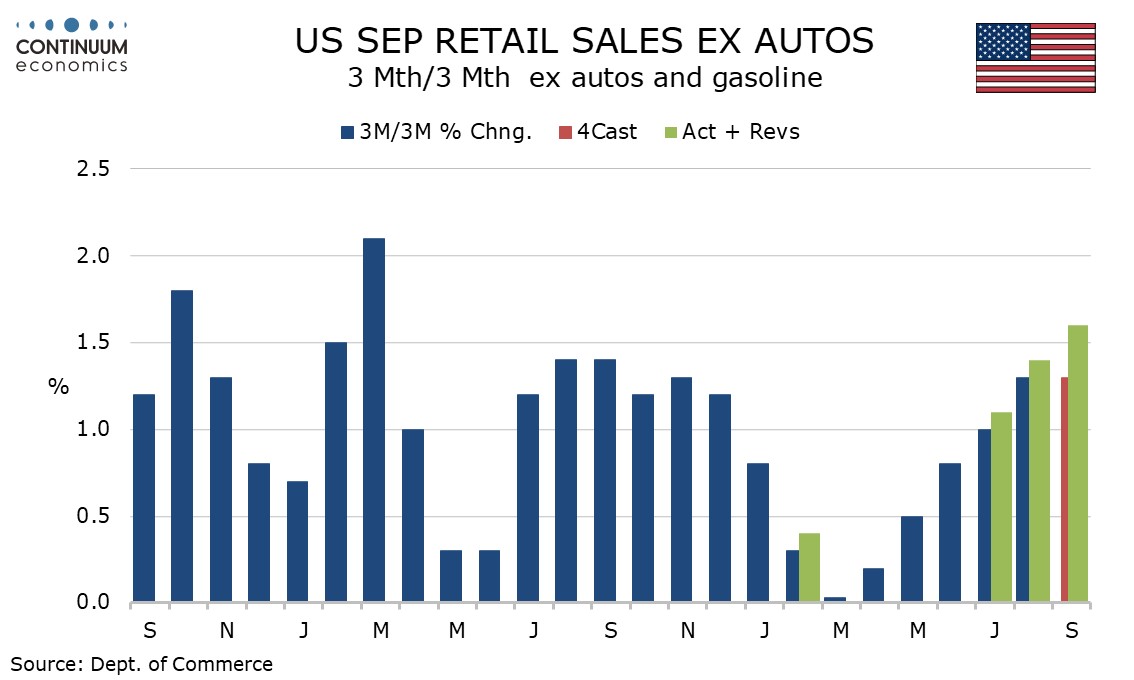

Auto retail sales were unchanged, slightly underperforming the total, and gasoline sales slipped by 1.6% on lower prices. The 0.7% rise ex auto and gasoline is stronger than expected with both preceding months revised up by 0.1%, leaving a solid Q3.

Q3 sales ex autos and gasoline rose by 1.6% (not annualized), the strongest quarter since Q1 2023. Overall sales rose by 1.3% in Q3 while sales ex autos rose by 1.1%.

Strong gains of 1.0% or more were seen in September from health and personal care, clothing, food and food services, though weakness was seen in electronics and furniture.

Initial claims fell by 19k after a 35k rise in the preceding week. Last week’s rise was led by states impacted by Hurricane Helene and Michigan. This week the sharpest fall came in Michigan, by 7.8k. Florida saw a 3.4k decline which could be because people impacted by Hurricane Milton were unable to file claims, meaning risk for a rise next week. Still, Hurricane Milton was less destructive than feared.

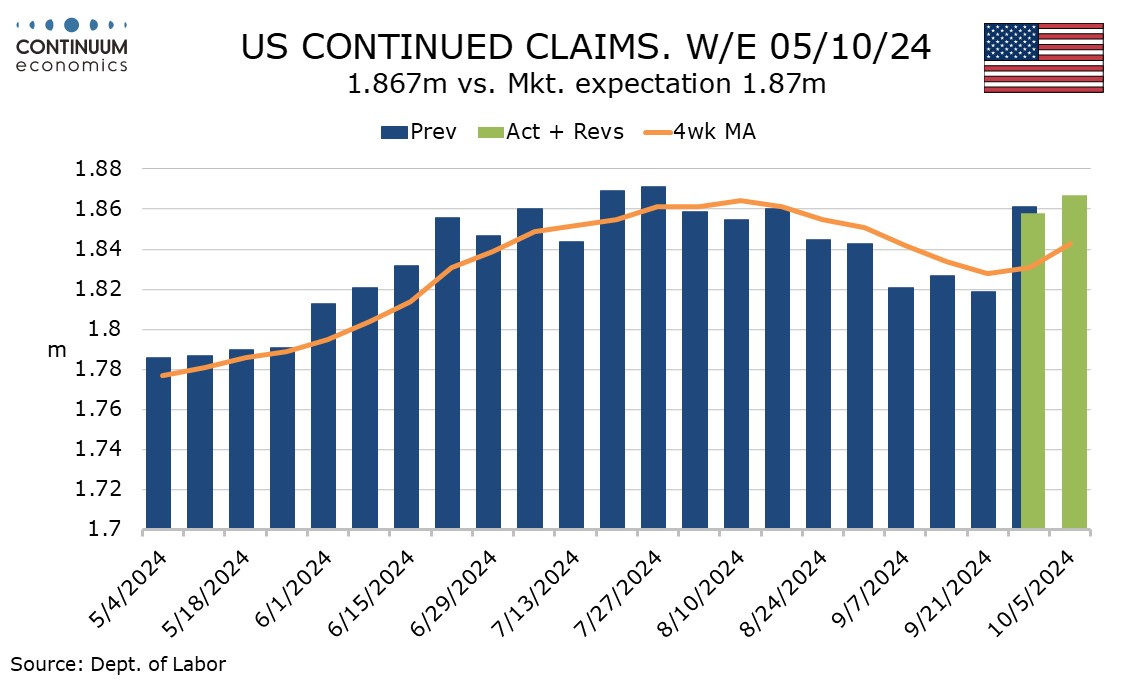

Continued claims, covering the week before initial claims, rose by a modest 9k after a 39k increase in the preceding week. 4-week averages show initial claims at an 8-week high of 236.25k and up from 228.25 in the survey week for September’s payroll. The continued claims 4-week average is at a 5-week high of 1.843m.