EZ HICP Review: More Core Disinflation Signs As Headline HICP Jumps on Energy Base Effects?

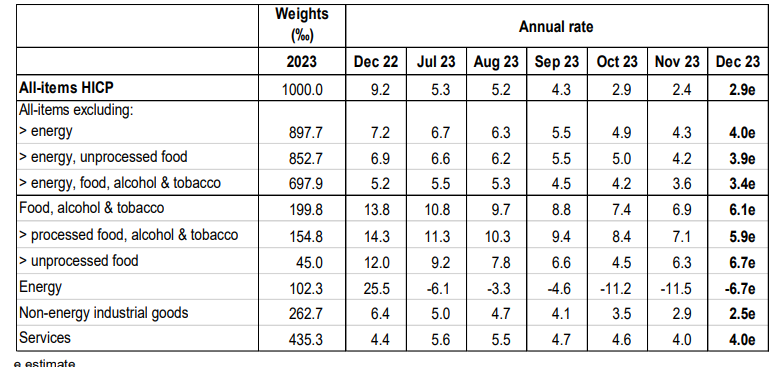

There has been repeated positive EZ news in the form of plunging inflation. After coming in lower than envisaged for three successive months, the December HICP inflation instead were in line with consensus thinking. Having dropped 0.5 ppt to a 28-month low of 2.4% in November, this was exactly reversed in December by energy related base effects (Figure 1) but with the core hitting a 21-mth low of 3.4%, still symptomatic of a drop in underlying inflation that is occurring faster and more broadly than had been ECB thinking, now encompassing not only falling core rates but also softer persistent inflation signals, the latter a key consideration for the ECB. Indeed, both headline and core were 0.1 ppt below ECB projections for Q4 made only a month ago. The path ahead may not be smooth as more energy base effects may be in store over and beyond those that dominated these December numbers and there may be some indirect tax rises in Germany as well as possible spill over from tensions in the Gulf. But in seasonally adjusted m/m terms, headline HICP is negative in the last few months!

Figure 1: Headline and Core Inflation Diverge?

Source: Eurostat, Continuum Economics

ECB Take Note!

Indeed, we now envisage that the headline may now hit target by mid-2024, well over a year earlier than the ECB envisages, while the core should continue to fall in the interim regardless. There are ever-clearer signs of softer underlying inflation both in terms of persistent price pressures which are now running below the 2% target.

Baseless Base Effects

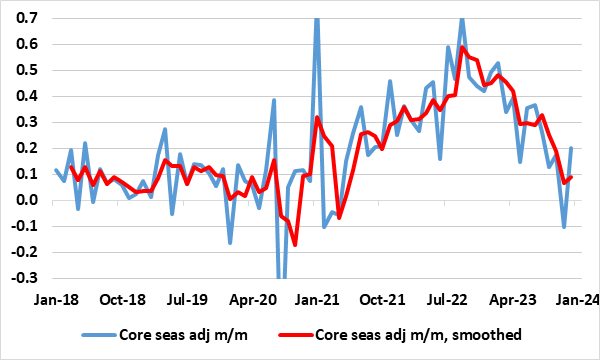

Indeed, in these December HICP data, the core rate hit a 21-month low 0f 3.4%, down 0.2 ppt on the month and down two ppt in the last 3-4 months. But this disguises an even clearer fall in recent price dynamics, as seen in m/m seasonally adjusted data (Figure 2), and with the smoothed core rate now consistent with an undershoot of the 2% target, albeit a little higher in pure m/m terms. The ECB instead continues to (at least overtly) focus on y/y rates despite the ensuing limitations from spurious base effects. Highlighting this, President Lagarde used the recent Council press conference to underscore that ‘This month, inflation is likely to pick up on account of an upward base effect for the cost of energy. In 2024, we expect inflation to decline more slowly because of further upward base effects. In other words the ECB is letting its inflation analysis be affected as much (if not more) by developments that happened up to 12 months ago rather than in the last month or so.

It could be argued that using m/m adjusted data would place too much emphasis on what may be an aberrant monthly observation. But this applies equally to y/y rates too as the base effects may just as much reflect aberrant observations. In addition using a smoothed (ie 3-mth mov avg) would give a clear idea of recent trends when using adjusted m/m data (as we have been using for some time). Notably the core rate on this basis has been running at less than 0.1% m/m for the last few months on average and this conti ued into December (Figure 2).

Figure 2: Smoothed Core m/m Price Pressures Running Near Zero

Source: ECB, CE