EZ Growth Risks Increasing?

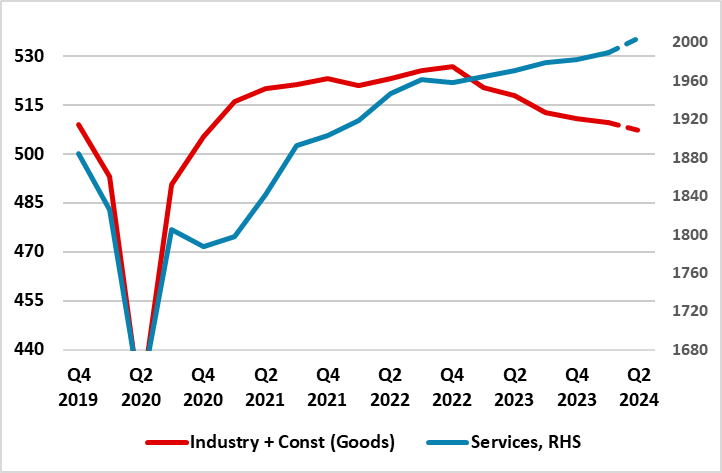

The EZ economy has been seeing downside risks but ones that may now be materializing. The fact that growth rates among the EZ main economies have diverged of late (Spain robust, Germany contracting afresh) actually reflects a marked disparity in growth rates between strong services and persisting declines in goods output, this evident in both survey data as well as official national account data (Figure 1). In itself this is not troubling, not least as services (an average of around 70% of GDP) are a far more sizeable component of GDP, but where the stronger economies have a relatively higher share. But recent survey data are now suggesting weaker activity, and now including services to a degree that imply that the support the sector has given the whole EZ economy through H1 this year may have dissipated, if not reversed. We think that this may mean that real economy consideration may start to rival inflation as ECB policy considerations.

Figure 1: Divergent Sector Performances Within EZ GDP Picture

Source: Eurostat, € billions

Supply Side Insights More Discernible

At best, the EZ economy is diverging ever more clearly as Germany falters while Spain prospers more discernibly. But while overall EZ GDP last quarter may have shown a slightly sub-trend type but respectable result of 0.3%, thereby matching the Q1 outcome, the demand details are far and few between. The details so far available continue to suggest that net trade was the main supportive factor as domestic demand continued to labour, at least outside of Italy. But this ignores the production of the economy, important both because it offers better insights into the supply side but also because it makes easier and better comparison with business survey numbers which largely provide insight via manufacturing, services and construction.

Is Sector Divergence Coming to an End?

Official national account data on the sectors for the last quarter are also yet to be produced, but unlike on the demand side there are monthly data available for most of the quarter. They suggest a sizeable q/q drop in construction, a more modest decline in manufacturing but a sizeable further advance on services (albeit with only two of the three months yet detailed. But these Q2 figures therefore suggest that services will continue a long-standing uptrend which has seen q/q gains in 11 out of the last 12 quarters, albeit where the sector has yet to return to its pre-pandemic trend line. In contrast the goods sector of manufacturing and construction have fallen for five successive quarters and look very likely to so again in Q2. This unusual divergence (Figure 1) helps explain the apparent resilience in the EZ economy amid an unprecedented tightening in monetary conditions into 2023 in which revised data suggest that a recession has been avoided and a recovery is now underway on the back of services. It also explains the divergence performances of individual economies within the likes of Spain and France, services have a much larger share of GDP (up to 80%) compared to 70% in Germany.

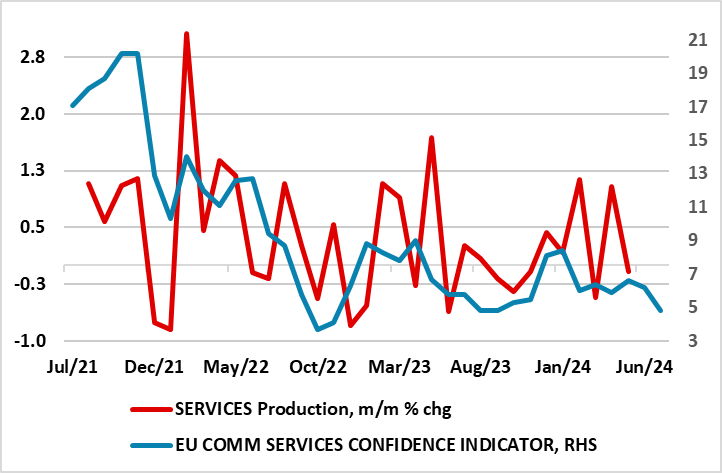

Figure 2: Survey Data Suggests Weaker Services Ahead

Source: Eurostat, European Commission

But the strength in actual services output so far this year is solely due to spikes in both February and April, which we think were partly aberrant – warm weather initially and the timing of Easter latterly). In other words, there are doubts as to whether genuine added momentum has developed. Such doubts are compounded by more recent business survey data which not only continue to suggest contracting manufacturing and construction but now a fragility, if not a fall, in the level of services output (Figure 2) in the current quarter.

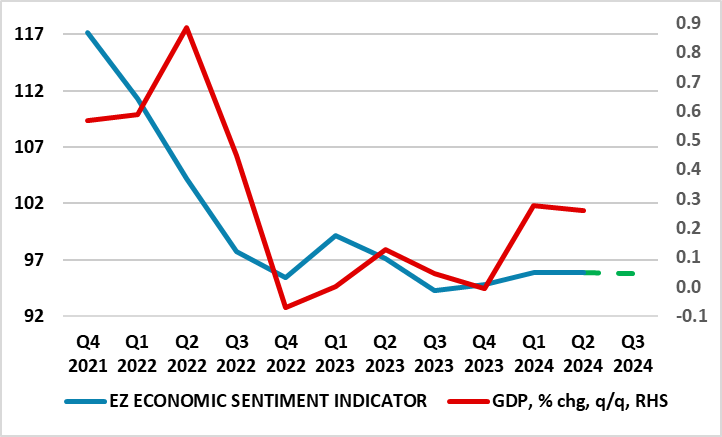

Figure 3: Survey Data Also Suggest Weaker GDP Ahead

Source: Eurostat, European Commission

GDP to Flat-line?

At this juncture, the weakness in survey data, either the PMI or European commission numbers) do no suggest fresh GDP declines ahead. Instead they suggest feeble growth (Figure 3) of the ilk of the projections we have been advancing, ie around 0.1% for Q3 and only a notch better in Q3, outcomes below currency consensus thinking and even more of an undershoot of ECB projections. We think that this may mean that real economy consideration may start to rival inflation as ECB policy considerations, especially if the services slow-down start to spill over into curbing services inflation.