Canada - BoC Q1 Business Outlook Survey shows some easing in inflation expectations

The Bank of Canada’s Q1 business outlook survey shows some easing of inflation expectations while being mostly subdued on the economic picture. The BoC looks unlikely to ease on April 10 with Q1 GDP looking set to exceed expectations, but this survey helps to maintain hope that by June enough progress on inflation will have been seen to allow the BoC to move.

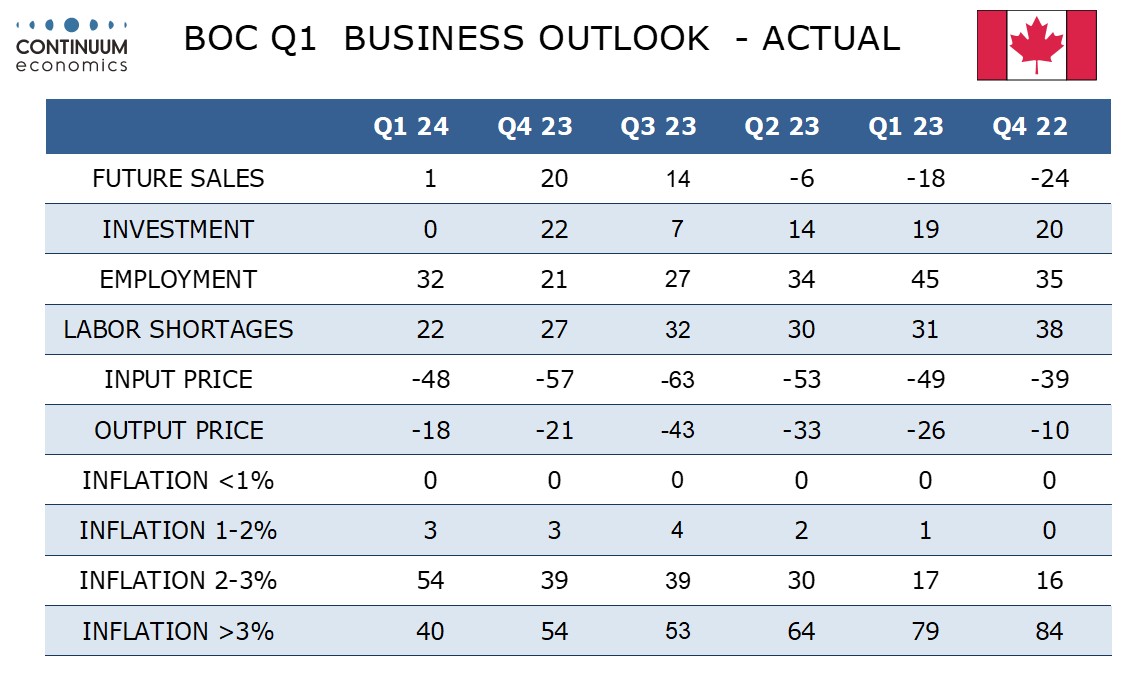

Only 3% of respondents see inflation coming in below the 2% target, but there has been a shift within the clear majority who expect above target inflation, with 54% now expecting inflation between 2 and 3%, when in Q4 54% had expected inflation to be above 3%. A separate survey of consumer expectations was however less encouraging. The 1-year expectation was almost unchanged at 4.92% from 4.91%, and the 2-year view slipped to 3.76% from 3.94%. However the 5-year view saw a worrying bounce, to 3.12% from 2.62%.

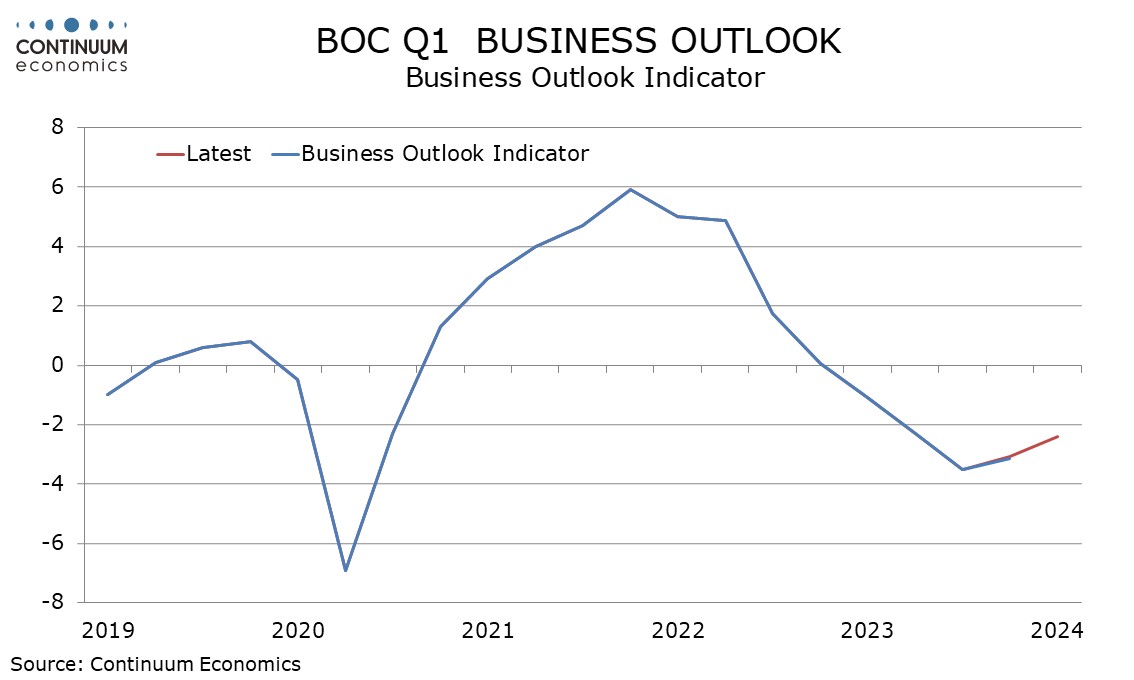

The BoC’s business outlook indicator was marginally improved at -2.42 from -3.09 but maintains a subdued picture. Expectations for future sales saw a significant dip to 1 from 20, while investment slipped to 0 from 22. BoC Senior Deputy Governor Rogers recently expressed a desire for more investment to improve Canada’s weak productivity performance. Employment picked up, but fewer see labor shortages, suggesting supply is improving.