Preview: Due February 6 - U.S. January Employment (Non-Farm Payrolls) - Above trend but with higher unemployment

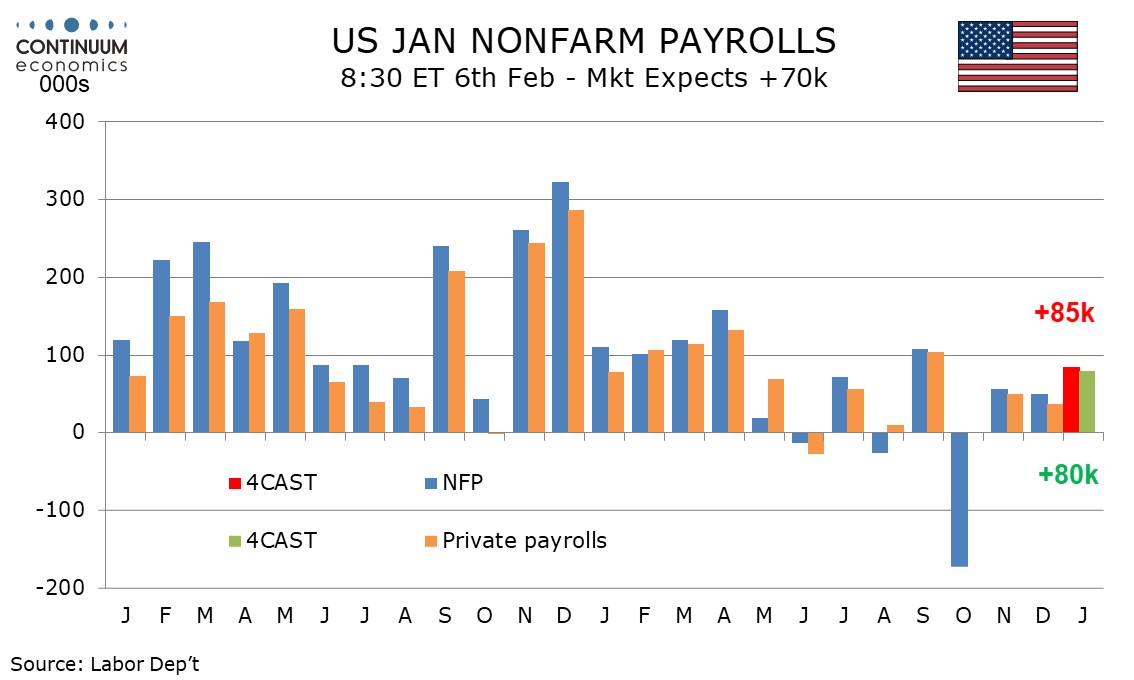

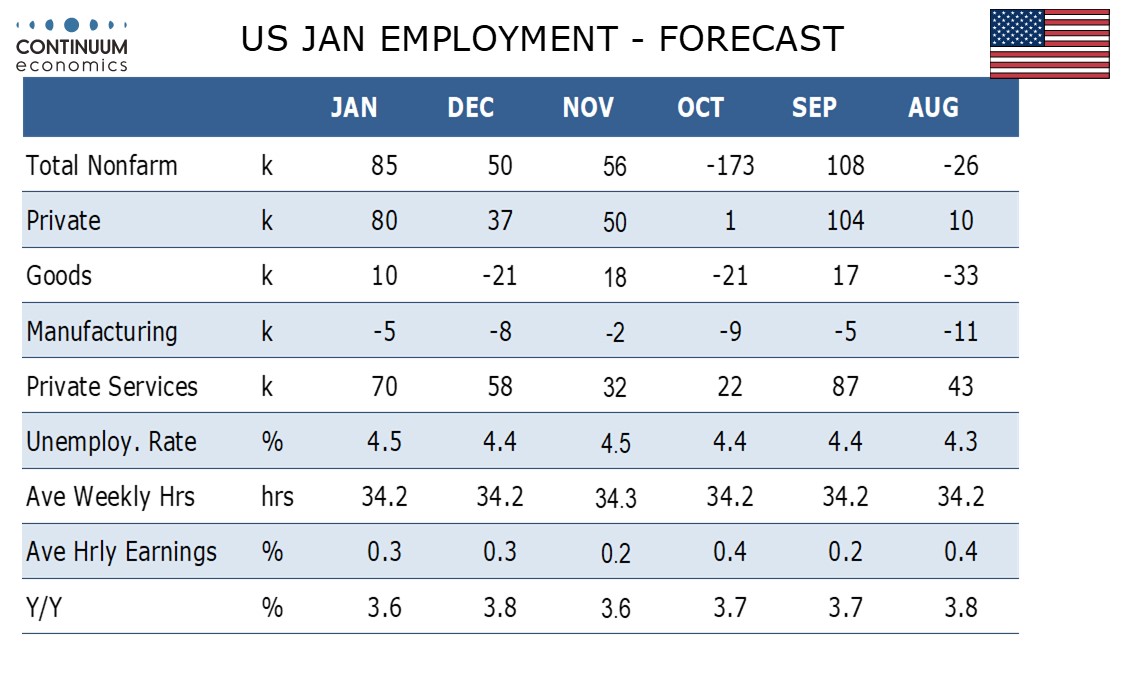

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect average hourly earnings to rise by 0.3%, in line with recent trend.

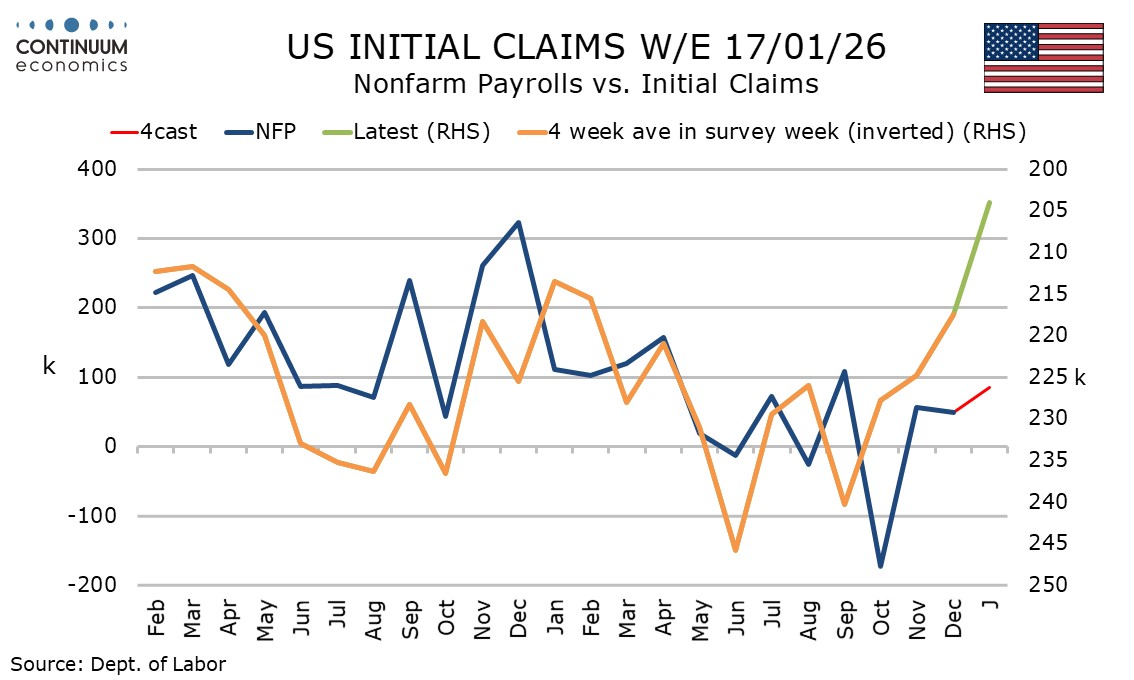

Initial claims remained low in January’s payroll survey week, suggesting layoffs remain limited too. While signals on hiring are also weak January is a month in which before seasonal adjustment payrolls fall sharply, meaning that a low level of layoffs could be more significant than a low level of hirings in seasonally adjusted data.

A sector to watch this month is retail. We have seen three straight declines of near 20k in this sector, despite retail sales holding up well. Limited seasonal hiring before Christmas may mean fewer layoffs than the seasonals assume in January. We expect private services to rise by 70k in January, the strongest since September, the last month in which retail employment increased. An improvement from a 58k increase in December private services will be more than fully explained by the swing in retail.

We expect a modest 10k rise in goods employment after a 21k decline in December and this would be a fourth straight month in which goods change direction, construction leading the volatility. Bad weather in late January came too late to be captured in January’s payroll. We expect a marginal 5k rise in government, fully in state and local. Federal is however stabilizing after a sharp drop in October as DOGE payoffs came through.

January data sees the annual benchmark revision incorporated into the payroll. The preliminary estimate released in September saw an unusually large 911k downward revision to the March 2025 benchmark. If this estimate proves accurate, and they are usually reasonably close, that would imply payroll gains averaged only 61k in the 12 months to March 2025 rather than 137k as currently published. Payrolls subsequent to March 2025 may also be revised lower, but we doubt as sharply, Between March and December of 2025, payroll gains averaged 28k and 48k in the private sector. We expect the private sector average gain will remain positive and that revisions will be modest (around -20k) to recent months.

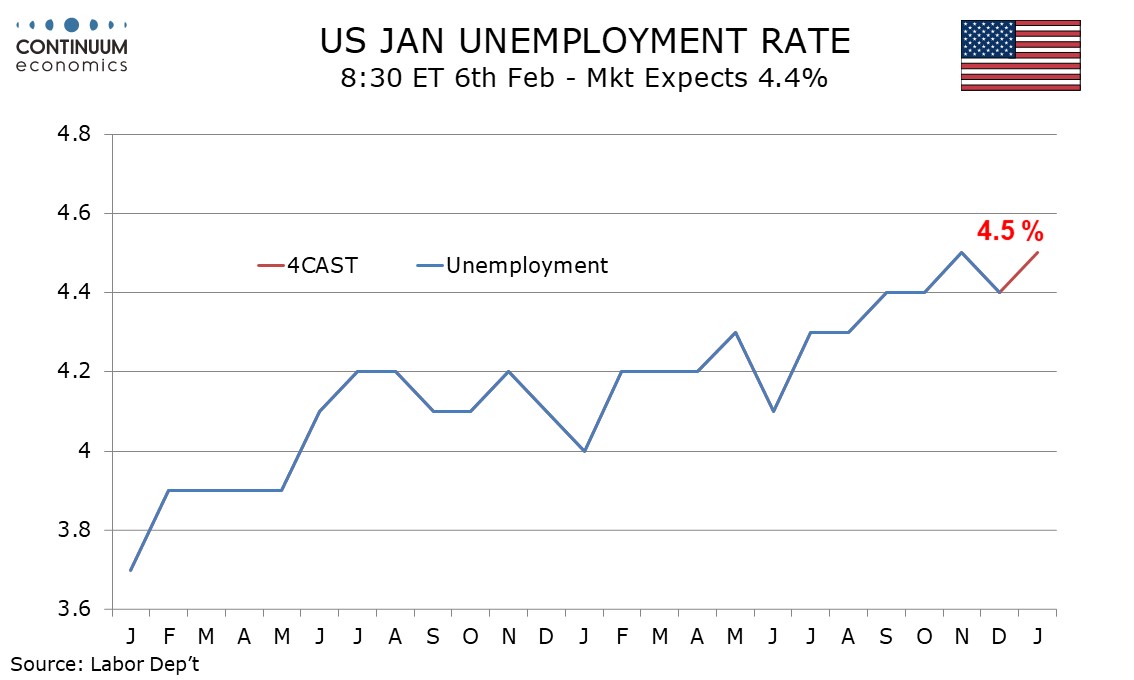

While we expect an above trend month from employment, we expect unemployment to rise to 4.5% from 4.4%, reversing a December decline when the household survey delivered a dip in the labor force and a stronger rise in employment than seen in the non-farm payroll. January reports usually see population control adjustments to the Household survey, though this year they will be delayed to February’s report. If the population control adjustment been coming in January, it could have reduced the unemployment rate, given risk that existing data is underestimating the slowdown in immigration.

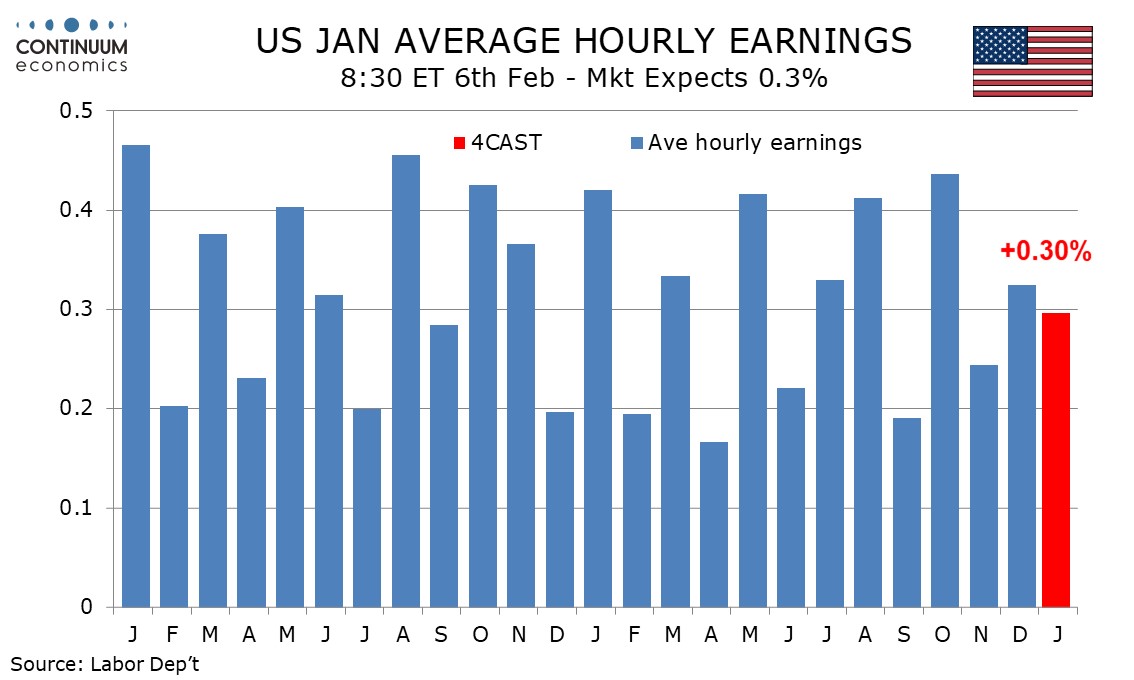

Average hourly earnings trend is around 0.3% per month, with 2005 having seen three gains of 0.3%, four of 0.5% and five of 0.2%. We expect a 0.3% increase in January, and close to 0.3% even before rounding. This would see yr/yr growth slip to 3.6% from 3.8%.

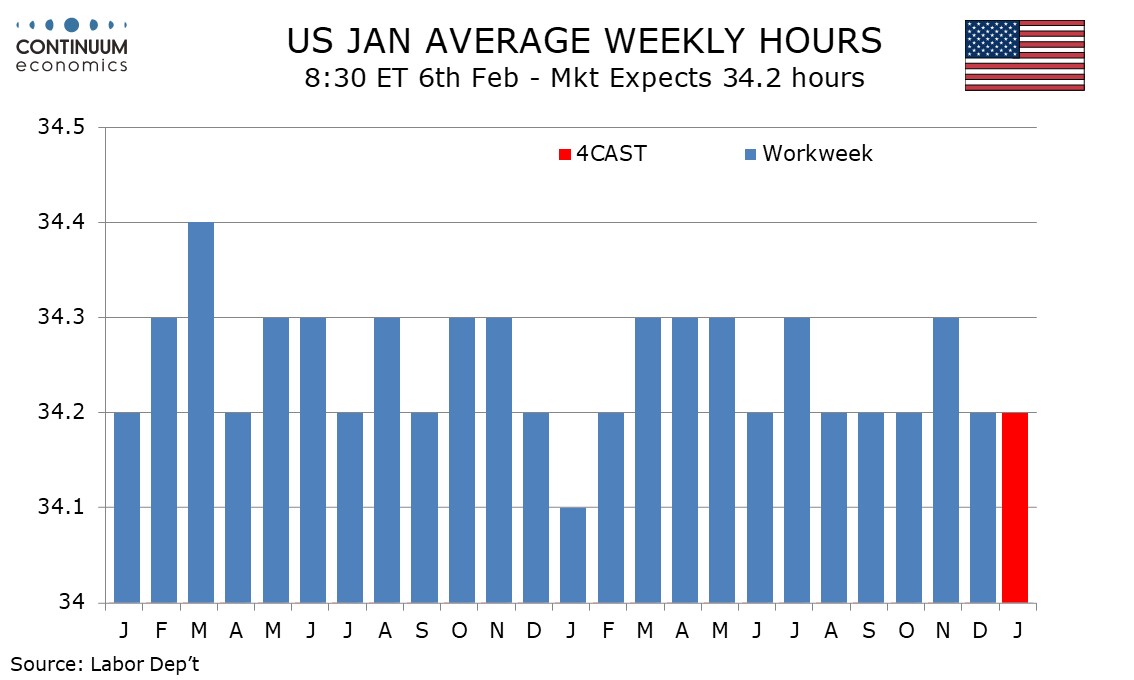

We expect an average workweek of 34.2 hours, unchanged from December and matching four of the last five months, a rise to 34.3 in November being the exception. Even if employment picks up in January, an unchanged workweek will imply only a modest pick-up in activity. Activity late in the month is likely to take a hit from bad weather, even if that is missed by January’s non-farm payroll.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.