ECB: Council Policy Reservations Deeper Than Expected?

The account of the June ECB Council meeting confirmed one dissent against the widely flagged 25 bp rate cut but also revealed perhaps clearer reservation among some other members about easing at that juncture. Indeed, there seemed to be disagreement about interpreting data; what is the basis for assessing how data moved relative to expectations and even an implicit objection to the ECB having a symmetric target! Unsurprisingly, there was no clearer pointer to when the next rate cut may arrive but especially against more recent soft real economy and monetary data, we see nothing in these minutes to alter our view which envisages 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance, the latter clearly a key consideration for the ECB.

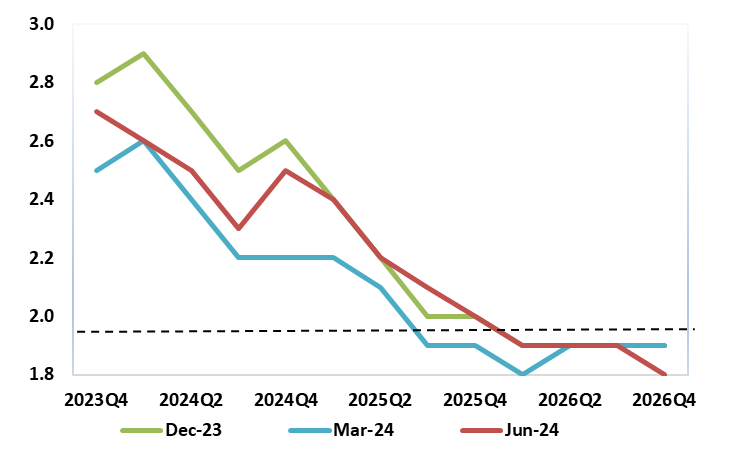

Figure 1: ECB Inflation Outlook – the Last Three Vintages

Source: ECB

With only one formal dissent made, the account did highlight that some members felt that the data available since the last meeting had not increased their confidence that inflation would converge to the 2% target by 2025 but instead pointed to greater uncertainty in the outlook. Notably, the bulk of the Council thought instead that it would be wrong to focus on such a short timeframe of data is assessing risks and policy. But the divisions were wider even in accepting what the data was actually saying, not least as to whether wage pressures had exceeded or undershot expectations.

There was also a clear divide in assessing the inflation outlook, not least in terms of what the relevant part of the forecast horizon was. The hawks noted that the June staff projections for both headline and core inflation in 2024 and 2025 had been revised up compared with the March projections, thereby totally ignoring that the end-2026 projection has been revised down a notch (Figure 1). The fact that rhetoric regarding the last mile, as the final phase of disinflation, being the most difficult, merely reiterates Bundesbank caution.

Regardless there was some disingenuous discussion and thinking by the hawks. They viewed risks to the inflation outlook as being tilted to the upside, partly because downside risks to inflation had diminished since the last meeting. This was allegedly due to the ongoing economic recovery but also owing to heightened geopolitical risks the latter meaning greater uncertainty in the outlook. On this basis, as such risks will never disappear totally, as there would never be a situation when the inflation outlook did not have an upward bias as there will always be uncertainty.

But the hawks also suggested that a small undershooting of inflation would be much less costly than a continued overshooting, especially as the anchoring of inflation expectations should not be taken as given. This is totally in conflict with the ECB’s updated monetary guidelines as of four years ago which moved to a very discernible symmetric 2% target.

Notwithstanding the reservations they put forward, all but one of the hawks showed a willingness to support Chief Economist Lane’s proposal to cut rates. But the account does highlight that amid the ECB’s oft-repeated three-pronged policy reaction function, some members are putting more weight on certain aspects than others, in particular in assessing incoming economic and financial data rather than the dynamics of underlying inflation and the strength of monetary policy transmission. All of which suggest that the policy path ahead is likely to see continued reservations and probably dissent!