Preview: Due November 13 - U.S. October CPI - Similar to August and September

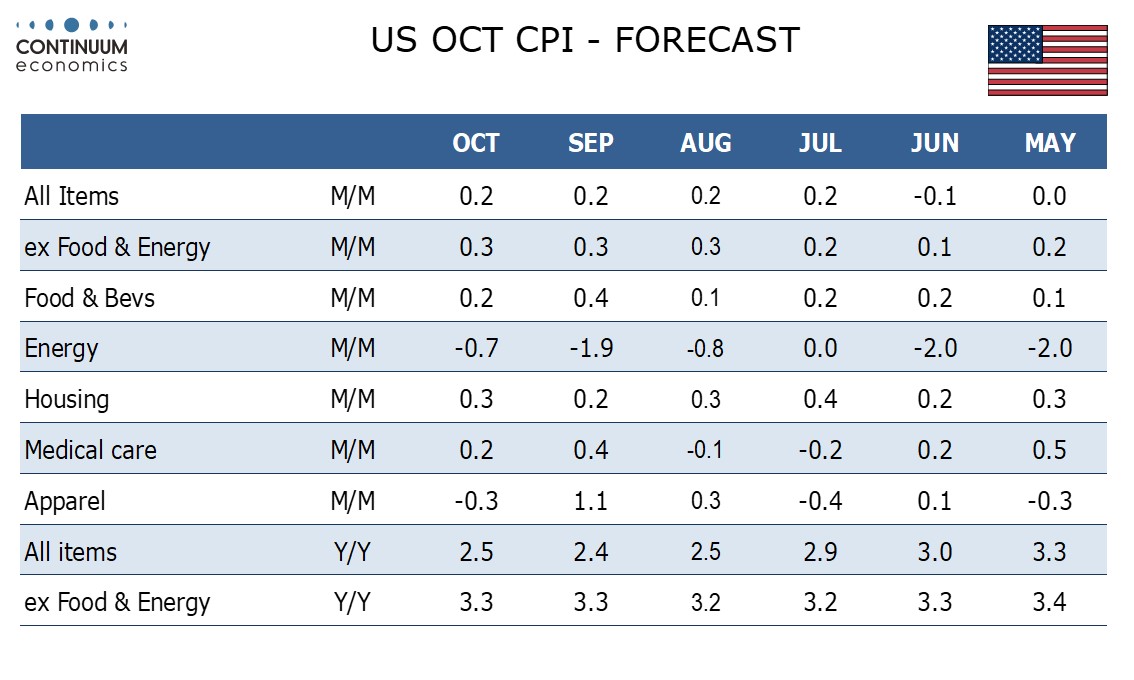

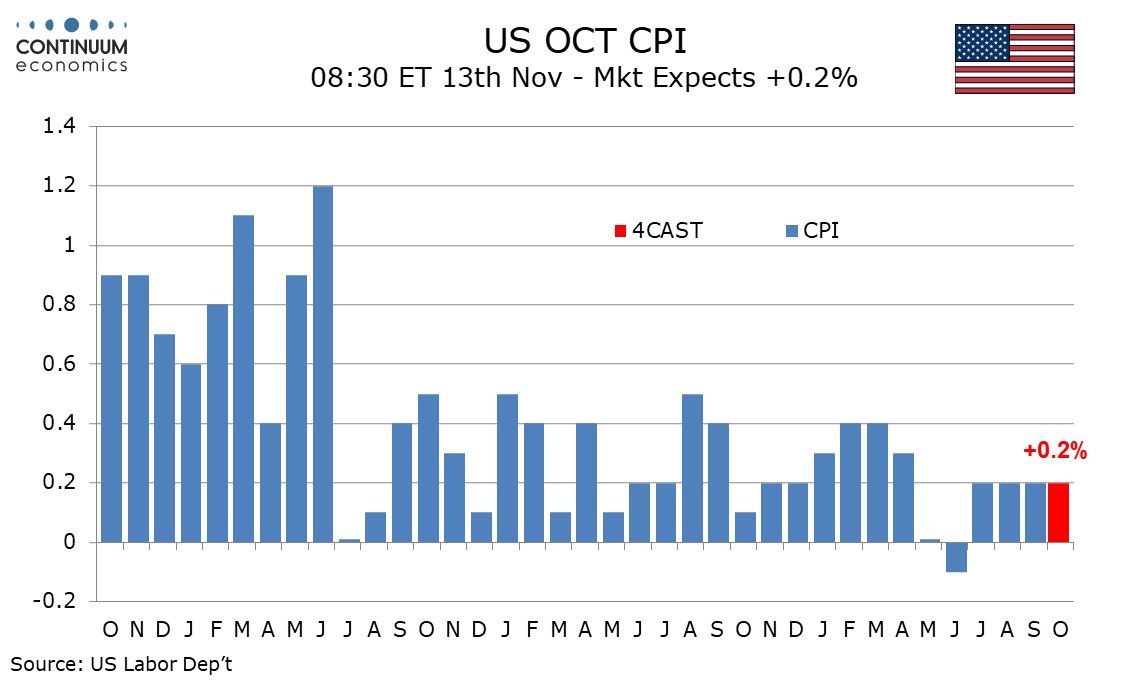

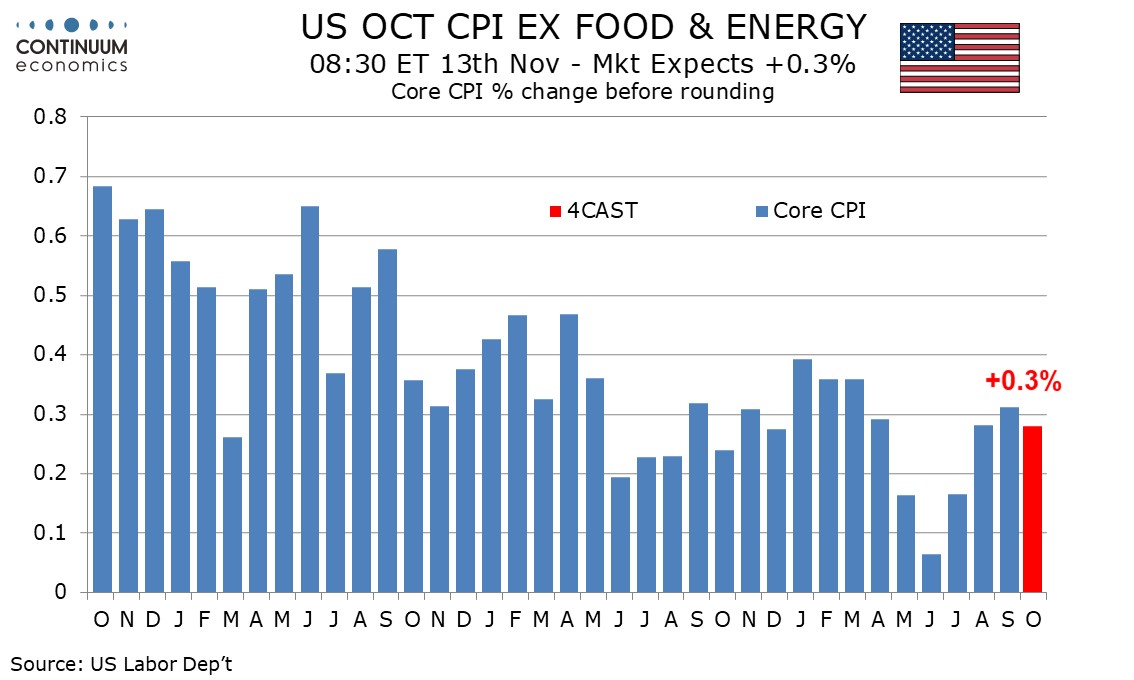

We expect October’s CPI to increase by 0.3% overall for a fourth straight month with a third straight 0.3% increase ex food and energy. Before rounding we expect a 0.20% rise overall, slightly stronger than the three preceding outcomes, with a 0.28% rise ex food and energy. The latter will be softer than September’s 0.31% but matching August’s 0.28%.

The 0.3% gains ex food and energy in both August and September came as modest disappointments. The details were different, with August boosted largely by strength in shelter and air fares, but September seeing broader based gains offsetting a correction below trend in shelter. Air fares remained strong, while apparel and medical care saw above trend months. September’s detail was more disappointing than that of August. September saw core PCE prices above trend at 0.3%, after a 0.2% rise in August (with both softer than their respective core CPI releases before rounding).

For October we expect owners’ equivalent rent to return to trend at 0.4% after a 0.3% September gains corrected a 0.5% rise in August. However hotel costs may be inflated by demand generated by hurricane-related evacuations. Apparel, medical care and air fares are unlikely to match September’s strength but used auto prices appear to have stopped declining.

Gasoline looks set to decline though less steeply than September. We expect a modest 0.2% increase in food. We expect yr/yr CPI to edge marginally higher to 2.5% from 2.4% with energy having seen a slightly steeper drip in October 2023 but the core rate is likely to be unchanged at 3.3%.