U.S. Fiscal Policy Post-Election: Temporary Fiscal Stress Rather Than a Crisis

We remain concerned that temporary fiscal stress will be evident in H1 2025, as rating agencies worry over the deficit/debt and interest rate trajectory that is unlikely to improve under either president. This leaves an event risk of a ratings downgrade from one of the major agencies, given that the fiscal picture warrants a lower rating for the U.S. government than it currently enjoys. However, current good yield levels on U.S. Treasuries, plus lack of alternative major reserve assets argues against a fiscal crisis occurring.

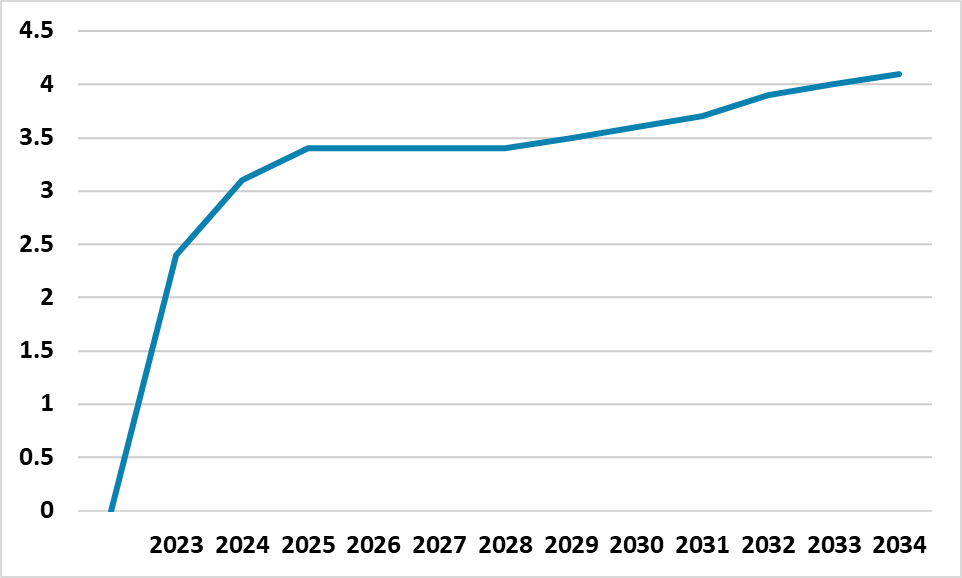

Figure 1: U.S. Government Debt Held by the Public (% of GDP)

Source: CBO June 2024 (here)

After the Election

Kamala Harris and Donald Trump have different ideas re spending and revenue measures if they become president, but the key is who controls congress. While national and state opinion polls make the presidential election too close to call, the polls suggest that the Democrats are likely to control the House and the Republicans the Senate. This split congress reduces the ability of either of the presidential candidates to enact their full proposed programs and requires Harris or Trump to compromise. H1 2025 will likely see more reality kicking in re fiscal programs.

However, if Donald Trump is elected, then he will likely push hard to ensure that the parts of the 2017 tax cuts due to lapse by end 2025 are renewed. This is estimated in itself to add around USD500bln to the deficit per annum. Kamala Harris platform is to extend the TCJA to those with incomes of less than USD400k at a cost of approximately USD300bln per annum, which leaves open the possibility of a bi partisan deal being reached under either president to avoid the 2017 tax cuts lapsing. Even so, divided politics will likely mean that difference will exist initially rather than compromise being reached early in H1 2025.

Indeed, we still remain of the view that temporary fiscal stress is likely in H1 2025, which could add around 20bps to 10yr U.S. Treasury yields (here). Firstly, if Kamala Harris is elected then Republicans would resist a debt ceiling increase. A deal would likely be eventually reached after political points have been scored given the Republicans in the Senate are less polarized than the House. A real debt ceiling crisis would likely only occur if the Republicans also still controlled the House. Debt ceiling issues would likely be less if Donald Trump is elected president. One other issue is Trump trying to offset the cost of his fiscal measures through tariffs. We would still feel that tariffs come later in his term if he wins, but he’s unpredictable and certainly talking up tariffs on the campaign trail. Though large tariffs would raise some revenue (up to USD270bln on some bi partisan estimates (here)), it is unlikely to be seen as credible fiscal policy in the markets – 2 round effects would reduce U.S. growth and overall tax revenues and could reduce demand for U.S. Treasuries.

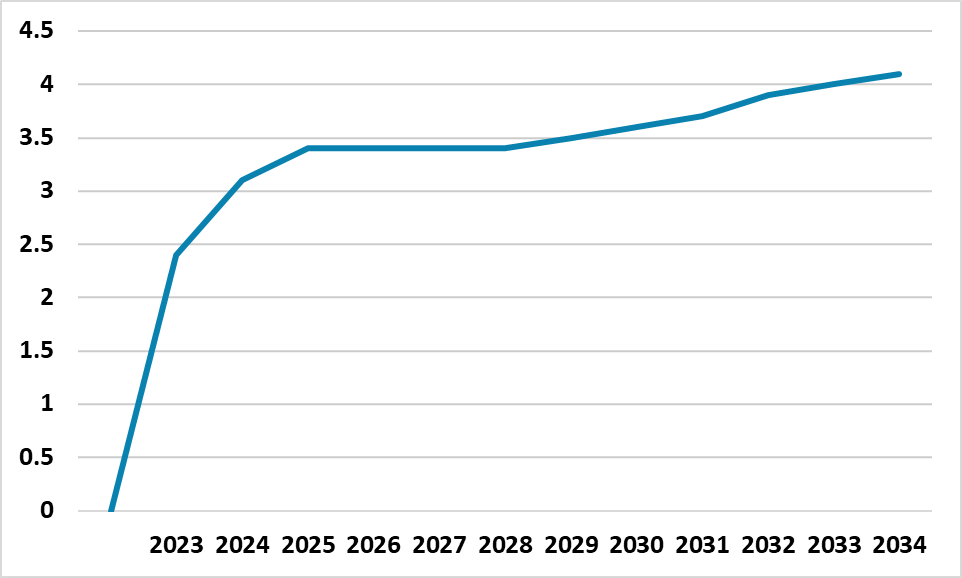

Secondly, rating agencies would likely be unimpressed by actual fiscal plans under either Harris or Trump. Neither would produce policies that would mean a budget deficit trajectory lower than the June 2024 CBO projections, which forecasts 6.5% of GDP in 2025 and then only down to 5.5% in 2027 before expanding again. This then helps drive the government debt (Figure 1) up consistently above 100% of GDP. In addition, rating agencies will be concerned about the trend higher in government debt interest payments (Figure 2). This leaves an event risk of a ratings downgrade from one of the major agencies, given that the fiscal picture warrants a lower rating for the U.S. government than it currently enjoys. Thirdly, if Donald Trump losses the presidential election then he will likely protest the result, which could cause political fallout if the election result is close and in turn cause political paralysis on the debt ceiling and government. However, we see all of this as producing temporary fiscal stress rather than a fiscal crisis.

Figure 2: U.S. Government Debt Interest Payments (% of GDP)

Source: CBO June 2024 (here)

Central banks around the world still view the USD as the global currency and U.S. Treasuries as the key FX reserve, while global investors see U.S. Treasuries as the key risk free asset. Though China has been reducing it’s holdings of U.S. Treasuries, this is not being echoed by other central banks. Additionally, no major alternative exists to the USD reserve status, with the Euro not a major alternative; Yuan being niche with China economic and political problems and Gold being mainly for diversification. Meanwhile, global investors worries over the U.S. long-term fiscal trend are counterbalanced by current higher real yields on U.S. government bonds than other major government bond markets. U.S. Treasuries yields mean they are a key aspect are now back as a key part of any asset allocation plans and a portfolio hedge against any sharp equity market fall.

The U.S. fiscal trajectory remain poor and a fiscal crisis could occur in future years, it just the backdrop suggests it is unlikely to be H1 2025.