U.S. Government Shutdown Expected Starting October 1

While a last minute deal is not to be ruled out, the US government looks set to shut down on October 1. Once a shutdown starts, the standoff could last for a few weeks, probably not as far as the next FOMC meeting on October 29, though that cannot be ruled out. As long as the government remains shut, the Fed and financial markets will have to deal with the absence of key economic data.

Keeping the government open will require 60 votes in the Senate, and the Republicans have only 53. Only one Democratic Senator, Pennsylvania’s John Fetterman, has indicated a willingness to vote with the Republicans. The leader of the Senate Democrats, Charles Schumer, came under heavy criticism from within his party in March when he backed down from a showdown and allowed the government to stay open, and now appears willing to fight. The Democrats are demanding is that cuts to health insurance subsidies, which will rase premiums for many, and to Medicaid, which provides insurance to poorer Americans, passed in the “One Big Beautiful Bill” be overturned.

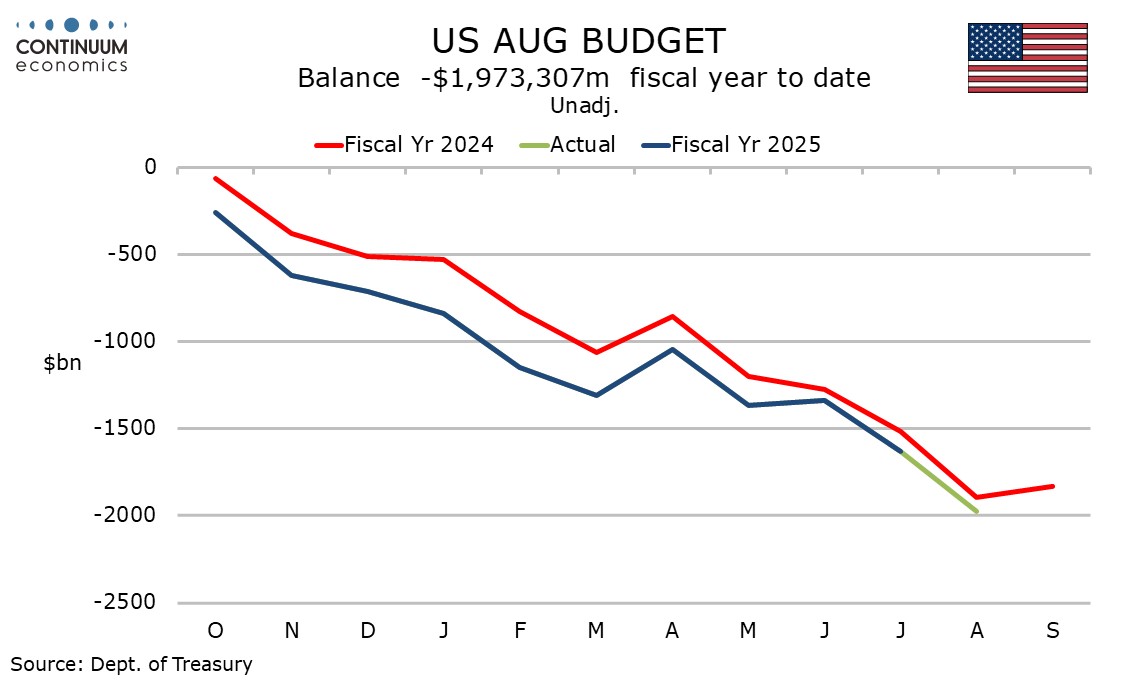

There is no doubt that the cuts to health care will be unpopular, with the Congressional Budget Office estimating that 17 million would lose health insurance by 2034, and more would be forced to pay more for it. However getting rid of the cuts without offsetting revenue increases would add significantly to the budget deficit, by over $1 trillion over ten years if fully repealed. That will make the Republicans reluctant to back down.

Standoffs in shutdowns usually come down to a test of public opinion. Most government shutdowns in the past have been initiated by Republicans in opposition to the policies of Democratic presidents, and have tended to see the Republicans blamed. Even if the Democratic cause is popular, they may still get the blame for the shutdown. A comparable situation is a 16 day shutdown in 2013 when Republicans tried to derail Obamacare, which was not popular at the time but the shutdown was unsuccessful.

The longest shutdown lasted 35 days, starting on December 22 2018, this time with a Republican president, as Trump unsuccessfully demanded funding for a wall on the Mexican border. In this case the shutdown was partial, impacting 380k government workers rather than the 800k that were seen in 2013. In 2018-19 the Labor Dep’t, which releases non-farm payrolls and CPI, stayed open, though the Commerce Dep’t, which releases GDP and core PCE prices, was shut. This time however the Labor Department has indicated that in the event of a shutdown all operations will be suspended.

For markets, the most significant impact of a protracted shutdown would be the absence of key economic data. It is unlikely but not impossible that the October 29 FOMC meeting would arrive without the August non-farm payroll or CPIs being released, but if so the FOMC would have limited fresh information to base a decision on. This would raise the risk that policy would pause, though if so a 50bps easing could be seen in December, which would keep policy consistent with September’s dots, if data eventually came in soft. The hit to the economy would likely to largely reversed by the end of Q4, assuming the shutdown does not extend well into November. Prior estimates that a shutdown of a week takes 0.2% annualized off GDP could however be too low should Trump carry out a threat to permanently layoff government employees rather than the usual temporary furloughs in the event of a shutdown.