EUR, GBP flows: EUR and particularly GBP vulnerable to PMIs

EUR PMIs expected to recover slightly, but risk of little change, while UK outperformance in recent months may be partly reversed

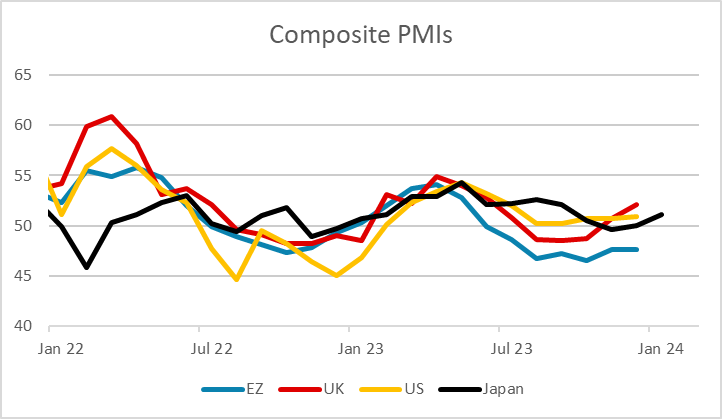

The PMIs will be the focus in Europe this morning, starting with France at 08:15 GMT, followed by Germany at 08:30, Eurozone at 09:00 and UK at 09:30. The relative softness of the Eurozone data has been a feature in the last couple of months, particularly relative to the stronger performance form the UK. We remain a little sceptical of the UK outperformance, and wouldn’t be surprised to see a dip back in the January data.

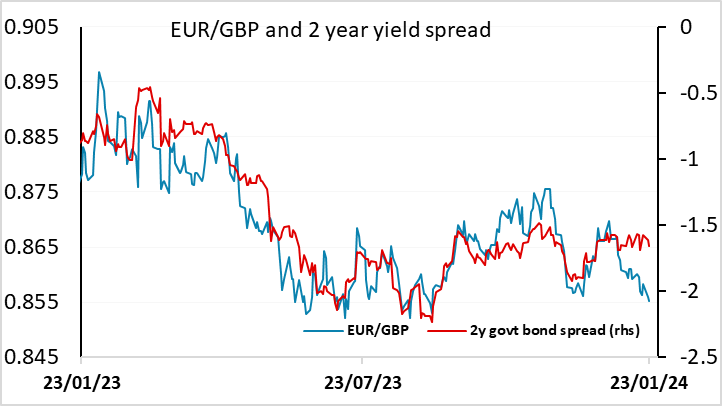

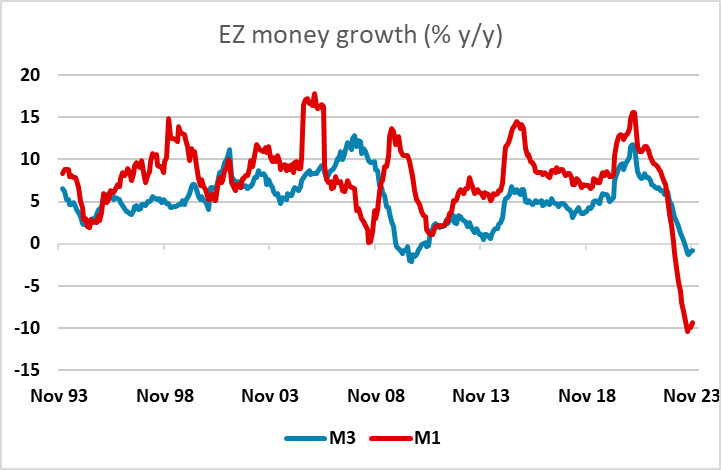

There is little reason to expect a major change in the Eurozone data, although the market consensus expectation is for a modest rise. The economy is likely to be benefiting from the decline in inflation seen in recent months, but we suspect the majority of the impact of the monetary tightening seen in the last year, which is clear in the money data (and the Bank lending Survey for Q4 released yesterday), is yet to be seen in the real sector data. So we are less confident that the PMIs will show a bottoming out. If we don’t see the rise that is expected, EUR/USD will likely come under a little pressure. However, we see more risks for GBP/USD, with more risk that the strength in the PMIs seen in the last two months is corrected in the January data. GBP in any case looks a little rich relative to yield spreads against the EUR, and CFTC data shows that net long GBP positioning has become a little extended, so we see the pound as vulnerable to weaker numbers.