U.S. October Retail Sales - Trend solid but may start to lose momentum

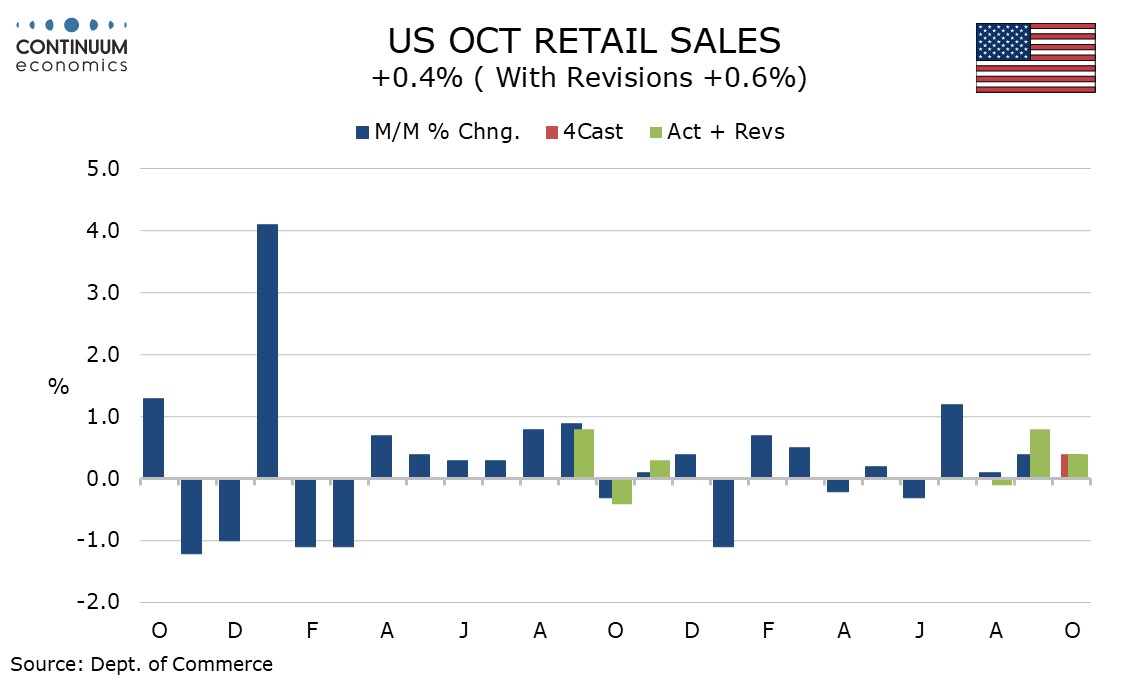

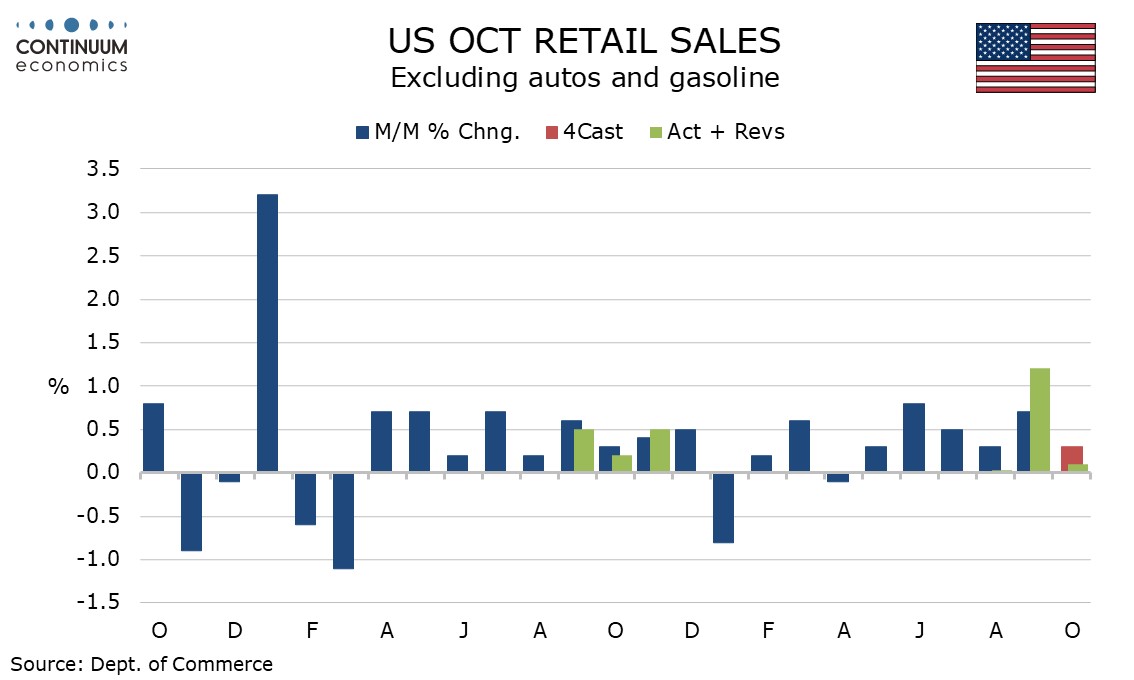

October retail sales are in line with expectations overall but stronger net of revisions, with September revised up to a 0.8% increase from 0.4%, outweighing a downward revision to August to -0.1% from a 0.1% increase. October gains were subdued ex autos and ex autos and gasoline, both up by 0.1%.

Autos saw a healthy rise after two near flat months but ex autos and gasoline October sales paused after what after revisions was a strong September. Gasoline sales rose by 0.1%, which implies a slightly larger gain in volumes.

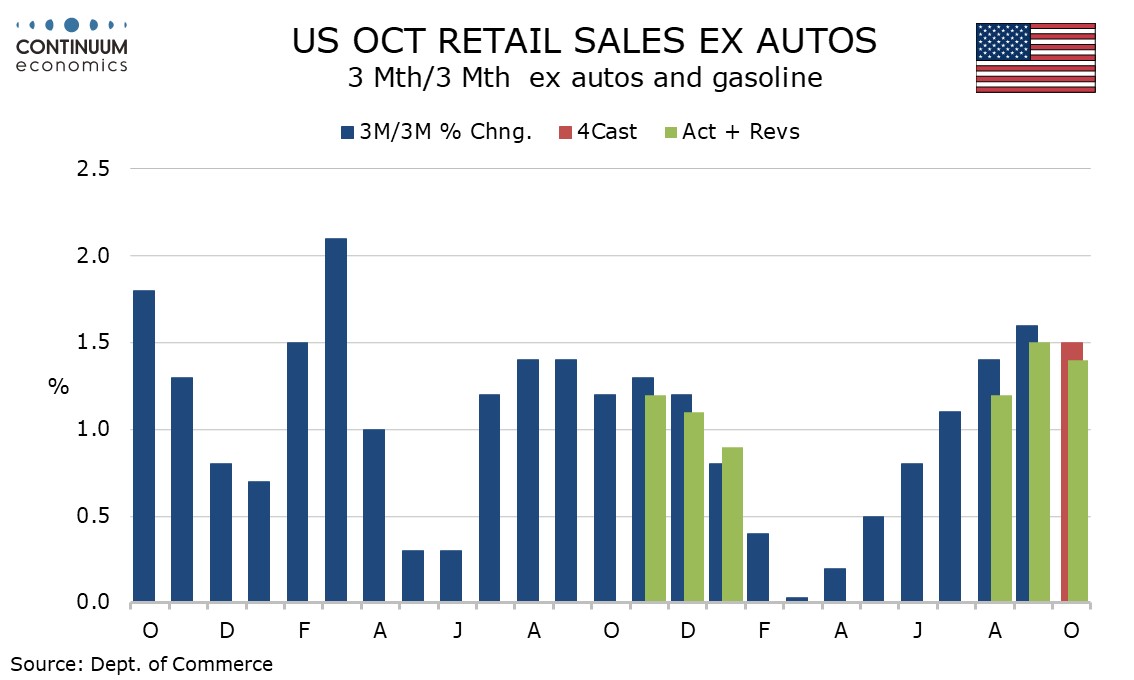

3 month/3 month rates remain strong at 1.3% overall, 1.1% ex autos and 1.4% ex autos and gasoline. Consumer spending is consistent with real disposable income on a yr/yr basis but outperformed income in Q3.

Yr/yr real disposable income is inflated by a strong January 2024 as social security benefits were upgraded to compensate for past inflation, and may therefore slow in January 2025. While the consumer still has momentum, risk is for some slowing, though it is too early to see October data as anything more than a pause in a solid trend.

The main restraints in October were declines of 1.1% in health and personal care and 1.3% in furniture. In addition to autos, strength was seen in electronics at 2.3% and eating and drinking places at 0.7%.