USD, JPY flows: JPY up after softer US housing starts

US July Housing starts the lowest since May 2020 extend JPY rise

Riskier currencies falling back and JPY and CHF rising after US housing starts data, which showed the lowest level of starts since May 2020. While some of this might be weather affected, the trend has been weak of late and many see this as an indication that higher mortgage rates are starting to bite. USD/JPY has fallen more than a figure from opening levels in Europe and has now largely reversed the rise seen after the retail sales and initial claims numbers on Thursday. While the housing starts data don’t necessarily mean we are seeing anything more than a slowdown, they provide good support for those arguing for rate cuts.

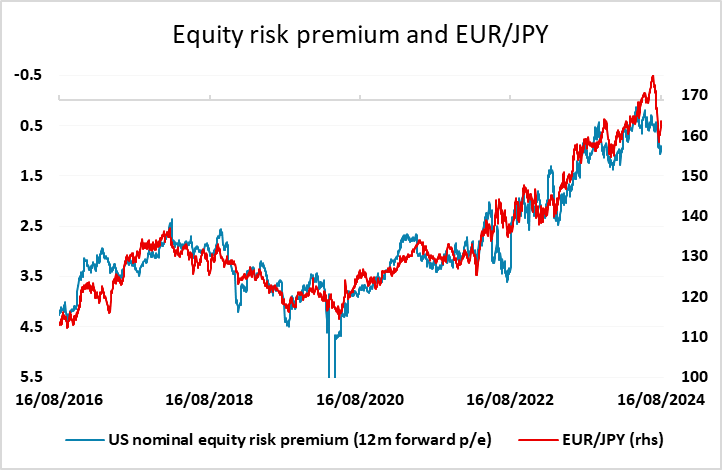

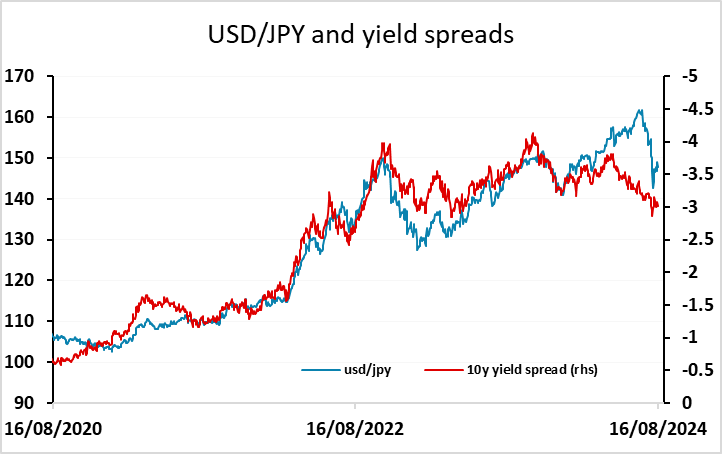

Yield spreads never recovered enough to justify significant USD/JPY gains, and still suggest scope back to 140. EUR/JPY meanwhile still looks to be overvalued above 160 based on the correlation with yield spreads. Other USD pairs have been less volatile, and the combination of lower yields across the board in the US and Europe and softer equities gives the USD a mild upside tilt against the riskier currencies, but it is doubtful that this will last unless we see significant equity declines.