Canada - BoC Q3 Business Outlook Survey suggests economy less weak, inflation not as strong

The Bank of Canada’s Q3 Business Outlook Survey shows activity looking less weak and inflation expectations less strong, which will be seen as good news. The report, particularly after today’s strong September employment report, suggests a 25bps easing is more likely than a 50bps move when the BoC meets on October 23, though we still have September CPI data to see on Tuesday.

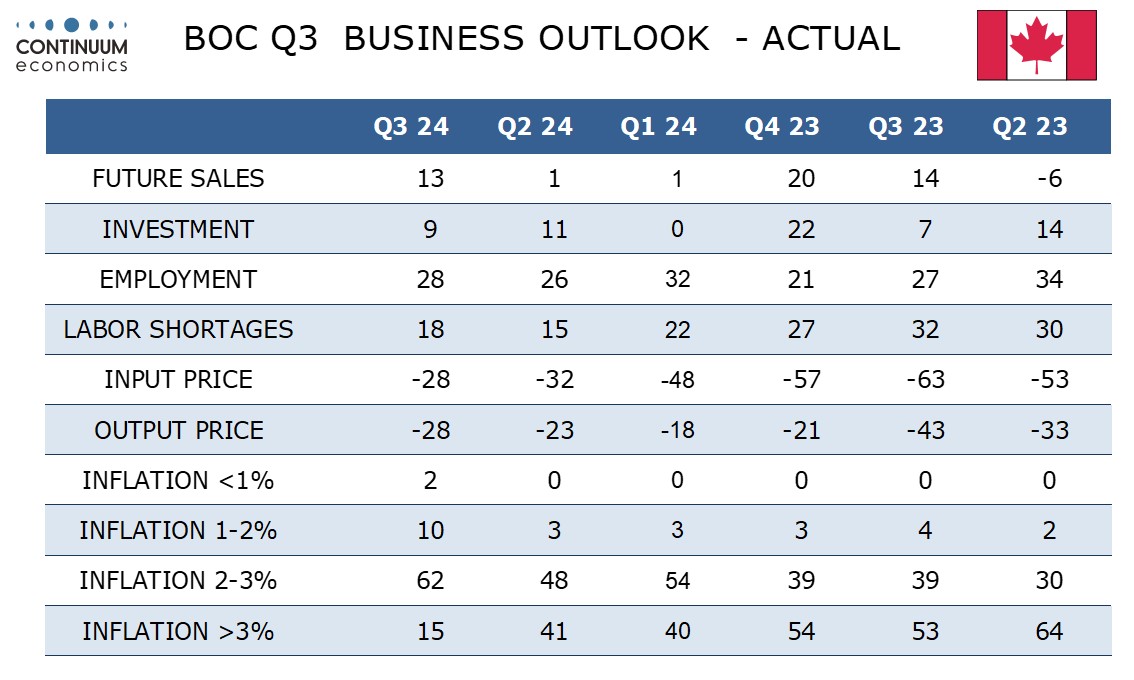

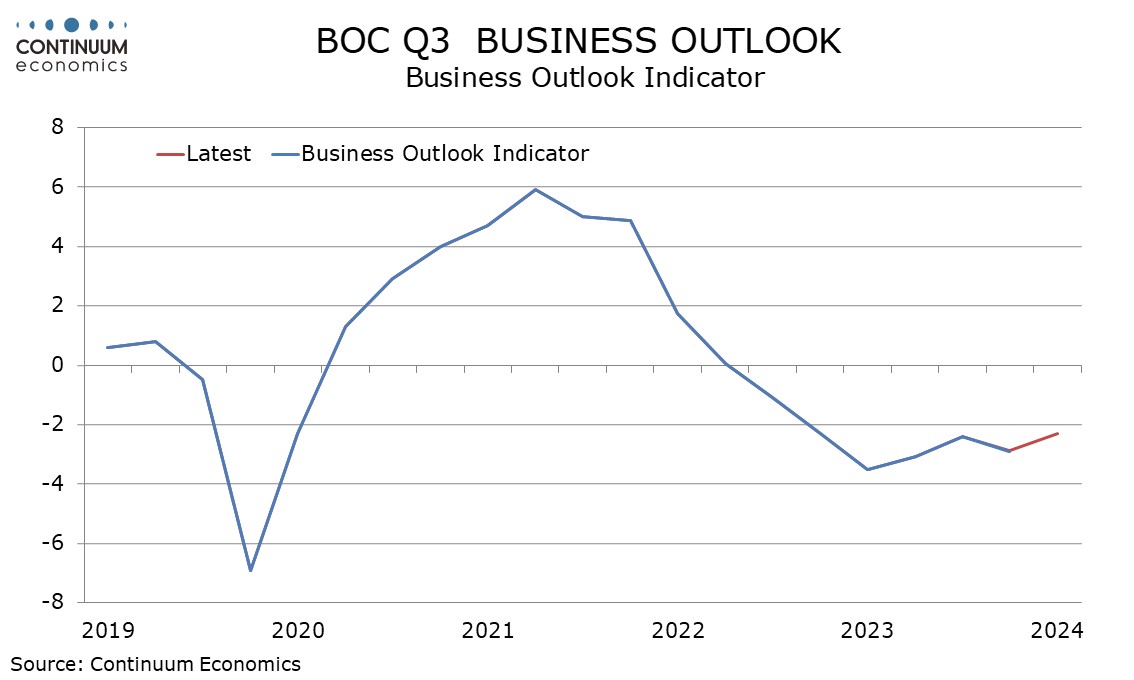

The Business Outlook Indicator of -2.31 is a 5-quarter high though still negative and only a modest improvement from Q2’s -2.88. Expectations for future sales saw a significant bounce to 13 from 1, though investment and employment expectations did not change much. The majority of respondents continue to expect inflation above 2% though the proportion seeing it below rose to 12% from 3% and the proportion seeing it above 3% fell sharply to 15% from 41%.

The message is that inflationary pressures are still too high but falling, and that is the message from a separate survey of consumers too, where the 1-year inflation expectations fell modestly to 3.84% from 4.09% but the 2-year view saw a significant dip to 3.05% from 3.91%, if still above the BoC’s 2% target. Consumers are also less pessimistic about employment than in Q2, though still slightly more pessimistic than in Q1. Past tightening is still working to reduce inflation but current easing is starting to support the weak economy. That suggest the BoC can continue with a gradual pace of easing.