JPY flows: JPY soft as earnings data weakens

JPY on the back foot as weak earnings data throws doubt on the potential for BoJ tightening. But JPY still has a case for gains based on valuation moves

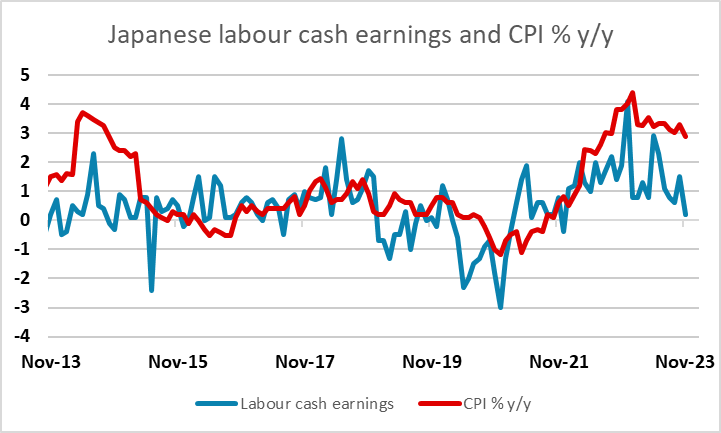

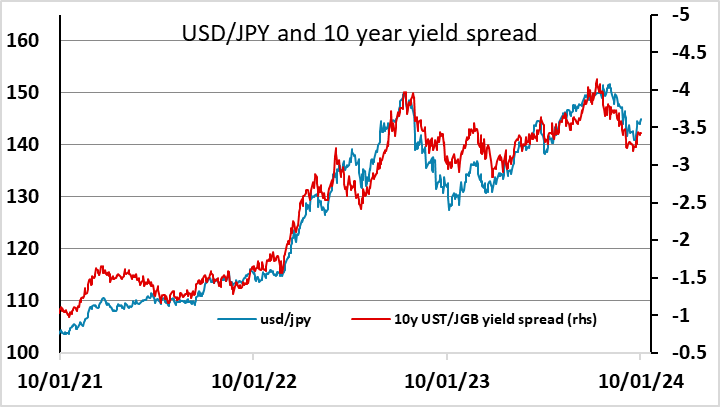

The weakness in the Japanese labour cash earnings data overnight helped trigger renewed JPY weakness and some further decline in JGB yields. Earnings growth fell to 0.2% y/y, the lowest since December 2021, and given the higher rate of inflation now this implies a significantly negative path in real incomes. This throws into doubt any expectation of BoJ tightening in the near term, especailyl since the CPI data is steadily falling back. In truth, JPY gains on Tuesday looked a bit out of line with the recent moves in yield spreads anyway, so from here we may see some further JPY weakness back towards the recent high near 146, but spreads still suggest that USD/JPY is stretched at 145.

Currently, the market is only pricing a 15bp rise in the policy rate over the year, but decisions over YCC and the effective ceiling for 10 year yields will be more relevant for the currency. In the absence of Japanese action, USD/JPY declines will depend on yields coming down elsewhere. We do expect this, but most of the decline in 10 year yields has likely already been seen. So USD/JPY declines may now not really get going until Q2, and only then if we see a significant rise in Japanese wage deals.

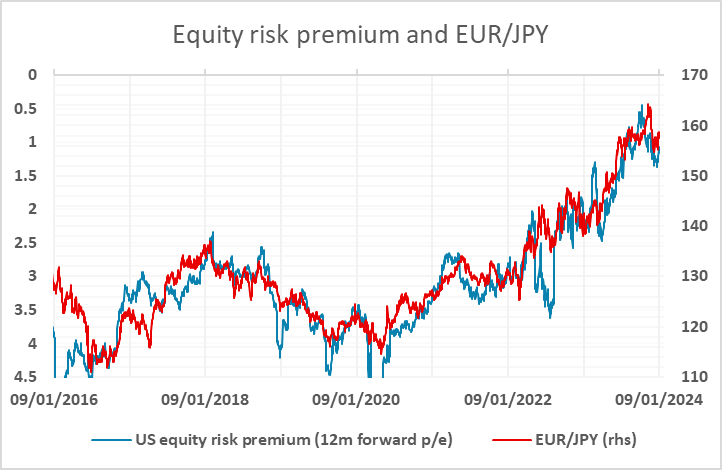

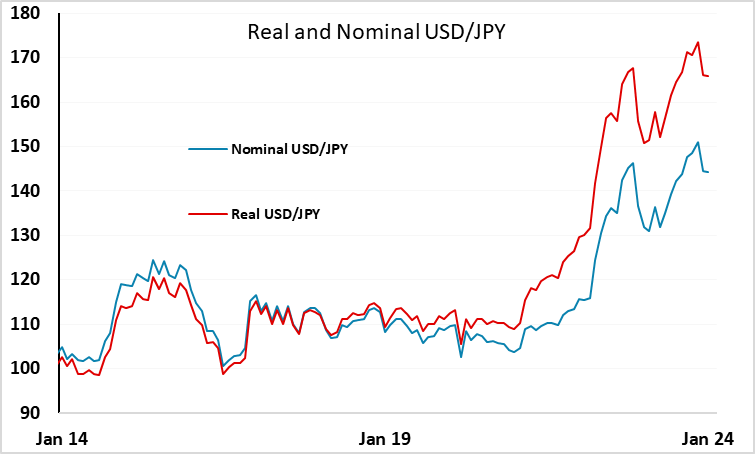

On most of the crosses, the JPY continues to be more correlated with equity risk premia than with yield spreads, so JPY gains will likely depend on risk premia rising slightly, as they will if yields come lower and equities hold steady. However, from a big picture perspective there is still a case for JPY gains based on the real depreciation in the JPY in the last few years. Due to relatively low Japanese inflation, USD/JPY has risen 13% more in real terms than in nominal terms in the last 3 years. At some point, this valuation move is going to be corrected, even without moves in yield spreads.

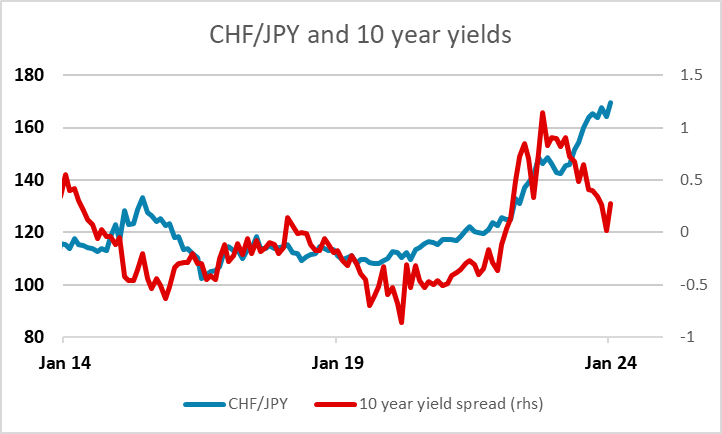

This valuation point is most clearly seen in CHF/JPY, since the CHF has behaved more classically by rising in line with relatively low Swiss inflation in spite of its lack of yield advantage. While Swiss and Japanese inflation has been similar in the last few years, CHF/JPY is up 44% in the last 3 years, and the case for these gains based on yield spreads has disappeared as Swiss yields have dropped in the last few months.