Powell suggests FOMC not in a hurry to get rates to neutral

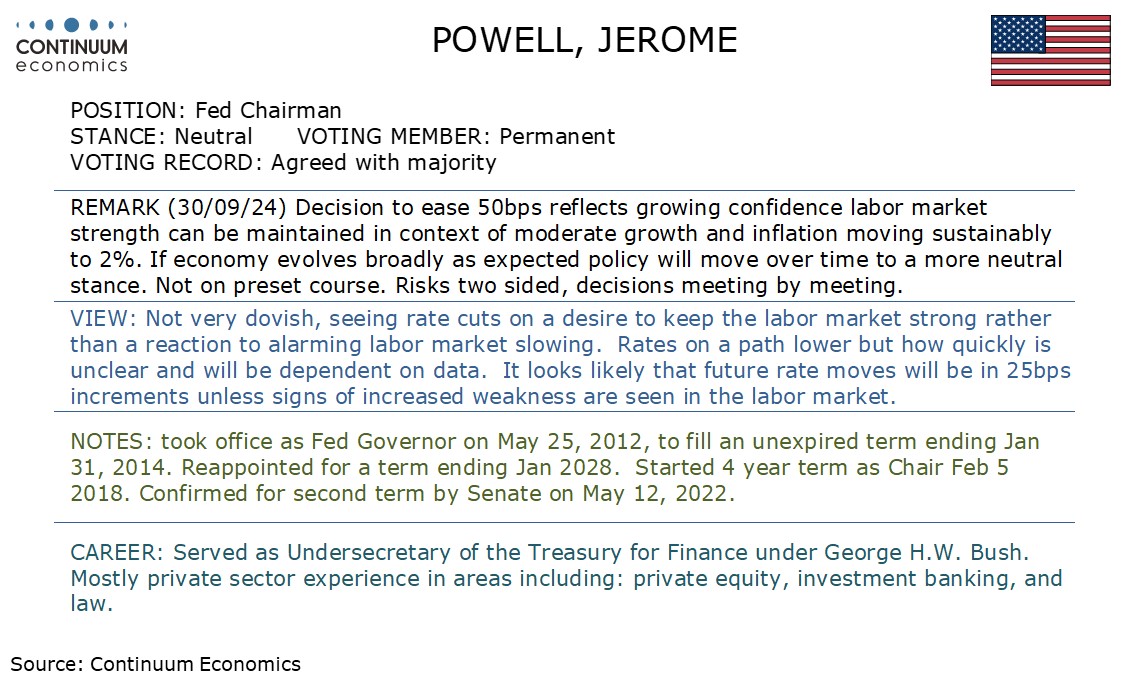

The latest speech given by Fed Chairman Jerome Powell to the NABE was not seen as dovish, suggesting the labor market is roughly where the Fed wants and easing is designed to keep it that way. In the Q+A he went on to see GDP revisions as having reduced downside risk, and suggested the Fed is not in a hurry to cut quickly.

Powell saw labor market conditions as solid, having cooled from a previously overheated state, and noted that job openings still exceed the number seeking work, if now only just, something that was rare prior to 2019. He went to say however that further labor market cooling is not seen as needed to achieve 2% inflation. He sees inflation in core goods and core services excluding housing as close to the pre-pandemic pace and while housing inflation is declining only sluggishly, he expects the decline to continue as long as the growth rate in rents changed to new tenants remains low.

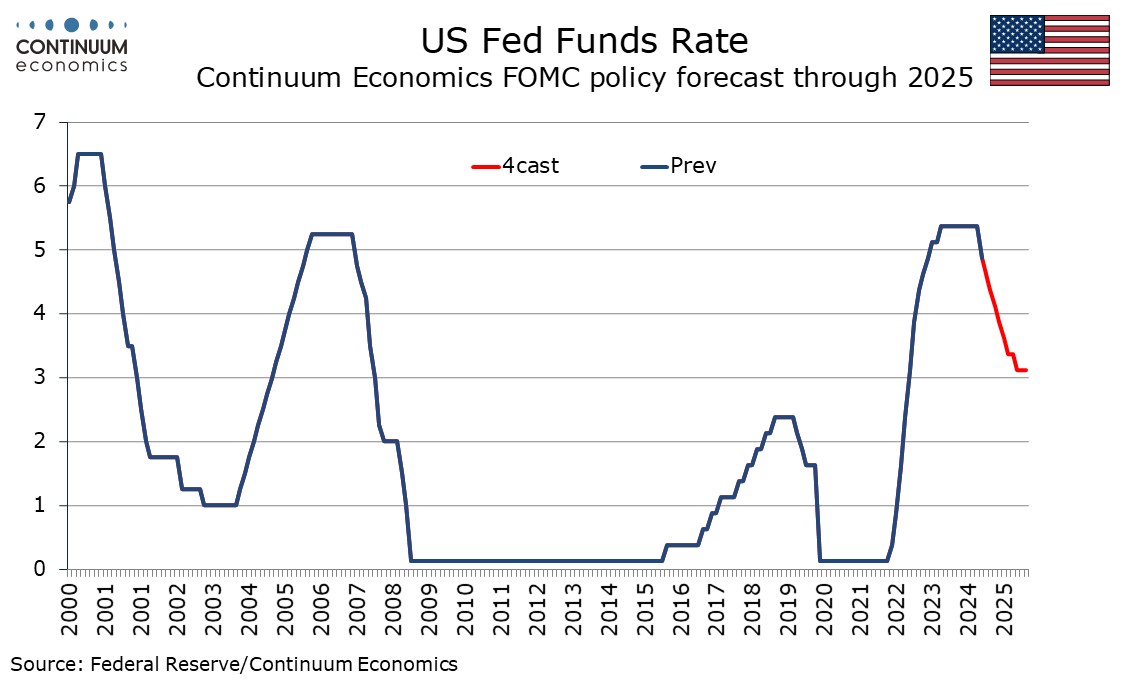

He notes that when rates hit their peak of the cycle core inflation was above 4% and unemployment 3.5%, and significant changes in both since then justify a recalibration of policy. He expects policy to move towards a more neutral stance if the economy evolves as expected, though he avoided stating clearly that rates are on a trajectory to neutral. He stated risks were roughly balanced and decisions would be taken meeting by meeting. In the Q+A he noted that before the next decision in November two employment reports and one CPI release will be seen.

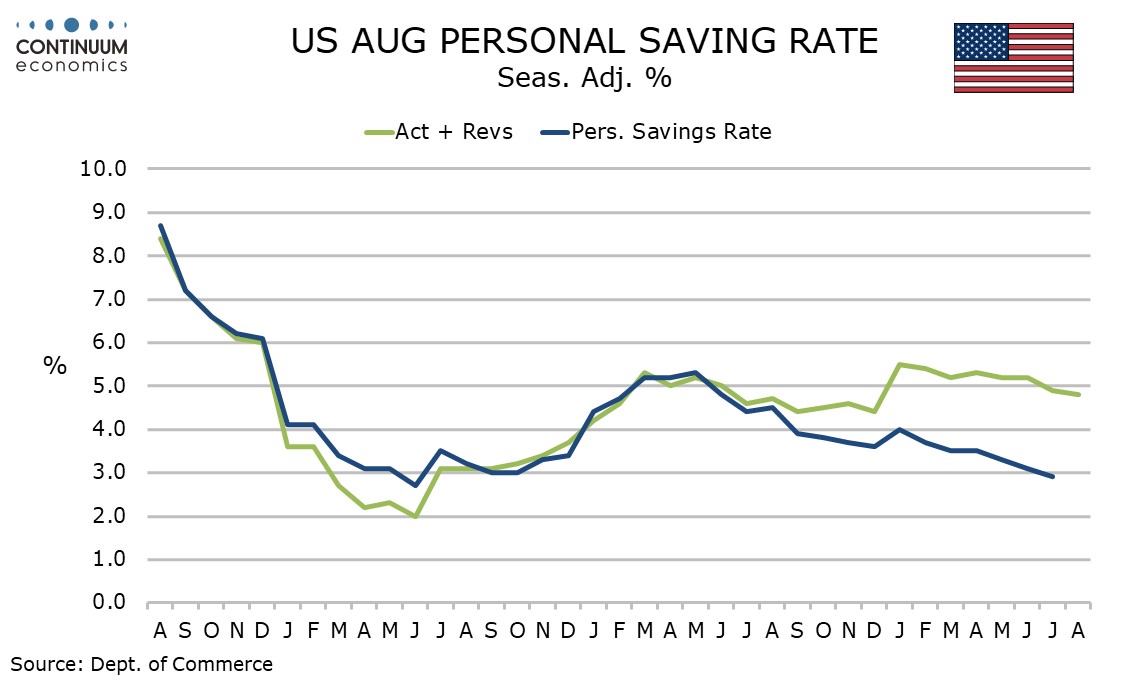

Most of the above could have been said immediately after the 50bps easing delivered on September 18. However he did also note upward revisions to income delivered with the September 26 GDP revisions, lifting the savings rate and moving incomes more into line with spending. Powell saw this as having reduced downside risks to consumer spending, and added that the Fed had been monitoring the risk of downward GDP revisions. That significant downward revisions to the March 2024 employment benchmark had previously been announced may have been a factor in the Fed’s decision to ease by 50bps and may also have generated fear that downward revisions to GDP would be seen. In fact the GDP revisions, while modest compared with those for income, were marginally higher.

Powell has made it clear that the Fed is not on a preset course and that key data due before the next meeting may influence the decision. Before Powell spoke, Atlanta Fed President Rafael Bostic stated he would be open to a 50bps move if weakness was seen in the labor market. However at present it appears that unless the labor market shows increased weakness, the Fed is likely to move in 25bps increments.