U.S. August Personal Income and Spending - Core PCE Prices looking subdued in Q3

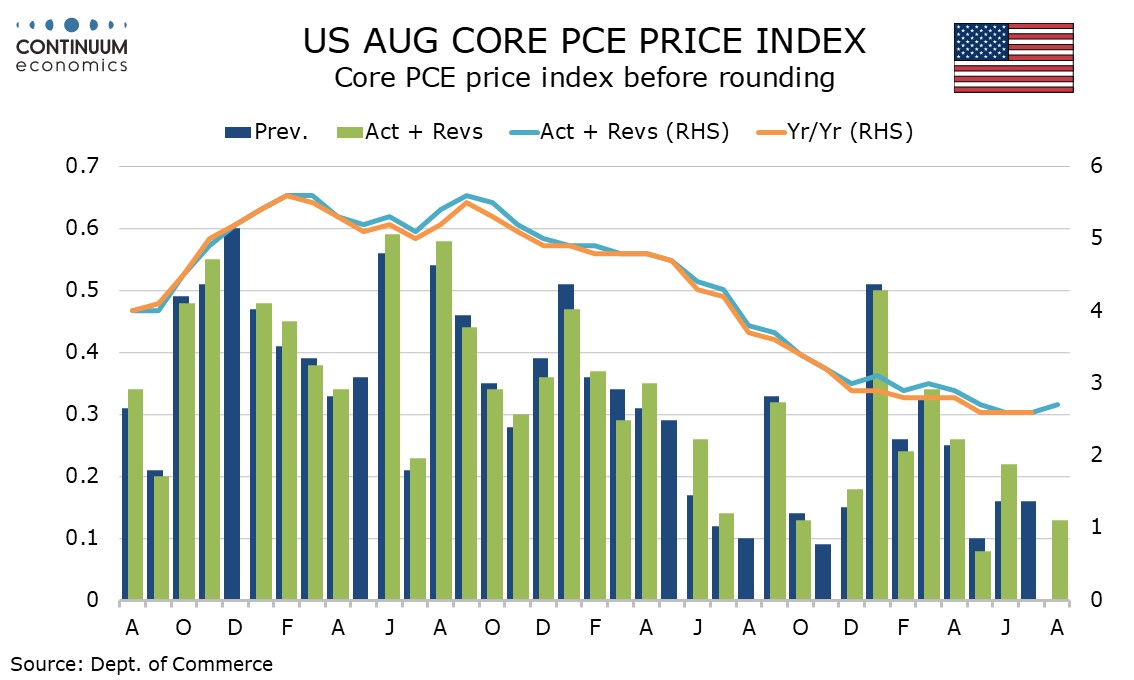

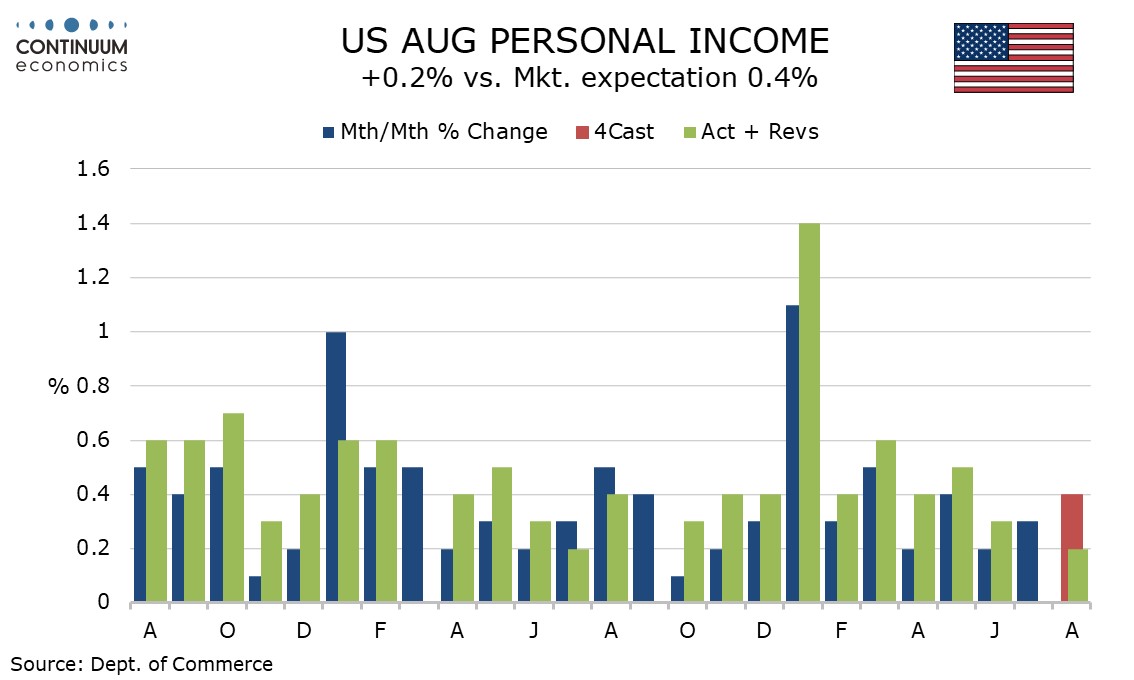

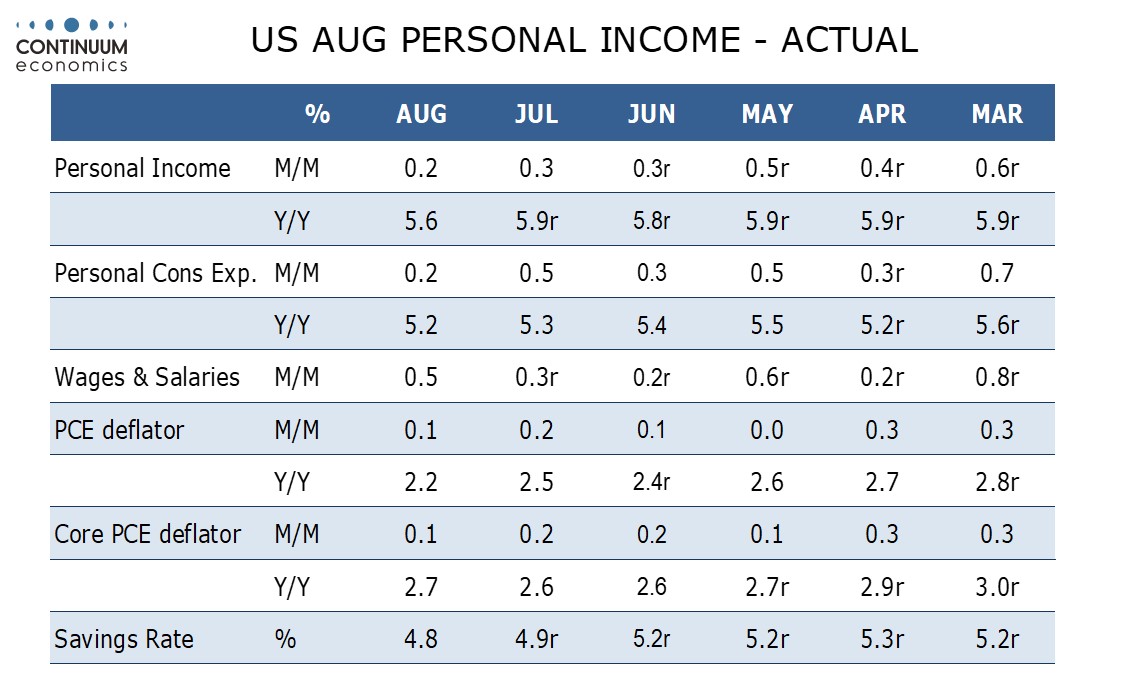

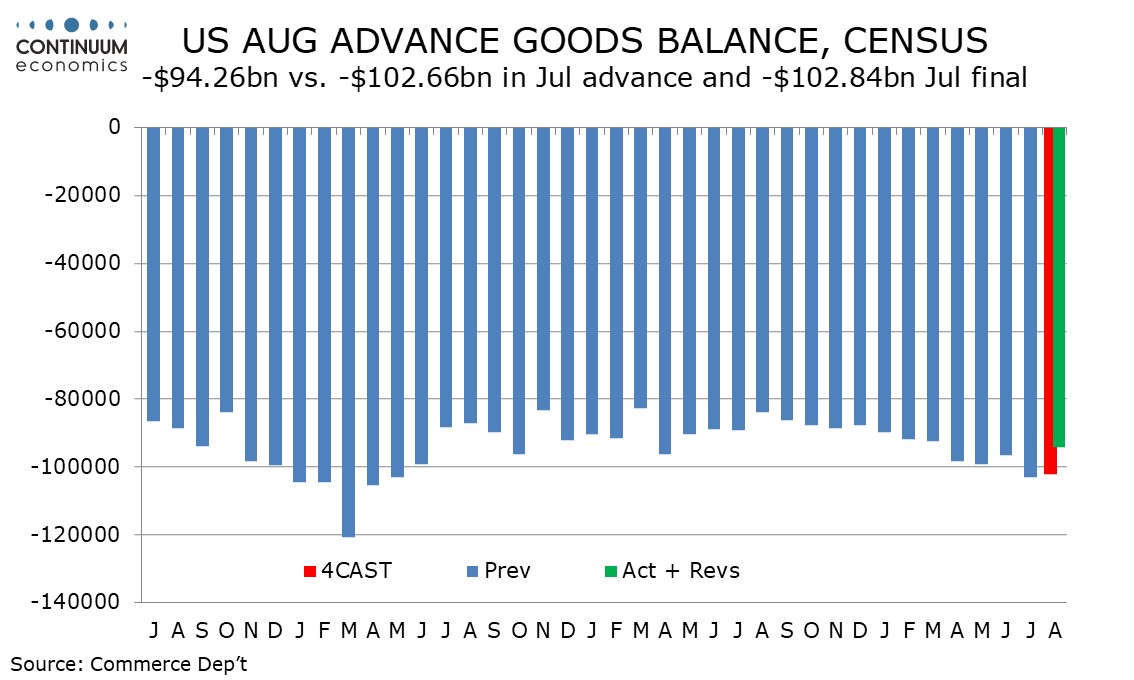

August’s PCE price data, up 0.1% both overall and core (0.09% and 0.13% respectively before rounding) shows the core rate softer than expected, and well below the 0.3% core CPI. Personal income and spending gains of 0.2% are both on the low side of expectations but a narrower August advance goods trade deficit of $94.3bn from $102.8bn) leaves the implications for Q3 GDP on balance positive.

Yr/yr PCE prices fell to 2.2% from 2.5%, weaker than expected, though the core rate at 2.7% from 2.6% is slightly stronger than expected, reflecting a marginal upward revision in yesterday’s GDP revisions.

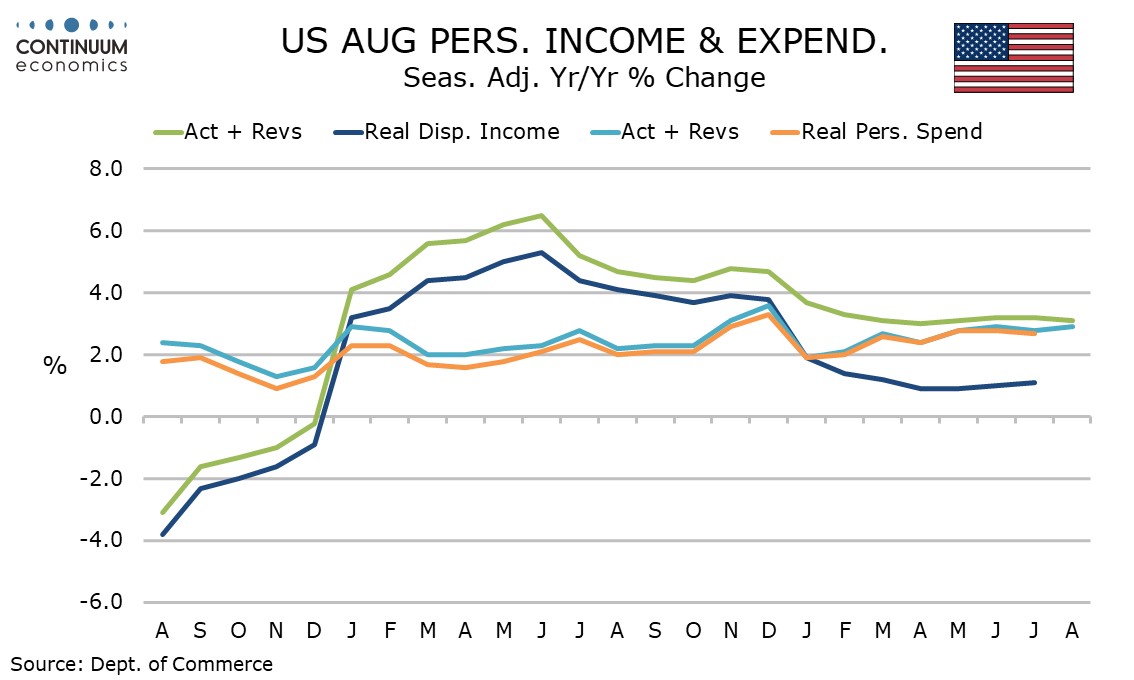

The most important aspect of the GDP revisions was upward revisions to personal income, putting income more in line with spending which it had previously appeared to be underperforming. The savings rate of 4.8% versus a revised 4.9% in July compares to 2.9% in last month’s release for July.

Despite the historical upward revisions, August’s 0.2% rise in personal income was weaker than expected despite a three month high gain of 0.5% in wages and salaries, reflecting stronger nonfarm payroll detail, particularly in the workweek and average hourly earnings. Negatives from interest and dividend income were seen, as well as a below trend increase in government transfers.

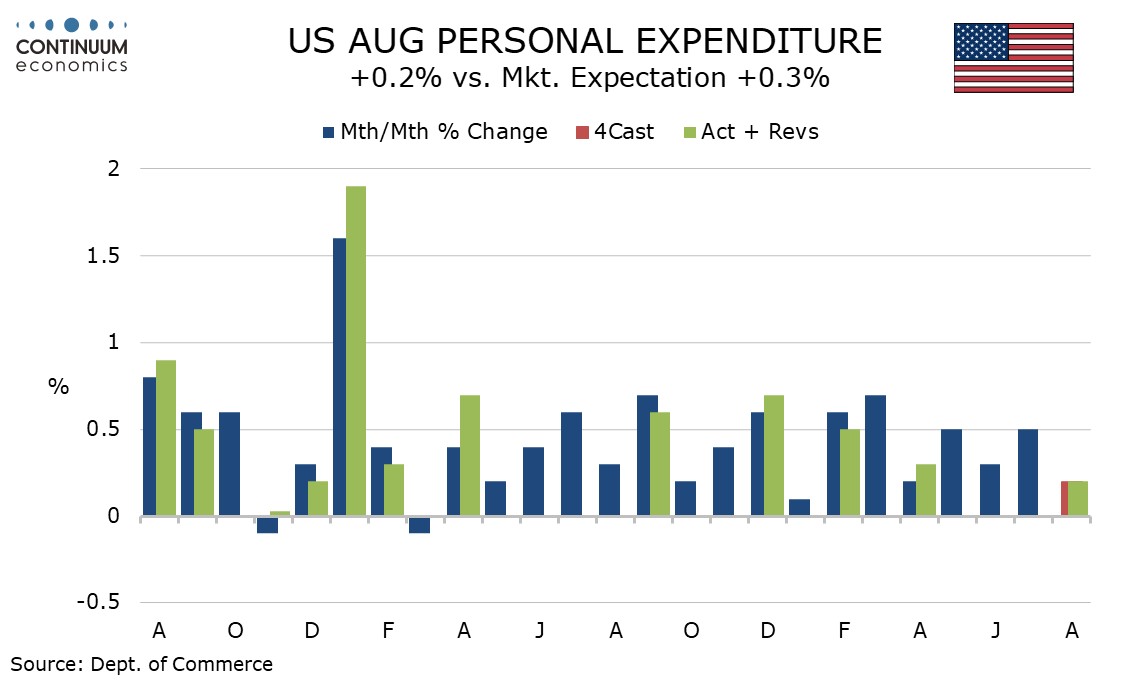

A 0.2% increase in personal spending was also weaker than expected, with marginal negatives in durables at -0.2% and nondurables at -0.1% slightly underperforming a 0.1% increase in retail sales. A 0.4% increase in services was in line with trend.

If September is unchanged, a conservative assumption, real disposable income would increase by 1.3% annualized while spending would increase by 2.9%, and the latter suggests Q3 GDP will sustain a solid pace. A 0.2% increase in September’s core PCE price index, a little stronger than in August, would leave Q3 consistent with target at 2.0% annualized.

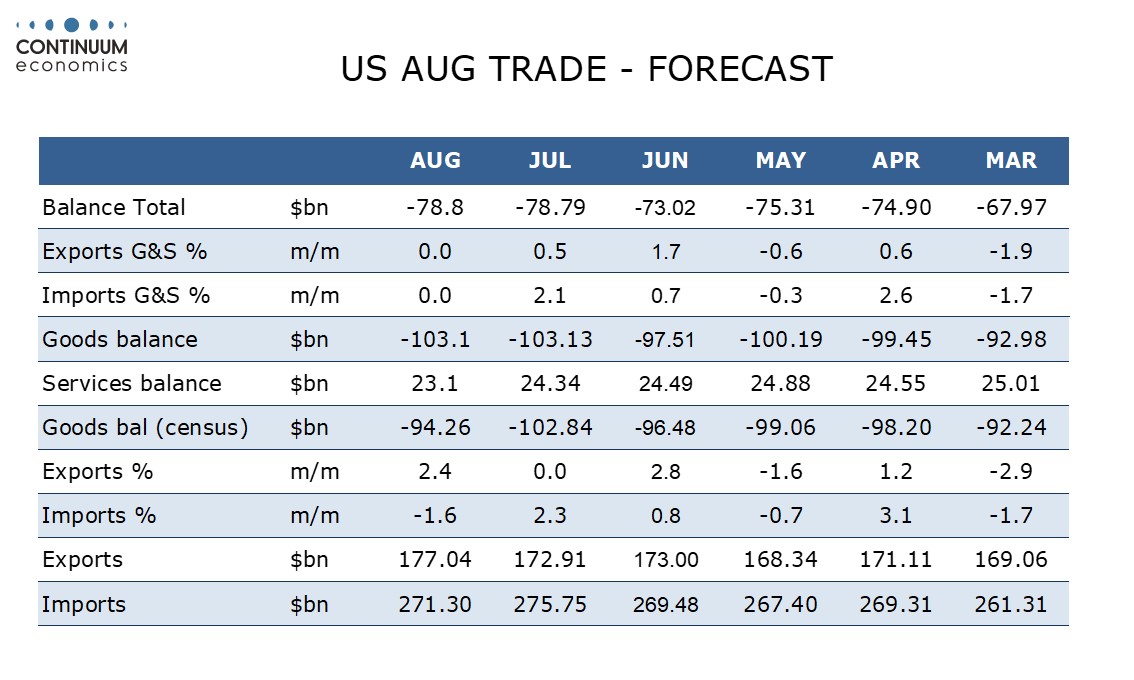

The narrower advance goods trade deficit showed exports up by 2.4% after a flat July and imports down by 1.6% after a 2.3% increase in July. July saw a sharp fall in auto exports which was only partially reversed in August, suggesting scope for further recovery in September.

August’s deficit is the lowest since March though the average of July and August of $98.5bn is slightly above the Q2 average of $97.9bn, though this suggests net exports will not have a major impact on Q3 GDP. Advance inventory data, showing gains 0.2% for wholesale and 0.5% for retail was in line with expectations.