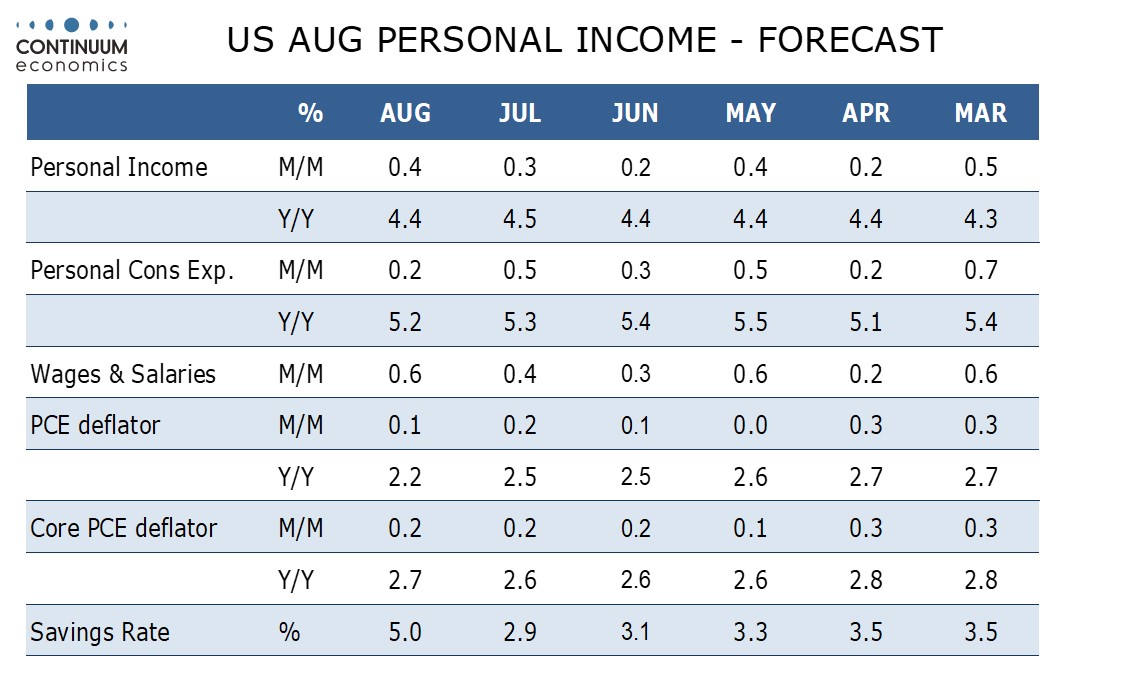

Preview: Due September 27 - U.S. August Personal Income and Spending - Core PCE prices to underperform Core CPI

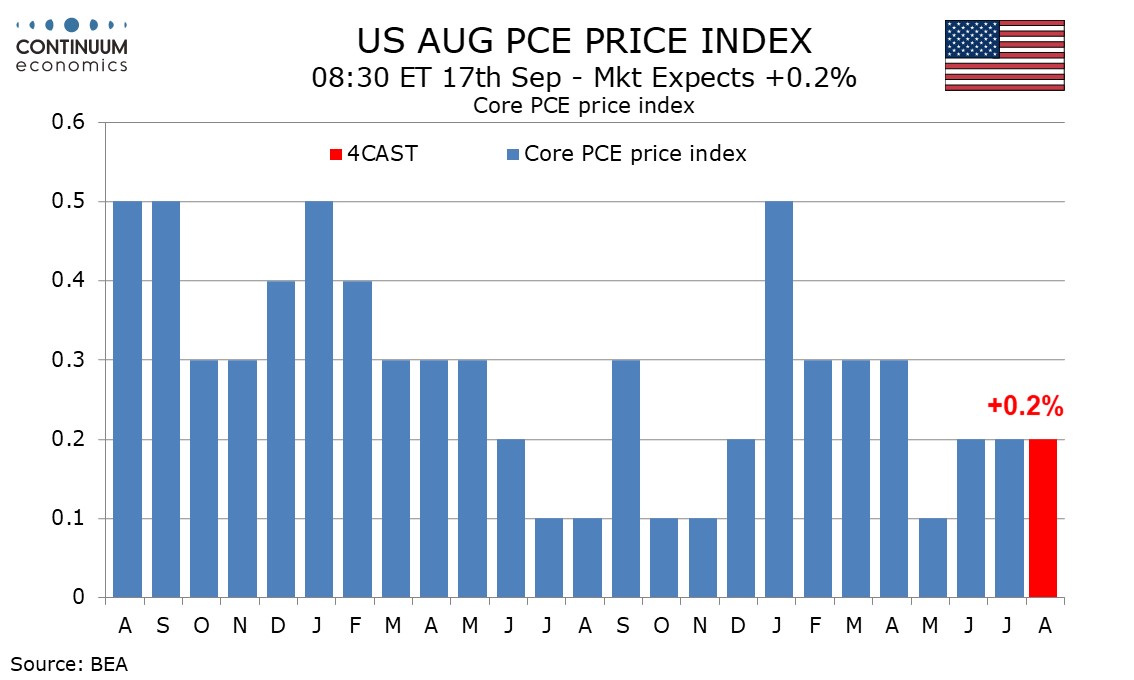

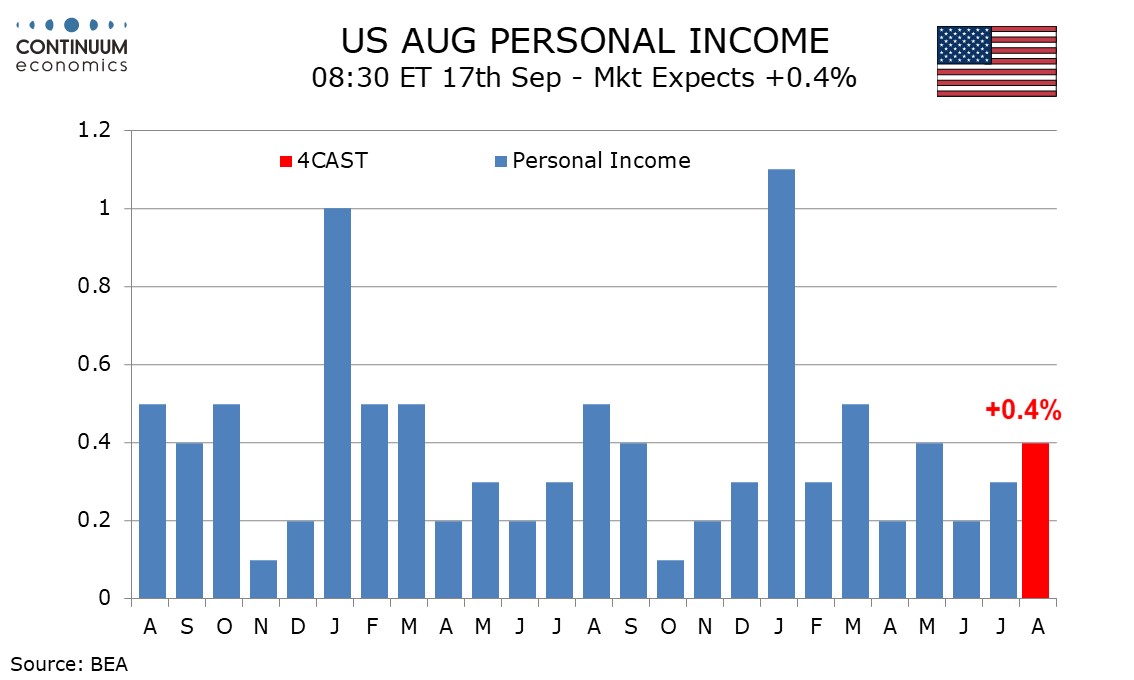

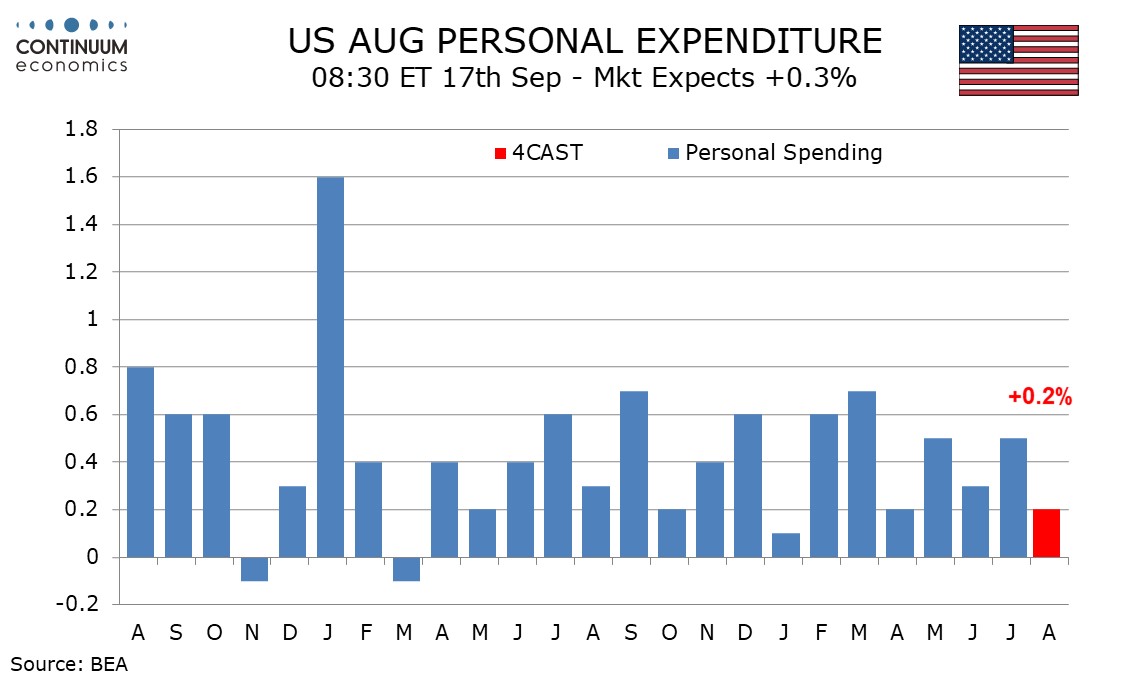

We expect August core PCE prices to rise by 0.2%, a little softer than the 0.3% core CPI which rose by 0.28% before rounding. We also expect personal income with a 0.4% rise to outpace a 0.2% increase in personal spending. GDP revisions suggest back data for personal income will be revised significantly higher, though revisions to spending and prices will be modest.

The upside surprise in core CPI came to a large extent in shelter which will probably impact the core PCE price index by less. We also expect overall PCE prices with a 0.1% increase to underperform a 0.2% rise in overall CPI. Without revisions yr/yr data would then slow to 2.2% from 2.5% for overall PCE prices but edge up to 2.7% from 2.6% in the core rate, though risk might be slightly to the upside on the yr/yr core rate. Quarterly revisions with the GDP report showed Q2 overall PCE prices unrevised at 2.6% yr/yr but the core rate revised up to 2.7% yr/yr from 2.6%.

Stronger non-farm payroll details in August relative to July, particularly from the workweek and average hourly earnings, suggest a boost to personal income from wages and salaries, which we expect to rise by 0.6%, though overall personal income is likely to continue underperforming, with a rise of 0.4%.

This would still outperform what we expect to be a 0.2% rise in personal spending. Retail sales rose by 0.1% in August but autos may underperform the retail data with the personal spending auto data often more consistent with industry auto sales, which slipped in August. We expect a third straight 0.4% increase in service spending.

The GDP revisions showed personal income revised significantly higher in recent years but only modest revisions to spending, lifting the Q2 savings rate to 5.2% from 3.3%. Before the GDP revisions were released we expected an August savings rate of 3.1%, up from 2.9% in July. An August savings rate of 5.0% now looks likely. Higher savings reduce downside risks to consumer spending going forward.