Published: 2024-09-17T15:00:49.000Z

Preview: Due September 27 - U.S. August Personal Income and Spending - Core PCE prices to underperform Core CPI

Senior Economist , North America

4

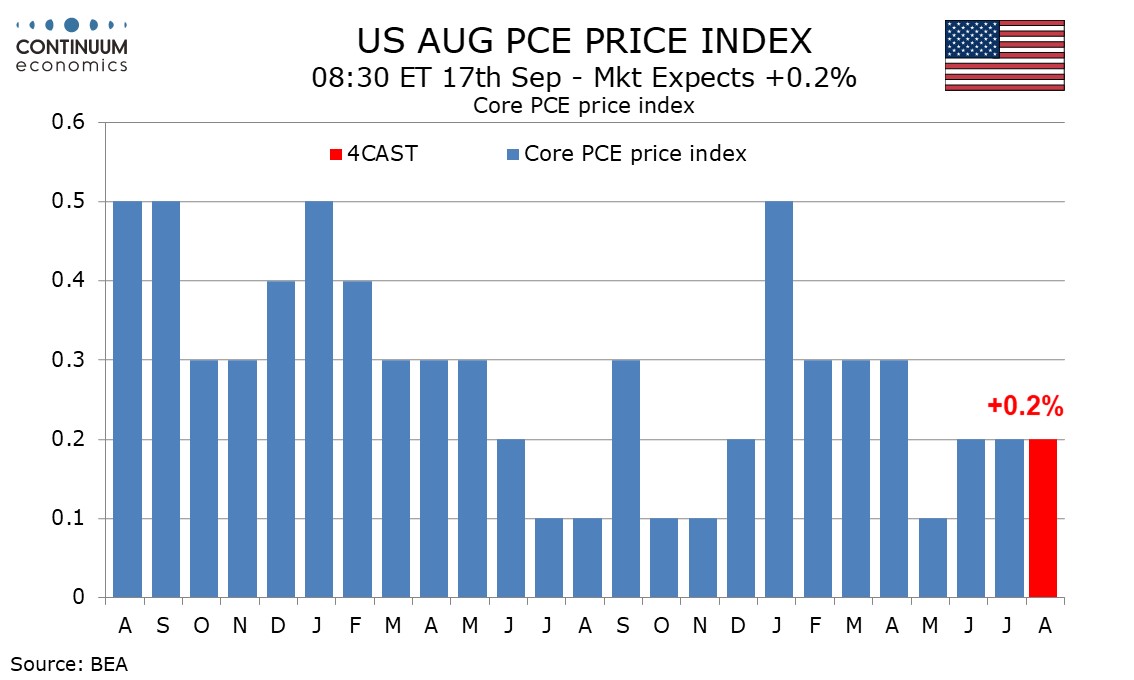

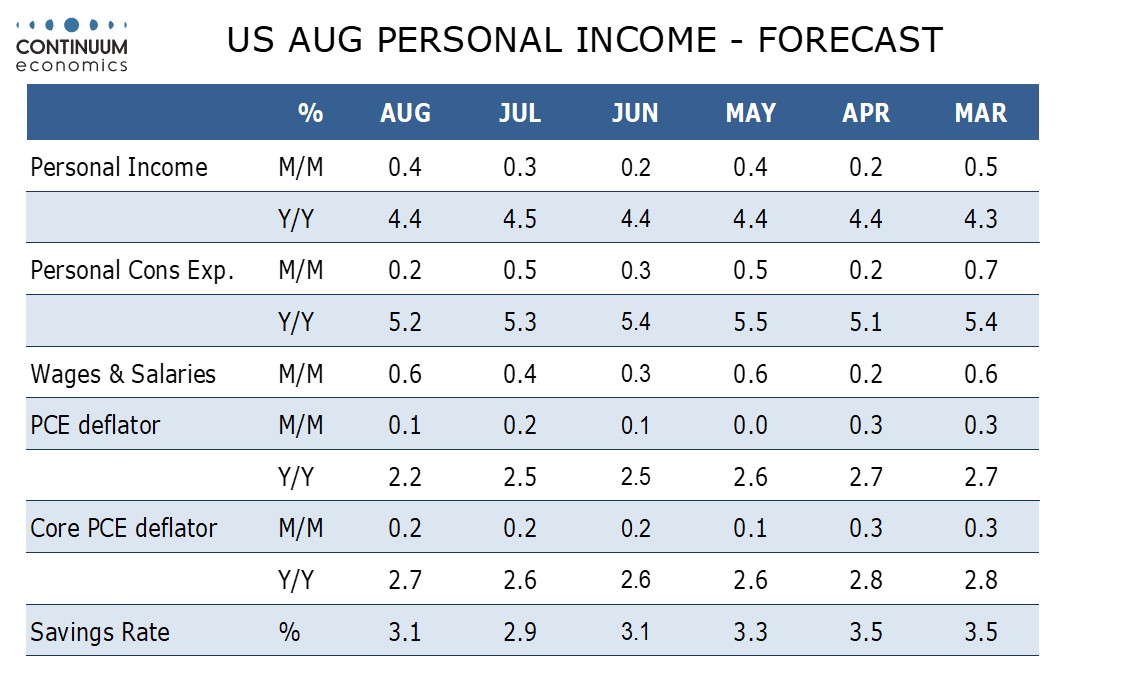

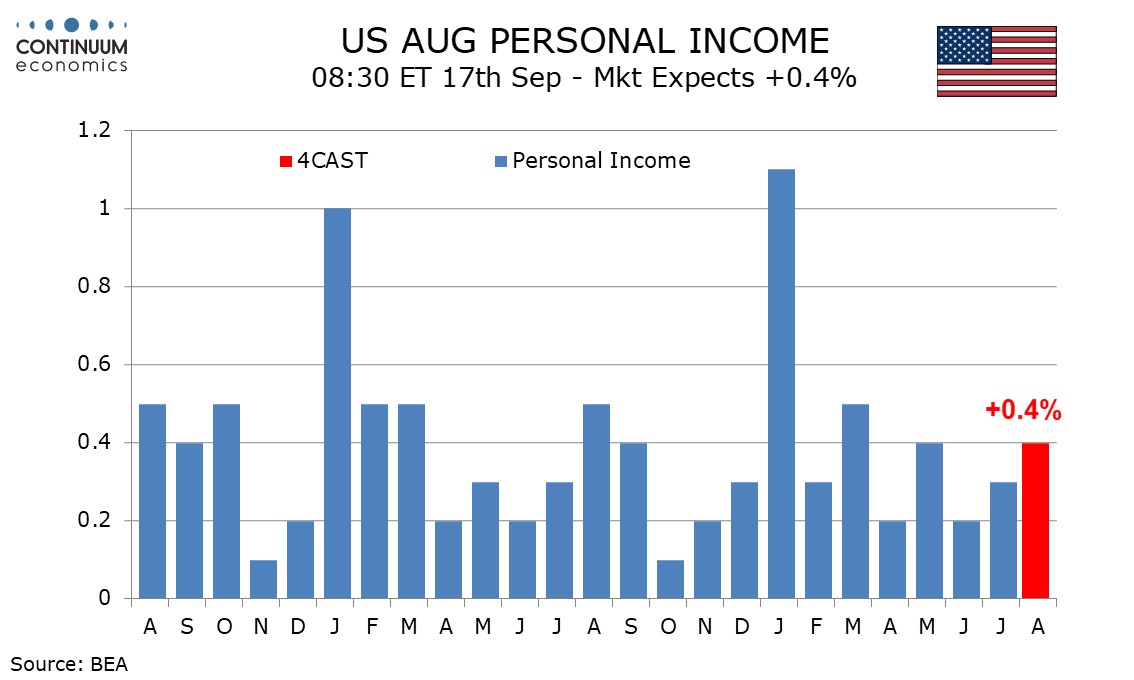

We expect August core PCE prices to rise by 0.2%, a little softer than the 0.3% core CPI which rose by 0.28% before rounding. We also expect personal income with a 0.4% rise to unusually outpace a 0.2% increase in personal spending.

The upside surprise in core CPI came to a large extent in shelter which will probably impact the core PCE price index by less.

We also expect overall PCE prices with a 0.1% increase to underperform a 0.2% rise in overall CPI. Yr/yr data would then slow to 2.2% from 2.5% for overall PCE prices but edge up to 2.7% from 2.6% in the core rate.

Stronger non-farm payroll details in August relative to July, particularly from the workweek and average hourly earnings, suggest a boost to personal income from wages and salaries, which we expect to rise by 0.6%, though overall personal income is likely to continue underperforming, with a rise of 0.4%.

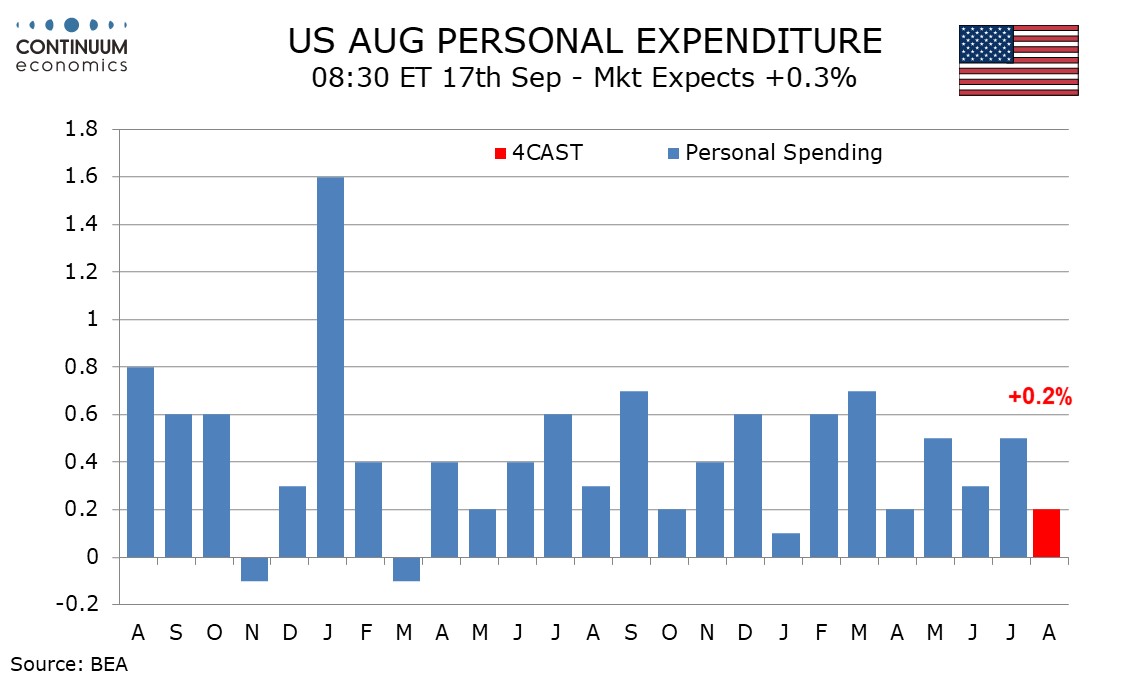

This would still outperform what we expect to be a 0.2% rise in personal spending. Retail sales rose by 0.1% in August but autos may underperform the retail data with the personal spending auto data often more consistent with industry auto sales, which slipped in August. We expect a third straight 0.4% increase in service spending.