Looking at press reports that the September FOMC call is a close one between 25bps and 50bps does not persuade us to change our call from 25bps. However the message of the reports is that the slightly disappointing August CPI does not exclude a 50bps move, and that whichever option the Fed does choose for September, markets should not assume a string of moves of equal magnitude.

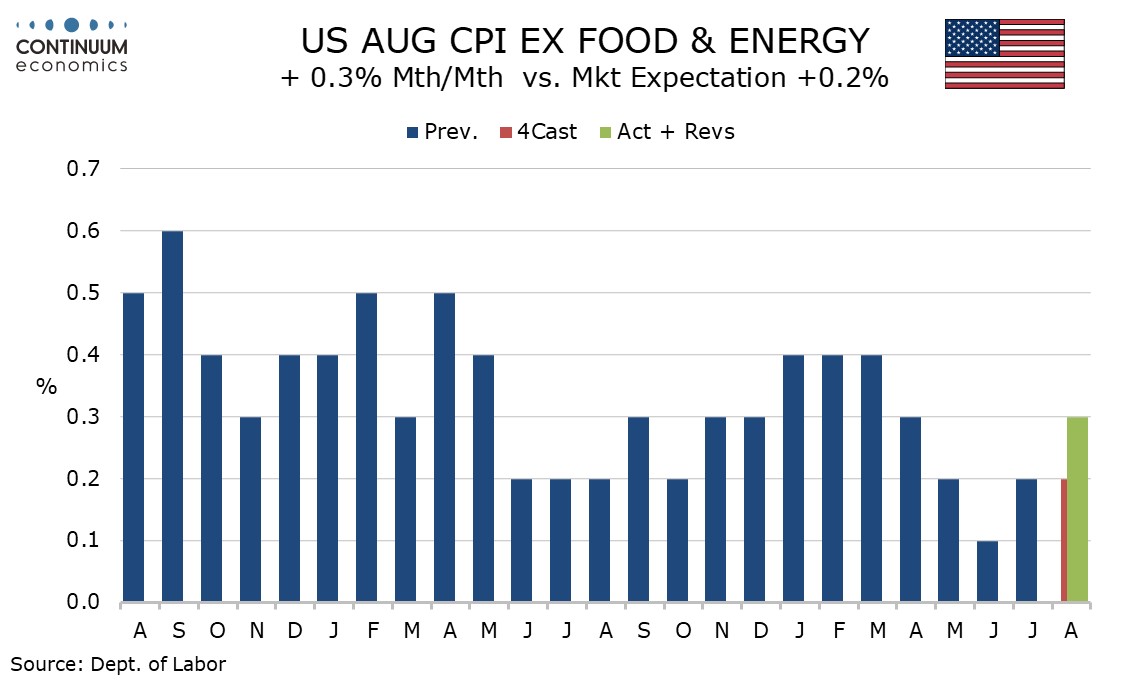

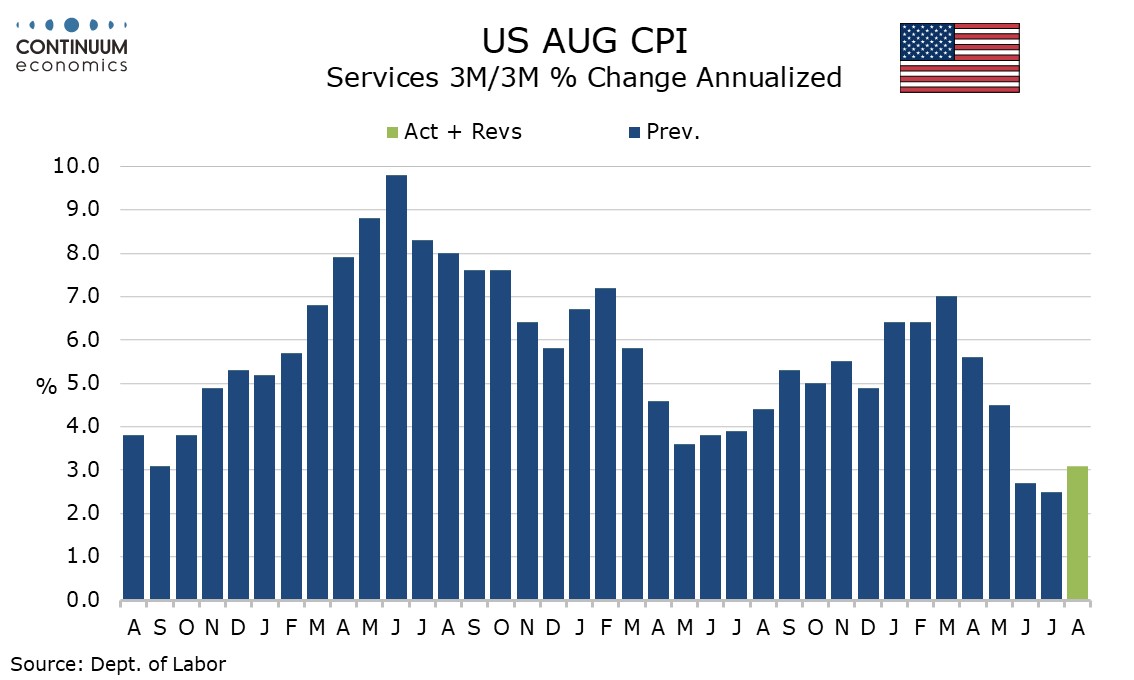

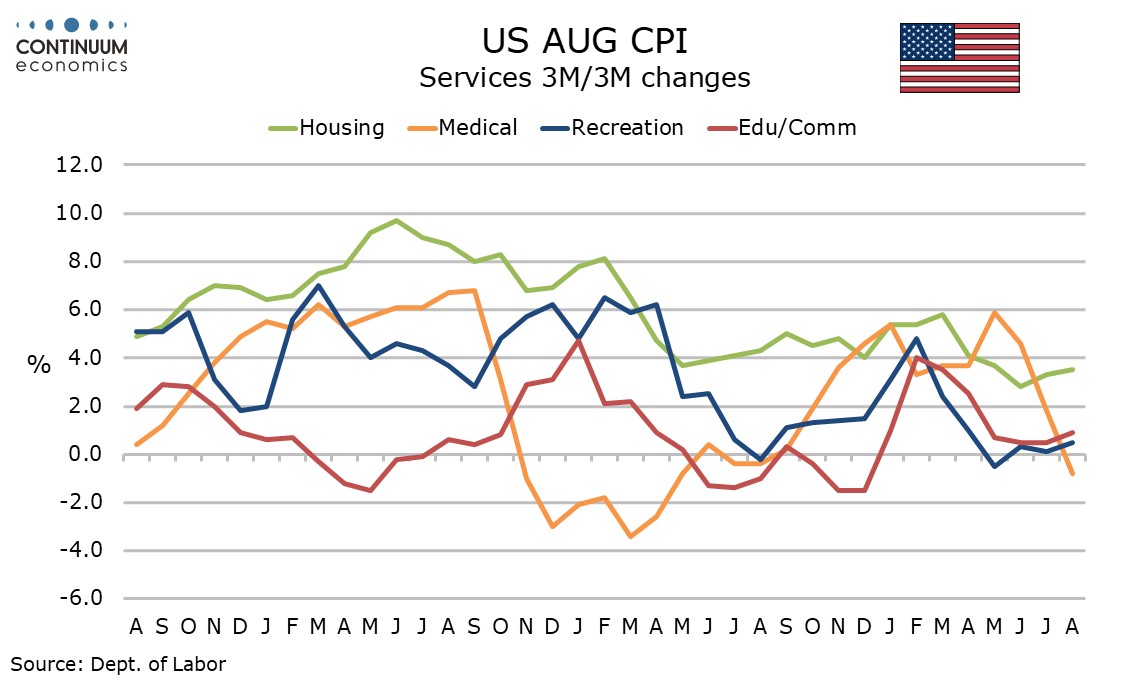

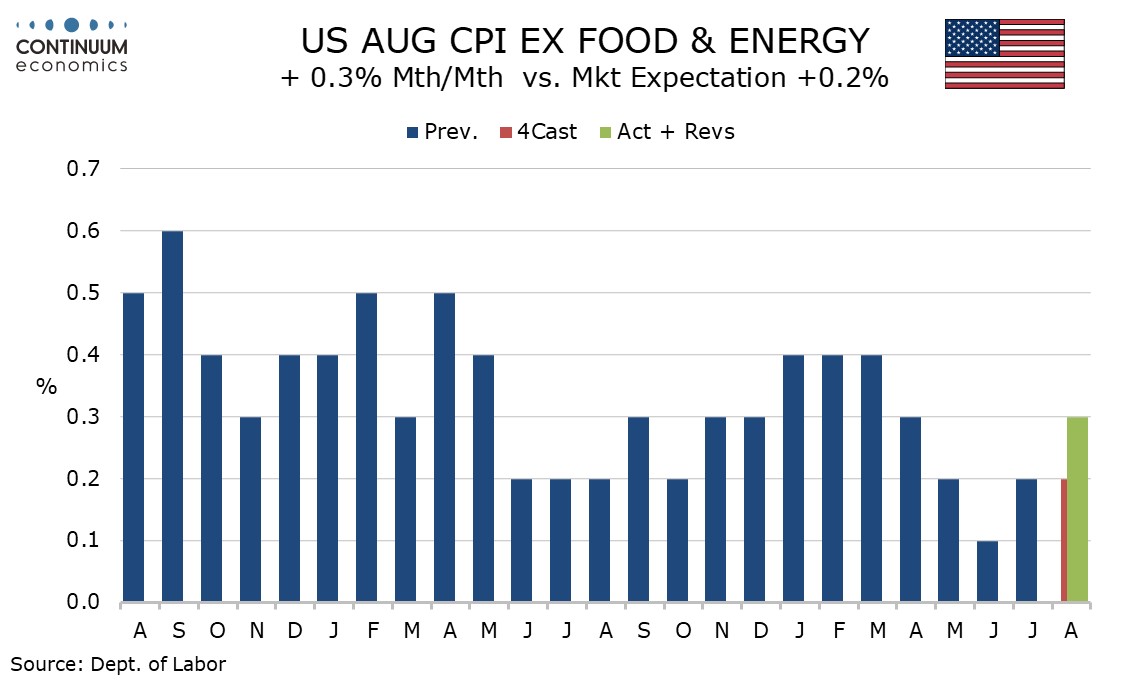

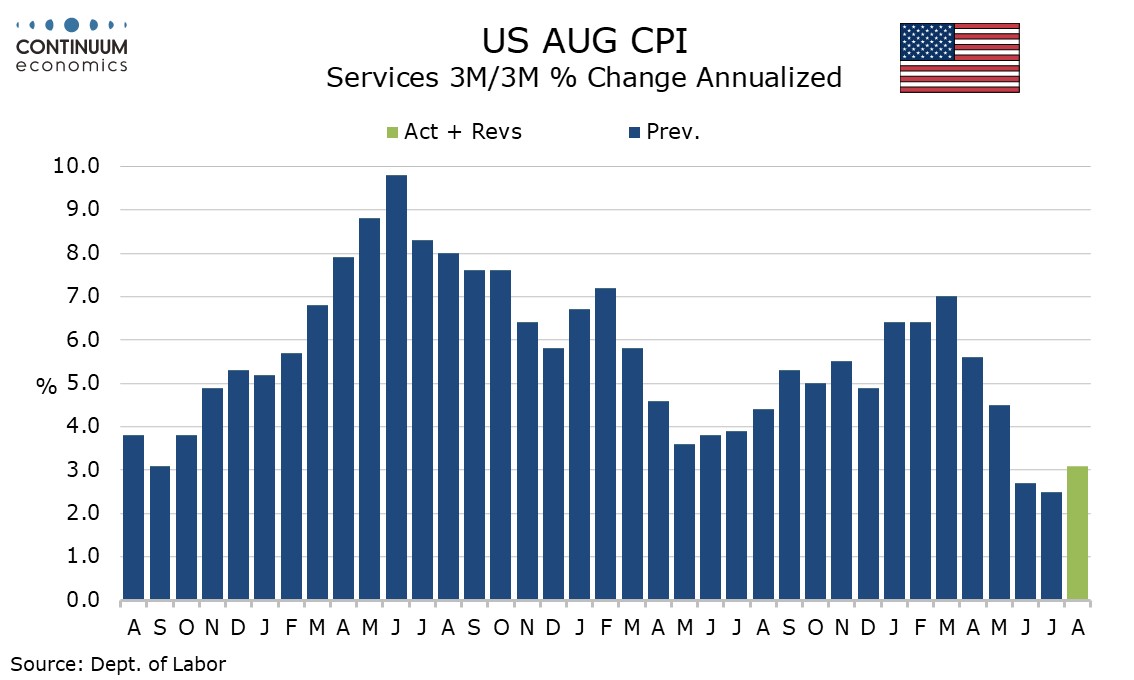

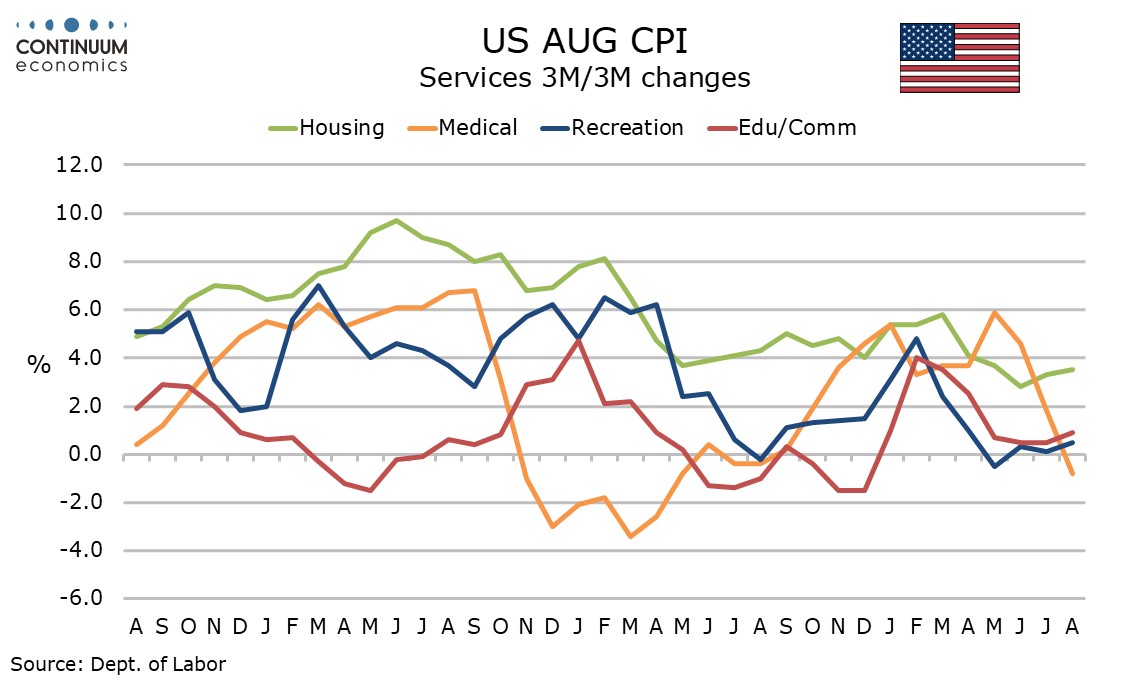

August’s CPI and PPI were both disappointing, with the ex food and energy rates increasing by 0.3% in both. However looking at the details, economists are still looking for a more moderate 0.2% increase in August core PCE prices, with a number slightly softer before rounding possible. The CPI disappointment was led by shelter, with commodities less food and energy down by 0.2% and services less shelter up only 0.1%, despite a 0.3% gain in services overall. However services look strong at 0.4% excluding only medical care or excluding only energy services, and strength in shelter is not to be dismissed. Still, the CPI detail is not sufficiently alarming to exclude a 50bps move.

Three former Fed officials have been quoted as advocating a 50bps move. Most emphatic, but the least surprising, is former New York Fed President William Dudley. Dudley previously called for easing ahead of the July 31 meeting, getting some attention in the markets, though rates were left unchanged. If Dudley wanted easing in July it is unsurprising he would want September to catch up with what he feels should have been done in July. Former Fed Vice-Chairman Donald Kohn stated he could go either way, but thinks risk management has shifted to the labor market and that favors doing 50bps. Perhaps the most surprising was former Kanas City Fed President Esther George, who had a reputation as a hawk. Her argument appears to be for front loading, with the Fed having moved quickly to raise rates above neutral can now “take a couple of bites at the apple” with rates now well above neutral.

Three former Fed officials have been quoted as advocating a 50bps move. Most emphatic, but the least surprising, is former New York Fed President William Dudley. Dudley previously called for easing ahead of the July 31 meeting, getting some attention in the markets, though rates were left unchanged. If Dudley wanted easing in July it is unsurprising he would want September to catch up with what he feels should have been done in July. Former Fed Vice-Chairman Donald Kohn stated he could go either way, but thinks risk management has shifted to the labor market and that favors doing 50bps. Perhaps the most surprising was former Kanas City Fed President Esther George, who had a reputation as a hawk. Her argument appears to be for front loading, with the Fed having moved quickly to raise rates above neutral can now “take a couple of bites at the apple” with rates now well above neutral.

Fed Governor Christopher Waller suggested he could support front loading in his speech released shortly after the slightly disappointing August non-farm payroll on August 6. However his message was that more aggressive moves were possible if data deteriorated, and in stating he expected cuts to be done carefully as the economy and employment continues to grow, appeared to favor 25bps at this point. We would give more weight to Waller as a current official than we would to Dudley, Kohn and George.

Fed Governor Christopher Waller suggested he could support front loading in his speech released shortly after the slightly disappointing August non-farm payroll on August 6. However his message was that more aggressive moves were possible if data deteriorated, and in stating he expected cuts to be done carefully as the economy and employment continues to grow, appeared to favor 25bps at this point. We would give more weight to Waller as a current official than we would to Dudley, Kohn and George.

In making the case for 25bps, former St Louis Fed President James Bullard cautioned that a 50bps move could lead markets to assume similar moves in November and December, though such concerns could easily be allayed by dots looking for less. Similarly a modest 25bps move could be offset by more aggressive dots, though many would then ask if 50bps is seen as appropriate in upcoming meetings, then why not now? We expect a 25bps move would be accompanied by dots implying only 25bps moves in the near term, but that would be on an assumption that employment continues to increase and inflation remains a little higher than the Fed would like. The option to respond aggressively to a further weakening in the data would be there, and Chairman Jerome Powell may stress this in his post-meeting press conference. Finally, while the Fed makes decisions outside political considerations, an aggressive move at the last meeting before the election may be interpreted by some as political, and that may weigh on a few minds struggling with a close decision.

In making the case for 25bps, former St Louis Fed President James Bullard cautioned that a 50bps move could lead markets to assume similar moves in November and December, though such concerns could easily be allayed by dots looking for less. Similarly a modest 25bps move could be offset by more aggressive dots, though many would then ask if 50bps is seen as appropriate in upcoming meetings, then why not now? We expect a 25bps move would be accompanied by dots implying only 25bps moves in the near term, but that would be on an assumption that employment continues to increase and inflation remains a little higher than the Fed would like. The option to respond aggressively to a further weakening in the data would be there, and Chairman Jerome Powell may stress this in his post-meeting press conference. Finally, while the Fed makes decisions outside political considerations, an aggressive move at the last meeting before the election may be interpreted by some as political, and that may weigh on a few minds struggling with a close decision.