Bank of Canada Preview for September 4: A Third Straight 25bps Easing

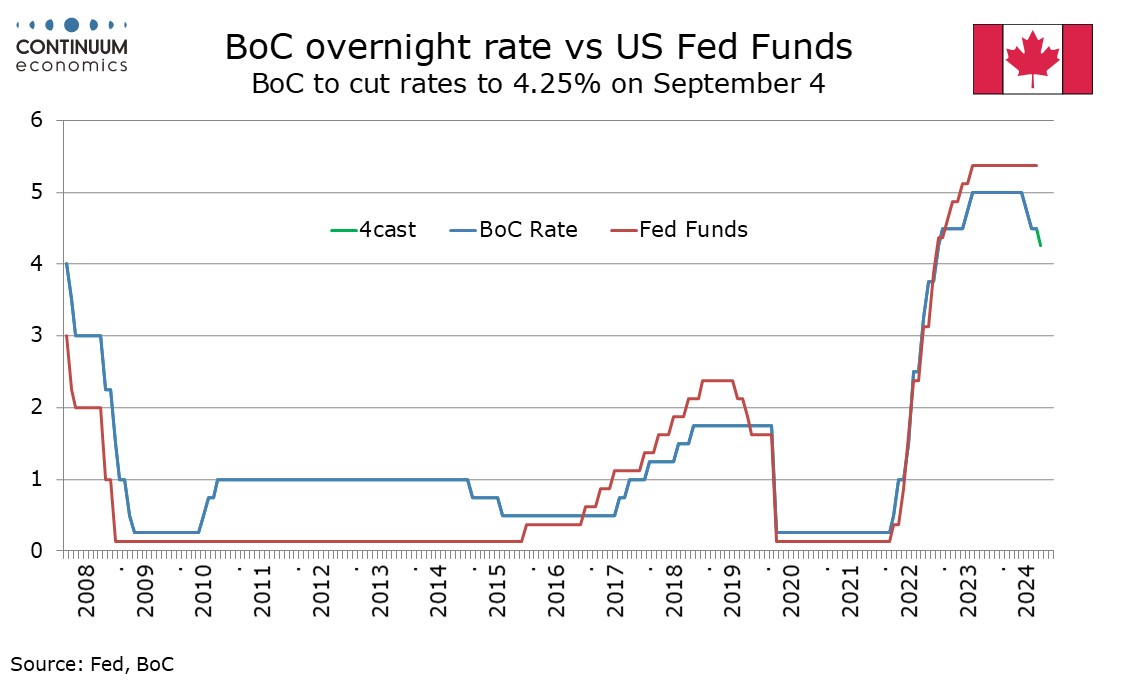

The Bank of Canada meets on September 4 and a third straight easing, by 25bs to 4.25%, looks likely. This meeting will not see a quarterly Monetary Policy Report so the BoC will not update its forecasts from those made in July. However continued progress in reducing inflation and GDP growth, while improved, still leaving the economy in excess supply gives the BoC scope to continue easing.

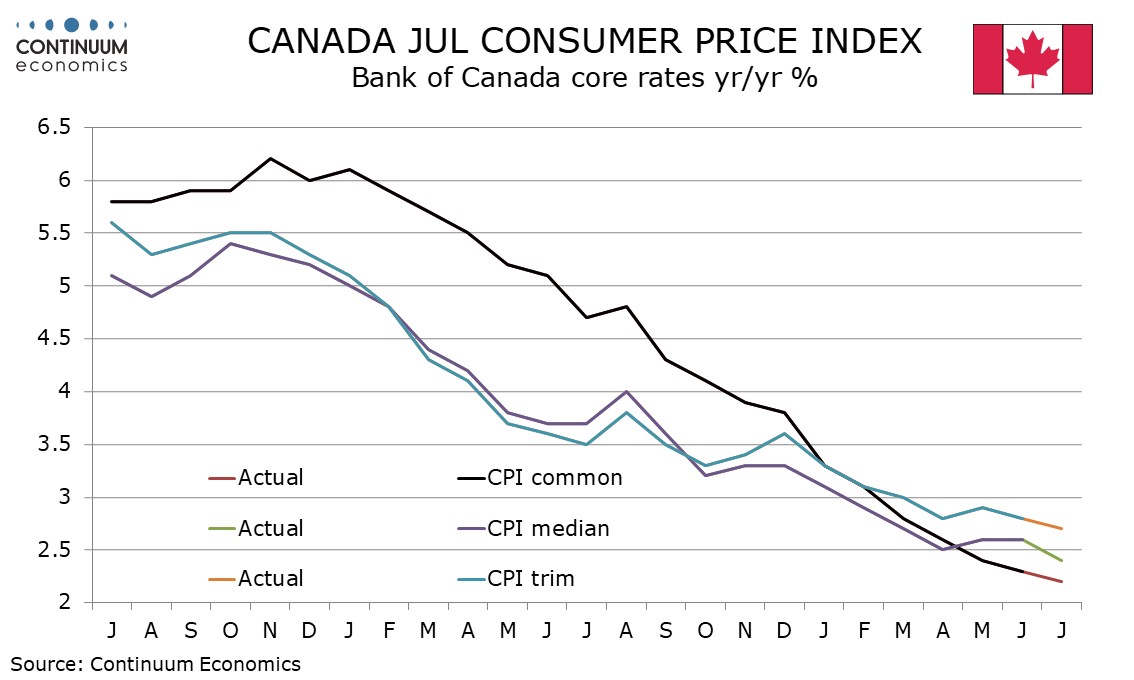

With the economy seen as in excess supply, the BoC sees the economy as having scope to increase without adding to inflationary pressures, meaning that their primary focus will be on inflationary data. July CPI data released since the last meeting showed continued progress in reducing inflation, including the core rates. The BoC easing in July came despite one of the two CPI releases released since it started easing in April, for May, having disappointed, though June data saw progress resuming. Progress on inflation looks a little more convincing going into this meeting, than it did going into July’s, which still delivered an easing.

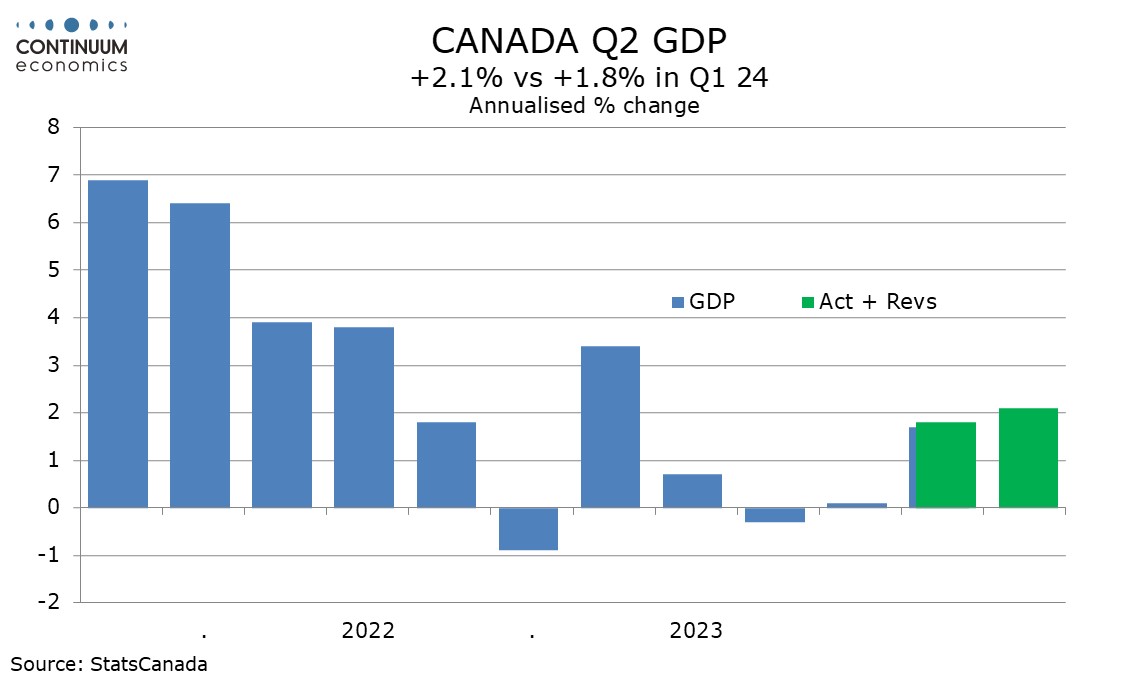

Q2 GDP at 2.1% annualized was a little firmer than a 1.5% forecast made by the BoC in July, but the detail, showing much of the strength due to government, with consumer spending subdued at 0.6%, was less impressive. That monthly data showed a flat GDP in June with the preliminary estimate for July also flat suggests limited momentum entering Q3. August employment data will be released on September 6, two days after the rates decision, but June and July employment were both almost unchanged, and unemployment is trending higher.

The statement is likely to look similar to that in July, noting excess supply and a broad easing of inflationary pressures, while noting continued upside risk in shelter and wage-sensitive prices. Balance sheet normalization is likely continue for now, probably fading around the end of the year. In his press conference in July Governor Tiff Macklem stated that if inflation continues to ease it is reasonable to expect further cuts in rates, but decisions would be taken one meeting at a time, dependent on incoming data. A similar message is likely at this meeting.

We expect that data will allow the BoC to ease again in the two remaining meetings this year, in October and December, which would take the rate to 3.75%. The pace of easing may slow in 2025 if the economy starts to respond to easing, but 100bps of easing in 2025 would take the rate back to 2.75%, the midpoint of the BoC’s current estimate of the neutral range. Inflation would have to return to the 2% target to see the BoC returning rates to neutral. We expect that to happen by late 2025.