U.S. July Personal Income and Spending - Core PCE Prices subdued, savings at a 2-year low

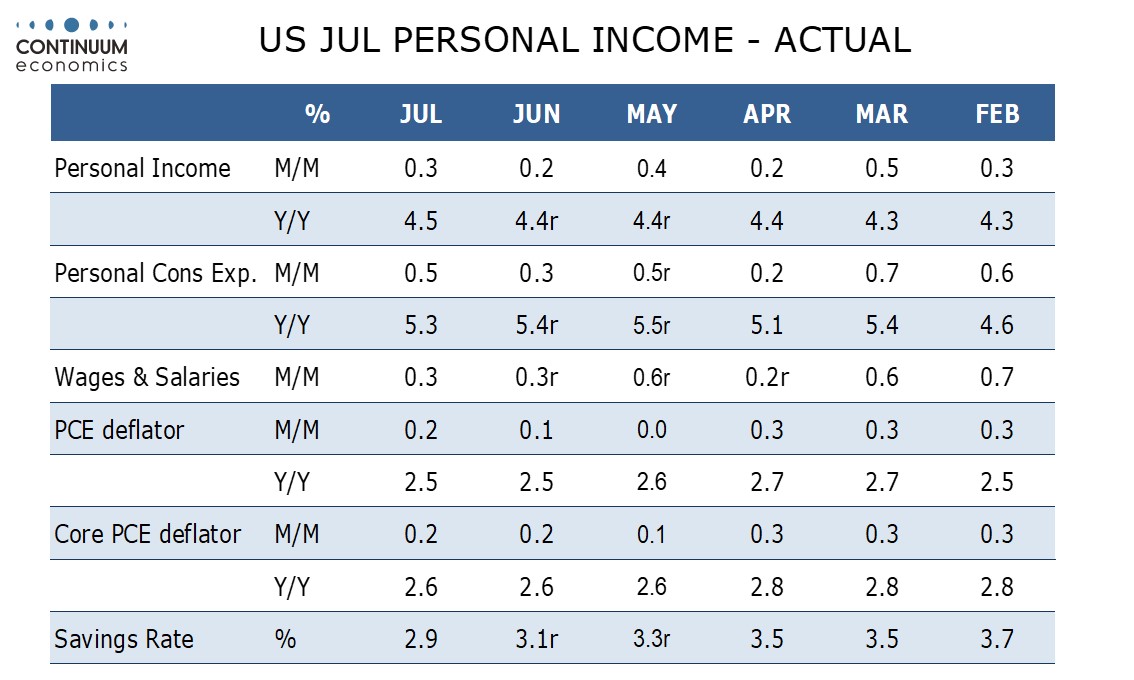

July’s PCE price data, up 0.2% both overall and core (with both subdued at 0.16% before rounding) is on consensus, as is a 0.5% increase in personal spending. Income at 0.3% is stronger than consensus, but still underperforms spending, leaving the savings rate at 2.9%, the lowest since June 2022.

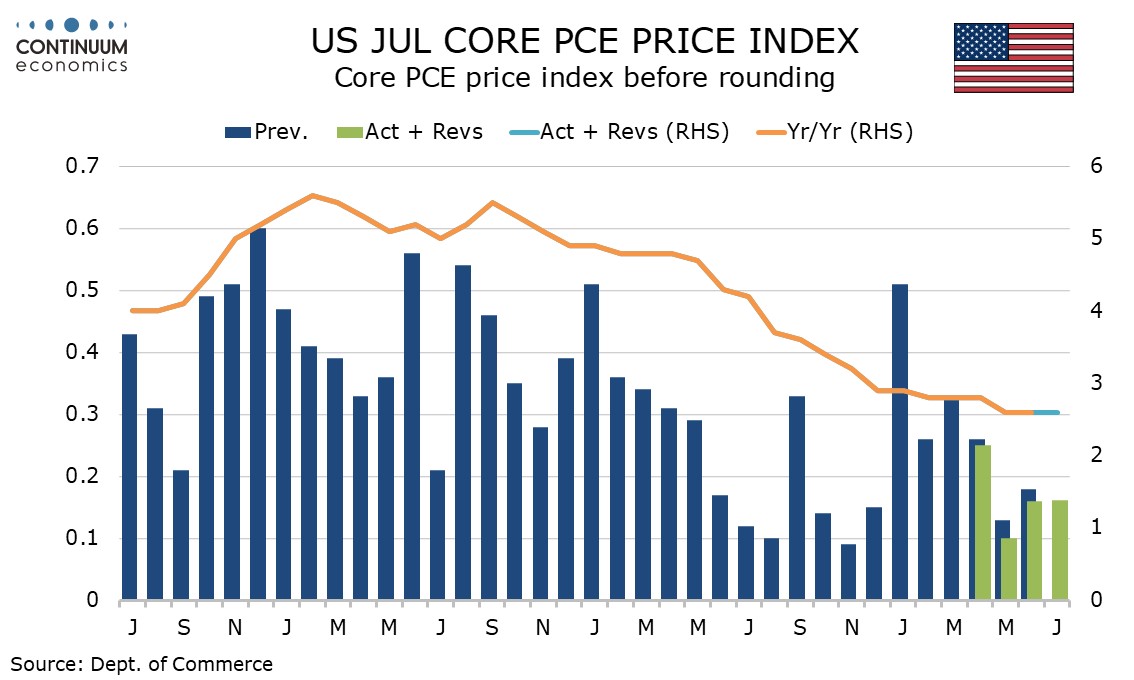

Both 2023 and 2024 saw core PCE prices make a firm start to the year before slowing in Q2 and further in Q3 and Q4, which in 2023 were consistent with the Fed’s 2.0% target on an annualized basis. July 2024 data is subdued though similar to that of July 2023 leaving yr/yr rates stable, at 2.5% for overall PCE prices and 2.6% for the core rate.

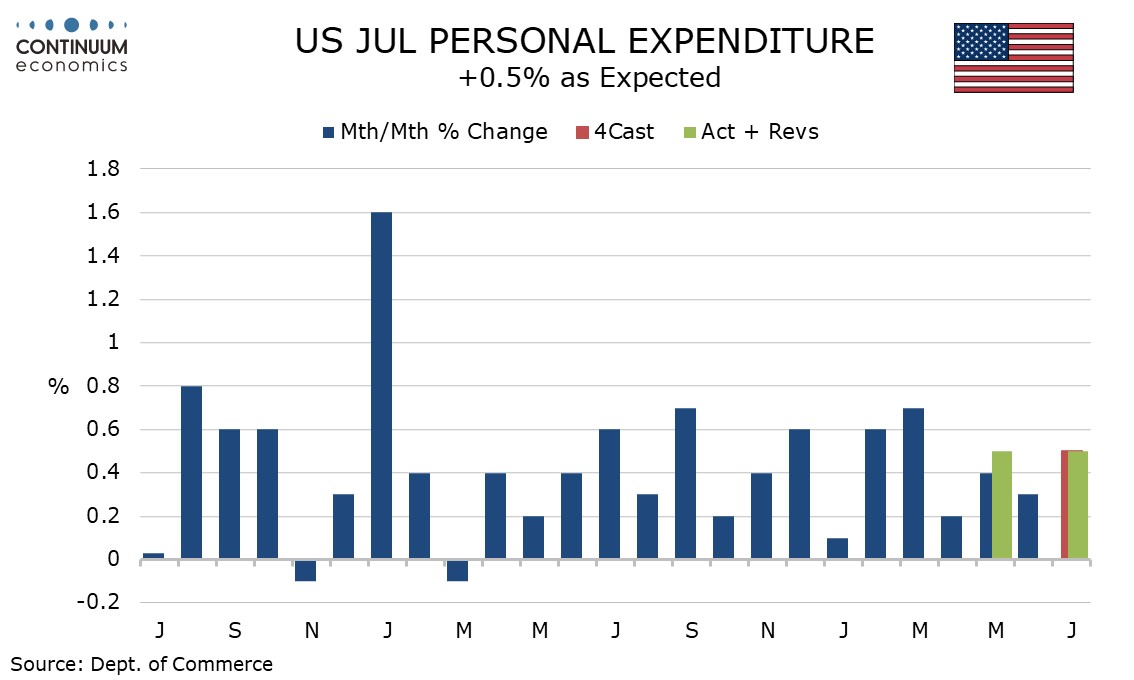

July personal spending showed durables up by 1.4% and non-durables up by 0.4% consistent with a positive retail sales report, and services up by 0.4% for a second straight month, though April and May were both revised up to 0.5% from 0.4%. Q2 GDP revisions had showed spending revised higher and the monthly data shows May data led the revision. In real terms spending was up by 0.4% in July, so the momentum of Q2 continues at the start of Q3.

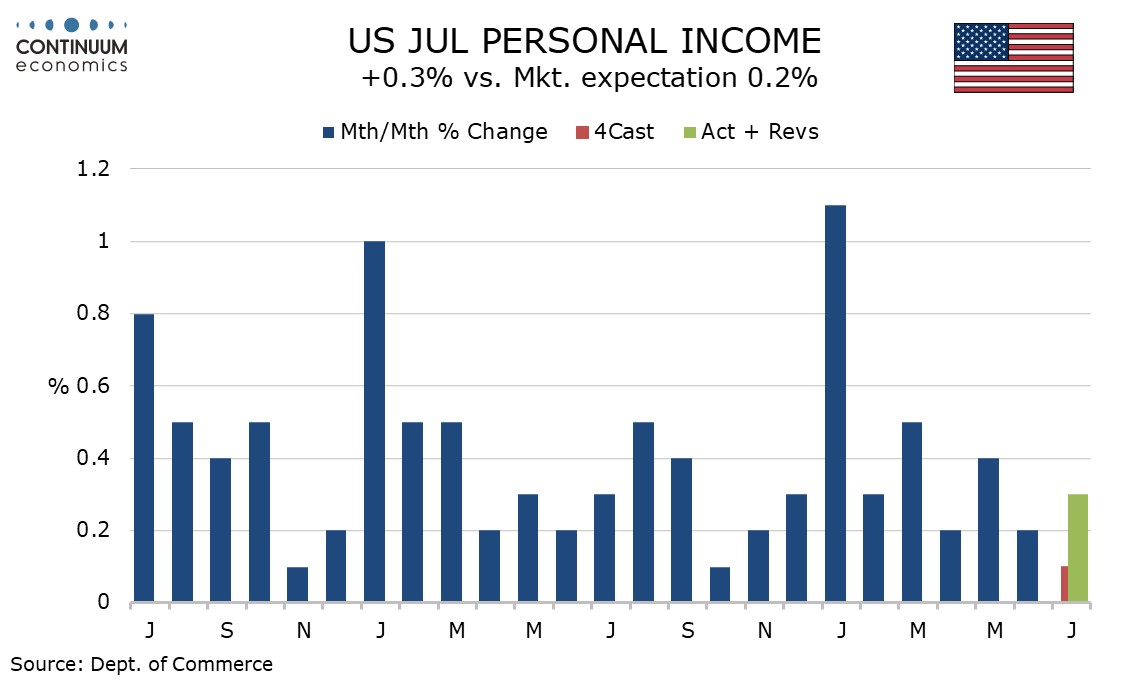

Personal income showed wages and salaries up by 0.3%, a little stronger than the payroll had implied suggesting the data might not have been quite as weak as some interpreted it to be, with the fact Hurricane Beryl came in the payroll survey week making the payroll look weaker than the month as a whole. The other components of personal income were on the firm side of recent trend, supported by pick-ups in proprietors income and rental income which were both weak through Q2.

Real disposable income rose by only 0.1% and is up only 1.1% yr/yr compared to 2.7% for real spending, explaining the slide in savings which questions for how long spending strength can be sustained. There will be historical revisions released with final Q2 GDP data on September 26 and it is possible income and spending data will look more consistent after the revisions, though which series will see the larger adjustment is harder to predict.