GBP, USD flows: GBP upside looking capped

UK public sector borrowing highr than expected and upcoming fiscal tightening suggests some downside risks for GBP

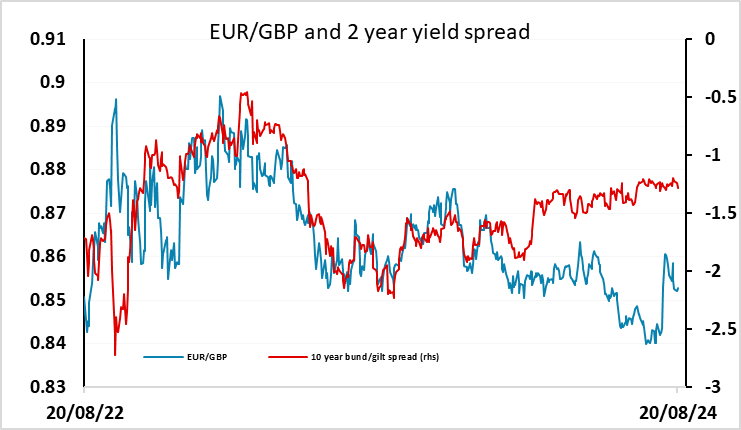

A fairly quiet calendar ahead of the US employment benchmark revisions and the FOMC minutes due later. We have seen UK public sector borrowing numbers this morning, and these showed a somewhat larger than expected deficit, and reports suggests that the government is planning a combination of tax rises and spending cuts in the autumn to being the public finances back towards meeting fiscal rules. There has been no GBP impact from this morning’s numbers, but tighter fiscal policy going forward will tend to reduce the strength of any UK recovery and increase the chances of BoE easing. This suggests that the recent strength of GBP may be reaching something close to a peak, and EUR/GBP will struggle to progress below 0.85.

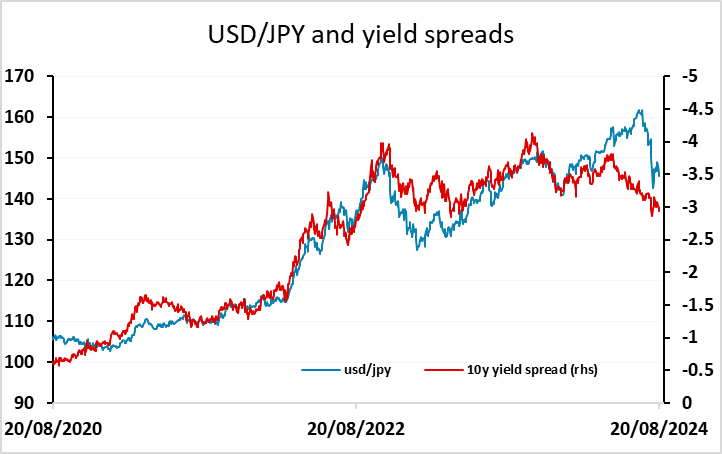

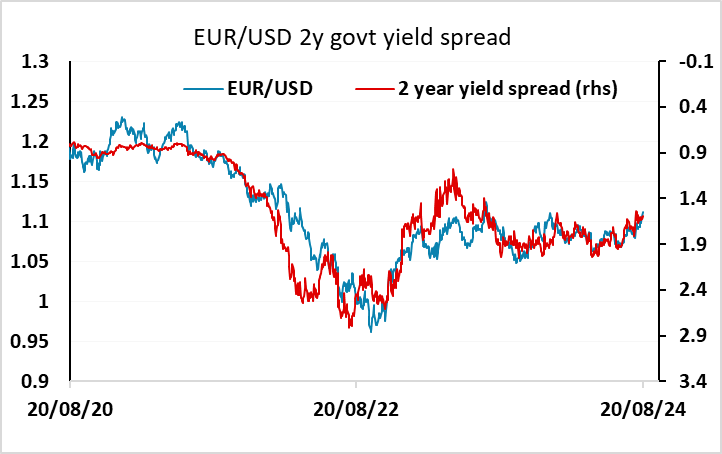

Otherwise, the USD saw a mild recovery in Asia after trading very soft in the first part of the week. Short term models suggest EUR/USD looks fully valued near 1.11, but there is still some scope for gains in the JPY and AUD. However, we doubt there will be much movement head of the US employment benchmark revisions this afternoon.