Published: 2024-08-15T15:15:45.000Z

Preview: Due August 30 - U.S. July Personal Income and Spending - PCE prices a close call between 0.1% and 0.2%

Senior Economist , North America

3

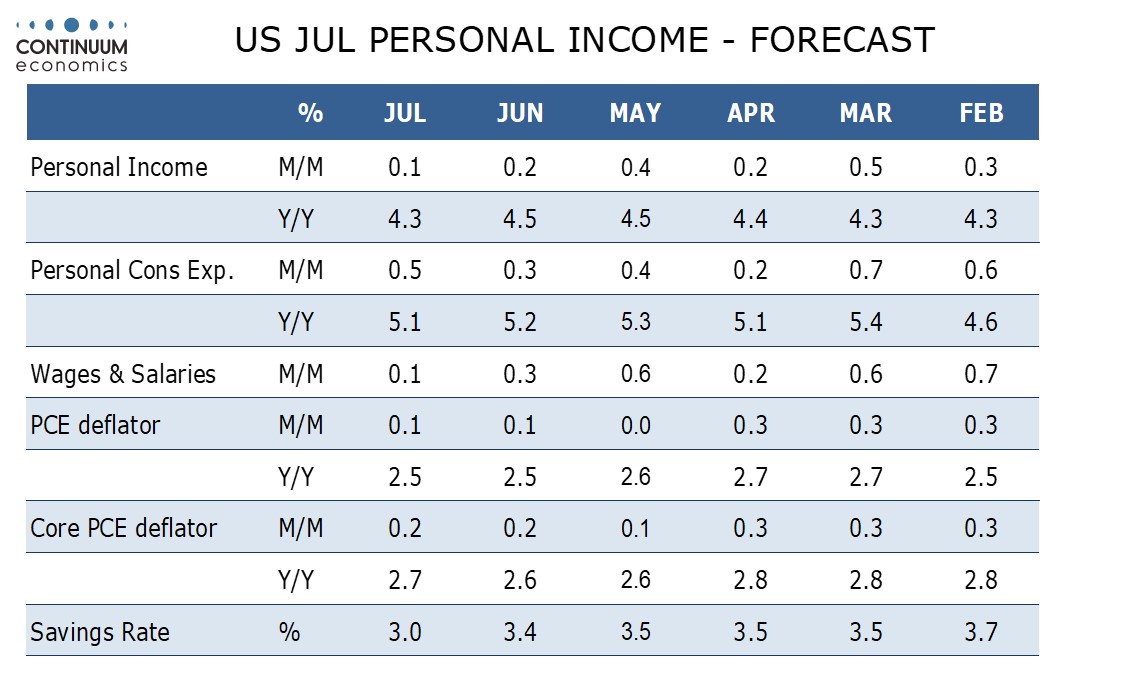

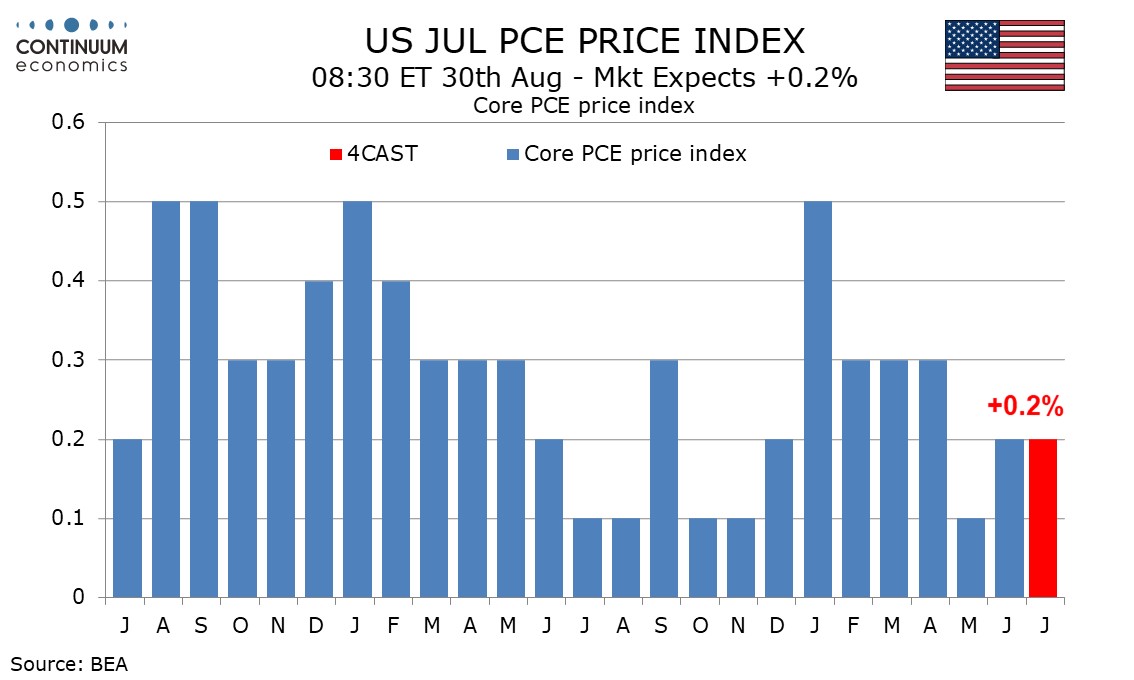

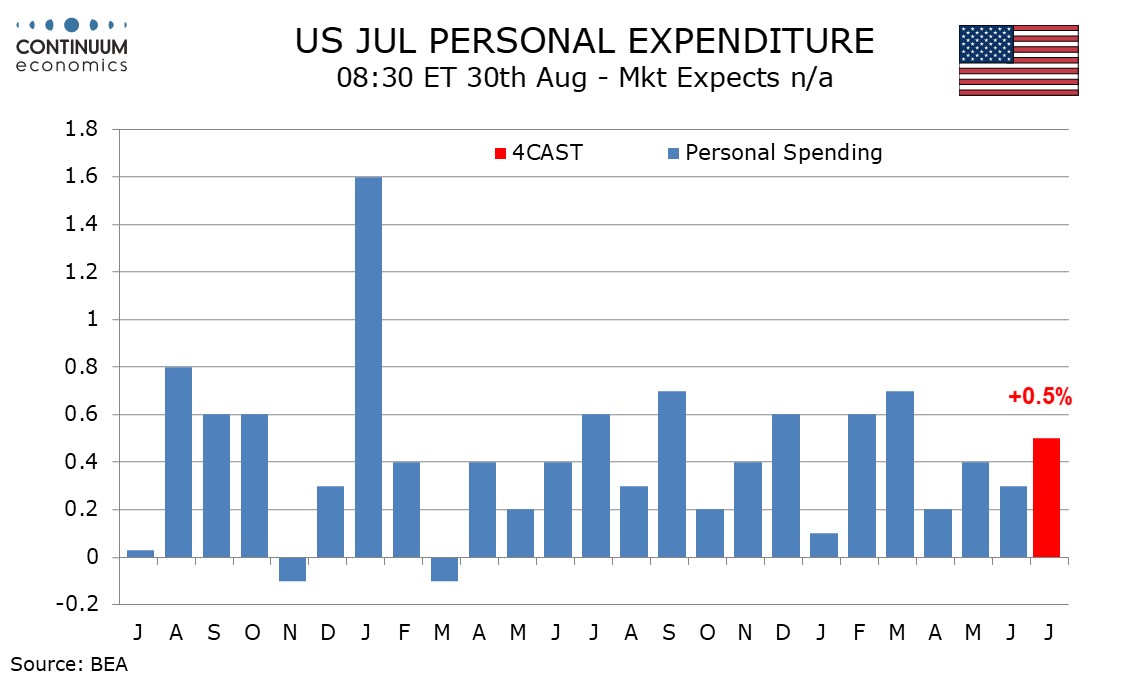

We expect July core PCE prices to be consistent with the core CPI, up by 0.2% but a little less before rounding. We expect a healthy 0.5% rise in personal spending to outperform a subdued 0.1% increase in personal income.

The core PCE price index is a close call between 0.1% and 0.2%. We expect overall PCE prices to rise by only 0.1% despite a 0.2% rise in overall CPI, which was also rounded up and closer to 0.15% than the core CPI. We expect the overall PCE price index to be rounded down to 0.1%.

The yr/yr overall PCE deflator would then remain at June’s 2.5% pace but the core rate would edge up to 2.7% after two months at 2.6%.

A subdued non-farm payroll breakdown, from average hourly earnings and the workweek as well as employment, suggests a below trend 0.1% increase in wages and salaries. Personal income trend elsewhere is weaker than for wages and salaries and we expect overall personal income to also rise by 0.1%.

Retail sales saw a strong 1.0% increase in July which might not be fully matched in July personal spending data, particularly from autos which led the retail sales gain. We expect a fourth straight 0.4% rise from services. Spending outpacing income would see the savings rate slip to 3.0% from 3.4%, reaching its lowest since October 2022.