U.S. July Retail Sales and Initial Claims show resilience, easing slowdown fears

July retail sales with a stronger than expected 1.0% increase shows the consumer still has some momentum at the start of Q3, while a dip in initial claims to 227k from 234k suggests the labor market is not seeing increased weakness in early August. August manufacturing surveys from the Philly Fed at -7.0 and the Empire State at -4.7 are negative, but not shockingly so. This is not data that suggests an economy in near term danger of entering recession.

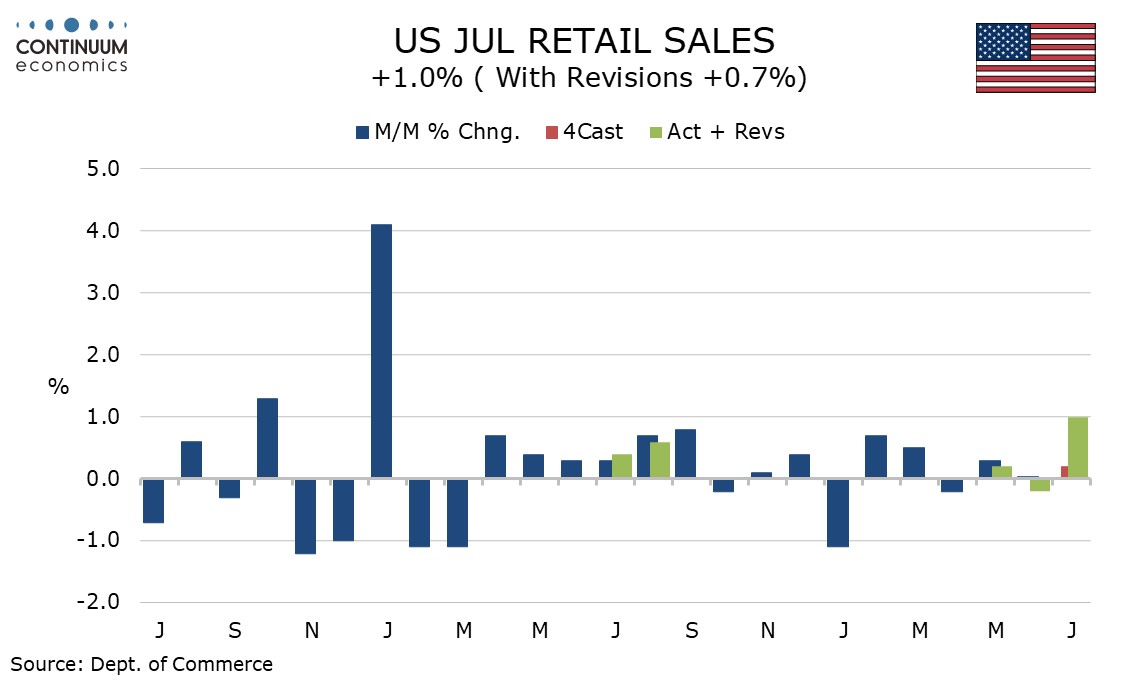

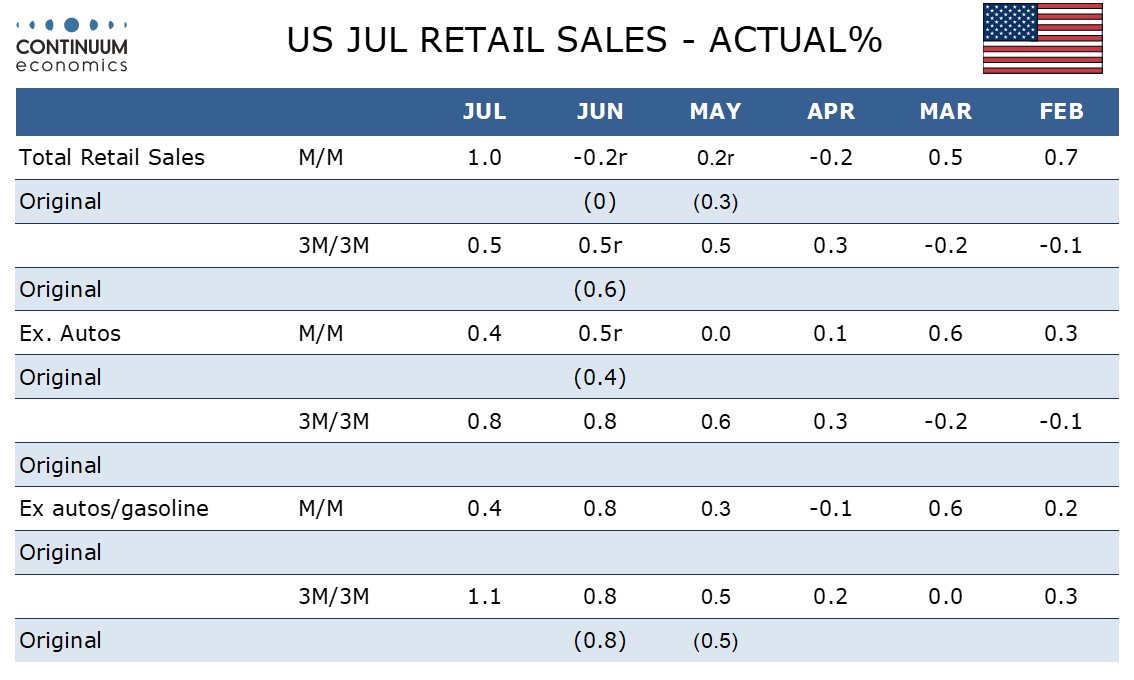

July’s retail sales gain as led by autos where a 3.6% rise reversed a 2.4% June decline that was due to temporary computer software issues. Overall sales rose by 1.0% but by 0.7% net of revisions, still stronger than expected.

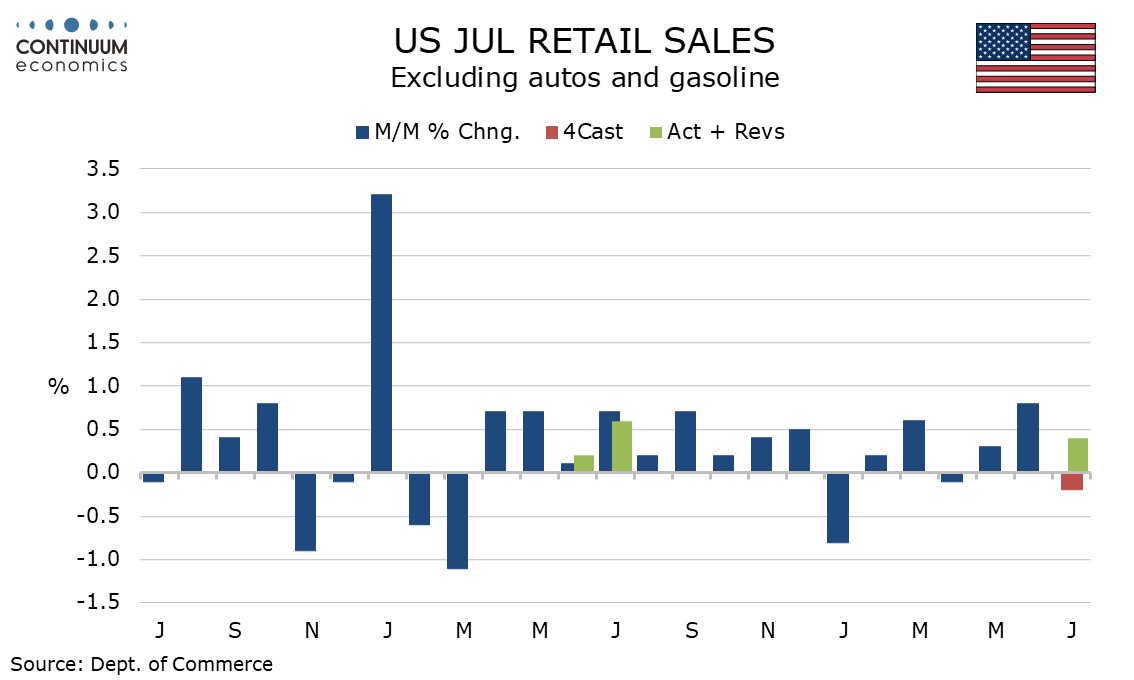

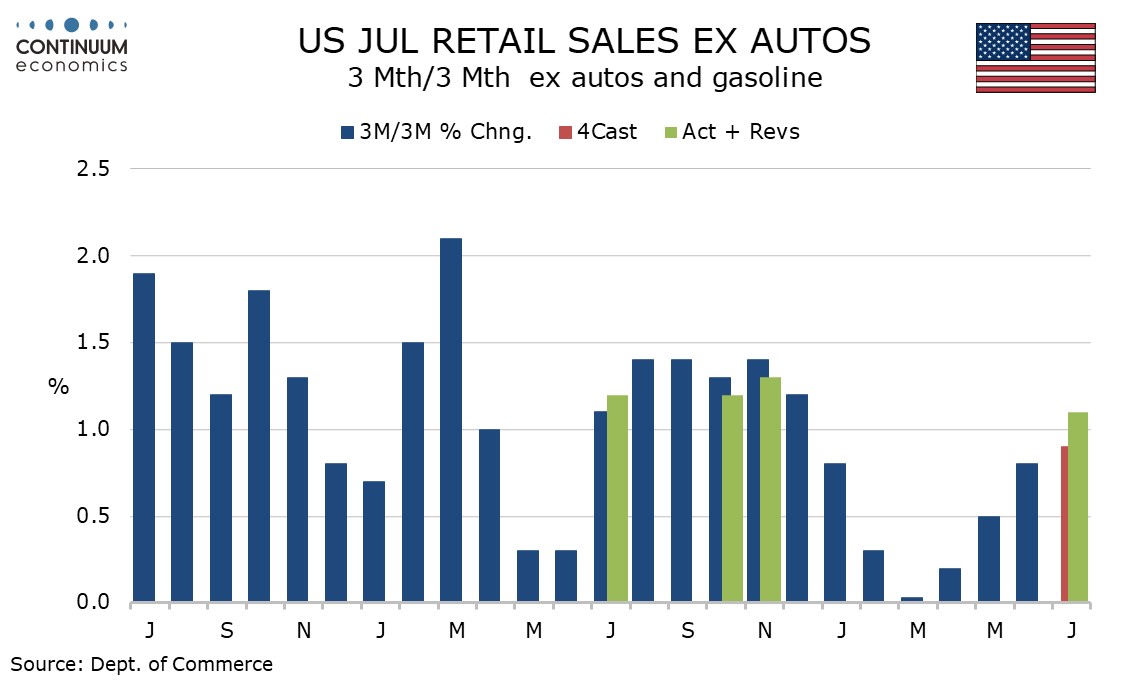

Ex-autos a 0.4% rise was similar to June’s 0.5% (here the revision was upwards from 0.4%) though with gasoline prices neutral the ex-auto and gasoline gain of 0.4% was a slowing from June’s strong 0.8%.

The control group, which contributes to GDP, saw a slightly steeper slowing, to 0.3% from 0.9%, but even a moderate July gain after a strong June suggests continued momentum. Details of the report show broad based if mostly moderate July gains.

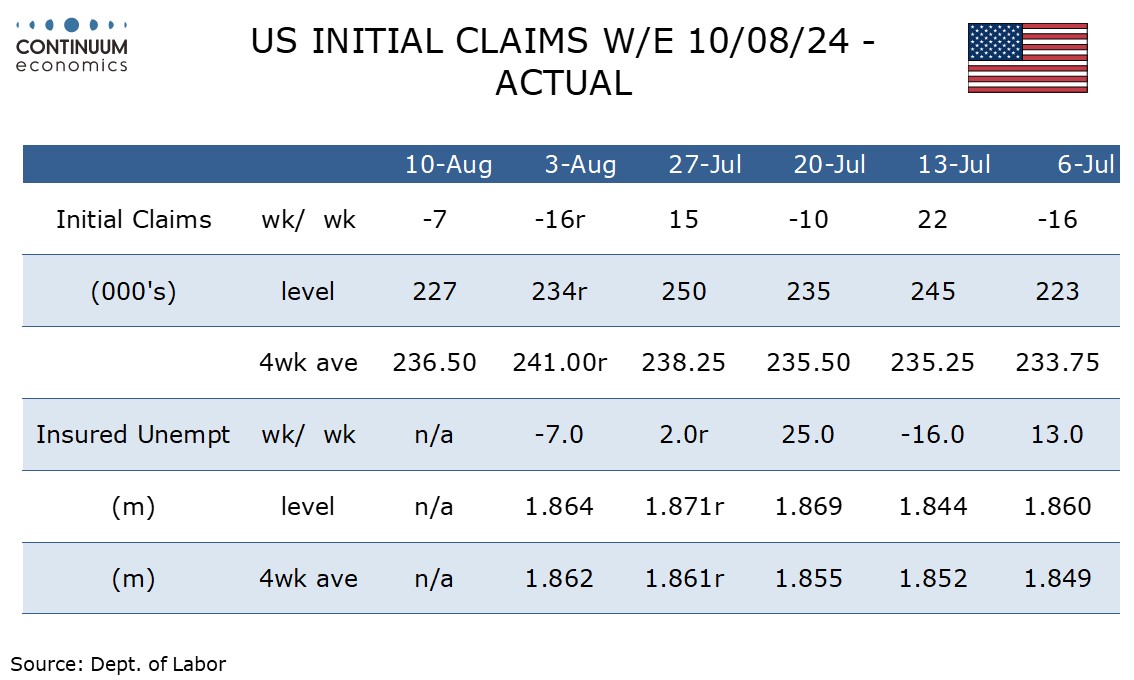

Initial claims at 227k and continued claims at 1.864m both fell by 7k on the week with the former a 5-week low and the latter a 3-week low. The 4-week average saw a modest dip in the case of initial claims but continues to rise, if marginally, in the case of continued claims.

Next week’s initial claims data will cover August’s non-farm payroll survey week though the payroll survey week is still two weeks away for continued claims. The current signals suggest that August’s payroll is unlikely to show further slowing from the disappointing July data.