Brazil CPI Review: 0.4% Growth in July

Brazil's CPI rose by 0.38% in July, pushing the Y/Y rate to 4.5%, the upper limit of the Central Bank's target. The increase was driven by rising transport costs, especially gasoline and airfare, while food prices fell. Despite this, uncertainty remains about the economy's potential overheating, with unemployment falling and wage growth accelerating. The CPI is expected to drop to around 4.0% by year-end, supported by the Central Bank's hawkish stance on inflation.

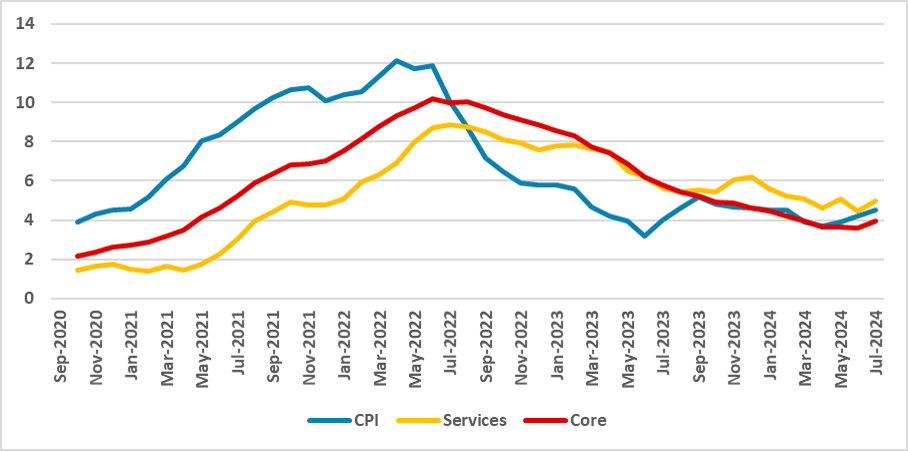

Figure 1: Brazil CPI (%, Y/Y)

Source: IBGE and BCB

The Brazilian National Statistics Institute (IBGE) has released the CPI data for July. The data shows that the CPI increased by 0.38% (m/m) in July, a figure aligned with market expectations (0.35%) according to Bloomberg. Consequently, the Y/Y CPI has risen to 4.5% from 4.2% in June, reaching the upper bound of the Brazilian Central Bank's target range.

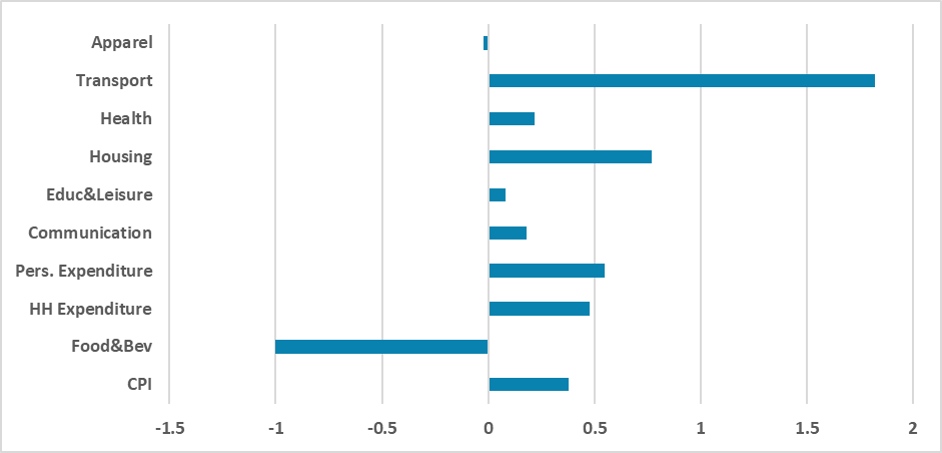

Figure 2: Brazil July CPI (%, m/m)

Source: IBGE

As we anticipated (here), the biggest contributor to the rise in July's CPI was the Transport group. This group increased by 1.8% in the month, driven by the rise in gasoline (+3.15%), ethanol (+5.9%), and airfare tickets (+19.4%). The increase in airfare tickets was a direct effect of seasonal demand, while gasoline prices were primarily affected by Petrobras's distribution price increases, reflecting the rise in oil prices and the depreciation of the exchange rate. The Housing group grew by 0.8%, largely due to the rise in electricity prices (+19.3%), as tariff schemes were changed in some regions of the country.

On the other hand, the good news came from the Food and Beverage CPI group, which contracted by 1.0%. This was influenced by the drop in prices of tomatoes (-31.2%), carrots (-27.4%), and onions (-9.0%). The other groups behaved more or less in line with their seasonal averages. We believe the rise in the Y/Y CPI is likely affected by the base effect, and once fuel prices stabilize, we expect inflation to decrease in the second half of the year.

However, it remains unclear whether the Brazilian economy is overheating. Unemployment data is declining towards levels that could be considered below neutral, and the total wage mass is growing, both in terms of the number of people earning wages and the level of those wages. Additionally, it appears that the exchange rate will remain at higher levels for longer, which also poses some inflationary risks. Adding to this complex situation are increased government transfers and unanchored inflation expectations.

We are forecasting the Brazilian CPI to end 2024 around the 4.0% mark, indicating a drop in the second half. We still believe that the economy's growth will not be sufficient to cause significant inflationary pressures, and the hawkish stance of the BCB on inflation will contribute to lower inflation in the latter half of the year. It remains to be seen whether the next BCB President, to be announced in the second half, will have a softer view on inflation, which could result in less contractionary monetary policy.