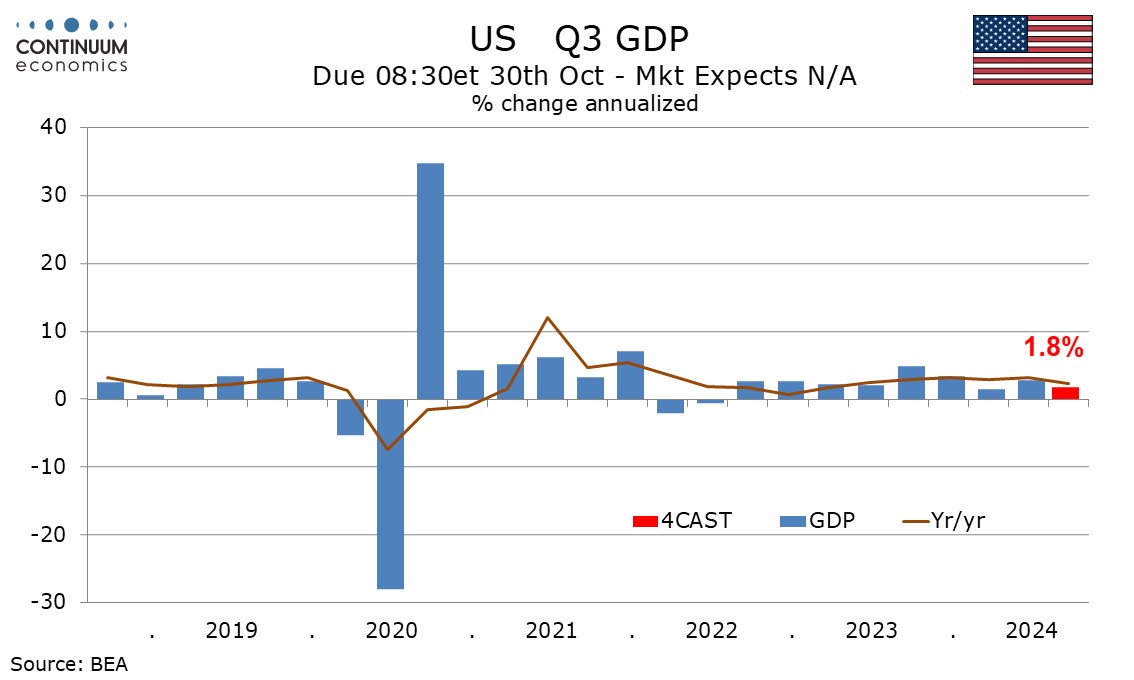

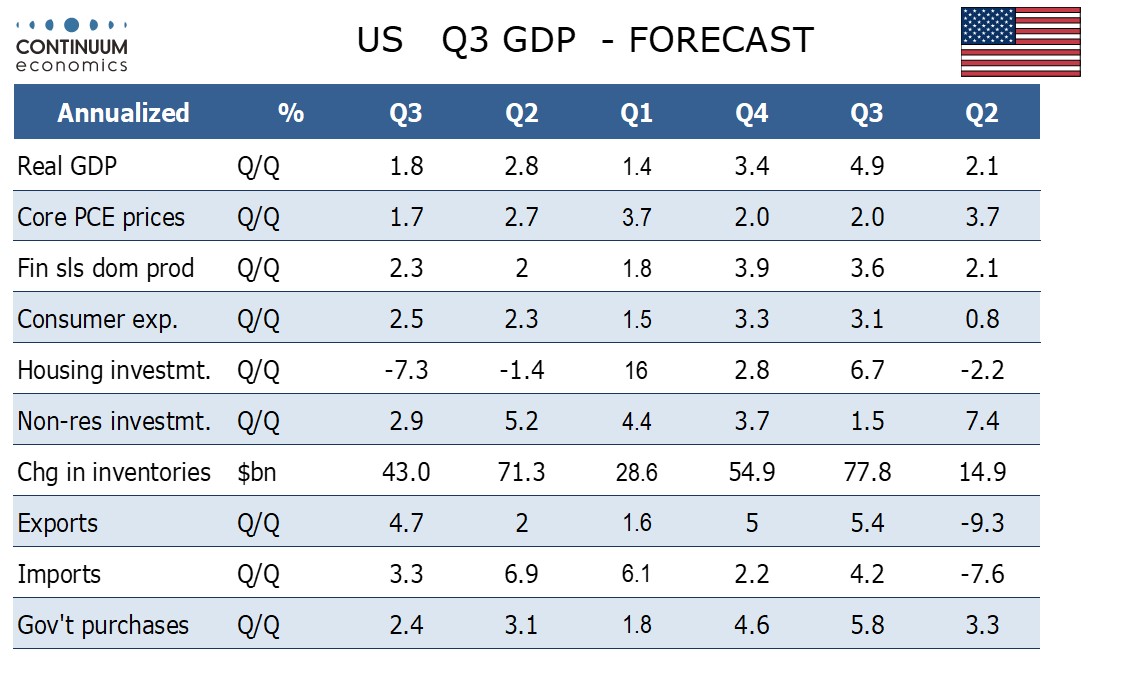

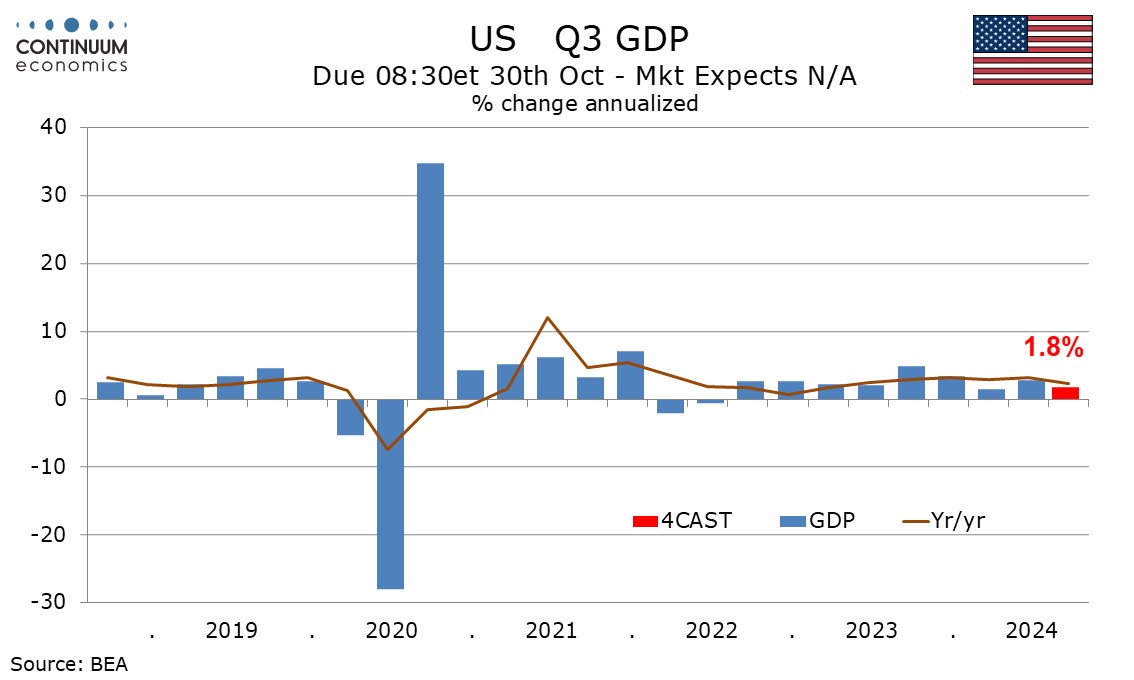

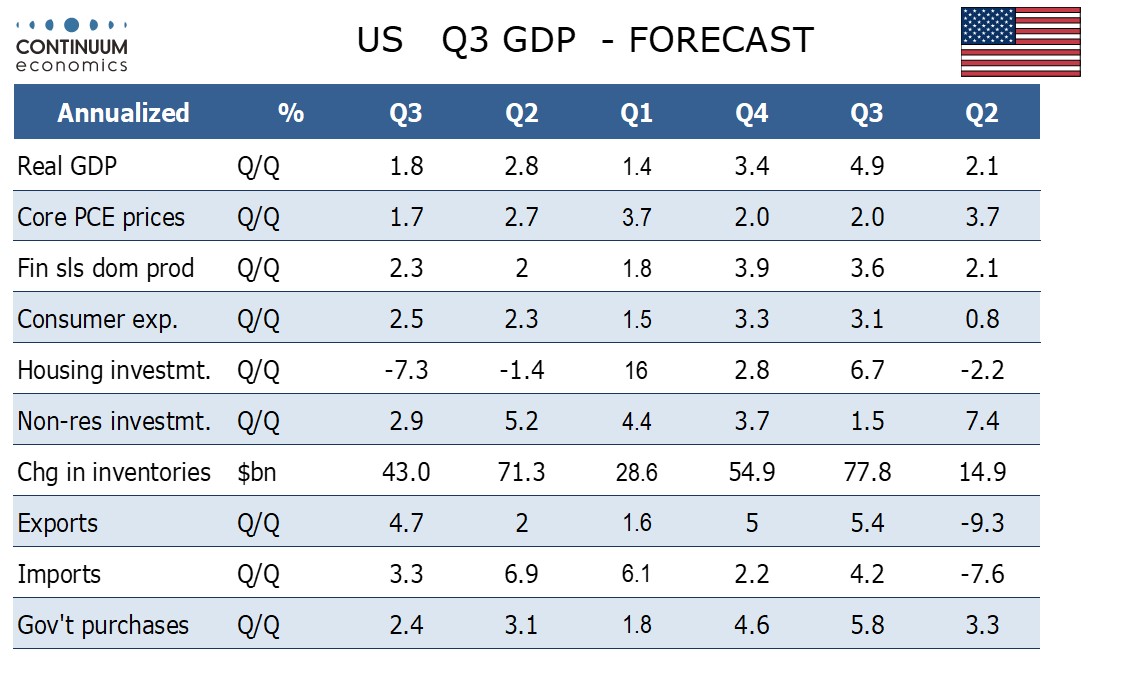

The stronger than expected 2.8% annualized increase in Q2 GDP contained some positive signals going forward, particularly retail sales and the trade balance showing stronger data in June to suggest momentum entering Q3. However a large Q2 inventory build up is a negative. We now look for Q3 to increase by 1.8% at an annualized pace, up from an estimate of 1.0% made before the Q2 data.

Not only were June retail sales stronger than expected, a June dip in auto sales was due to temporary computer outages and preliminary signals are for a sharp rebound in July auto sales. We expect Q3 consumer spending to rise by 2.5%, led by a 3.7% increase in durables.

Also giving some support to the consumer is the prospect of real disposable income picking up from recent weakness as inflation falls. We expect a 2.0% increase in Q3, double the pace of Q2 and a five quarter high, though still below our projected increase in spending.

Also giving some support to the consumer is the prospect of real disposable income picking up from recent weakness as inflation falls. We expect a 2.0% increase in Q3, double the pace of Q2 and a five quarter high, though still below our projected increase in spending.

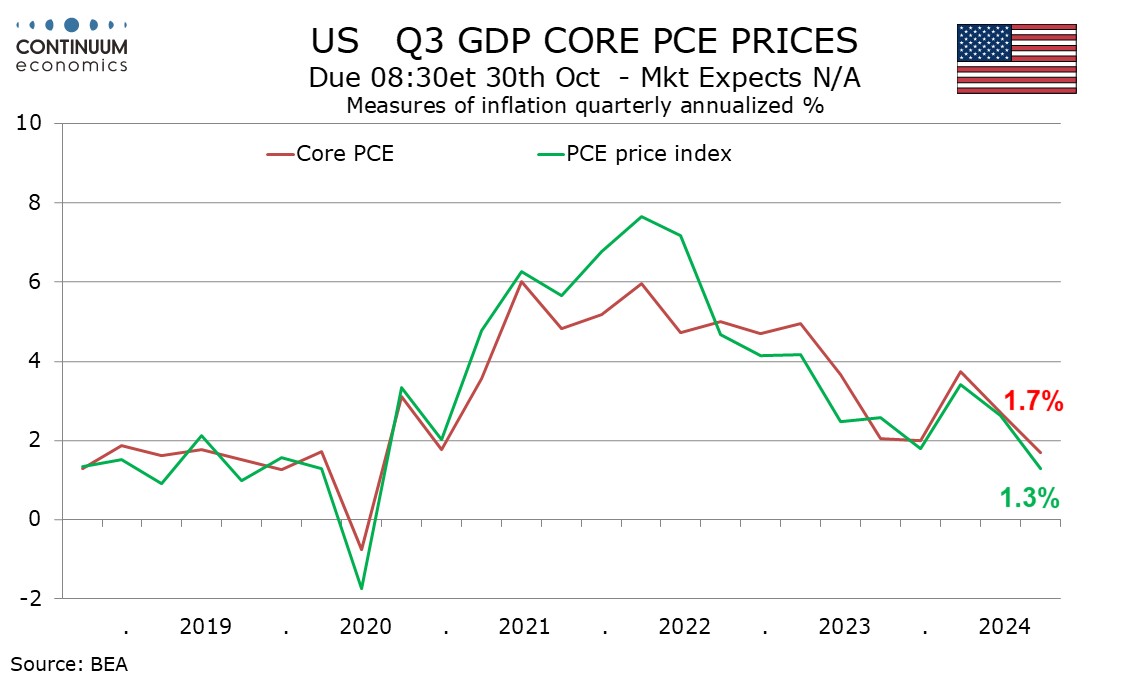

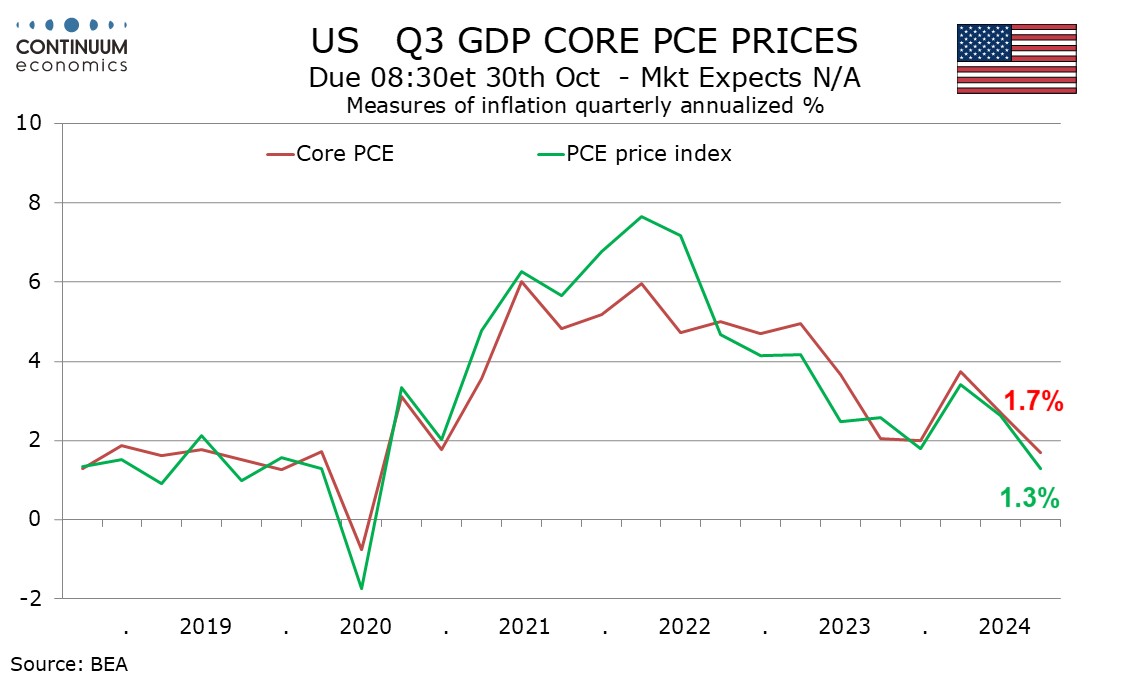

We expect the recent slowing in inflation to persist through Q3, with annualized gains of 1.7% in core PCE prices and 1.3% in overall PCE prices. There appears to be some residual seasonality in the data. In 2023 core PCE prices rose by 2.0% annualized in Q3 and Q4. We expect the data to continue coming in softer than a year ago, though the second half of the year will understate the true inflationary picture.

We expect the recent slowing in inflation to persist through Q3, with annualized gains of 1.7% in core PCE prices and 1.3% in overall PCE prices. There appears to be some residual seasonality in the data. In 2023 core PCE prices rose by 2.0% annualized in Q3 and Q4. We expect the data to continue coming in softer than a year ago, though the second half of the year will understate the true inflationary picture.

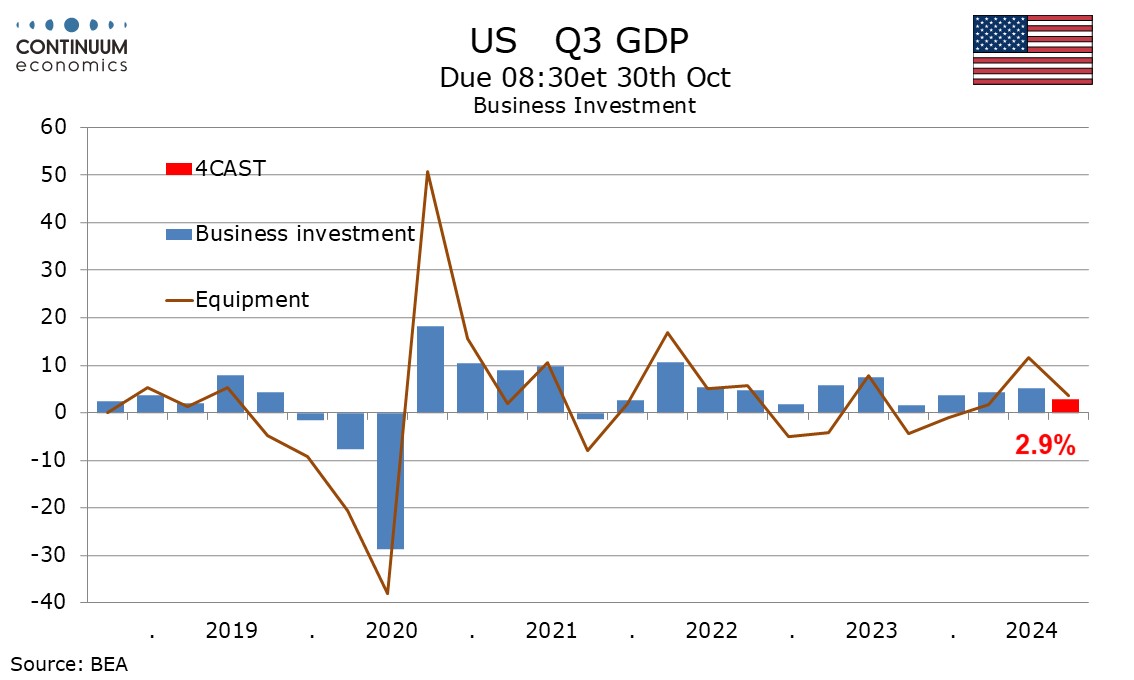

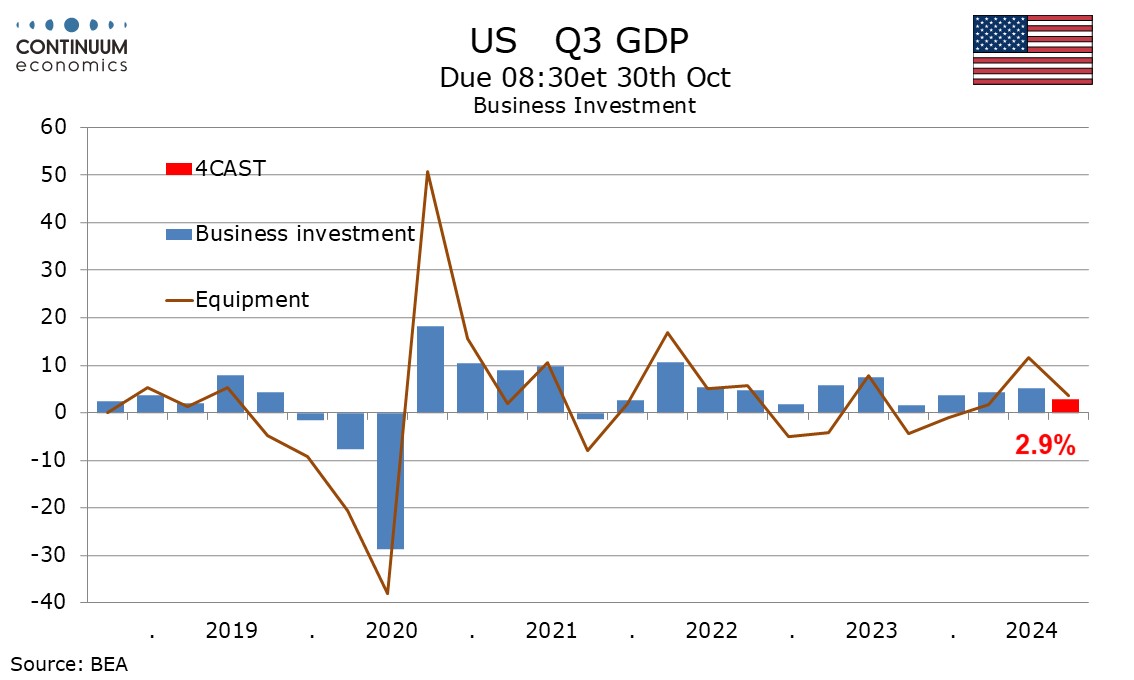

A significant surprise in the Q2 GDP detail was a strong 11.6% bounce in investment in equipment explaining most of a 5.2% increase in business investment. Most of the bounce in equipment came in transport, which was correcting from three straight declines. We expect moderate gains in Q3, of 3.6% for equipment and 2.9% for business investment.

A significant surprise in the Q2 GDP detail was a strong 11.6% bounce in investment in equipment explaining most of a 5.2% increase in business investment. Most of the bounce in equipment came in transport, which was correcting from three straight declines. We expect moderate gains in Q3, of 3.6% for equipment and 2.9% for business investment.

We expect a significant negative of -7.3% from housing investment, after a marginal 1.4% dip in Q2 followed a 16.0% surge in Q1. We expect government to rise by 2.4%, slower than Q2’s 3.1% defense-led gain but stronger than a 1.8% rise in Q1 when defense was negative.

We expect a significant negative of -7.3% from housing investment, after a marginal 1.4% dip in Q2 followed a 16.0% surge in Q1. We expect government to rise by 2.4%, slower than Q2’s 3.1% defense-led gain but stronger than a 1.8% rise in Q1 when defense was negative.

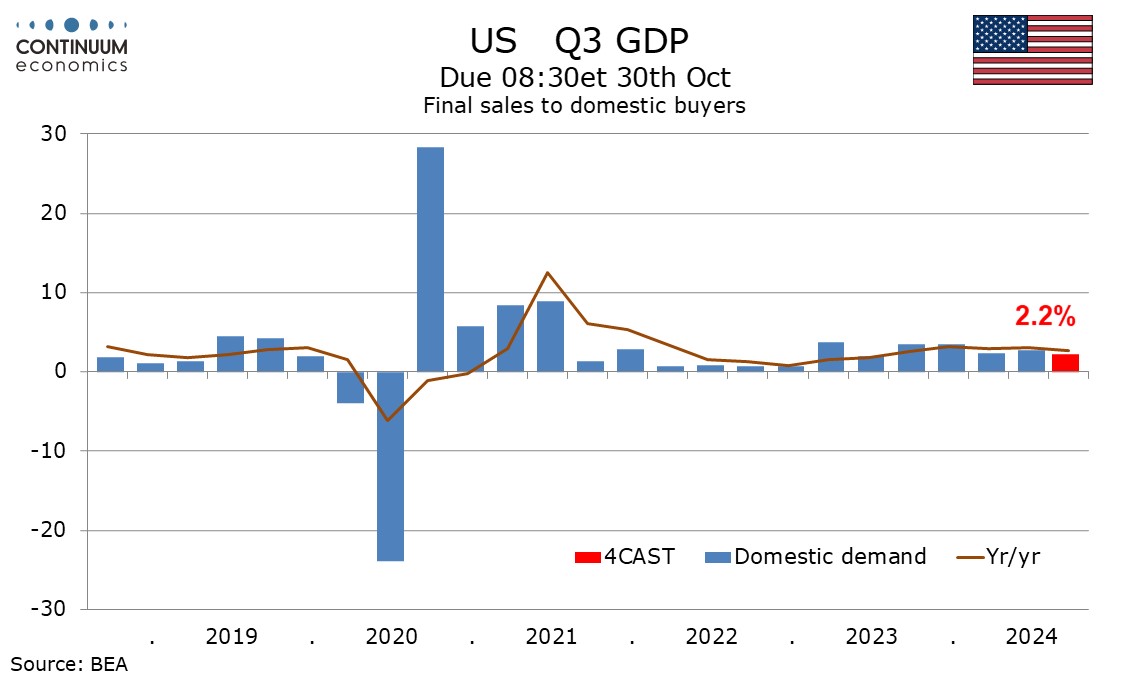

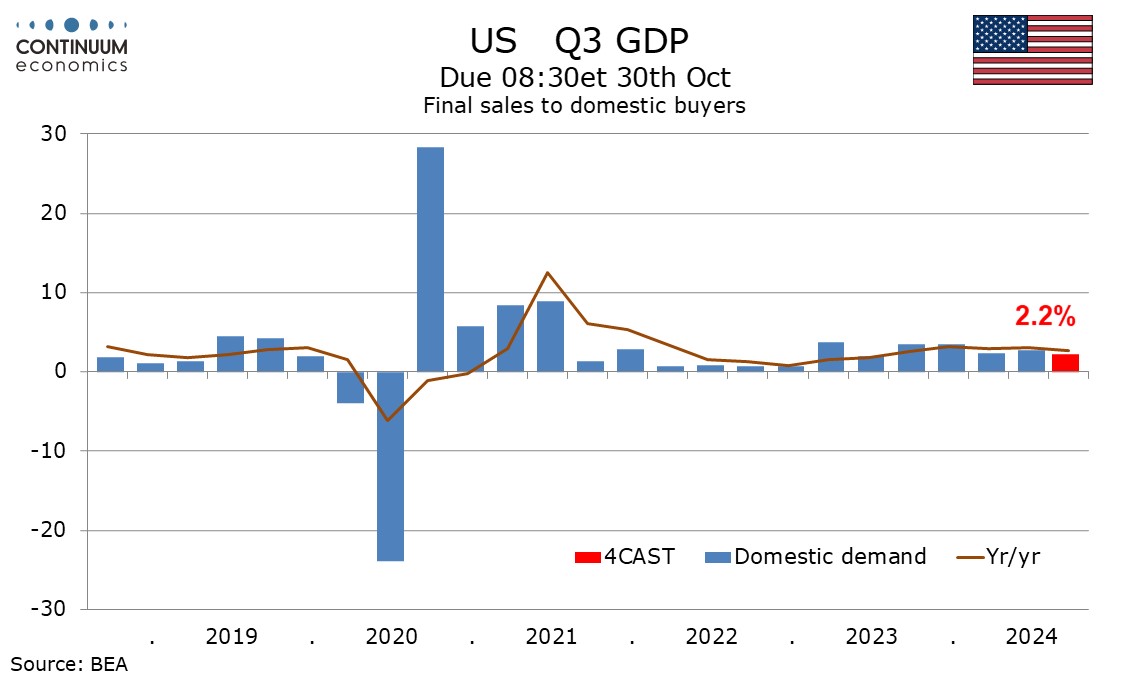

This will leave final sales to domestic buyers (GDP less inventories and net exports) up by 2.2% in Q3, slower than Q2’s 2.7% and Q1’s 2.4%, and well below the 3.5% gains in in Q3 and Q4 of 2023.We expect final sales (GDP less inventories) to rise by 2.1%, meaning a near neutral contribution from net exports after significant negatives in Q1 and Q2. A dip in June’s trade deficit is a constructive signal. We expect exports to rise by 4.7% in Q3 while imports rise by 3.3%, though in USD terms the gains will be similar.

This will leave final sales to domestic buyers (GDP less inventories and net exports) up by 2.2% in Q3, slower than Q2’s 2.7% and Q1’s 2.4%, and well below the 3.5% gains in in Q3 and Q4 of 2023.We expect final sales (GDP less inventories) to rise by 2.1%, meaning a near neutral contribution from net exports after significant negatives in Q1 and Q2. A dip in June’s trade deficit is a constructive signal. We expect exports to rise by 4.7% in Q3 while imports rise by 3.3%, though in USD terms the gains will be similar.

Slower import growth would be consistent with slower growth in inventories after a strong build up in Q2, much of which came from autos. We expect inventories to deduct 0.5% from Q3 GDP after adding 0.8% in Q4. Auto output explained 0.5% of Q2’s GDP increase, after being a negative in the three preceding quarters.

Slower import growth would be consistent with slower growth in inventories after a strong build up in Q2, much of which came from autos. We expect inventories to deduct 0.5% from Q3 GDP after adding 0.8% in Q4. Auto output explained 0.5% of Q2’s GDP increase, after being a negative in the three preceding quarters.