Eurozone Banks See Consumer Loan Demand Recover

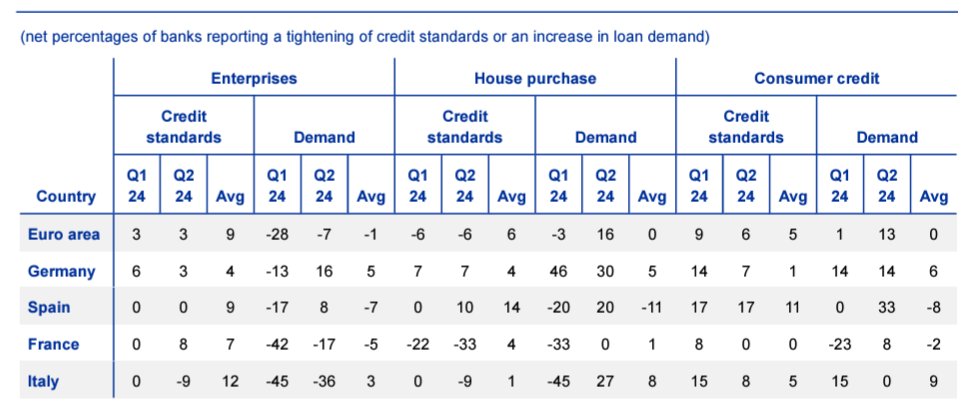

There were more positive straws in the wind in the latest (July 2024) bank lending survey (BLS), providing some reassurance for the ECB ahead of this week’s Council meeting. Most notable was a reported increase in demand for both housing loans and consumer credit for the first time since 2022 and to a well-above average outcome. This came alongside a further, albeit still moderate, easing in credit standards for home purchases. But consumer credit standards rose a little further and firms faced a further rise in credit standards, albeit much more moderate (Figure 1). Otherwise, although company loan demand fell far less than in the previous (April) BLS, it is still clearly weaker than average but with increased national divergences. Unlike in April, there was little new in highlighting how the ongoing central bank balance sheet reduction has affected tightening pressures, save for noting a moderate impact form the drop in excess liquidity on bank lending conditions.

Figure 1; Banks Still Seeing Company Credit Supply Slipping as Demand Drops Further

Source; ECB

Green Shoots Need Nurturing?

ECB Chief Economist Lane has frequently stressed how the BLS plays a key role in the Council’s analysis of the banking channel of the monetary policy transmission. This latest set of BLS data will provide some reassurance in regard to the consumer, but less so as far as companies are concerned. It is clear that improving housing market prospects, cited primarily by German banks, were the main driver of the increase in housing loan demand, this presumably a result of anticipated further rate cuts. In this regard, the Council will not feel that it has to ease any faster than it hitherto may have (covertly) considered, but should realise that without additional easing, the ‘green shoots’ in this BLS may not grow further.

And these green shoots are hardly widespread with company credit demand falling further even after the slump last time around with a continued deferring of capex plans and concerns about interest rates. In addition, rejection rates for company loans continued to increase (unlike on the consumer side). Moreover, while the drop in companies’ loan demand was moderated by inventory building for the first time in six quarters, it is unclear whether this stock-building is voluntary or not.

But on the more positive side, there was a further fall in credit standards for mortgage lending but this was (again) almost exclusively a French rather than EZ-wide development but came alongside still recovering demand (amid what are still falling EZ house prices). Notably, actual ECB lending data still suggest that this recovery in loan demand is still very feeble at just 0.3% y/y. The data certainly back the case for some ECB rate cutting, but this is going to have only a gradual and partial impact as the BLS makes clear that ongoing central bank balance sheet reduction has continued to exert tightening pressures and the ECB has no plans yet) to slow, let alone stop its unconventional tightening regardless of what and when its reduces official rates. Admittedly, the BLS suggest that ECB unconventional policy is biting but only moderately, but this is something we have long argued has been accentuating the conventional rise in interest rates and has been visible in both the slump in bank deposits and credit levels of late.