UK CPI Preview (Jul 17): Inflation To Stay at Target – An Update on the Policy Outlook?

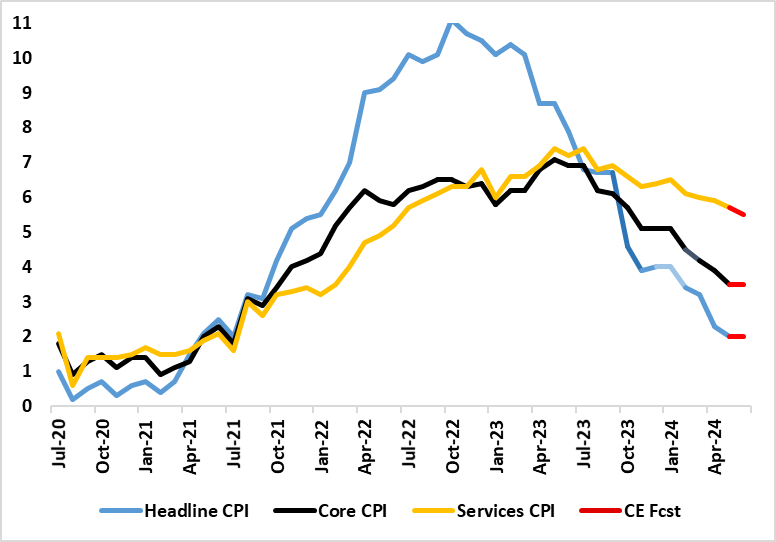

As has been made clear by policy-makers, labor market and particularly CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. In this regard the fact that headline CPI inflation dropped back to the 2% target in May is important but far from definitive. Indeed, largely meeting expectations, CPI headline inflation fell from 2.3% to 2.0% and thus back in line with the target for the first time in just over three years. But apparent service sector resilience is troubling the BoE (certainly the hawks). We see the headline staying at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services easing only to 5.5% (Figure 1) and thus some 0.4 ppt above BoE thinking.

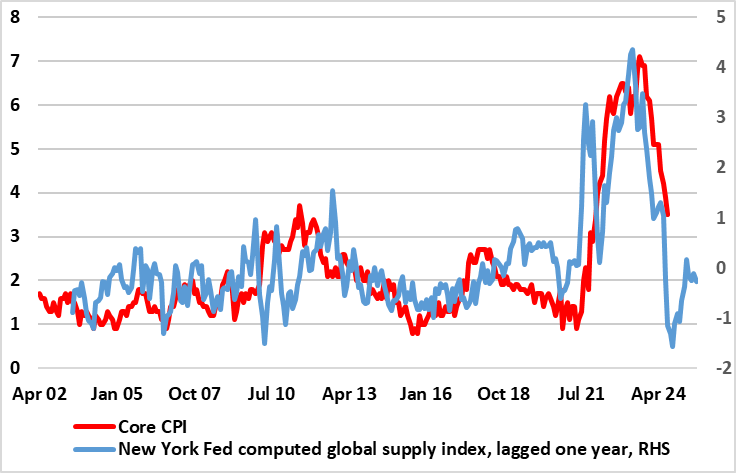

Thus, the data alone is not going to give a green light to a rate cut as soon as August, especially as GDP data may suggest another solid gain in Q2 is in store. But we still are pencilling in a cut next month, given the manner in which the thrust of inflation news has evolved of late (Figures 2,3&4) and with it therefore highly likely that the August Monetary Policy Report will continue to point to a substantial inflation undershoot ahead. Indeed, this seems consistent with remarks today from Chief Economist Pill, ie ‘in the absence of any big new shocks, the “when-rather-than-if” characterisation of prospective Bank Rate cuts still seems appropriate’.

Figure 1: Headline and Core Inflation Steady But Services Less Resilient?

Source: ONS, Continuum Economics

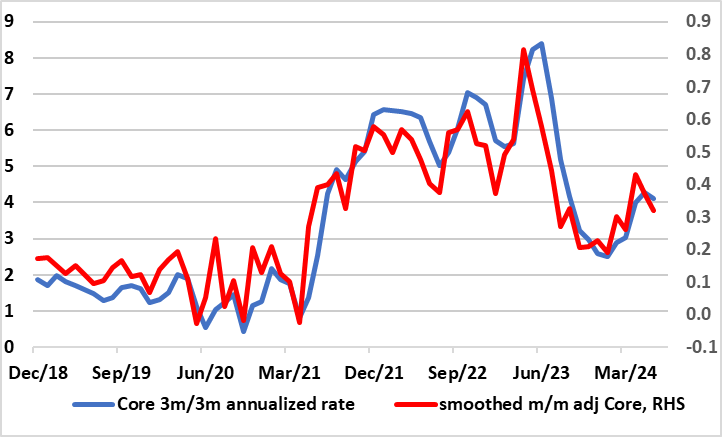

Indeed, some of this services resilience partly due to strong, if not record, rental inflation. This is contributing some 0.5 ppt at present with it notable that rental prices had been a clear factor suppressing services inflation prior to the start of the BoE hiking cycle raising the question as to what extent they are proactively linked to Bank Rate. Regardless, there will still be some reassuring aspects to the June CPI data, where petrol costs are likely to add to the headline rate (as may industrial goods) but be offset by lower food inflation. Overall, this may mean little change in the core rate, this stuck at or around 3.5%, but where this is still being held up by base effects. Indeed, this anticipated outcome implies a m/m adjusted reading still above a rate consistent with target (Figure 2) but with some fresh slowing evident, either on smoothed monthly basis or even the 3-month annualized rate that some at the BoE favour. This may be the case for services too where we see the smoothed m/m rate down to 0.4% m/m.

As for recent trends, what was notable in the May numbers was the easing in the annual inflation rate reflected downward contributions from eight (of the 12) divisions, partially offset by upward contributions from two. The largest downward effects came from food and non-alcoholic beverages, recreation and culture, and furniture and household goods. Transport provided the largest, partially offsetting, upward contribution, this mainly due to a spike in petrol prices which has now largely reversed). As noted above, services inflation fell but less than expected but this partly reflects higher rental costs which can be attributable to high(er) mortgage rates which suggest that monetary hiking may in parts be contributing to inflation pressures.

Figure 2: Adjusted Core CPI Pressures Falling Afresh?

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

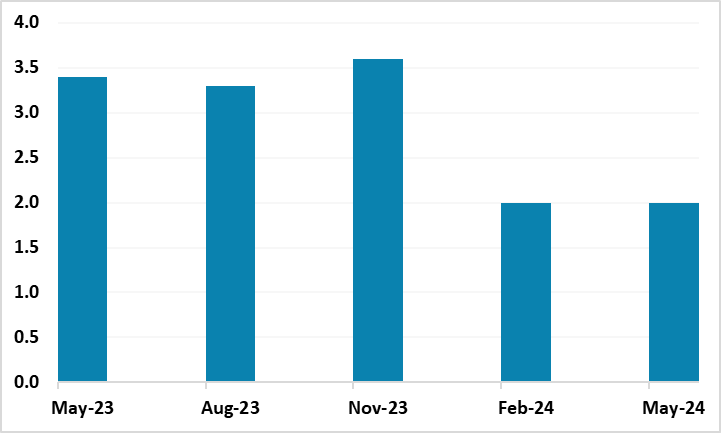

Notably, and as suggested above, these June data are only part of the inflation story that will unfold ahead of the next MPC decision and the updated forecast that the BoE will then present. But they are part of a trend that is seeing inflation somewhat lower than the MPC had been predicting. Admittedly, the current 2% inflation rate is something the BoE forecast had been predicting for some months but actually only since February when the projections moved down materially from well over 3%, ie where they have persisted at for some time (Figure 3).

Policy Perspectives

Indeed, context is needed. UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. This backdrop has made the BoE reassess the inflation outlook, with two key MPC reassessments. Firstly, has come an acknowledgement that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE now seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought, this backed up by its own survey data suggesting companies are becoming less able to pass on higher costs to consumers.

Figure 3: Much Softer BoE Inflation Forecasts?

Source: BoE last five Monetary Policy Reports projection for Q2 2024

Overall, and given what we think was far more mixed Q1 GDP than the media considered, we still think the current thrust of data still leaves open the case and momentum for a BoE rate as soon as next month and further moves through H2 and then through 2025. This partly reflects that (more supply-side) UK inflation dynamics are different enough to those in the U.S. to allow a possible cut before anything made by the Fed and thus instead chime with ever-clearer ECB policy leanings. Moreover, the May MPR updated projections at least validated the rate path discounted by markets, with below target inflation and it is unlikely that the updated forecast due in August will change this outlook

Figure 4: Global Supply Pressures Suggest Clear Fall in Cost Backdrop?

Source: NY Fed, ONS, CE

How Restrictive?

Regardless, the BoE will probably agree with us that much of the recent (and possibly looming) disinflation is supply driven (Figure 4 shows the extent to which easing global supply pressures as computed by the New York Fed has probably driven UK underlying inflation – both up and now down). This means that even with some reduction in the excess supply picture evident in the May Monetary Policy Report (of 1% of GDP into 2027), domestic price pressures should add to this easing in supply strains – hence the clearly below target inflation outlook the BoE is likely to adhere to in August both on stable and market rate forecast policy. Against this picture, comments from Chief Economist Pill again underscore the extent to which the BoE must consider how restrictive policy must be with the clear proviso that even with the scale of cuts markets currently discount policy would still be far from neutral