Preview: Due July 11 - U.S. June CPI - Another subdued month, similar to May

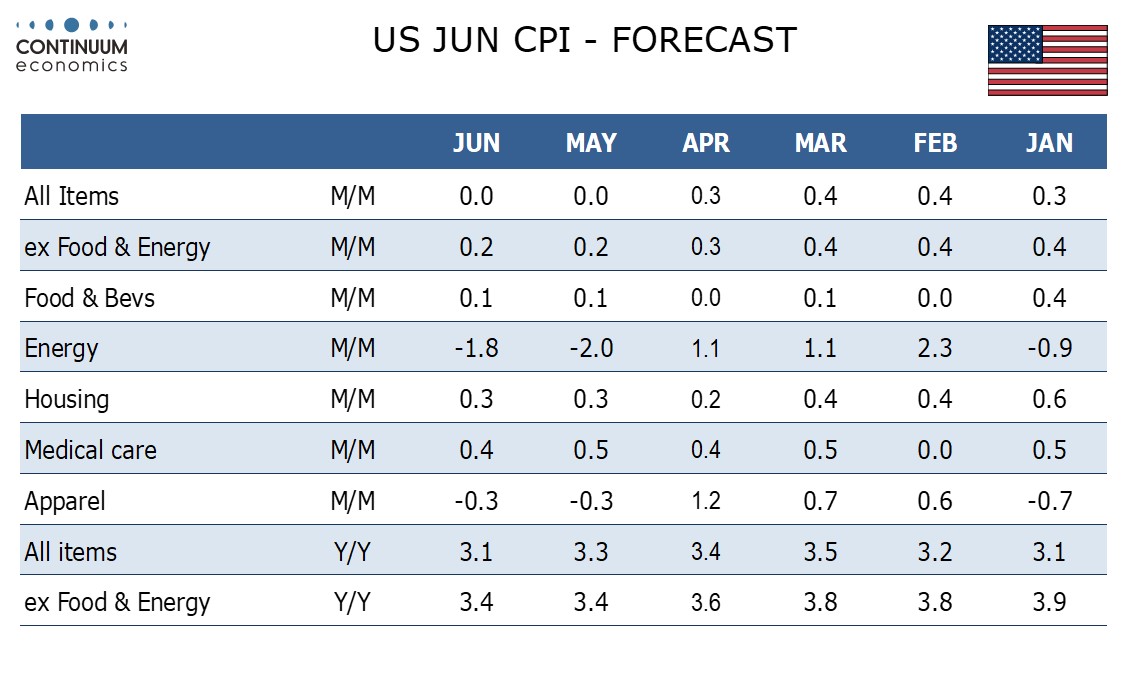

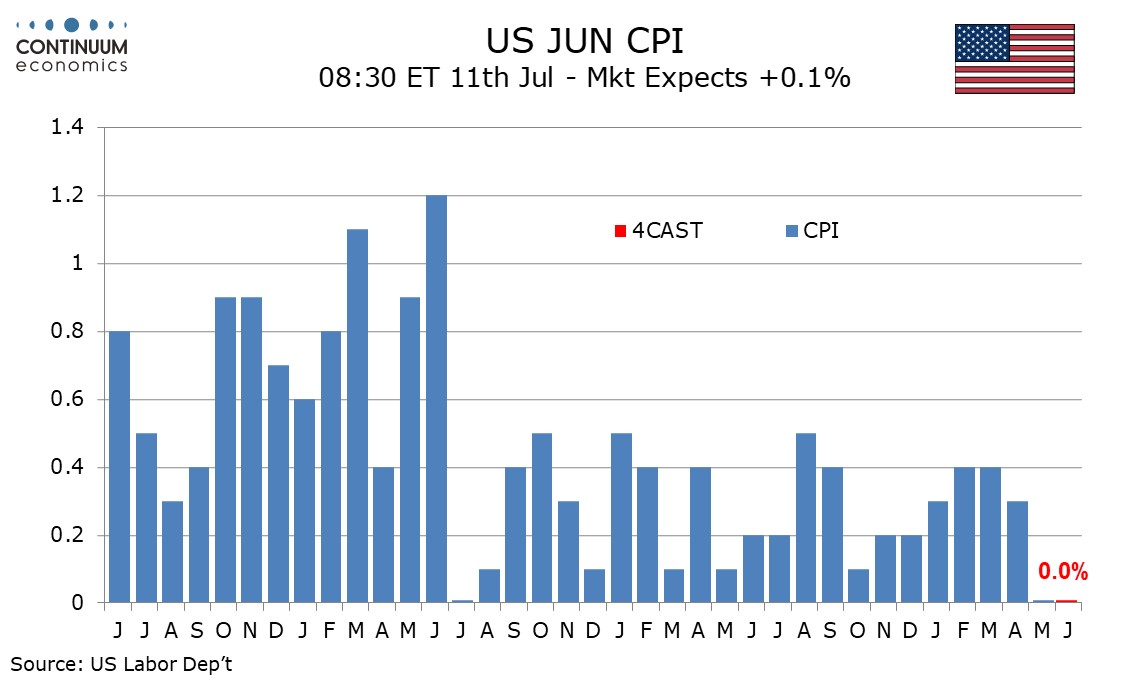

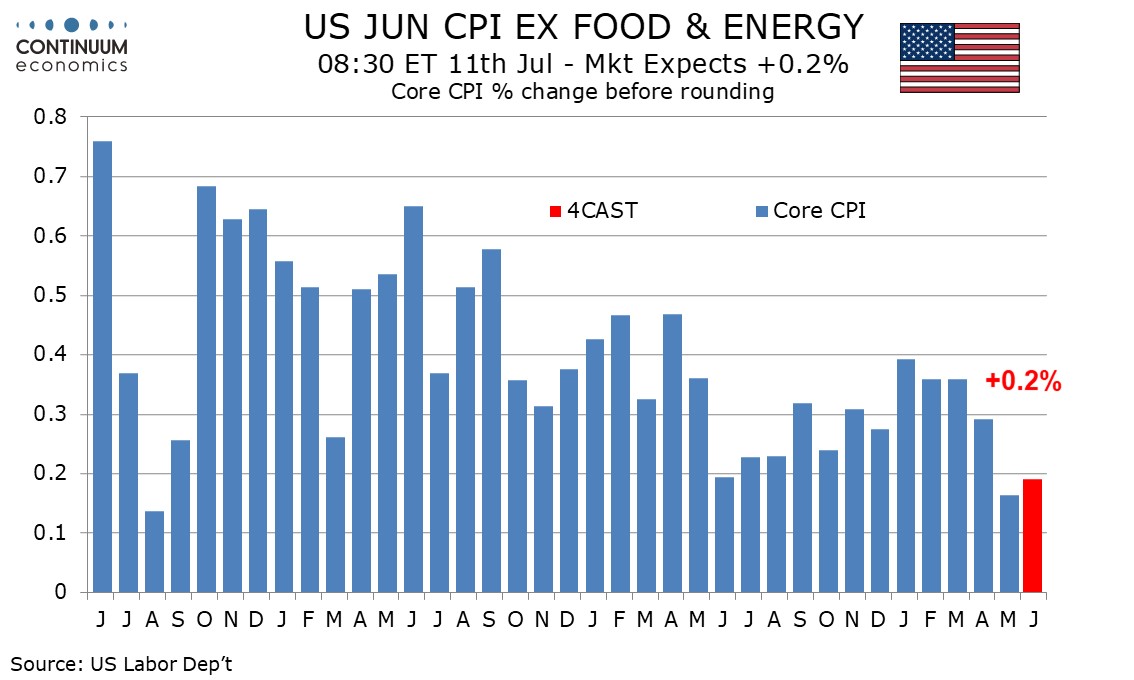

We expect June’s CPI to look similar to May’s, with an unchanged outcome overall and a 0.2% increase ex food and energy. Before rounding we expect gains of 0.04% overall and 0.19% ex food and energy, up from 0.01% and 0.15% respectively in May, but both May and June would still be softer than any month in 2023 in each series.

Gasoline prices extended a May decline in June, with June’s decline looking slightly sharper than May’s, though we expect the other components of energy to be a little stronger in June. We expect food to remain subdued with a 0.1% rise. Weakness in energy may have some feed through to air fares, a volatile component of core CPI that was weak in May.

While there are a few components that slipped in May that are unlikely to be quite as soft, there are enough components that are likely to be soft to leave us forecasting another subdued month. Used autos, which saw a rare increase in May, are likely to resume a downtrend, while auto services are likely to continue unwinding exceptional strength seen in April. Apparel similarly has scope to extend May’s correction lower after three straight strong months. June 2023 actually saw the softest core rate of the year, at 0.195% before rounding.

A similar year ago core rate will see yr/yr core CPI remain at May’s 3.4% pace, which was the slowest since April 2021. Weaker gasoline prices will however allow overall CPI to slip to 3.1% yr/yr from 3.3% in May, though the overall yr/yr pace was as low as this as recently as January.