EZ HICP Preview (Jul 2): Broad Disinflation Resumes? – A Round-Up of Recent Trends

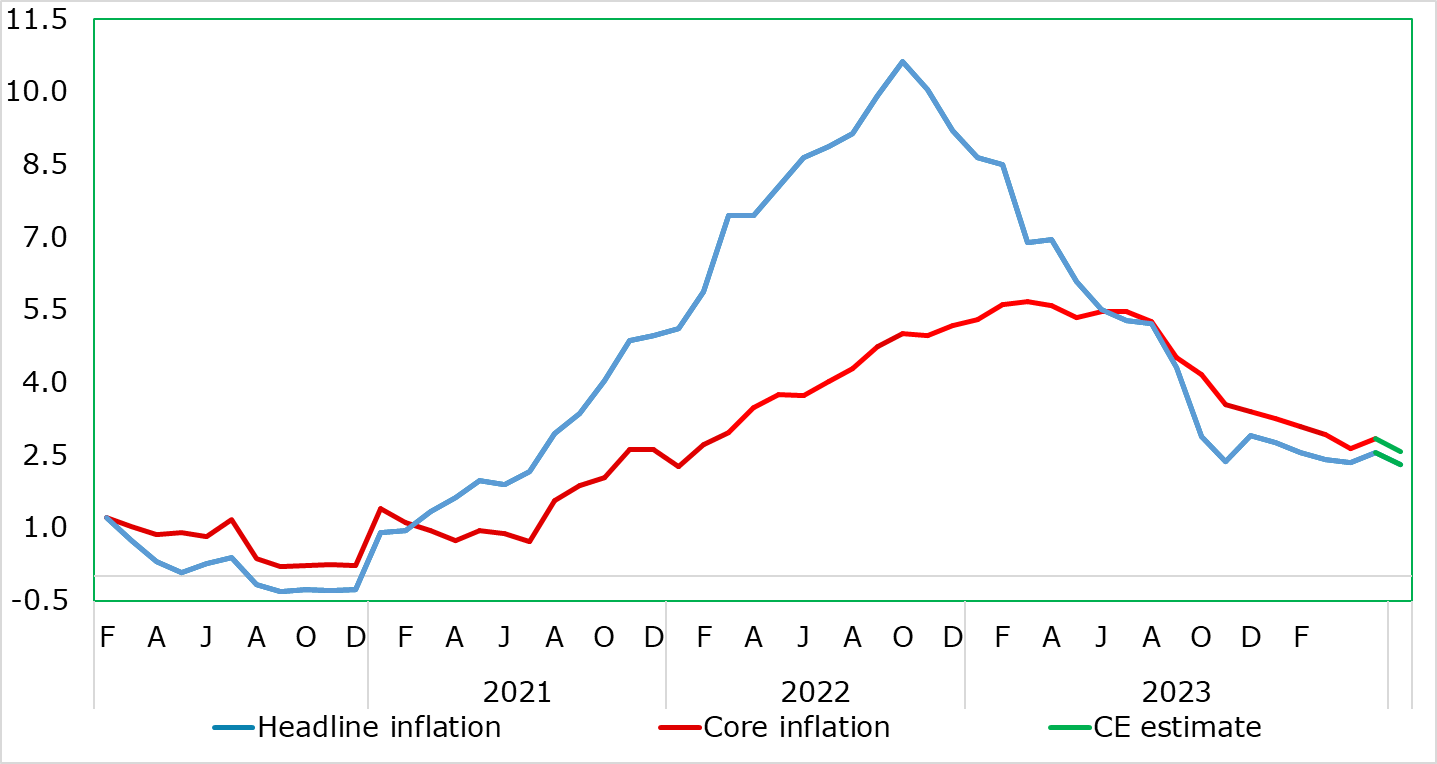

The clear disinflation thrust of recent data (Figure 1) has obviously affected most ECB thinking. Notably, the downward trend is still evident even after higher and higher-than-expected May numbers, where the headline moved up from 2.4% to a three-month high of 2.6%. More notable perhaps was that the core also moved back up by 0.2 ppt from a 27-mth low of 2.7%, largely reflecting a surprise jump in back in services inflation, the latter accentuating worries about aspects of price resilience despite evidence to the contrary (Figures 2 & 4). Moreover, the June data may be more reassuring, with the headline rate possibly hitting a new cycle-low of 2.3% (rounding effects could also mean the rate merely drops to 2.4% and thus reverses the May rise). Within this, services inflation may drop afresh but only 0.2-0.3 ppt but the core should fall 0.2 ppt and even possibly also instead hit a cycle low of 2.6%. Perhaps more notable is that these data will imply a fresh slowing in shorter-term price dynamics as monthly seasonally adjusted numbers may be softer on both a core and services basis (Figure 3).

Figure 1: Headline and Core Inflation to Fall Afresh in June?

Source: Eurostat, CE, % chg y/y

Wages Pressures in Context

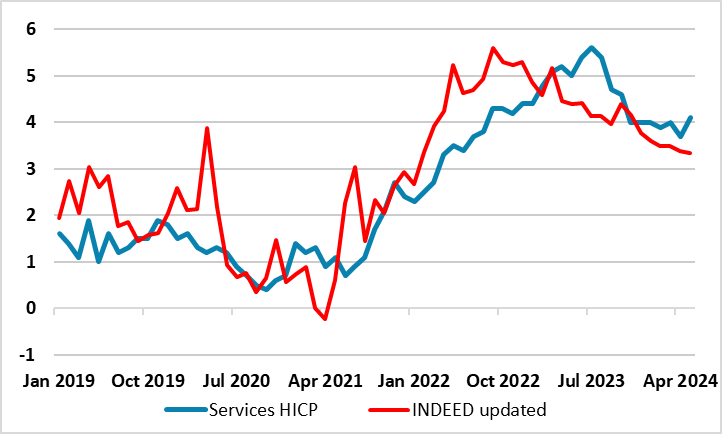

Amid those worries about price resilience, more signs of softer wage pressures will act as some foil – Indeed-compiled wage tracker data for May fell to 3.35% (Figure 2) the lowest in over two years and these are numbers recently cited by Chief Economist Lane as suggesting they ‘signal that wage dynamics will remain elevated in 2024 but will decelerate in 2025’. Even so, inflation uncertainty continues and remains concentrated enough around wages that explains the ECB Council being unwilling to offer firm(er) policy guidance for H2, let alone into next year. It is notable that this explicit data dependency has attracted surprising and open criticism, not least from ex World Bank Chief Robert Zoellick who suggested that being data dependent means effectively that central bankers don’t know what to do!

Regardless, returning to EZ recent inflation dynamics, the May HICP data encompassed an unexpected jump in services inflation, rising back to 4.1% from to 3.7%, a 21-mth low, this only partly reflecting base effects and more indicative of a genuine underlying rise. Energy inflation turned positive (partly due to higher petrol costs (which now seem to have reversed) while unprocessed food price inflation eased further.

Figure 2: Wage Pressures Easing and Will Curb Services Inflation?

Source: ECB, CE, Bloomberg, % chg y/y

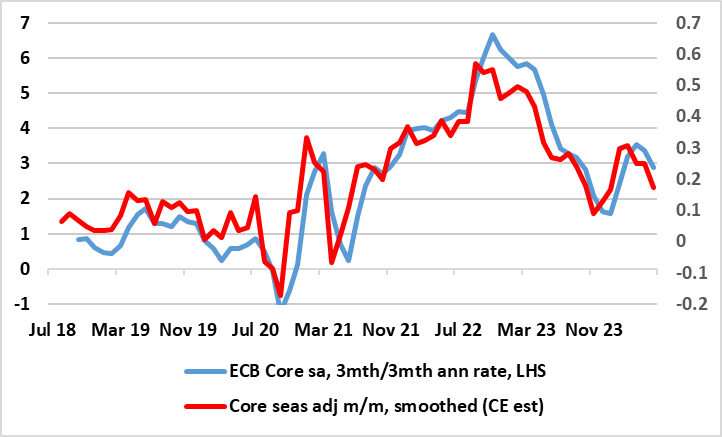

As for underlying trends, it is notable that the ECB has been somewhat troubled by the failure of services inflation to have fallen in the last few months, and its apparent stability in m/m adjusted terms may harden some of the hawks worries about aspects of price resilience as may monthly adjusted core numbers which have also shown some such resilience, if not revival. But helped by a further fall in petrol prices and some easing in services and food inflation we see the headline and core rates falling around 0.2 ppt in June, both possibly reaching new cycle lows. More notably to us, this would encompass fresh signs of softer short-term inflation dynamics, whether this be the smoothed adjusted m/m measure we compile or the 3-mth annualized rate the ECB follows (Figure 3).

Figure 3: Softer Short-Term Core Inflation Dynamics?

Source: Eurostat, CE

Gauging Persistent Price Dynamics

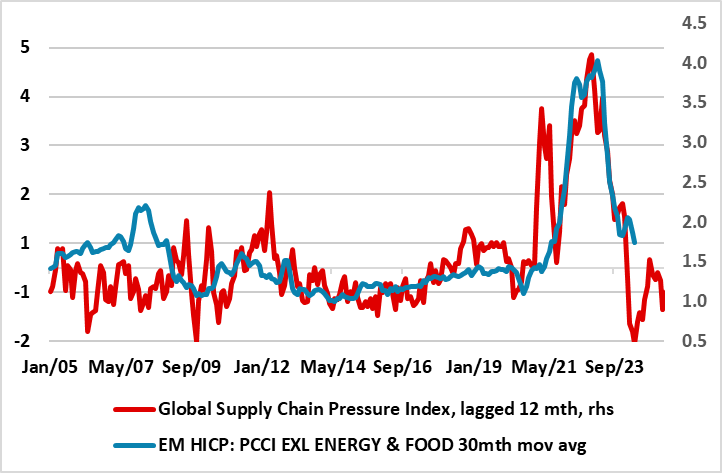

But notably ECB Chief Economist Lane has very much underscored that the Persistent and Common Component of Inflation (PCCI) is the best predictor of inflation one and two years ahead and this is all the more notable as this measures has eased to below 2% of late and stayed there. Given its correlation with (easing) global supply pressures, the former’s fall may yet continue (Figure 4).

Figure 4: Persistent Price Pressures Have Ebbed Further Amid Softer Supply Pressures

Source: ECB, New York Fed - PCCI is Persistent and Common Component of Inflation

Indeed, actually suggesting not only below target price pressures even on an overall basis but also at the core level with the latest PCCI core outcome at 1.7% this being only a few notches above its pre-pandemic average and having fallen of late as fast it rose previously. Furthermore, the PCCI measure very much offers lead properties, having repeatedly foreshadowed HICP inflation turning points in the past. An added reassurance comes from the fact that its recent slowing is an indication that price pressures are not broadening out, the very opposite. This is because the PCCI captures widespread developments across the HICP basket that are persistent (hence the name), this being all more crucial as the ECB hawks apparent focus is on preventing the recent inflation surge becoming embedded.

Below-Target Inflation Blip Still Looming in H2

On the basis of the slightly softer headline reading for June, it now looks as if HICP inflation will average 2.4% in Q2, a notch below ECB projections made this month. These envisage that the headline rate will slip below target in early-2005 but drop to 1.8% by end-2026, the lowest end-target HICP projection made by the ECB since December 2021. But given the wage, underlying HICP and PCCI dynamics, we still think an undershoot may even occur later this summer, albeit amid late-year volatility but where a more durable drop below 2% is on the cards for 2025 – and beyond.