UK CPI Inflation Review: Inflation Back at Target

As labor market and particularly CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle, this further drop in inflation is important but uncertain. Indeed, largely meeting expectations, CPI headline inflation fell from 2.3% to 2.0% (actually just under before rounding) and thus back in line with the target for the first time in just over three years. The data is around a notch above the BoE projections, but with the 0.2 ppt drop in services inflation to 5.7% leaving it well above the 5.3% outcome projected by the MPC, but this resilience partly due to strong rental inflation which can be seen to be proactively linked to Bank Rate. The question is whether the data are soft enough to warrant the start of an easing cycle as soon as tomorrow’s BoE verdict (the MPC has had access to the data for the last two days) with the complication being the extent the Bank focuses on resilient services as opposed to on-target inflation and lower food costs in assessing what it calls persistent price pressures. A cut tomorrow is unlikely but not impossible with the imponderable being the extent to which any stable policy decision is instead explicitly attributed to restrictions related to the current election campaign.

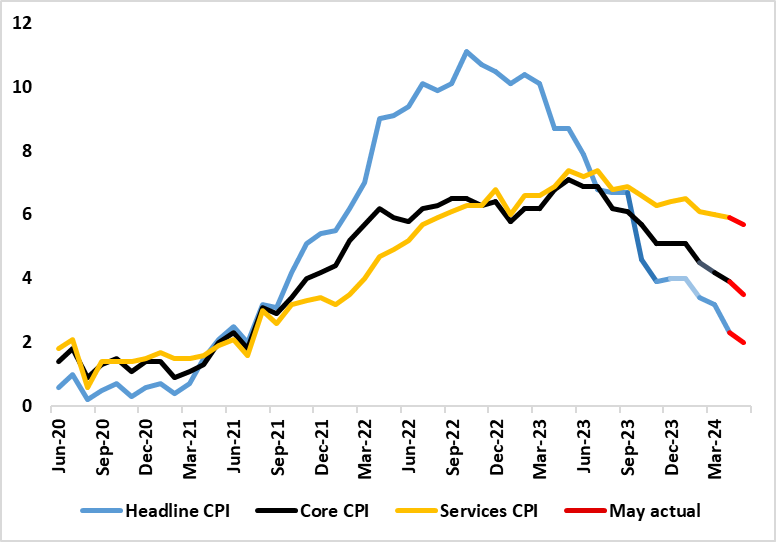

Figure 1: Headline and Core Inflation Drop to Continue But Services Still Resilient?

Source: ONS, Continuum Economics

Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.5% in the 12 months to May 2024, down from 3.9% in April; the CPI goods annual rate fell from negative 0.8% to negative 1.3%, while the CPI services annual rate eased from 5.9% to 5.7%.

What the bar of acceptability is for the MPC in terms of the CPI picture is unclear; do they just have to hit the forecasts laid out in the recent Monetary Policy Report, or undershoot and to what extent does the composition of any drop matter. As for the May numbers, the easing in the annual inflation rates reflected downward contributions from eight (of the 12) divisions, partially offset by upward contributions from two. The largest downward effects came from food and non-alcoholic beverages, recreation and culture, and furniture and household goods. Transport provided the largest, partially offsetting, upward contribution, this mainly due to a spike in petrol prices which has now largely reversed). It is worth noting that services inflation fell but less than expected but this partly reflects higher rental costs which can be attributable to high(er) mortgage rates which suggest that monetary hiking may in parts be contributing to inflation pressures. Indeed services inflation ex rents fell to 5.3%, a result in line with BoE projections!