BoE Preview (Jun 20): Data Dependent Easing Bias Makes BoE Decision Unclear

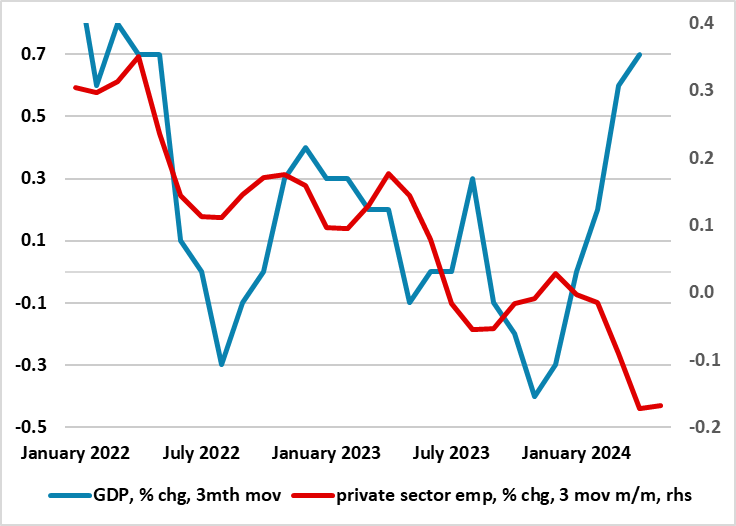

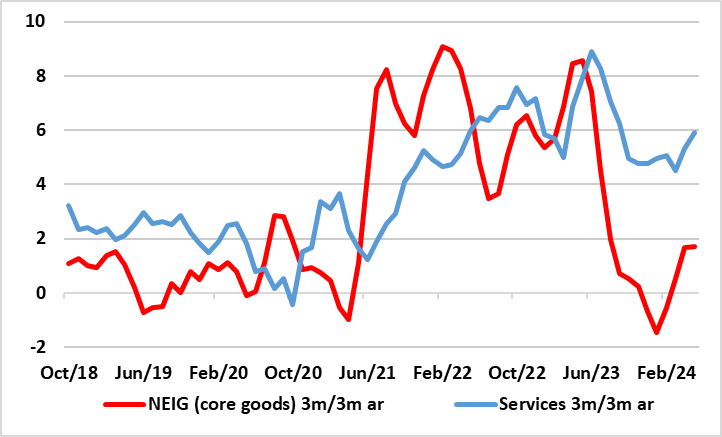

After Bank Rate was kept at 5.25% for the sixth successive MPC meeting last month, Governor Bailey remarked that then market rate pricing may be too cautious. He also accepted that a rate cut at the next MPC verdict on June 20 was a distinct possibility, but underscored the importance of the data due in the interim. In this regard, it is quite possible that the key May CPI data due on June 19 could largely reverse the upside surprise see in April’s numbers released last month. In addition, labor market numbers have offered both signs of softer wage pressures as well as implying a softer GDP picture than official national account numbers have (Figure 1), this adding to divergent trends in other perhaps even more key data that the BoE also has to assess (Figure 2). Thus we see a 25% chance of the BoE easing next week as opposed to the near zero possibility flagged by markets. But with the BoE verdict now coming during a surprise election campaign this perhaps being the main factor arguing for another stable policy decision.

Figure 1: Softer Jobs Market Suggest Weaker Picture Than GDP Trends?

Source: ONS

Even if policy is again unchanged, there may be even more dissent in favor of an immediate rate cut after of Dep Gov Ramsden confirmed his more dovish leanings last month. But the picture of BoE thinking is unclear after the MPC went into effective purdah once the general election was called and we do not know to what extent this may also affect any willingness to make actual near-term policy changes. What remains the case is that the updated BoE projections offered last month at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves then seen through this year. This is something that chimed with the cumulative reduction of 100 bp by year end we have been forecasting and still largely adhere to.

BoE Thinking Changing

We think that even such a rate cut profile would still leave policy restrictive and thus bearing down on inflation further. It is notable that despite modest upgrades to the real GDP outlook, the BoE has actually revised up its assessment of excess supply over the coming 2-3 years. Moreover, two key MPC recent reassessments have affected its inflation outlook. Firstly, came an acknowledgement last month that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought. All of which helps explain the overall greater overall confidence in a softer inflation outlook and with risks much more balanced. Thus, it is not surprising that the BoE inflation profile has been revised down.

Figure 2: Diverging CPI Trends?

Source: ONS, Continuum Economics

Key Inflation Reassessments

Regardless, it is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. But perhaps the CPI data is the most crucial especially with April’s signs of resilient services (and particularly in regard to eating out) very much questioning whether a rate cut from the MPC will come as soon as the verdict due on June 20; markets just about think not. What the bar of acceptability is for the MPC in terms of the CPI picture is unclear; do they just have to hit the forecasts laid out in the May Monetary Policy Report, or undershoot. As for the looming May numbers, helped by favourable base effects and a belated drop back in services, we see the headline down 0.2-0.3 ppt to 2.0-2.1% (the lowest since July 2021). Such an outcome would still be a notch above existing BoE forecasts, however.

Data Divergences

But the picture is complicated as alongside the apparent resilience in services inflation, core goods inflation has moved the other way (Figure 2) a divergence that is not the only one evident in recent key data developments. Indeed, seemingly improving GDP data are very much running in contrast to what labor market data show (Figure 1) even those more authoritative and exhaustive numbers offered by HMRC as opposed to the official ONS numbers. All of which maintains a certain degree of circumspection about the actual backdrop. It could be argued that such data divergences may persuade the MPC to amass more data, this providing a more credible argument for deferring a policy move until at least August