ECB Review: Clearly No Policy Pre-Commitment But Policy Entering New Phase

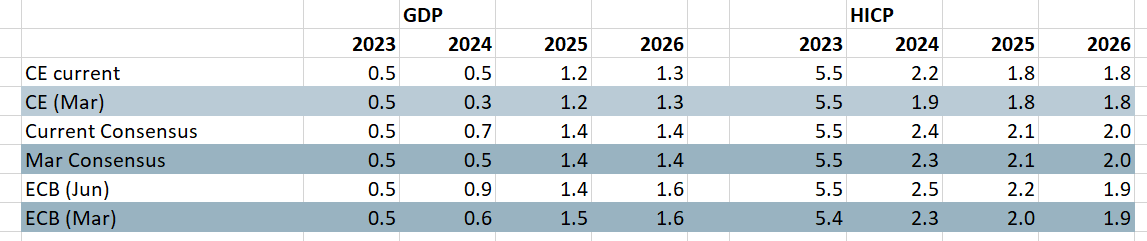

As has been the case with many recent ECB verdicts, markets are keener to hear what is being said by the Council rather than what has been done. In regard to the latter, and given the almost unanimous hints from Council members, all policy rates were cut by the expected 25 bp, with the key deposit rate falling from at an unprecedented 4.0% for the first reduction since 2019. But markets were more focused on hints on the speed and timing of further moves. Given splits within the ECB Council, it was no surprise that no formal guidance was forthcoming, save to underline that policy will be data dependent and clearly not pre-committing to a particular rate path not least alongside upgraded forecasts for this year and next and to ‘keep policy rates sufficiently restrictive for as long as necessary’. But those updated and possibly optimistic (GDP) forecasts (Figure 1) do corroborate market thinking of rates falling well below 3%, even given the slightly later, but still clear, undershoot of the inflation target being flagged. ECB Lagarde also appeared to back ECB Lane’s clearer guidance in a speech earlier this week. We still see two more 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance.

Figure 1: Little Change in the Real Economy Outlook?

Easing Restrictiveness

Repeating the theme offered at its last meeting in April, the ECB Council made it clear that, after what have been nine months since the last hikes, it is now appropriate to ‘moderate’ the current level of monetary policy restriction. Admittedly, while this view was unanimous save for one, others on the Council may have had reservations, but not steadfast enough to scupper market expectations that had been fed a clear message from the ECB itself.

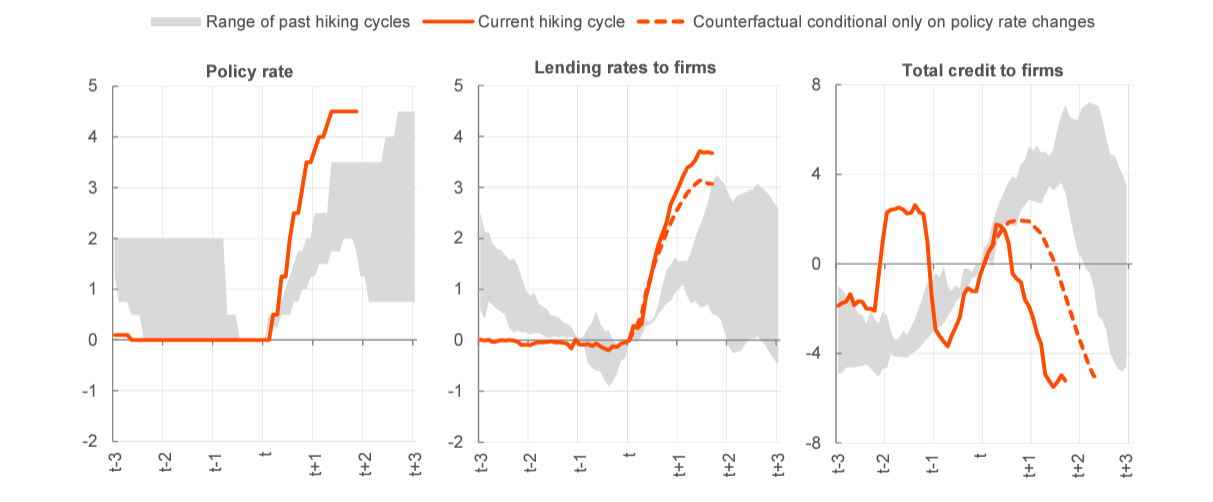

Even so, there is probably still a view that policy has been hiked relatively aggressively in both speed and extent in what Lagarde referred as the first policy phase. This is something we have underlined by suggesting that recent monetary tightening (which also encompasses unconventional moves) has not only been extensive, but possibly excessive. Supporting this notion is a chart offered in a recent presentation by Chief Economist Lane which shows not only the unprecedented speed of recent (conventional) hikes but the even-more unprecedented repercussions in terms of credit growth weakness (Figure 2).

Figure 2: Unprecedented ECB Hiking in Terms of Speed and Results?

Source: ECB, monetary policy transmission across previous hiking cycles (horizontal axis: years; vertical axis: cumulative changes in ppt)

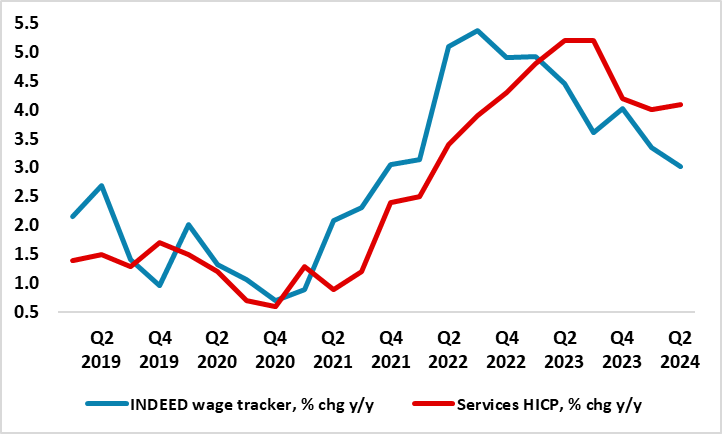

Meeting-by-Meeting

Regardless and far from unsurprising, the ECB is reluctant to plan out any particular explicit path, insistent it is, and will remain, ‘data dependent’ probably most notably on labor costs data and will consider policy on a meeting by meeting basis. Despite the degree of remaining policy restrictiveness, there is a clear view among Council hawks of price persistence, most evident in services sector inflation which ticked higher in the May HICP data for last month. This is undeniable but also glosses over the fact that core goods prices have been showing the opposite trend, this divergence enough to mean that overall HICP inflation has been averaging just over 0.1% m/m in adjusted terms in the last few months, something that implies the headline y/y rate falling below target around late summer rather than well into 2025 as the ECB now asserts. In addition, the omens point to services inflation succumbing in due course. The key wage compensation data the ECB has been awaiting in revised Q1 national accounts numbers due officially on June 7 have already been effectively superseded by the likes of monthly wage tracking numbers which suggest such cost pressures have fallen into early Q2. Although the ECB is still pointing to elevated wage pressures, this drop in Indeed-computed numbers has exceeded ECB expectations and is something that makes it more likely that still-stubborn and wage sensitive service sector HICP inflation will fall further (Figure 3).

Figure 3: Easier Wage Trends Suggest Resilient Service Inflation Will Buckle?

Source: Eurostat, Indeed

But given existing projections which shows inflation below target by H2 next year and remaining so into 2026 (Figure 1), the ECB is effectively validating the current market rate outlook those projections embrace which imply 3-mth rates down to 2.5% by 2026. Indeed, President Lagarde even used the Q&A to suggest a greater confidence in its outlook. We think, if anything, there may be downside risks to that inflation outlook from the likes of the transmission mechanism of past tightening feeding through.

Inflation Undershoot Still Envisaged?

We also still feel that neither Fed policy, nor the USD, are likely to delay any ECB move(s). Perspective is needed. Despite the stronger US dollar, the EZ is not getting any competitive gain as the euro effective exchange rate is almost at record highs, partly a result of the weak yen, the net impact adding to tighter EZ financial conditions. Indeed, it has been noted that the tightening in financial conditions ensuing from diluted Fed easing speculation may mean that the ECB has to cut short rates earlier or faster than otherwise.

In this regard, EZ market rates have risen in recent months now being some 20 bp higher than those used to compile the March ECB projections. This may explain why the updated ECB projections did not see any marked upgrade to the GDP picture save for an upward revision to the path for this year after the better than expected Q1 figures – but the 2025 outlook was downgraded a notch (Figure 1). In fact, these growth forecasts look optimistic to us, this due a range of factor not least as fiscal policy is likely to be somewhat more restrictive – the ECB pared back its government spending assumptions.

Transmission Mechanism Risks

As is clear, the ECB is very reluctant to discuss openly any possible rate cut path. But regardless, perhaps the main risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more powerful than we have estimated reflecting a grudging and belated acknowledgement that the ECB balance sheet reduction is adding to tighter financial conditions. It is noteworthy that the ECB cites the transmission mechanism as a downside risk to its outlook and this risks continues, if not grows not least given the negative impact from the ECB balance sheet reduction on credit dynamics was very much underscored in the last bank lending survey. This is all the more important as the ECB has no plans (yet) to slow, let alone stop, its unconventional tightening regardless of what and when its reduces official rates. It could be argued that if the ECB purses further balance sheet reduction, then larger/faster conventional easing may be needed!

Policy Outlook

As a result, the inflation outlook may see an earlier and/or more sizeable undershoot of the inflation target than the H2 schedule envisaged by the Council. Moreover, while a good portion of recent disinflation is supply not policy driven but, with policy hikes still biting, the impact of weak demand will only accentuate and extend this. This is implicitly accepted by the ECB as coming quarters would see the impact of past policy tightening continuing to be transmitted.

Partly as the ECB remains focused on the labor costs updates, numbers produced quarterly, but also wants to amass a broad but fresh thrust of added insights, then subsequent rate cuts may only arrive in September and December. Hence, our long-standing view that the ECB may cut only a further 50 bp this year but with President Lagarde implicitly hinting more rate cuts are being considered as the ECB has now entered third policy phase, ie after hiking and then pausing. However, by year-end more durable evidence of labour costs easing should convince the ECB to continue easing and we see 100 bp further easing through 2025, with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into a clear expansionary stance. This would chime with ECB Chief Economist Lane’s thinking which suggests that on the basis of inflation moving durably to target as seen in 2025, this would allow policy to veer away from restrictiveness and thus toward an eventual neutral setting of circa-2%!