EZ HICP Review: Core Disinflation Unwinds as Services Resilience Persists?

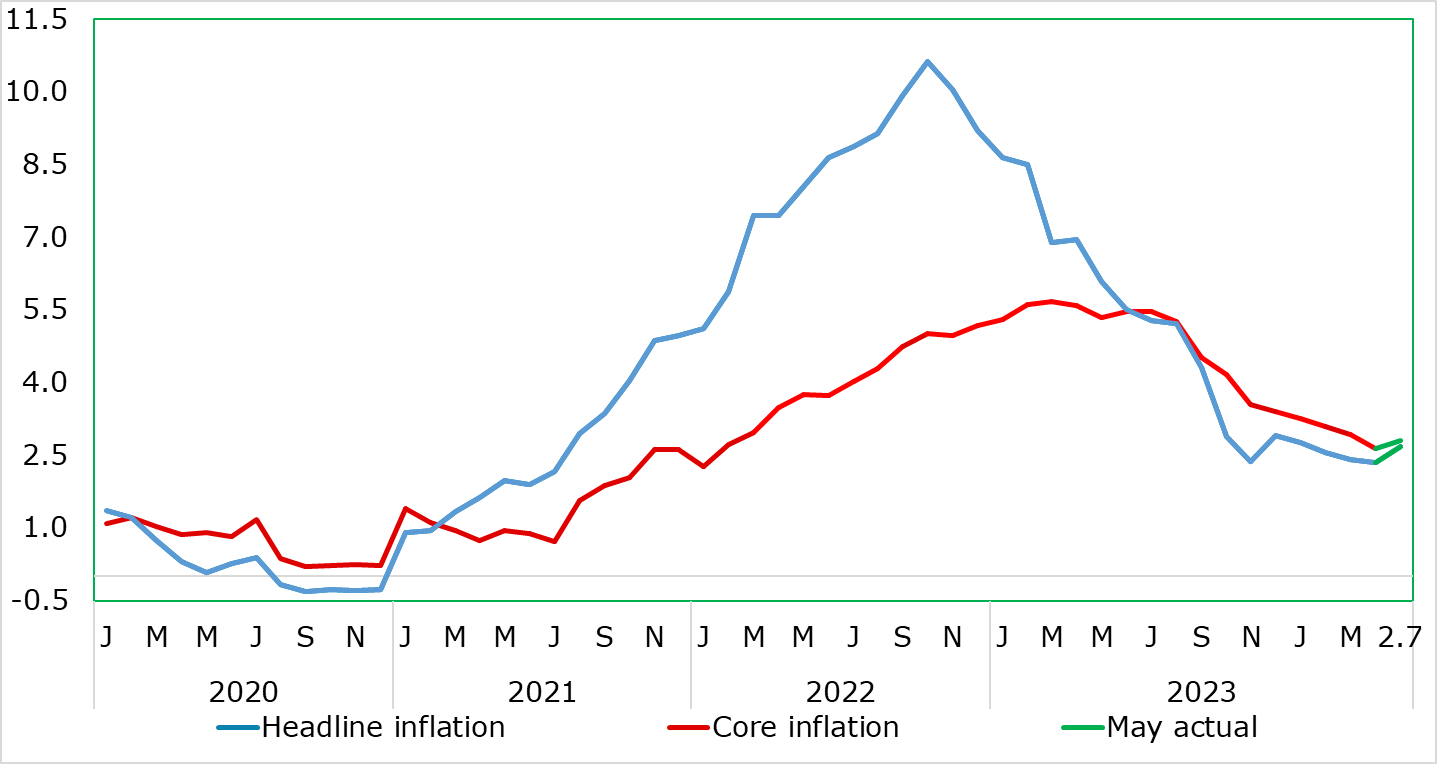

Very much having affected ECB thinking, there has been repeated positive EZ news in the form of falling EZ HICP inflation and somewhat broadly so. This abated last month and even more so in these May numbers, with the headline moving up from the unchanged 2.4% reading to a three-month high of 2.6%, an outcome that exceeded consensus thinking. More notable perhaps was that the core moved back up by 0.2 ppt from a 27-mth low of 2.7%, largely reflecting a surprise jump in back in services inflation). Clearly this latter figure will be troubling some Council members’ worries about aspects of price resilience not least as monthly seasonally adjusted numbers have also shown some such resilience, if not revival, notably on both a core and services basis. In addition, the data do suggest ECB Q2 HICP projections may be overshot. But given what the ECB has hinted in terms of a softer wage picture having emerged, we do not think these numbers will derail the widely flagged ECB easing next Thursday but will certainly make the Council even more unwilling to offer firm(er) policy guidance for H2, let alone into next year.

Figure 1: Higher Headline and Core Inflation?

Source: Eurostat, CE

Indeed, and very disappointedly, the May HICP data encompassed an unexpected jump in services inflation, rising back to 4.1% from to 3.7%, a 21-mth low, this only partly reflecting base effects and more indicative of a genuine underlying rise. Energy inflation turned positive (partly due to higher petrol costs which now seem to have reversed) while unprocessed food price inflation s further. In perspective, given the

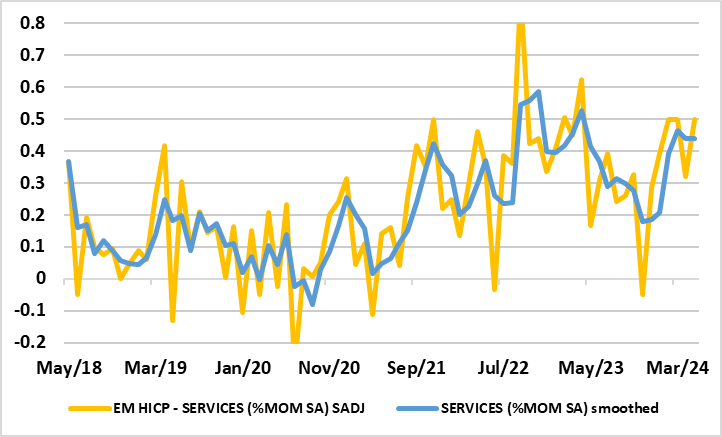

Figure 2: Smoothed Services m/m Price Pressures Resilient?

Source: ECB, CE, smoothed is 3 mth mov avg

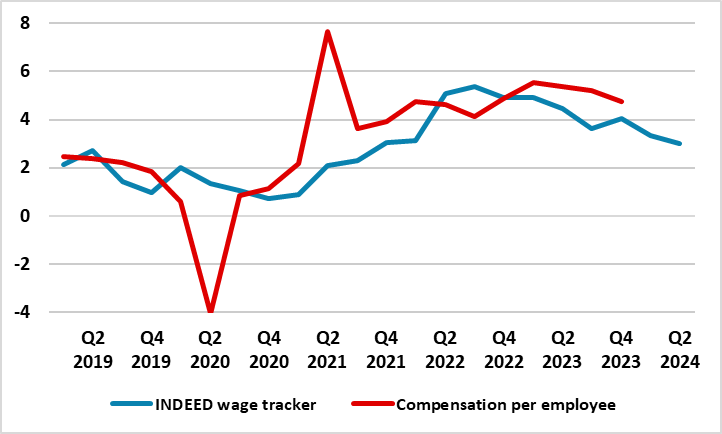

As for underlying trends, it is notable that the ECB has been somewhat troubled by the failure of services inflation to have fallen in the last few months, and its apparent stability in m/m adjusted terms may harden some of the hawks worries about aspects of price resilience as may monthly adjusted core numbers (Figure 2) which have also shown some such resilience, if not revival. As a result, the data do not make the case for rapid ECB easing any greater; we still see three 25 bp cuts this year with a move in next week still very much on the cards, especially given wage data (compiled by Indeed) which has pointed to a clear and further easing in such cost pressures, actually more clearly than the ECB had anticipated.

Figure 3: Wage Pressures Easing?

Source: ECB, CE, Indeed, % chg y/y

Below-Target Inflation Still Looming in H2

On the basis of a presumed unchanged headline reading for June, it now looks as if HICP inflation will average 2.5% in Q2, just a notch above ECB projections made in March. These will be updated next week and will now encompassing the slight fall back in oil/petrol prices seen of late. We still envisage that the headline slip below target temporarily in late-summer 2024, well over a year earlier than the ECB currently envisages officially, and then undershoot more durably through 2025, while the core should continue to fall in the interim regardless. The ECB’s updated projections may be more circumspect, but should still adhere to a below target forecast I n H2 next year, thereby validating market rate speculation.