Preview: Due June 7 - U.S. May Employment (Non-Farm Payrolls) - Stronger than April but trend may be starting to slow

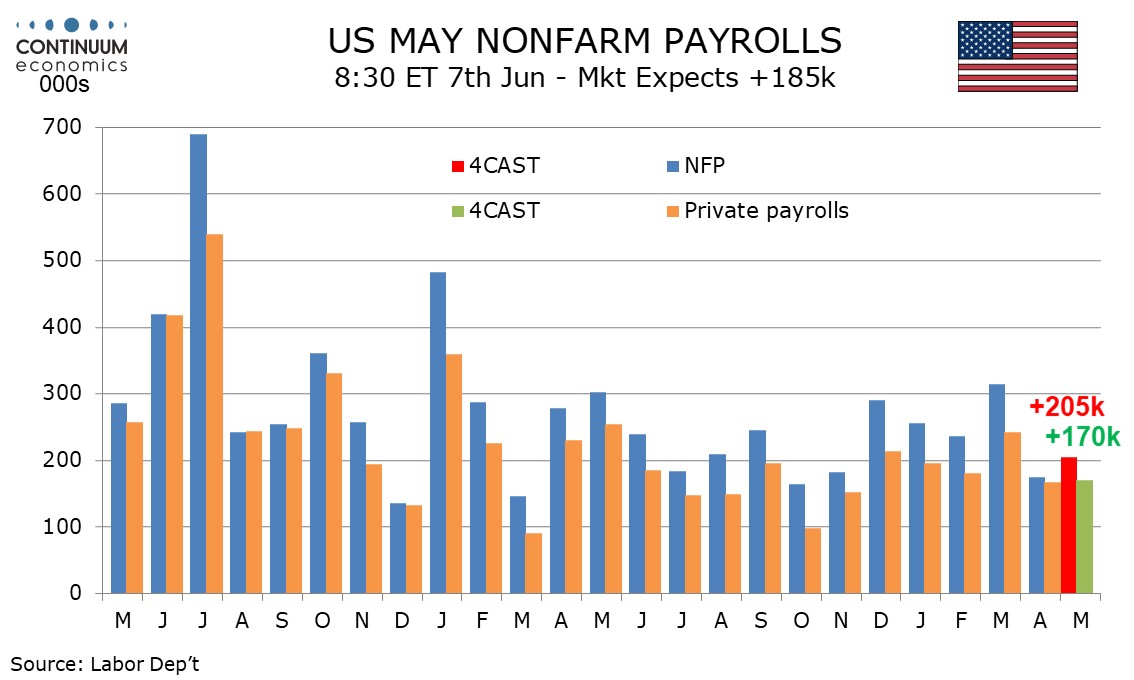

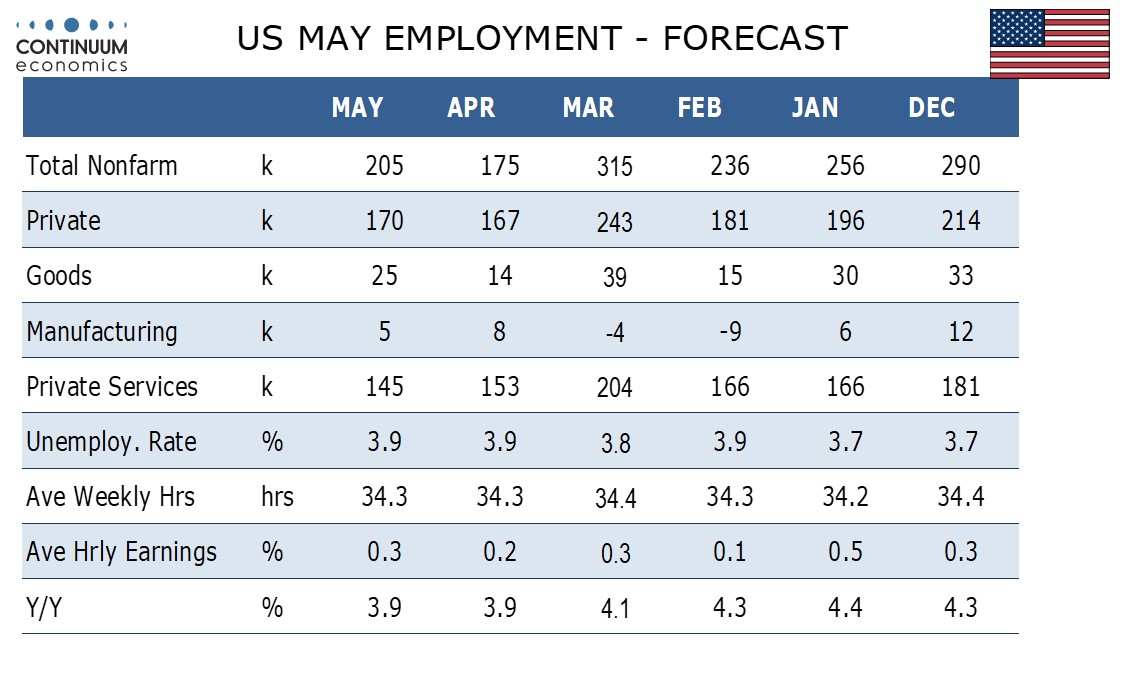

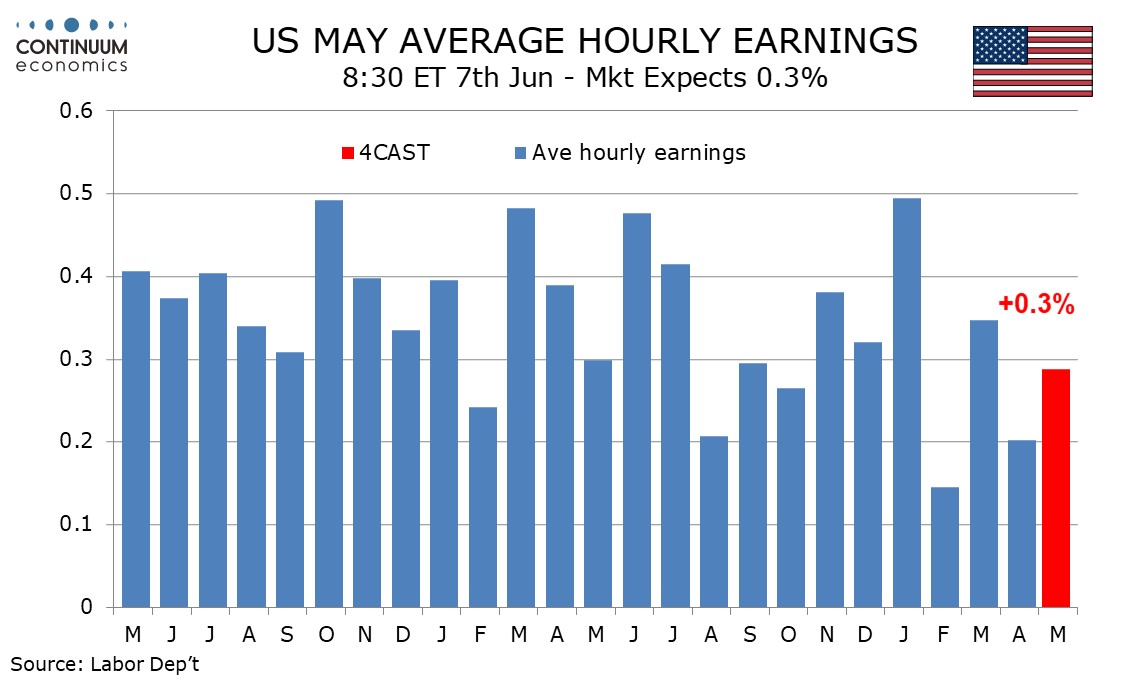

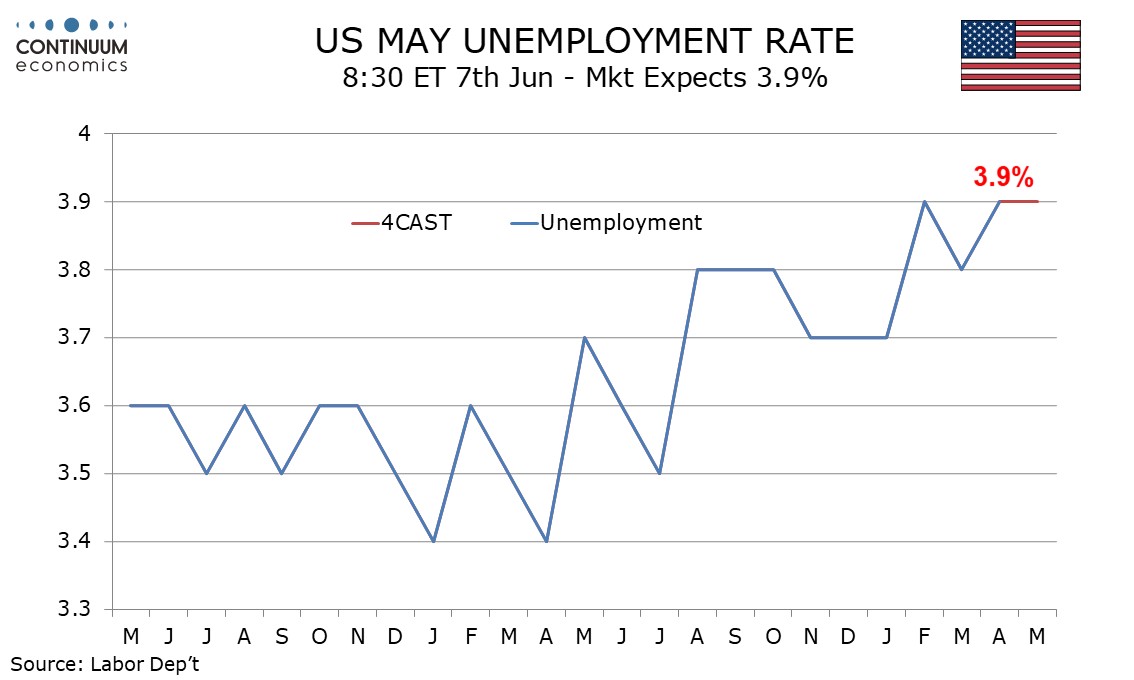

We expect a 205k increase in May’s non-farm payroll, a little stronger than April’s below trend 175k but closer to that than March’s above trend 315k. We expect average hourly earnings with a 0.3% increase to also be a little stronger than in April, when a below trend 0.2% increase was seen, but we expect unemployment to be unchanged at 3.9%, sustaining an increase from March’s 3.8%.

We believe the economy is losing momentum and seasonal adjustments are negative in May, compensating for improving weather, though cooler than usual weather in early May this year may prevent some of the usual seasonal hirings taking place. This argues for a below trend payroll, though most evidence, including initial claims, suggests any easing of the labor market is likely to be marginal.

April’s slower 175k payroll increase was not a clear signal for a slowdown, coming after a 315k increase in May putting the 2-month average at 245k, similar to the 6-month average of 242k. We expect May’s rise to marginally exceed April’s despite believing trend will soon start to show clearer signs of slowing. We expect private payrolls to rise by 170k, similar to April’s 167k but below March’s 243k. April’s 8k increase in government was well below the 6-month average of 50k and we expect a stronger May.

Average hourly earnings rose by 0.20% in April after a 0.35% March increase that was rounded down to 0.3%, and trend now appears to be a little below 0.3% per month. We however expect May’s gain to be rounded up to 0.3% after the below trend April, and leave yr/yr growth at the 3.9% pace seen in April that was the slowest since June 2021.

We expect the labor force to rise by slightly more than employment in May, though not by enough to lift the unemployment rate from 3.9%. April’s rate, which increase from 3.8% in April, saw an unemployment rate of 3.86% before rounding, which means that labor force growth would have to significantly exceed that of employment to lift the unemployment rate to 4.0%.

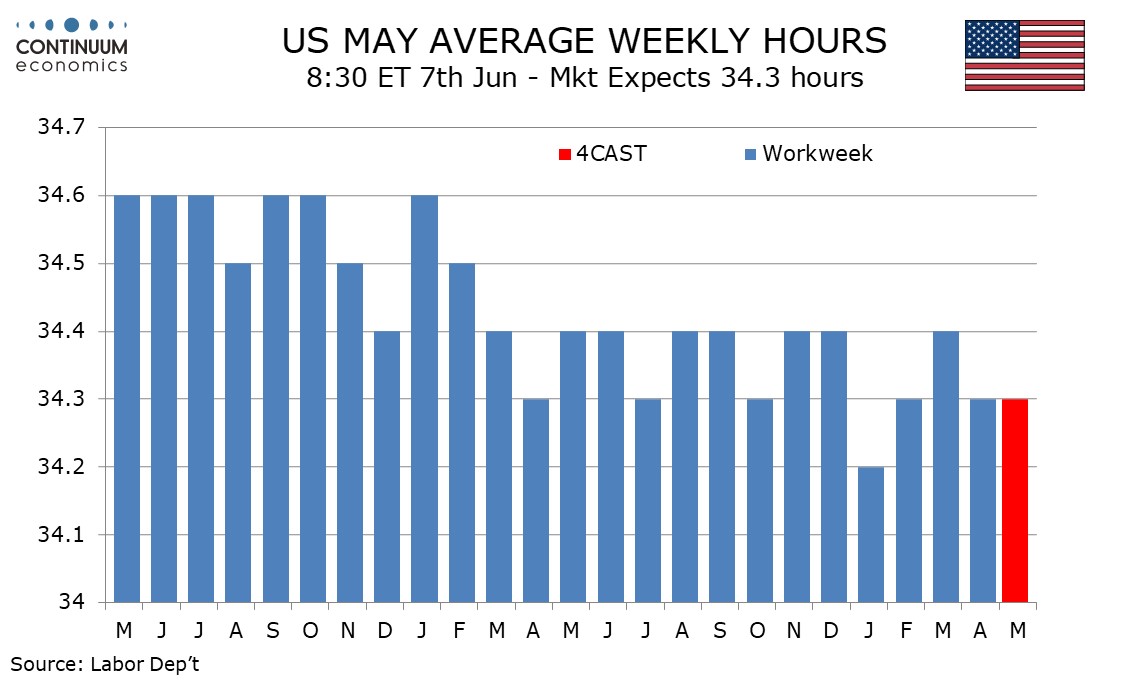

We also the workweek to be unchanged from April, at 34.3 hours, though a rise back to March’s 34.4 is more likely than a fall. Most recent months have been either 34.3 or 34.4, with the exception, January’s 34.2, probably due to bad weather. A second straight month at 34.3 would be consistent with a modest loss of momentum in the economy.