JPY, EUR flows: Stuck in ranges in quiet markets

Fundamentlas pointing toward JPY strength, but quiet markets encouraging carry trades. EUR/USD capped at 1.09 after Villeroy comments.

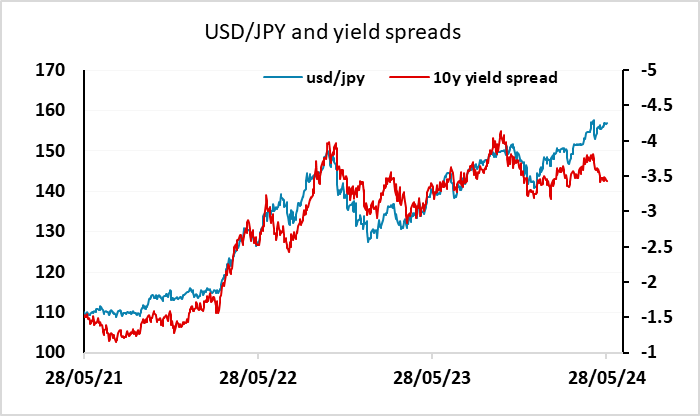

The calendar is quiet so breaking out of recent ranges will be difficult. The JPY remains the currency with most potential for movement, with yield spreads and risk premia pointing to potential for JPY gains, while overnight comments from finance minister Suzuki also called for currencies to reflect fundamentals. USD/JPY remains a long way above any normal fundamental valuation. But in quiet conditions there will always be a tendency to carry trade, and this looks likely to prevent any near term JPY recovery, even though JGB yields are finding a foothold above 1%.

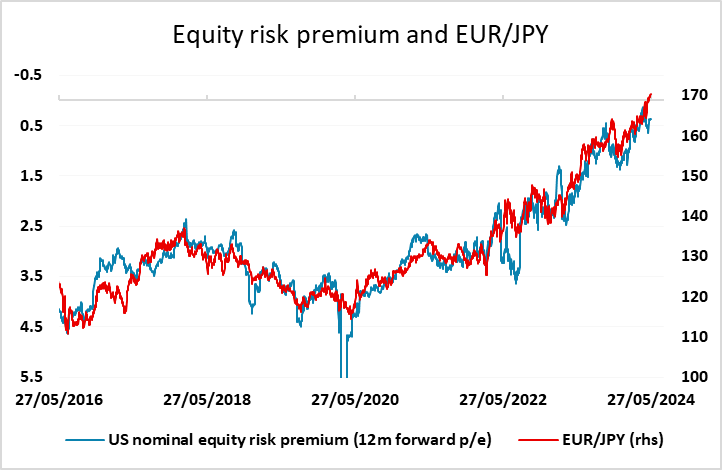

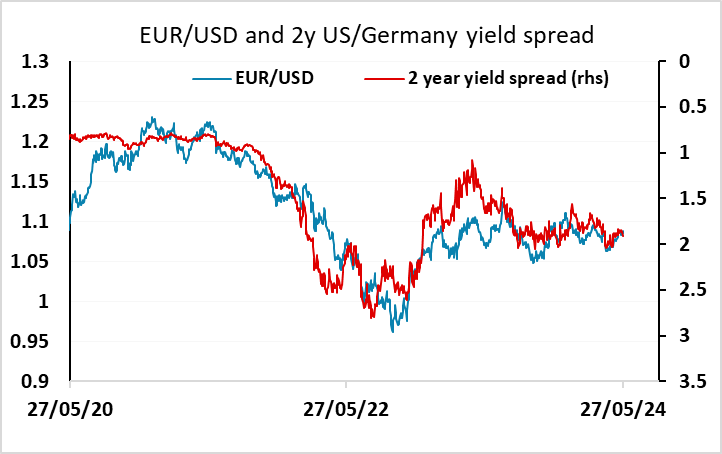

While EUR/USD retains a mild upside bias, a break above 1.09 looks unlikely with front end yield spreads still pointing to EUR/USD stability. ECB’s Villeroy suggested on Monday that the ECB should not rule out a July cut after the widely expected June 6 cut, and this suggests scope for front end yield spreads to move in the USD’s favour rather than the EUR’s. Meanwhile, risk premia suggest scope for EUR/JPY declines into the mid-160s, but any significant move in this direction will come from on USD/JPY rather than EUR/USD.