Eurozone: PMIs Offer More Positive Gimmers – Still Too Good to be True?

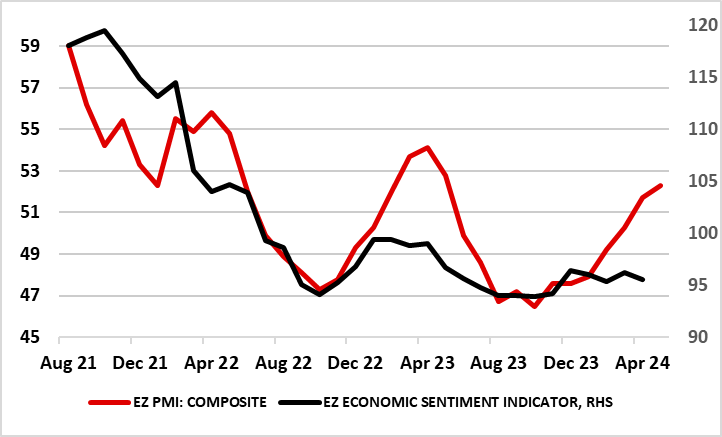

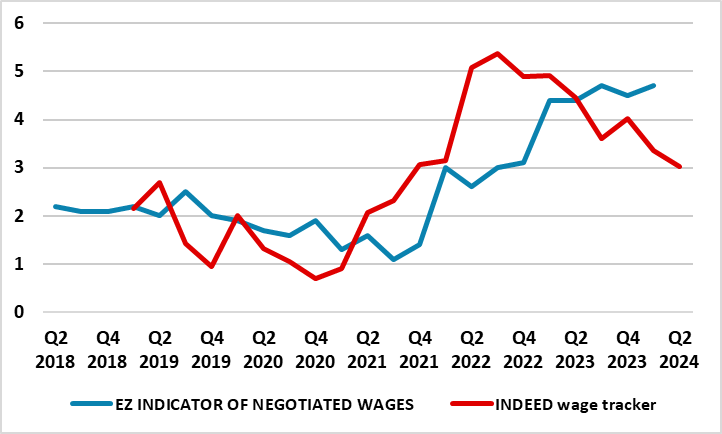

The latest PMI data suggest the EZ economic recovery gained further momentum in May as the composite index rose to 52.3 in May from 51.7 in April, thereby implying positive private sector growth for the third consecutive month. We remain wary about the messages from the data (see below and Figure 1), at least regarding real activity swings but note that the survey also highlighted that both input costs and output prices softened afresh. And for once the survey made no mention of added wage pressures, thereby conflicting with the firmer negotiated wage data for Q1 but more in line with other and softer wage indicators (Figure 2). As such the thrust if data will only add to the already-concrete case for the looming ECB rate cuts next month, the area of debate for the Council is what happens to policy in H2 and to what extent even informal guidance can/should be offered at the next meeting.

Figure 1: PMI Survey Data Contrasts with EU Commission Numbers

Source: Markit, European Commission

Divergences Persist

The PMI pointed to geographical divergences as increases in business activity were recorded in Germany, but France saw output decrease afresh. There were also divergences among sectors as the rate of expansion was again driven by the service sector, where activity was up for a fourth consecutive month, albeit unchanged on that seen in April. Meanwhile, manufacturing production continued to fall, extending the current sequence of decline to 14 months, but where the rate of contraction was only marginal, however, easing further to the weakest in this period of reduction.

Softer Inflation Signals

The PMI data are highly regarded by the ECB at least in terms of activity and thus will be positively received by the hawks. We are more skeptical about the data, noting the poor correlation between the PMI and EZ GDP growth of late and the much gloomier messages from alternative business survey data such as that compiled by the European Commission (Figure 1).

The PMI data suggested that rates of inflation for both input costs and output prices eased in May, albeit remaining above the pre-pandemic average. Once again, the service sector was the principal source of inflationary pressure, with input costs rising rapidly but eased to a three-year low. Meanwhile, manufacturing input costs decreased slightly again, though to the least marked extent in the current 15-month sequence of decline. The pace of output price inflation also softened in May, and was the weakest since November 2023. Notably for the ECB hawks and their worries about price persistence in services, there was a slower increase in services charges, one that was partially offset by a weaker reduction in manufacturing selling prices. Notably, softer output price inflation was seen across Germany, France and the rest of the EZ. Moreover, despite a slight firming in negotiated wage pressures, alternative-compiled wage data (produced by Indeed) have pointed to a clear and further easing in such cost pressures (Figure 2), actually more clearly than the ECB had anticipated.

Figure 2: Wage Pressures Easing?

Source: ECB, CE, Bloomberg

Fiscal Considerations

We are also sceptical about the PMI survey due to its relatively limited sector coverage, it not including the three sectors possibly most fragile at the moment, namely construction (its PMI is very soft at just over 40), retailing and government. Indeed, one key area of ECB concern in terms of construction outlined in the recent Financial Stability Report is the commercial real estate sector, amid the property market downturn, which it accepts is challenging real estate firms and some financial institutions. As for government, it is noteworthy that fiscal policy is already tightening across the EZ as governments unwind energy support policies, but this has taken a new twist of late given the marked budget overshoots seen in the likes of France and Italy in 2023.