JPY, USD, CHF, EUR flows: JPY soft, EUR pressing 1.09

JPY and CHF weak in quiet conditions, EUR/JPY highest since intervention

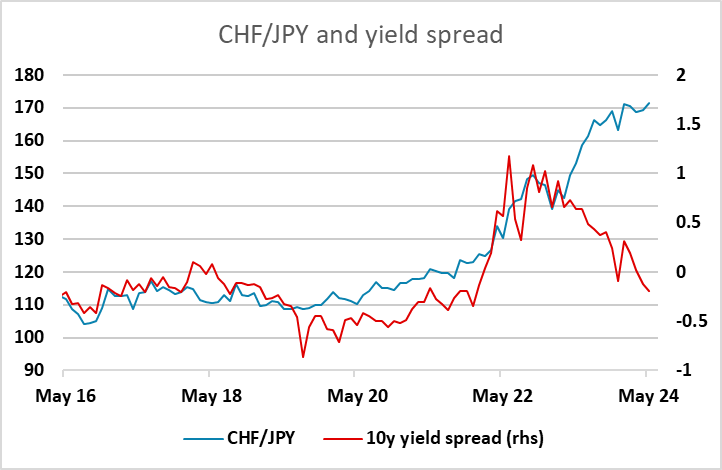

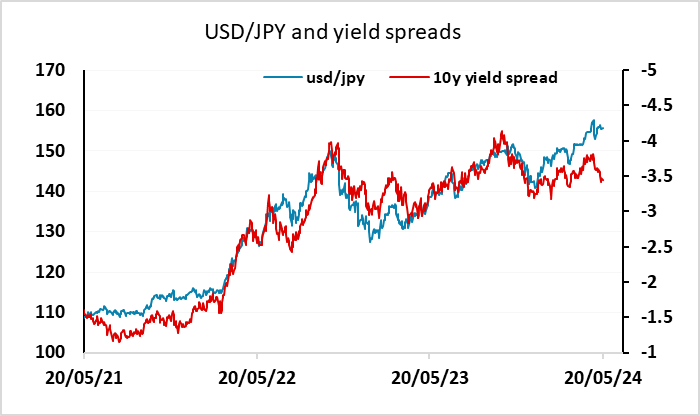

A very quiet Monday calendar suggests a similarly quiet FX market today. However, we have seen more JPY weakness overnight with EUR/JPY reaching its highest since BoJ intervention on April 29, while EUR/USD is also maintaining a mildly positive tone, pressing towards 1.09. It remains hard to find a rationale for JPY weakness beyond the relatively quiet conditions and high yield spread encouraging carry trades. However, this does look to be a factor, as we are also seeing weakness in the CHF, with EUR/CHF up to its highest in a year and testing 0.99. There is a lot more case from a value perspective for CHF weakness than JPY weakness, but value aside, both offer relatively cheap funding.

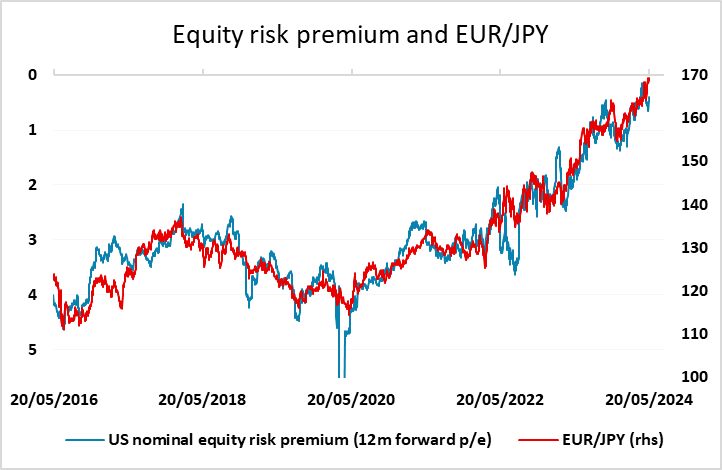

The Japanese authorities may be concerned about the renewed JPY weakness, but may also be wary of triggering too sharp a JPY recovery, with a BoJ survey overnight indicating manufacturers wanted exchange rate stability. Even so, we doubt they will allow EUR/JPY to trade through 170 without some reaction. The correlation with equity risk premia suggests EUR/JPY is now stretched, while yield spreads point to USD/JPY declines. For EUR/USD, and the USD in general, the focus is likely to be on this week’s PMIs, with any continuation of US underperformance potentially leading to some further USD declines.